Indian Stock Market Rally: Sensex At 1,400 Points, Nifty 50 Above 23,800

Table of Contents

Key Factors Influencing Indian Stock Market Growth

Several interconnected factors are contributing to this robust Indian Stock Market Rally. Analyzing these factors provides a clearer picture of the current market dynamics.

Global Economic Indicators

Positive global economic trends are playing a significant role. Easing inflation in key economies like the US and Europe, coupled with improved corporate earnings globally, is boosting investor confidence and driving capital flows into emerging markets, including India. For example, the recent moderation in US inflation has lessened concerns about aggressive interest rate hikes by the Federal Reserve, creating a more favorable environment for global equity markets. This positive sentiment directly influences foreign investment in the Indian stock market. Relevant keywords: global economy, inflation, foreign investment, emerging markets.

Domestic Economic Performance

India's strong domestic economic performance is another major driver. Robust GDP growth, exceeding expectations in recent quarters, demonstrates the resilience of the Indian economy. Furthermore, a positive manufacturing Purchasing Managers' Index (PMI) indicates healthy industrial activity. Increased consumer spending, fueled by rising disposable incomes, further strengthens the economic outlook and boosts market sentiment. Keywords: GDP growth, Indian economy, consumer spending, PMI, disposable income.

Government Policies and Initiatives

Government policies aimed at boosting infrastructure development, promoting ease of doing business, and implementing tax reforms are fostering a positive investment climate. The ambitious infrastructure spending plans, focused on enhancing connectivity and improving logistics, are attracting significant investments and creating new opportunities. Simplification of tax procedures and other reforms aimed at streamlining regulations contribute to a more efficient and attractive business environment. Keywords: government policies, infrastructure, tax reforms, ease of doing business, investment climate.

Strong Corporate Earnings

Strong corporate earnings across various sectors are a key indicator of the market's health. Many Indian companies have reported impressive results, fueled by robust domestic demand and increased exports. High-performing sectors include IT, banking, and pharmaceuticals, demonstrating the diverse nature of this economic growth. Specific examples of companies exceeding expectations should be included here (replace with actual company examples). Keywords: corporate earnings, sector performance, stock market gains, export growth, domestic demand.

Top Performing Sectors in the Indian Stock Market

The current Indian Stock Market Rally is not uniform across all sectors. Some sectors are experiencing significantly stronger growth than others.

- IT Sector: The IT sector continues to perform exceptionally well, driven by strong global demand for technology services and software solutions. Keywords: IT sector growth, technology services, software solutions.

- Banking Sector: The banking sector is benefiting from increased credit growth and improving asset quality. Keywords: banking stocks, credit growth, asset quality.

- Pharmaceutical Industry: The pharmaceutical industry is witnessing robust growth, fueled by both domestic and international demand. Keywords: pharmaceutical industry, drug manufacturing, export market.

- FMCG Performance: The Fast-Moving Consumer Goods (FMCG) sector is experiencing steady growth, driven by rising consumer spending and increasing product diversification. Keywords: FMCG performance, consumer spending, product diversification.

However, it’s important to note potential risks within each sector. For example, the IT sector could face challenges from global economic slowdowns, while the banking sector may be impacted by rising interest rates. A balanced perspective is crucial when analyzing sector performance.

Investor Sentiment and Market Volatility in India

Currently, investor sentiment leans towards bullishness, driven by the positive economic indicators and strong corporate earnings. However, market volatility remains a factor to consider. While the recent rally has been significant, fluctuations are still present, and investors should be prepared for potential corrections. Keywords: investor confidence, market volatility, risk assessment, market correction.

Expert opinions suggest that while the outlook is generally positive, global uncertainties, such as geopolitical tensions and the possibility of renewed inflationary pressures, could impact market performance. It's important to maintain a balanced perspective and acknowledge the potential for risk.

Navigating the Indian Stock Market Rally – What's Next?

The significant Indian Stock Market Rally, marked by the Sensex's impressive gain and the Nifty 50 exceeding 23,800, is fueled by a combination of global and domestic factors. Strong corporate earnings, positive economic indicators, and supportive government policies have all contributed to this growth. However, investors should remain vigilant, acknowledging potential risks and uncertainties in the global landscape. Continued monitoring of global economic trends, domestic policy developments, and sector-specific performance is crucial.

For investors, this means conducting thorough due diligence before making any investment decisions. Consider diversification across sectors and asset classes to mitigate risks. Stay informed about the evolving market dynamics and consult with financial advisors to create a personalized investment strategy. Stay tuned for further updates on the Indian stock market rally and its future trajectory, and make informed investment decisions based on thorough research and analysis. The current rally presents opportunities, but understanding the potential challenges is equally important for long-term success.

Featured Posts

-

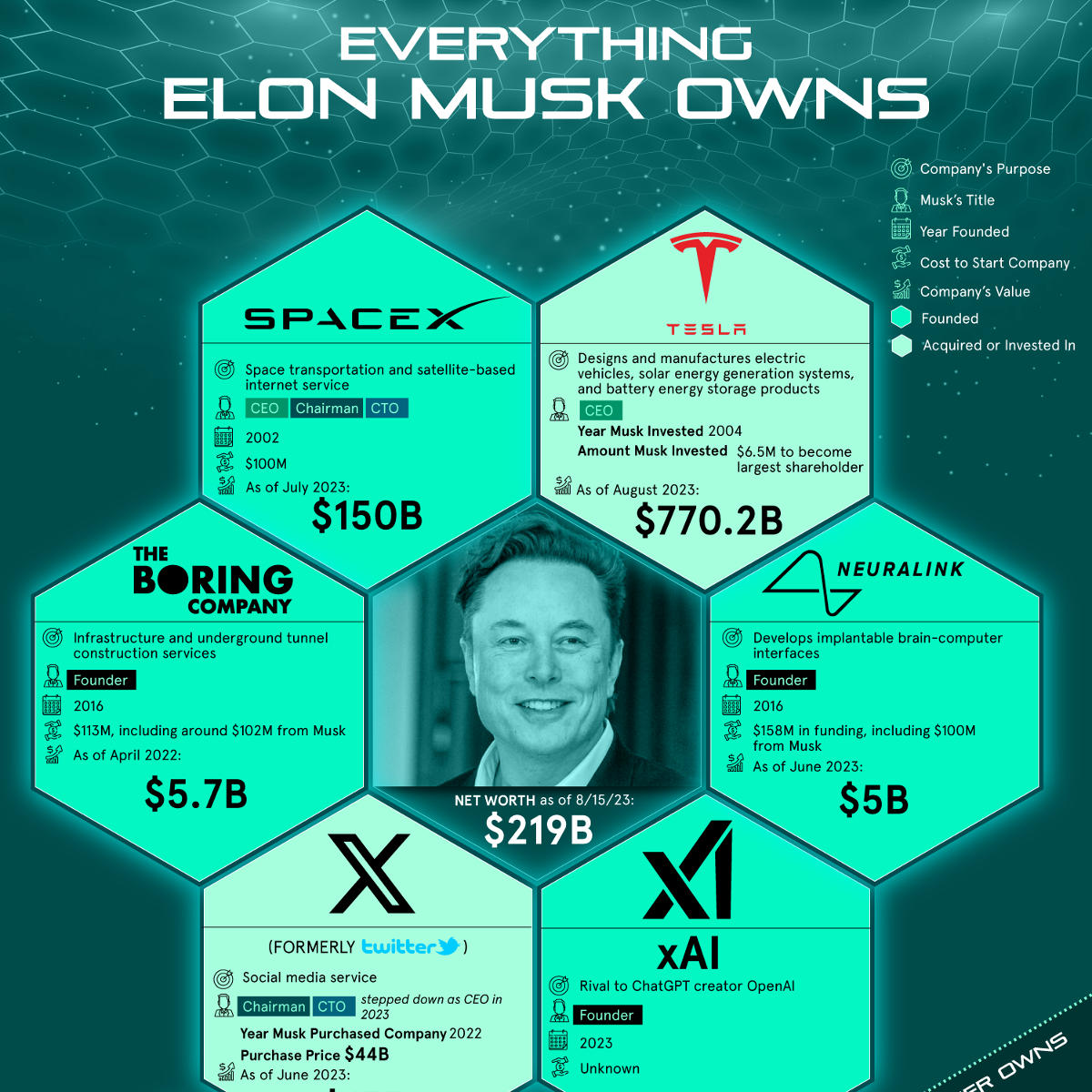

Elon Musks Net Worth A Comprehensive Look At His Business Ventures

May 10, 2025

Elon Musks Net Worth A Comprehensive Look At His Business Ventures

May 10, 2025 -

Donald Trumps Billionaire Friends Post Tariff Losses Since Liberation Day

May 10, 2025

Donald Trumps Billionaire Friends Post Tariff Losses Since Liberation Day

May 10, 2025 -

High Potential Season 1 5 Instances Where Morgan Wasnt The Smartest

May 10, 2025

High Potential Season 1 5 Instances Where Morgan Wasnt The Smartest

May 10, 2025 -

How Did Trumps Executive Orders Affect Transgender People We Want To Hear Your Story

May 10, 2025

How Did Trumps Executive Orders Affect Transgender People We Want To Hear Your Story

May 10, 2025 -

Kiev 9 Maya Starmer Makron Merts I Tusk Ne Podtverdili Uchastie

May 10, 2025

Kiev 9 Maya Starmer Makron Merts I Tusk Ne Podtverdili Uchastie

May 10, 2025