Election Promises: A Realistic Assessment Of Fiscal Sustainability

Table of Contents

Analyzing the Cost of Election Promises

Identifying Key Spending Commitments

Elections typically involve a barrage of promises focusing on key areas impacting voters' lives. These often translate into significant financial commitments for the government. Let's examine some typical examples:

- Infrastructure Projects: Promises to build new roads, bridges, and public transit systems often involve billions of dollars in investment. The true cost, including maintenance and long-term upkeep, is frequently underestimated.

- Social Programs: Expanding social safety nets, such as universal healthcare or increased unemployment benefits, significantly increases government spending. These programs, while beneficial, require careful budgeting and sustainable funding models.

- Tax Cuts: While popular, across-the-board tax cuts can drastically reduce government revenue, impacting the funding of essential public services. Targeted tax cuts may be more fiscally responsible.

The sheer scale of these commitments is often staggering. For instance, a recent study estimated that the cost of a particular party's infrastructure plan would exceed $1 trillion over ten years, raising serious questions about its fiscal sustainability.

Evaluating the Revenue Projections

Funding these ambitious promises requires realistic revenue projections. Common methods include:

- Tax Increases: Raising taxes on individuals or corporations can generate additional revenue, but this can stifle economic growth if not implemented carefully.

- Spending Cuts: Reducing spending in other areas can free up funds, but this requires tough choices and can negatively impact essential services.

- Increased Borrowing: Borrowing money to finance government spending increases the national debt, leading to potential long-term economic consequences.

Relying on projected economic growth to fund promises is particularly risky. Economic forecasts are inherently uncertain, and unexpected downturns can leave governments struggling to meet their commitments. Thorough economic analysis is crucial for evaluating the feasibility of revenue projections.

The Impact of Election Promises on Long-Term Fiscal Health

Debt Accumulation and its Consequences

Unfunded or underfunded election promises inevitably lead to increased national debt. This debt accumulation carries severe long-term consequences:

- Reduced Credit Rating: High levels of debt can negatively impact a country's credit rating, making it more expensive to borrow money in the future.

- Higher Interest Rates: Higher interest rates increase the cost of servicing the national debt, diverting funds from other essential programs.

- Fiscal Crises: In extreme cases, unsustainable debt levels can lead to full-blown fiscal crises, with devastating consequences for the economy and citizens.

Greece's debt crisis serves as a stark reminder of the potential consequences of ignoring fiscal sustainability.

Sustainability and Intergenerational Equity

Making promises that burden future generations with debt raises serious ethical questions. It's crucial to consider:

- Intergenerational Equity: Is it fair to prioritize short-term political gains over the long-term financial well-being of future generations?

- Sustainable Fiscal Policy: Adopting sustainable fiscal policy involves balancing current spending needs with the long-term fiscal health of the nation. This requires difficult choices, but it's essential for responsible governance.

Alternative approaches, such as investing in human capital and infrastructure projects with a high return on investment, can lead to more sustainable economic growth and reduce the reliance on borrowing.

Assessing the Transparency and Accountability of Election Promises

The Importance of Detailed Cost-Benefit Analyses

To make informed decisions, voters need access to detailed cost-benefit analyses of candidates' proposals.

- Independent Scrutiny: Independent organizations play a vital role in scrutinizing election promises, providing objective assessments of their fiscal impact.

- Public Access to Information: Transparency in government finances is paramount. The public has a right to know how their tax money is being spent.

Candidates should be held accountable for providing realistic and detailed information about the costs and benefits of their proposed policies.

Mechanisms for Ensuring Accountability After the Election

Ensuring accountability after the election is just as crucial as scrutinizing promises beforehand:

- Parliamentary Oversight: Strong parliamentary oversight mechanisms are essential for monitoring government spending and holding elected officials accountable.

- Independent Audits: Regular independent audits of government finances provide an objective assessment of fiscal performance.

Improving transparency and accountability in government spending through mechanisms such as open data initiatives and strengthened auditing processes is critical for responsible governance.

Conclusion

A realistic assessment of election promises is crucial for maintaining long-term fiscal sustainability. The analysis presented above highlights the significant financial implications of unfunded or underfunded promises, emphasizing the risks associated with debt accumulation and the importance of intergenerational equity. By demanding a realistic assessment of election promises and focusing on responsible fiscal policy, we can ensure a brighter financial future for our nation. Let's engage in informed decision-making by critically evaluating candidates' fiscal plans and demanding transparency and accountability in government spending – promoting sustainable fiscal policy for generations to come. Demand responsible election promises and hold our elected officials accountable for their fiscal commitments.

Featured Posts

-

Werder Bremen Fall To Bayern Munich As Kane Bags A Brace

Apr 25, 2025

Werder Bremen Fall To Bayern Munich As Kane Bags A Brace

Apr 25, 2025 -

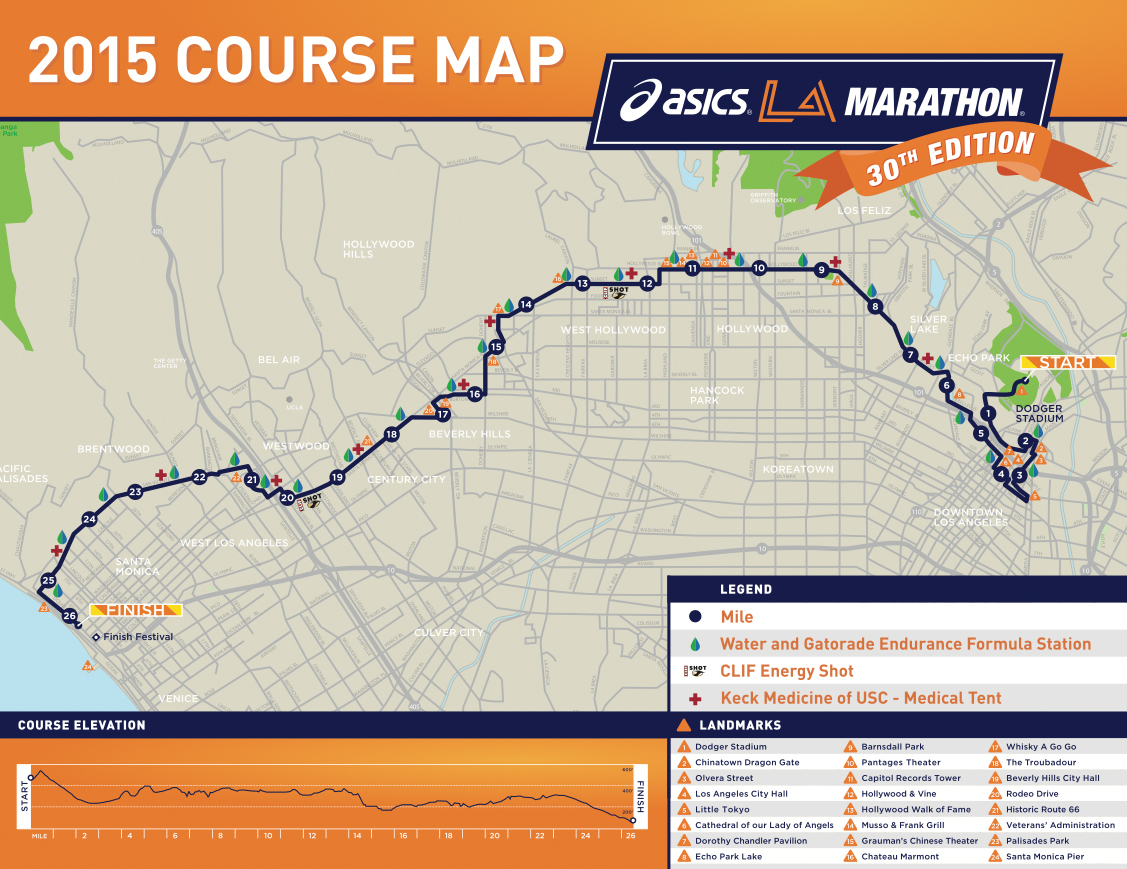

2025 Los Angeles Marathon 10 Essential Things To Know

Apr 25, 2025

2025 Los Angeles Marathon 10 Essential Things To Know

Apr 25, 2025 -

Severe Weather Timeline For Oklahoma Wednesdays Hail And Wind Threat

Apr 25, 2025

Severe Weather Timeline For Oklahoma Wednesdays Hail And Wind Threat

Apr 25, 2025 -

Building Peace On The Dnieper A Framework For Sustainable Development

Apr 25, 2025

Building Peace On The Dnieper A Framework For Sustainable Development

Apr 25, 2025 -

Mercer Internationals 2024 Fourth Quarter And Annual Report 0 075 Dividend

Apr 25, 2025

Mercer Internationals 2024 Fourth Quarter And Annual Report 0 075 Dividend

Apr 25, 2025

Latest Posts

-

Frantsiya I Polsha Makron I Tusk Gotovyatsya Podpisat Dogovor

May 10, 2025

Frantsiya I Polsha Makron I Tusk Gotovyatsya Podpisat Dogovor

May 10, 2025 -

Novoe Voennoe Soglashenie Frantsiya I Polsha Protivostoyat Rossii I S Sh A

May 10, 2025

Novoe Voennoe Soglashenie Frantsiya I Polsha Protivostoyat Rossii I S Sh A

May 10, 2025 -

Chto Soderzhitsya V Oboronnom Soglashenii Makrona I Tuska 9 Maya

May 10, 2025

Chto Soderzhitsya V Oboronnom Soglashenii Makrona I Tuska 9 Maya

May 10, 2025 -

Frantsiya Polsha Podpisanie Oboronnogo Pakta Posledstviya Dlya Geopolitiki

May 10, 2025

Frantsiya Polsha Podpisanie Oboronnogo Pakta Posledstviya Dlya Geopolitiki

May 10, 2025 -

Soglashenie Makrona I Tuska 9 Maya Klyuchevye Punkty I Analiz

May 10, 2025

Soglashenie Makrona I Tuska 9 Maya Klyuchevye Punkty I Analiz

May 10, 2025