Microsoft Stock: A Safe Haven In The Tariff Storm?

Table of Contents

Microsoft's Diversified Revenue Streams

Microsoft's success isn't tied to a single product or industry, making it a potentially resilient investment during times of economic volatility. Its diversified revenue streams act as a buffer against sector-specific shocks, including those caused by tariffs.

Reduced Dependence on Specific Sectors

Unlike companies heavily reliant on manufacturing or import/export, Microsoft benefits from a broad portfolio spanning various sectors. This diversified approach significantly reduces its vulnerability to tariff-related disruptions.

-

Azure's consistent growth: Microsoft's cloud computing platform, Azure, continues to demonstrate strong performance, even in challenging economic conditions. This showcases the resilience of the cloud computing market and Microsoft's position as a leader in this space. The demand for cloud services is relatively inelastic, meaning it remains strong even during economic downturns.

-

Sustained demand for core products: Microsoft's core products, including Windows and Office 365, enjoy persistent demand from businesses and consumers worldwide. These established products provide a stable revenue base, less susceptible to the whims of international trade policies.

-

Gaming sector growth: The gaming industry, through Xbox and Game Pass, contributes significantly to Microsoft's revenue and growth. This sector offers further diversification, adding another layer of protection against market fluctuations stemming from tariffs.

-

Minimal direct tariff exposure: Unlike many manufacturing-focused companies, Microsoft has relatively low direct exposure to tariffs on imported goods. Its business model is less reliant on physical goods and more on software and services.

Microsoft's Strong Financial Position

Beyond diversification, Microsoft boasts a robust financial foundation that enhances its stability in uncertain times. Its strong balance sheet and consistent cash flow make it well-equipped to navigate economic downturns.

Robust Balance Sheet and Cash Flow

Microsoft's financial health is undeniable. The company consistently delivers high profit margins and demonstrates steady revenue growth, even amidst global economic uncertainty.

-

High profitability and growth: Consistent profitability and revenue growth indicate a strong business model capable of withstanding external pressures.

-

Significant cash reserves: Microsoft holds substantial cash reserves, providing a financial cushion to weather unexpected challenges and pursue strategic opportunities.

-

Low debt-to-equity ratio: A low debt-to-equity ratio signifies financial stability and a reduced reliance on debt financing, making the company less vulnerable to interest rate fluctuations.

-

Reliable dividend payouts: Microsoft's history of consistent dividend payouts attracts income-seeking investors, adding another layer of appeal during periods of market instability.

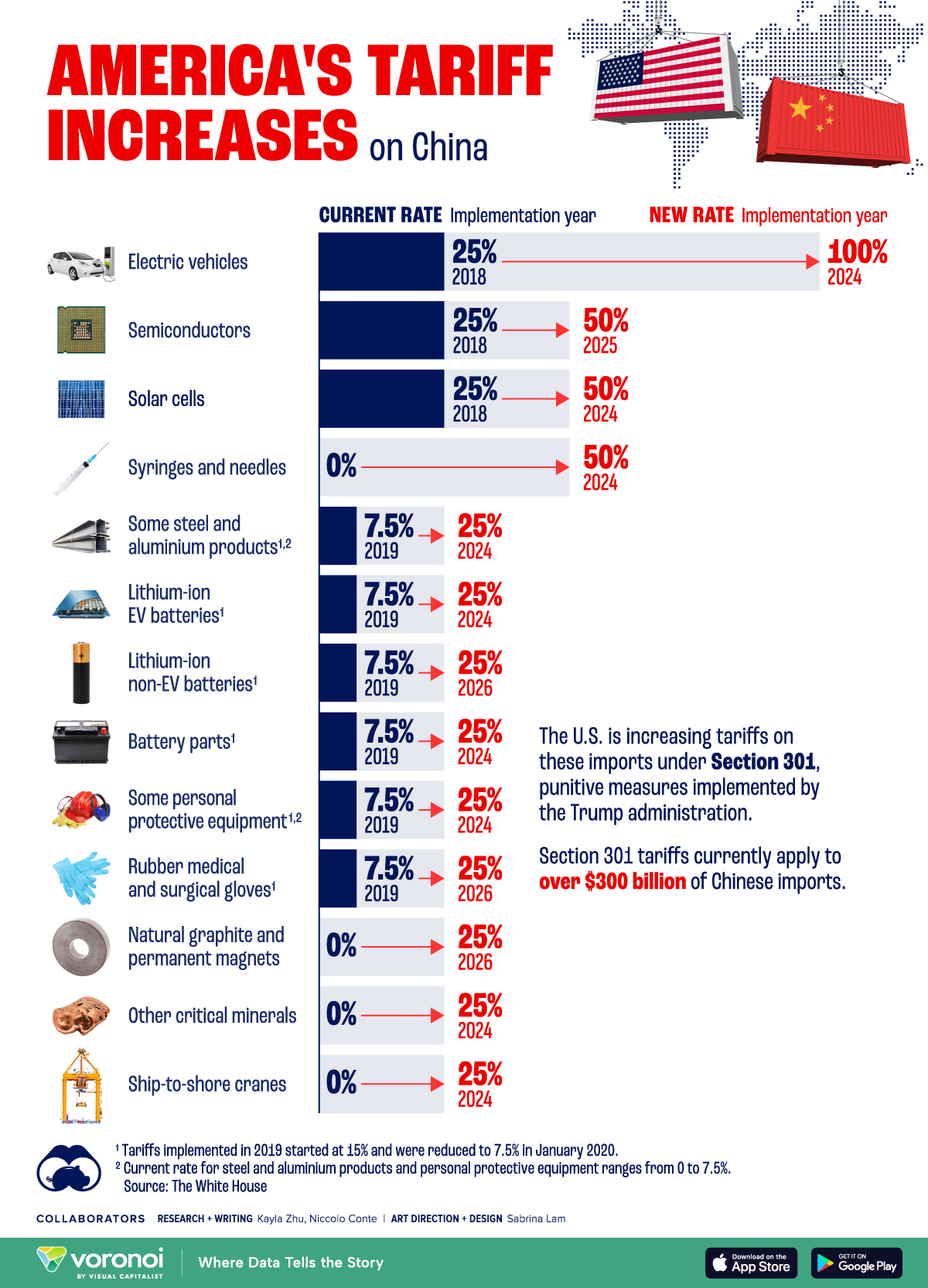

The Impact of Tariffs on Microsoft (Indirect Effects)

While Microsoft has minimal direct exposure to tariffs, indirect effects are worth considering. However, even these indirect impacts are likely to be limited.

Supply Chain Considerations

Microsoft's global supply chain may experience minor disruptions due to tariffs on components or materials. However, the company's geographic diversification of manufacturing and sourcing helps mitigate these risks.

-

Geographic diversification: Microsoft's strategic sourcing and manufacturing across multiple regions minimizes its vulnerability to disruptions in any single location.

-

Cost absorption capabilities: Microsoft has the financial strength to absorb increased input costs without significantly impacting its profitability.

-

Price adjustments: If necessary, Microsoft could adjust its pricing strategy to offset minor cost increases resulting from tariff-related pressures.

Comparing Microsoft to Other Tech Stocks

Compared to other technology companies, Microsoft demonstrates a notable level of stability during economic uncertainty.

Relative Stability During Economic Uncertainty

Historical data shows that Microsoft stock has generally performed well during past economic downturns and periods of market volatility, showcasing its resilience relative to other technology stocks.

-

Historical performance analysis: Examining Microsoft's performance during previous economic crises reveals its tendency to outperform many of its competitors.

-

Comparison with tech giants: Comparing Microsoft's financial stability and growth potential to other tech giants highlights its relatively strong position.

-

Risk assessment: Analyzing Microsoft's sector-specific risks compared to overall market risk underscores its position as a potentially lower-risk investment.

Considering Alternatives

While other investments might be considered "safe havens," such as government bonds or gold, Microsoft's combination of growth potential and relative stability makes it a compelling alternative in the current tariff-laden climate. Its strong financial foundation and diversified revenue streams offer a better risk-reward profile for many investors compared to other traditionally defensive asset classes.

Conclusion

Microsoft's diversified revenue streams, strong financial position, and relative resilience to tariff-related impacts make it a compelling investment option during periods of economic uncertainty. While no investment is entirely without risk, Microsoft's robust business model and substantial cash reserves position it favorably against many other technology companies. Therefore, considering Microsoft stock as a safe haven investment during the current tariff environment is a valid strategy. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions. Invest wisely in Microsoft Stock and consider adding Microsoft Stock to your diversified investment portfolio. Explore the potential of Microsoft Stock as a safe haven for your investments.

Featured Posts

-

China Secures Us Deal The Role Of Xis Experienced Advisors

May 16, 2025

China Secures Us Deal The Role Of Xis Experienced Advisors

May 16, 2025 -

The King Of Davoss Reign Rise Fall And Legacy

May 16, 2025

The King Of Davoss Reign Rise Fall And Legacy

May 16, 2025 -

103 X Vont Weekend A Visual Summary April 4 6 2025

May 16, 2025

103 X Vont Weekend A Visual Summary April 4 6 2025

May 16, 2025 -

La Liga Announces Uk And Ireland Rights Tender Bidding Now Open

May 16, 2025

La Liga Announces Uk And Ireland Rights Tender Bidding Now Open

May 16, 2025 -

Is Trump Right Us Dependence On Canadian Goods An Expert Assessment

May 16, 2025

Is Trump Right Us Dependence On Canadian Goods An Expert Assessment

May 16, 2025

Latest Posts

-

Pre Game Analysis San Jose Earthquakes Opposition Scouting Report

May 16, 2025

Pre Game Analysis San Jose Earthquakes Opposition Scouting Report

May 16, 2025 -

Analyzing The San Jose Earthquakes A Detailed Scouting Report For Opponents

May 16, 2025

Analyzing The San Jose Earthquakes A Detailed Scouting Report For Opponents

May 16, 2025 -

Comprehensive Opposition Scouting Report Preparing To Face The San Jose Earthquakes

May 16, 2025

Comprehensive Opposition Scouting Report Preparing To Face The San Jose Earthquakes

May 16, 2025 -

San Jose Earthquakes Opposition Scouting Report Key Strengths And Weaknesses

May 16, 2025

San Jose Earthquakes Opposition Scouting Report Key Strengths And Weaknesses

May 16, 2025 -

The 2024 Australian Election Key Differences Between Albanese And Duttons Approaches

May 16, 2025

The 2024 Australian Election Key Differences Between Albanese And Duttons Approaches

May 16, 2025