UBS Changes Stance: Bullish On India, Bearish On Hong Kong

Table of Contents

UBS's Bullish Outlook on India: A Detailed Analysis

UBS's positive outlook on India is underpinned by a confluence of factors pointing towards sustained, robust economic growth.

Strong Economic Fundamentals Fueling India's Growth:

India's impressive economic performance is fueling UBS's bullish stance. Several key elements contribute to this positive assessment:

- Robust GDP Growth: India consistently demonstrates strong GDP growth, outpacing many other major economies. This sustained growth is projected to continue for the foreseeable future.

- Positive Demographic Trends: India boasts a young and rapidly growing population, representing a vast pool of skilled labor and a large consumer market. This demographic dividend is a significant driver of future economic expansion.

- Government Initiatives: Government programs like "Digital India" and "Make in India" are successfully modernizing the economy and attracting significant foreign investment. These initiatives are creating a favorable environment for businesses and driving innovation.

- Increasing Foreign Investment: Foreign investors are increasingly recognizing India's potential, leading to a steady influx of capital that further stimulates economic activity.

UBS is particularly optimistic about several key sectors within the Indian economy:

- Technology: India's thriving tech sector is attracting global attention, with numerous startups and established companies driving innovation and creating high-value jobs.

- Infrastructure: Massive investments in infrastructure development are modernizing the country, improving connectivity, and creating new opportunities across various industries.

- Consumer Goods: India's burgeoning middle class is fueling rapid growth in the consumer goods sector, presenting significant investment potential.

Reduced Risks and Increased Investment Opportunities in India:

While challenges remain, UBS believes that several factors are mitigating the risks associated with investing in India:

- Improving Infrastructure: Ongoing infrastructure improvements are reducing logistical bottlenecks and enhancing efficiency across various sectors.

- Regulatory Reforms: Government efforts to streamline regulations and improve the ease of doing business are making India a more attractive destination for foreign investment.

UBS highlights several compelling investment opportunities within the Indian market, including:

- Technology companies poised for significant growth.

- Infrastructure projects with strong government backing.

- Consumer goods brands targeting India's expanding middle class.

While acknowledging potential headwinds such as inflation and geopolitical uncertainties, UBS believes that these risks are manageable and outweighed by the significant growth potential.

UBS's Bearish Outlook on Hong Kong: Understanding the Downturn

In stark contrast to its bullish outlook on India, UBS expresses a bearish view on Hong Kong's economic prospects. This negativity stems from a number of interconnected challenges.

Geopolitical Risks and Economic Slowdown in Hong Kong:

Hong Kong's economy is facing significant headwinds:

- China's Influence: Increasing influence from mainland China is impacting Hong Kong's autonomy and creating uncertainty for businesses.

- Political Instability: Ongoing political tensions and social unrest are disrupting business activity and discouraging investment.

- Economic Slowdown: Hong Kong's economy is experiencing a noticeable slowdown, reflected in declining economic indicators. This slowdown is impacting various sectors and hindering overall growth.

- US-China Trade Tensions: The ongoing trade disputes between the US and China have negatively impacted Hong Kong’s position as a crucial trade hub, further exacerbating its economic woes.

Diminished Investment Appeal and Potential for Capital Flight:

UBS believes that these factors have significantly diminished Hong Kong's investment appeal:

- Limited Investment Opportunities: The current climate makes it difficult to identify attractive investment opportunities in Hong Kong, with many investors adopting a wait-and-see approach.

- Increased Risks: The combination of geopolitical risks and economic uncertainty significantly increases the risks associated with maintaining investments in Hong Kong.

- Potential Capital Flight: Investors may be inclined to move their capital out of Hong Kong to safer, more stable markets, potentially leading to further economic decline.

Comparing India and Hong Kong: A Contrasting Investment Landscape

| Feature | India | Hong Kong |

|---|---|---|

| Economic Growth | Strong, sustained growth | Slowdown, declining growth |

| Geopolitical Risk | Relatively low | High, due to China's influence |

| Investment Appeal | High, numerous opportunities | Low, limited opportunities |

| Risk | Manageable, outweighed by growth | Significant, potentially destabilizing |

The table clearly illustrates why UBS favors India as a far more attractive investment destination compared to Hong Kong at the present time. The contrasting growth prospects, coupled with the differing risk profiles, make India a compelling choice for investors seeking higher returns with manageable risks.

Conclusion: Navigating the Shifting Investment Landscape: India vs. Hong Kong

UBS's revised investment outlook clearly highlights a significant shift in the Asian investment landscape. The firm's bullish stance on India is driven by strong economic fundamentals, positive demographic trends, and government-led initiatives. Conversely, the bearish outlook on Hong Kong reflects concerns about geopolitical risks, economic slowdown, and diminished investment opportunities. This contrasting analysis underscores the importance of carefully considering the unique circumstances of each market when making investment decisions. By understanding the key factors driving UBS's investment analysis and reviewing the India investment opportunities versus the Hong Kong market outlook, investors can make informed decisions to adjust their portfolios accordingly. To learn more about UBS's investment strategies and to gain a deeper understanding of these significant market shifts, explore UBS's comprehensive reports and analyses.

Featured Posts

-

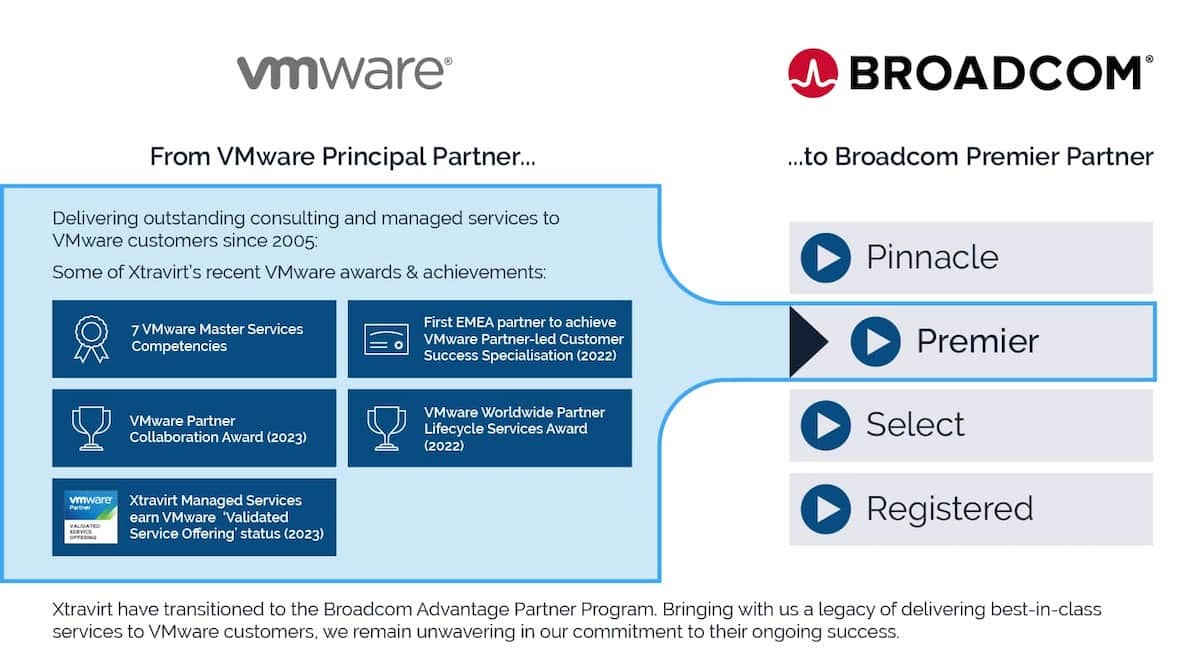

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Implications

Apr 25, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Implications

Apr 25, 2025 -

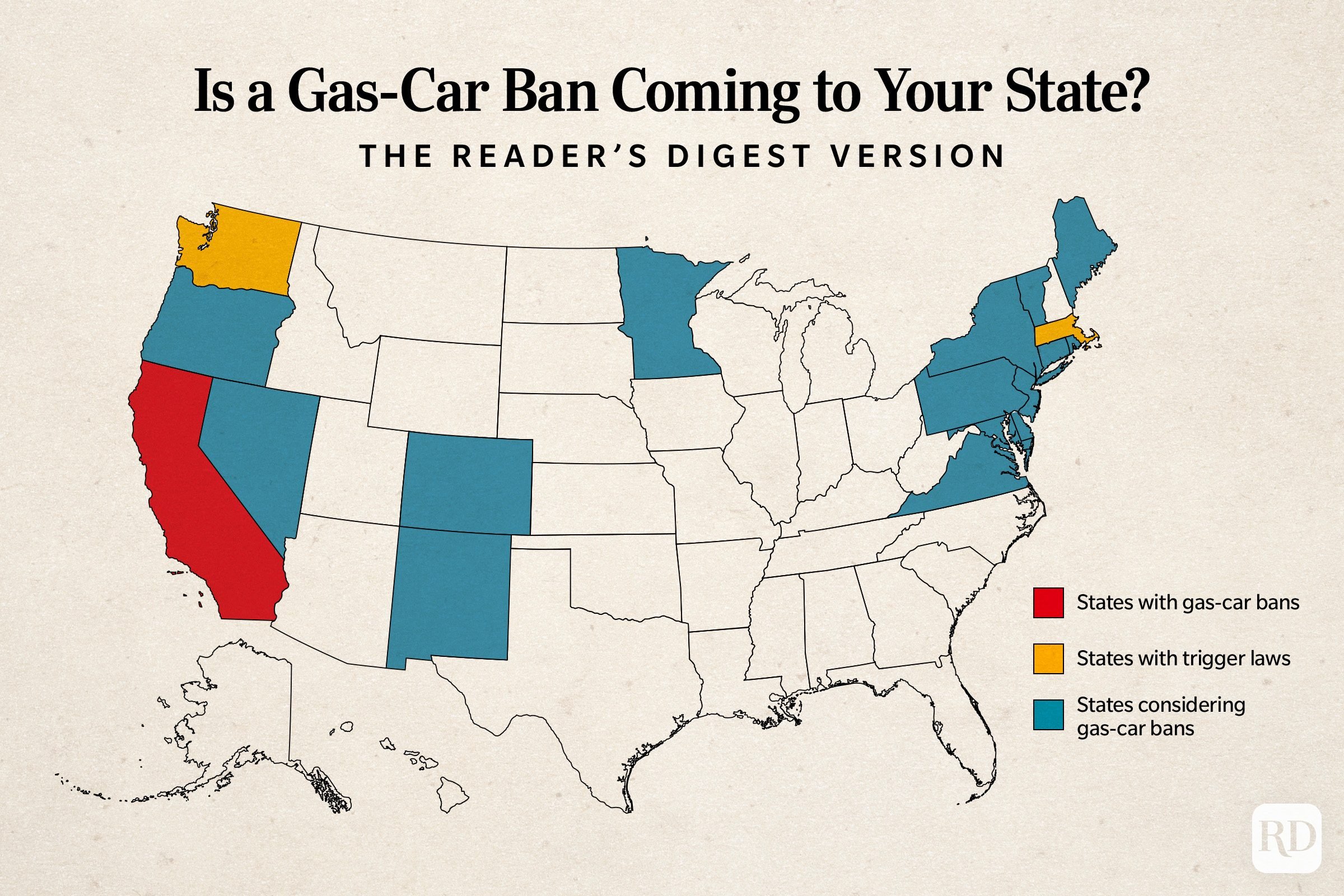

Delhis Old Petrol Car Ban Should Other Indian Cities Follow Suit

Apr 25, 2025

Delhis Old Petrol Car Ban Should Other Indian Cities Follow Suit

Apr 25, 2025 -

Cassidy Hutchinson Key Witness To The January 6th Hearings Announces Memoir

Apr 25, 2025

Cassidy Hutchinson Key Witness To The January 6th Hearings Announces Memoir

Apr 25, 2025 -

Election Promises A Realistic Assessment Of Fiscal Sustainability

Apr 25, 2025

Election Promises A Realistic Assessment Of Fiscal Sustainability

Apr 25, 2025 -

2025 Nfl Draft Profile Texas Wr Matthew Golden

Apr 25, 2025

2025 Nfl Draft Profile Texas Wr Matthew Golden

Apr 25, 2025

Latest Posts

-

Investing In Palantir Should You Buy Before The May 5th Deadline

May 10, 2025

Investing In Palantir Should You Buy Before The May 5th Deadline

May 10, 2025 -

Should You Invest In Palantir Stock Before May 5th

May 10, 2025

Should You Invest In Palantir Stock Before May 5th

May 10, 2025 -

Indian Stock Market Rally Sensex At 1 400 Points Nifty 50 Above 23 800

May 10, 2025

Indian Stock Market Rally Sensex At 1 400 Points Nifty 50 Above 23 800

May 10, 2025 -

Palantir Stock Buy Or Sell Before May 5th A Wall Street Perspective

May 10, 2025

Palantir Stock Buy Or Sell Before May 5th A Wall Street Perspective

May 10, 2025 -

Wall Streets Verdict On Palantir Stock Should You Buy Before May 5th

May 10, 2025

Wall Streets Verdict On Palantir Stock Should You Buy Before May 5th

May 10, 2025