Net Asset Value (NAV) Explained: Amundi MSCI All Country World UCITS ETF USD (Acc)

Table of Contents

Calculating the Net Asset Value (NAV) of the Amundi MSCI ETF

The Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi MSCI All Country World UCITS ETF USD (Acc), the NAV calculation is straightforward:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

Let's break down the components:

-

Total Assets: This includes the market value of all the securities held within the ETF. For a globally diversified ETF like the Amundi MSCI All Country World UCITS ETF USD (Acc), this encompasses a vast portfolio of stocks and potentially bonds from various countries. Other assets include:

- Market value of stocks and bonds

- Cash holdings

- Receivables (money owed to the fund)

-

Total Liabilities: These are the fund's outstanding obligations. This primarily includes:

- Management fees and expenses

- Payable amounts (e.g., to brokers or other service providers)

Amundi, the fund manager, calculates and publishes the NAV daily, ensuring transparency for investors. This daily Amundi MSCI ETF NAV reflects the value of your investment at the close of the trading day. This rigorous ETF asset valuation process is critical for accurate reporting and investor confidence.

The Importance of NAV for Amundi MSCI All Country World UCITS ETF USD (Acc) Investors

The NAV of the Amundi MSCI All Country World UCITS ETF USD (Acc) is a key indicator of its performance. Several important points highlight its significance:

-

NAV reflects performance: Changes in the NAV directly reflect the overall performance of the fund's underlying assets. If the market value of the holdings increases, so does the NAV, indicating positive performance. Conversely, a decrease in the market value leads to a lower NAV.

-

Impact on investor returns: Your returns as an investor are directly tied to the changes in the NAV. A rising NAV translates to growth in your investment, while a falling NAV indicates a loss. Monitoring your Amundi MSCI ETF performance through NAV changes is therefore crucial.

-

Tracking investment growth: By regularly monitoring the NAV, you can effectively track the growth of your investment over time. This allows for informed decisions regarding your investment strategy.

-

Relationship with ETF share price: While the ETF share price generally tracks the NAV closely, there can be a slight difference, known as tracking error. This difference is typically small but can be influenced by trading volume and market liquidity.

Using the NAV and understanding the potential for tracking error allows for more informed monitoring of your Amundi MSCI ETF performance.

Factors Affecting the NAV of the Amundi MSCI All Country World UCITS ETF USD (Acc)

Several factors influence the daily NAV of the Amundi MSCI All Country World UCITS ETF USD (Acc):

-

Market fluctuations: Changes in the global stock markets significantly impact the NAV. Positive market movements generally lead to an increase in NAV, while negative movements decrease it.

-

Currency exchange rate impact: Because the Amundi MSCI All Country World UCITS ETF is denominated in USD (Acc), fluctuations in exchange rates against other currencies affect the value of the underlying assets held in different currencies.

-

Dividends and capital gains: Dividends received from the underlying holdings and capital gains realized from selling assets will influence the NAV. These are typically reinvested, increasing the total assets and hence the NAV.

-

Expense ratio impact: The fund's expense ratio, which covers management fees and operational costs, gradually reduces the NAV over time. This is a crucial factor to consider when evaluating the fund's overall performance. Understanding the expense ratio impact allows you to assess the net growth of your investment after accounting for the fund's operational costs.

Accessing and Interpreting the NAV of the Amundi MSCI All Country World UCITS ETF USD (Acc)

Finding the daily NAV for the Amundi MSCI All Country World UCITS ETF USD (Acc) is relatively straightforward:

-

Amundi website: The official Amundi website provides regularly updated NAV information.

-

Financial news sources: Many financial news websites and investment platforms also publish ETF NAV data.

Interpreting the NAV data requires understanding its relevance to your investment goals:

-

Investment goal alignment: Compare the NAV's performance against your projected returns and risk tolerance.

-

Buy/Sell decisions: While the NAV is not the sole factor to consider when buying or selling, it serves as a crucial benchmark for evaluating the fund's performance in relation to your investment strategy.

Conclusion: Using NAV to Make Informed Decisions about the Amundi MSCI All Country World UCITS ETF USD (Acc)

Understanding Net Asset Value (NAV) is paramount for making informed investment decisions regarding the Amundi MSCI All Country World UCITS ETF USD (Acc). Regularly monitoring the NAV provides valuable insights into the fund's performance, allowing you to assess its alignment with your investment goals. Remember, while the NAV is a key performance indicator, it's essential to consider other factors, such as the fund's expense ratio and broader market trends, before making buy or sell decisions. Learn more about the Amundi MSCI All Country World UCITS ETF USD (Acc) and its Net Asset Value (NAV) by visiting [insert relevant link here] to make informed investment decisions. Understanding and utilizing NAV in your ETF investment strategy will empower you to navigate global markets more effectively.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

Porsche Cayenne Gts Coupe Kompletny Test I Ocena

May 24, 2025

Porsche Cayenne Gts Coupe Kompletny Test I Ocena

May 24, 2025 -

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Talent

May 24, 2025

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Talent

May 24, 2025 -

Classic Art Week Indonesia 2025 Menampilkan Koleksi Porsche

May 24, 2025

Classic Art Week Indonesia 2025 Menampilkan Koleksi Porsche

May 24, 2025 -

Finding Your Dream Home Escape To The Country For Under 1m

May 24, 2025

Finding Your Dream Home Escape To The Country For Under 1m

May 24, 2025

Latest Posts

-

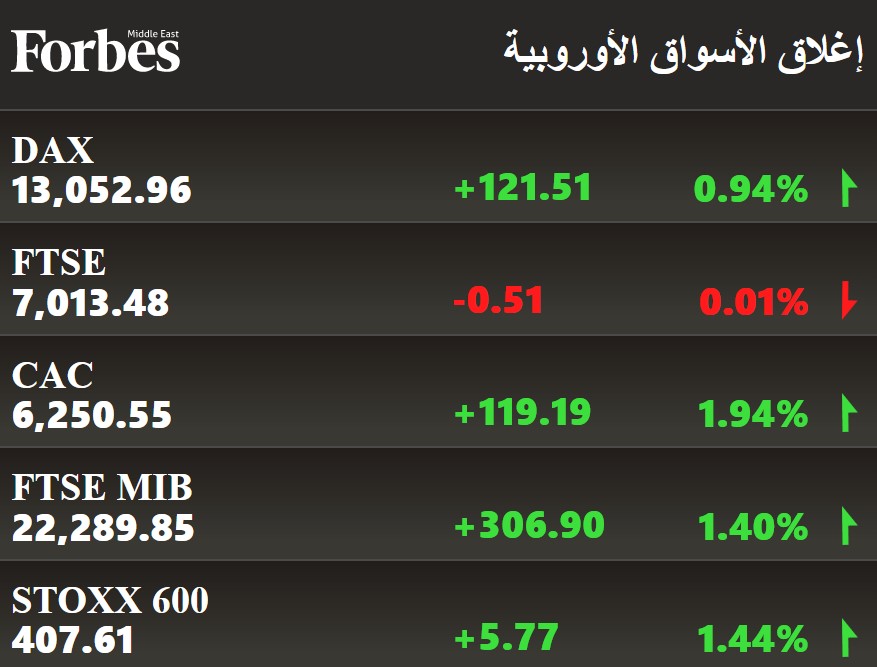

Artfae Mfajy Fy Mwshr Daks Alalmany Dwr Atfaq Washntn Wbkyn

May 24, 2025

Artfae Mfajy Fy Mwshr Daks Alalmany Dwr Atfaq Washntn Wbkyn

May 24, 2025 -

Alastthmar Fy Daks 30 Thlyl Adae Almwshr Bed Tjawz Dhrwt Mars

May 24, 2025

Alastthmar Fy Daks 30 Thlyl Adae Almwshr Bed Tjawz Dhrwt Mars

May 24, 2025 -

Tathyr Atfaq Aljmark Byn Alwlayat Almthdt Walsyn Ela Mwshr Daks Alalmany

May 24, 2025

Tathyr Atfaq Aljmark Byn Alwlayat Almthdt Walsyn Ela Mwshr Daks Alalmany

May 24, 2025 -

Mwshr Daks Alalmany Tjawz Dhrwt Mars Welamat Ela Teafy Alswq Alawrwby

May 24, 2025

Mwshr Daks Alalmany Tjawz Dhrwt Mars Welamat Ela Teafy Alswq Alawrwby

May 24, 2025 -

Is The Glastonbury 2025 Lineup A Letdown Fan Reactions

May 24, 2025

Is The Glastonbury 2025 Lineup A Letdown Fan Reactions

May 24, 2025