Unexpected Dip: PBOC's Daily Yuan Support Below Projections

Table of Contents

The PBOC's Intervention Strategy and its Shortfall

The PBOC typically employs a daily intervention strategy to manage the Chinese Yuan's (CNY) value against other major currencies, particularly the US dollar. This involves setting a daily fixing rate for the RMB, influencing the exchange rate through buying and selling of currency in the foreign exchange market. However, on [Insert Date], the PBOC's intervention fell significantly short of market projections.

- Projected Intervention Amount: [Insert Projected Amount/Range]

- Actual Intervention Amount: [Insert Actual Amount/Range]

- Expected Yuan Exchange Rate: [Insert Expected Rate]

- Actual Yuan Exchange Rate: [Insert Actual Rate]

This discrepancy between projected and actual intervention resulted in a noticeable weakening of the Yuan against the US dollar and other major currencies. The impact on market sentiment and investor confidence was immediate and palpable, leading to increased volatility in currency trading and a general sense of uncertainty. The PBOC's intervention, or lack thereof, directly impacts the RMB exchange rate and significantly influences currency trading strategies involving the Chinese Yuan (CNY) and offshore yuan (CNH). Understanding the PBOC's yuan fixing mechanism is crucial for navigating this complex market.

Potential Reasons Behind the Unexpected Dip

Several factors could contribute to the PBOC's decision to reduce its support for the Yuan. These include:

-

Changing Economic Conditions in China: A slowdown in China's economic growth, coupled with concerns about rising inflation, might have prompted the PBOC to adopt a more cautious approach to currency intervention. Data regarding economic indicators like GDP growth and inflation rates should be examined closely.

-

External Factors Influencing the Yuan's Value: The strength of the US dollar (USD), driven by factors like rising interest rates in the US, puts downward pressure on many currencies, including the Yuan. Global trade tensions and geopolitical uncertainties also play a significant role, impacting capital flows and investor sentiment towards emerging market currencies like the RMB. The US dollar index (DXY) is a key indicator to watch in this context.

-

Internal Policy Adjustments within the PBOC: The PBOC may be shifting its monetary policy, prioritizing other objectives such as managing inflation or preventing excessive capital outflows. A more flexible exchange rate might be part of a broader strategy to allow market forces to play a more significant role in determining the Yuan's value.

-

Market Speculation and its Impact: Market speculation about the future direction of the Yuan can create self-fulfilling prophecies. If investors anticipate a weaker Yuan, they may sell the currency, further exacerbating the downward pressure.

Market Reaction and its Implications

The unexpected dip in PBOC support triggered a noticeable market reaction:

-

Changes in the Yuan's exchange rate against major currencies: The Yuan experienced a significant depreciation against the US dollar and other major currencies in the immediate aftermath of the reduced intervention.

-

Fluctuations in Chinese stock markets: The uncertainty surrounding the Yuan's value caused volatility in Chinese stock markets, with some sectors experiencing more pronounced drops than others.

-

Impact on foreign trade and investment: A weaker Yuan can make Chinese exports more competitive but also increases the cost of imports. It can also impact foreign investment flows into and out of China, potentially leading to capital flight.

For businesses, exporters might benefit temporarily from increased competitiveness, but importers will face higher costs. Investors will need to adjust their portfolios and risk management strategies accordingly. The market volatility created by this unexpected move highlights the increased risk aversion among investors. Currency depreciation, if sustained, poses a threat to China's economic outlook.

Conclusion: Understanding the Yuan's Unexpected Dip and What Lies Ahead

The PBOC's decision to provide less daily support to the Yuan than anticipated has created significant uncertainty in the market. Potential causes range from internal economic adjustments to external pressures from the global market, particularly the strength of the USD. The market reaction has been swift, demonstrating the sensitivity of the currency to changes in PBOC intervention. Understanding the implications of this unexpected dip in PBOC's yuan support is crucial for anyone involved in international trade or investment related to the Chinese economy.

The future trajectory of the Yuan remains uncertain. The PBOC's future intervention strategies, the evolution of China's economic conditions, and the global economic environment will all play a key role in determining the RMB exchange rate in the coming months. Stay informed on these developments to accurately assess the impact on your business or investment portfolio. To receive updates on the ongoing impact of the PBOC's unexpected yuan support dip and its continuing influence on the RMB exchange rate, subscribe to our newsletter [link to newsletter].

Featured Posts

-

V Mware Costs To Explode At And T Highlights Broadcoms Extreme Pricing

May 16, 2025

V Mware Costs To Explode At And T Highlights Broadcoms Extreme Pricing

May 16, 2025 -

Disaster Betting A Look At The Los Angeles Wildfires And The Implications

May 16, 2025

Disaster Betting A Look At The Los Angeles Wildfires And The Implications

May 16, 2025 -

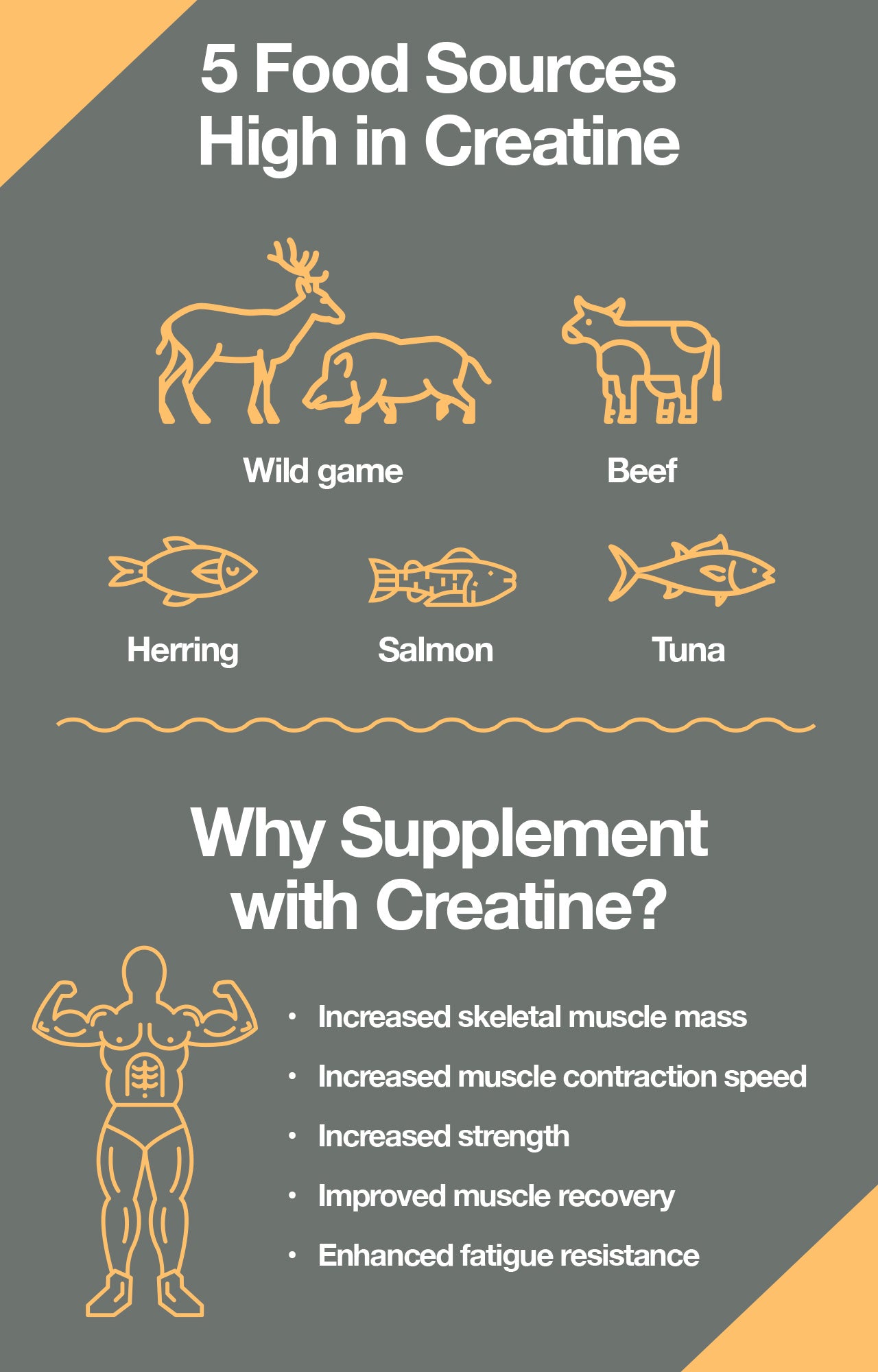

What Is Creatine And How Does It Work

May 16, 2025

What Is Creatine And How Does It Work

May 16, 2025 -

United Healths Hemsley Can A Boomerang Ceo Deliver

May 16, 2025

United Healths Hemsley Can A Boomerang Ceo Deliver

May 16, 2025 -

Hondas Ontario Ev Project 15 Billion Investment On Hold

May 16, 2025

Hondas Ontario Ev Project 15 Billion Investment On Hold

May 16, 2025

Latest Posts

-

Is Microsoft A Safe Investment During Trade Wars

May 16, 2025

Is Microsoft A Safe Investment During Trade Wars

May 16, 2025 -

Microsoft Stock A Safe Haven In The Tariff Storm

May 16, 2025

Microsoft Stock A Safe Haven In The Tariff Storm

May 16, 2025 -

Honda Halts 15 Billion Electric Vehicle Plant Project In Ontario

May 16, 2025

Honda Halts 15 Billion Electric Vehicle Plant Project In Ontario

May 16, 2025 -

Butlers Big Game Golden State Warriors Triumph Over Houston Rockets

May 16, 2025

Butlers Big Game Golden State Warriors Triumph Over Houston Rockets

May 16, 2025 -

Egg Prices Plummet Dozen Now 5 After Record Highs

May 16, 2025

Egg Prices Plummet Dozen Now 5 After Record Highs

May 16, 2025