Is Microsoft A Safe Investment During Trade Wars?

Table of Contents

Microsoft's Diversified Revenue Streams

Microsoft's reduced reliance on international trade is a significant factor in evaluating its stability during trade wars. The company's revenue diversification strategy shields it from the volatility affecting businesses heavily reliant on physical goods exports and imports. This "Microsoft revenue diversification" is key to its resilience.

-

Reduced Reliance on International Trade: A large portion of Microsoft's revenue comes from its cloud services (Azure), software licensing (Windows, Office 365), and gaming (Xbox). These are less susceptible to the immediate impacts of tariffs and trade restrictions compared to businesses that manufacture and export physical goods. The impact of the "Azure trade war" has been minimal, illustrating this point.

-

Global Presence, Mitigated Risk: While Microsoft operates globally, its diversified revenue streams prevent a single market downturn from severely impacting its overall performance. A decline in one region's sales is often offset by growth in others. For instance, strong growth in the Asian market can compensate for a slowdown in Europe. "Microsoft international revenue" is spread across various regions.

-

Geographical Diversification of Revenue: Microsoft actively cultivates a global customer base. This strategic approach minimizes its vulnerability to trade conflicts affecting specific countries or regions. Its revenue is not concentrated in any single market, which further reduces risk.

Microsoft's Strong Financial Position & Stability

Microsoft’s robust financial health is another reason why it's often considered a safe investment, even during times of economic uncertainty. The company's "Microsoft financial stability" is evident in its balance sheet.

-

Robust Balance Sheet & Cash Reserves: Microsoft boasts substantial cash reserves and consistently high profitability. This financial strength provides a cushion against economic downturns and allows the company to continue investing in research and development (R&D) and strategic acquisitions, even during periods of trade uncertainty. Analyzing Microsoft's financial statements reveals strong revenue, healthy profit margins, and manageable debt levels.

-

Investment & Acquisition Capabilities: Microsoft's substantial "Microsoft cash reserves" allow for continued investment in R&D and strategic acquisitions, fostering growth and innovation even amidst trade disputes. This ongoing investment strengthens its long-term competitiveness.

-

Competitive Advantage: Comparing Microsoft's financial health to its competitors further highlights its strong position. Its consistent profitability and substantial cash reserves provide a significant competitive advantage.

Long-Term Growth Potential & Innovation

Microsoft’s future prospects are bright, largely due to its commitment to innovation. Its investments in growth areas like cloud computing and AI position it for continued success regardless of short-term trade headwinds.

-

Cloud Computing & AI Leadership: Microsoft is a market leader in cloud computing (Azure) and artificial intelligence (AI). These sectors are expected to experience significant growth in the coming years, regardless of trade tensions. This is a key driver of "Microsoft cloud computing growth."

-

Key Innovations & Product Launches: Microsoft consistently introduces new products and updates existing ones, ensuring its relevance and competitiveness in the ever-evolving tech landscape. This continuous innovation reinforces its market leadership.

-

Future Growth Prospects: Microsoft's strategic investments in emerging technologies like AI and its dominant position in cloud computing indicate strong "Microsoft future prospects." These factors support its long-term growth potential.

Risks & Considerations

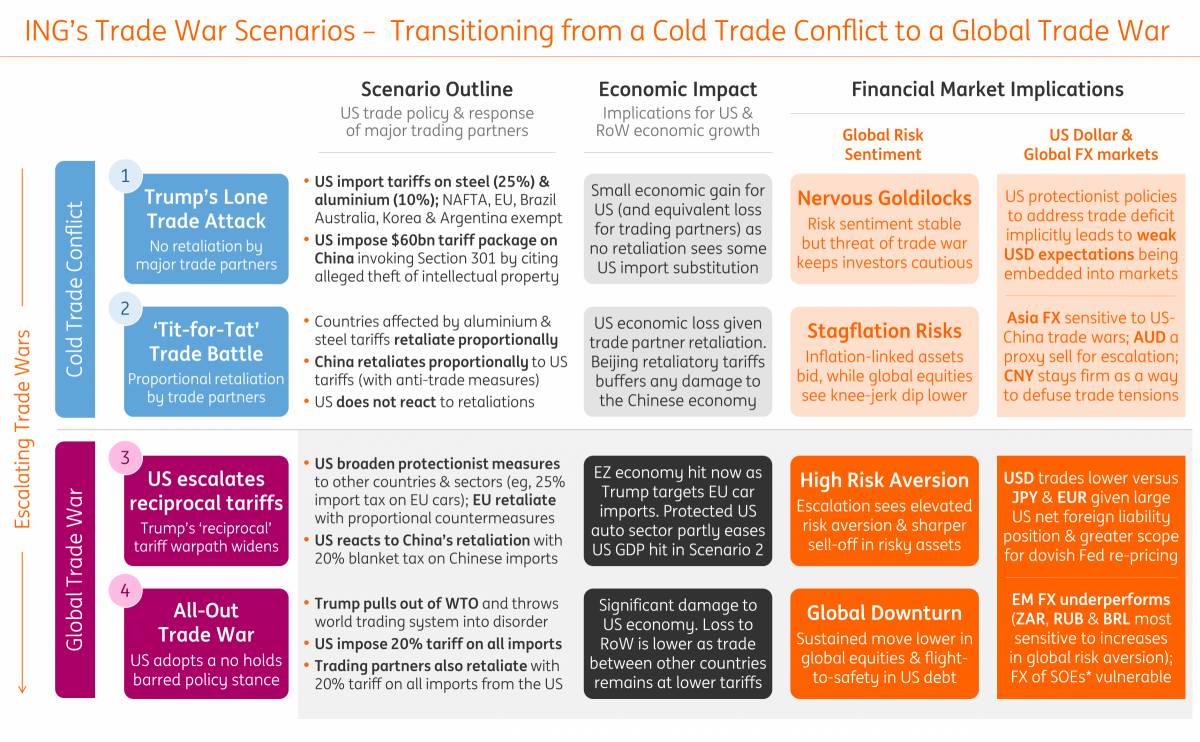

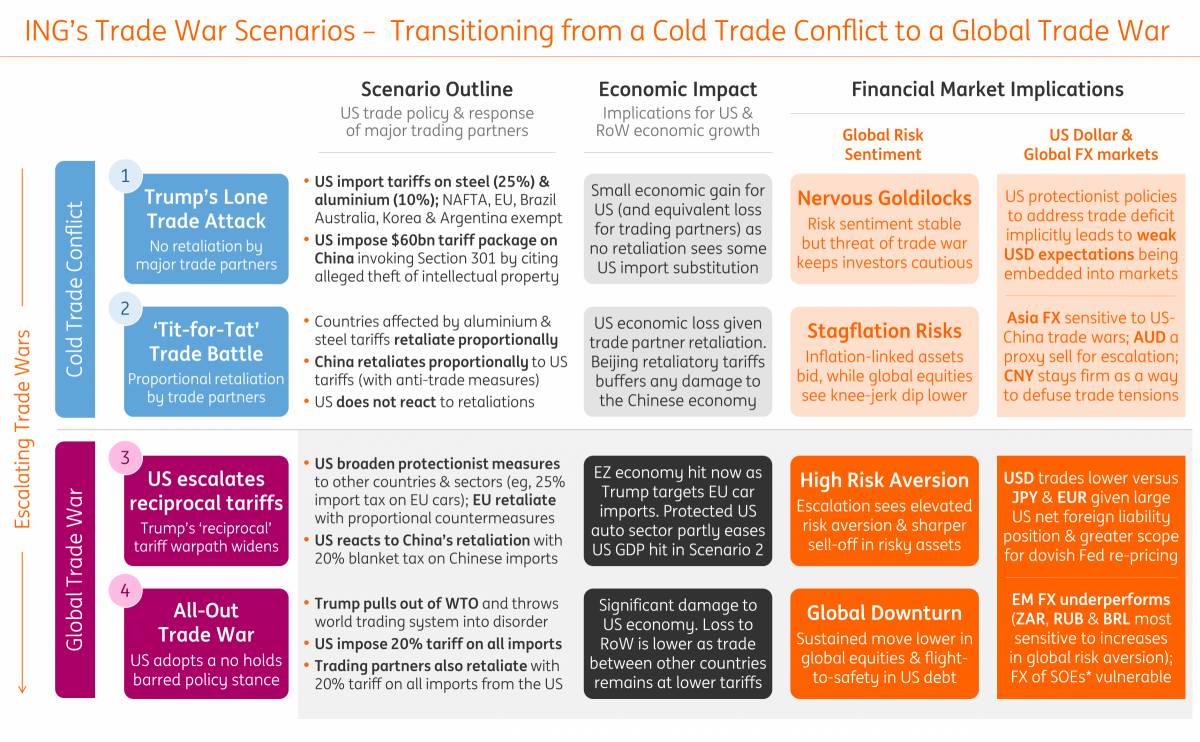

While Microsoft offers several compelling reasons for investment, it's crucial to acknowledge potential risks. Geopolitical instability and regulatory changes could indirectly impact the company.

-

Potential Impacts of Geopolitical Instability: Escalating trade tensions or unforeseen geopolitical events could indirectly affect Microsoft's operations. These are inherent risks in any global business. Understanding "Microsoft trade war risks" is crucial.

-

Risk Mitigation Strategies: Microsoft employs various risk mitigation strategies, including geographic diversification and robust financial planning. However, unforeseen circumstances can still impact the company.

-

Regulatory Challenges: Changes in regulations or increased scrutiny from government bodies could pose challenges. Assessing "geopolitical risk Microsoft" and "Microsoft regulatory challenges" is vital for a comprehensive investment analysis.

Conclusion:

Microsoft's diversified revenue streams, robust financial position, and focus on long-term growth, particularly in cloud computing and AI, mitigate many risks associated with trade wars. While some risks remain—as with any investment—these factors make a Microsoft investment a relatively safe option compared to companies more directly exposed to international trade. However, remember that a thorough due diligence process is crucial before making any investment decision. Consider Microsoft investment during trade wars as part of a diversified portfolio, but always conduct your own thorough research and assessment before investing. Develop a robust "Microsoft investment strategy" based on your risk tolerance and financial goals, carefully assessing Microsoft as a safe investment within the context of your overall investment portfolio.

Featured Posts

-

Menendez Brothers Judge Allows Resentencing

May 16, 2025

Menendez Brothers Judge Allows Resentencing

May 16, 2025 -

Muncy Breaks Drought First Home Run Of 2025

May 16, 2025

Muncy Breaks Drought First Home Run Of 2025

May 16, 2025 -

July 31 Deadline Court Grants Hudsons Bay Company Creditor Protection Extension

May 16, 2025

July 31 Deadline Court Grants Hudsons Bay Company Creditor Protection Extension

May 16, 2025 -

Ftc Challenges Court Ruling On Microsoft Activision Deal

May 16, 2025

Ftc Challenges Court Ruling On Microsoft Activision Deal

May 16, 2025 -

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

May 16, 2025

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

May 16, 2025

Latest Posts

-

Timbers 7 Game Unbeaten Streak Ends Against San Jose

May 16, 2025

Timbers 7 Game Unbeaten Streak Ends Against San Jose

May 16, 2025 -

Mora Scores But Timbers Outmatched In 4 1 Loss To Earthquakes

May 16, 2025

Mora Scores But Timbers Outmatched In 4 1 Loss To Earthquakes

May 16, 2025 -

Earthquakes Dominant 4 1 Victory Over Portland Timbers

May 16, 2025

Earthquakes Dominant 4 1 Victory Over Portland Timbers

May 16, 2025 -

Everything You Need To Know Seattle Sounders San Jose Earthquakes

May 16, 2025

Everything You Need To Know Seattle Sounders San Jose Earthquakes

May 16, 2025 -

S Jv Sea Match Preview What To Expect When The Sounders Visit San Jose

May 16, 2025

S Jv Sea Match Preview What To Expect When The Sounders Visit San Jose

May 16, 2025