Uber's Self-Driving Gamble: Assessing The Impact On Stock Price

Table of Contents

The Potential for Disruptive Innovation and Stock Appreciation

The potential for self-driving technology to revolutionize the ride-sharing market and boost Uber's self-driving stock is undeniable. Autonomous vehicles promise to significantly disrupt the industry, offering Uber a pathway to increased market share and profitability. This disruptive potential is a key driver of investor interest in Uber's self-driving initiatives.

-

Increased Efficiency and Market Share: Self-driving cars could operate 24/7, maximizing vehicle utilization and minimizing downtime. This increased efficiency translates directly to higher revenue and a stronger competitive advantage against traditional taxi services and emerging ride-sharing competitors.

-

Cost Savings and Higher Profit Margins: The most significant cost for ride-sharing companies is labor. Autonomous vehicles drastically reduce this expense, leading to significantly higher profit margins. This cost reduction is a major factor influencing the potential for Uber's self-driving stock to appreciate.

-

Analyst Predictions and Market Projections: Many analysts predict substantial growth in the autonomous vehicle market, forecasting a significant positive impact on Uber's stock price if the company successfully integrates this technology. Positive projections often cite the potential for expansion into new markets and revenue streams.

-

New Revenue Streams: Beyond ride-sharing, autonomous vehicles open doors to new revenue streams, such as autonomous delivery services (Uber Eats expansion) and potentially even subscription models for autonomous vehicle access. This diversification further strengthens the case for Uber's self-driving stock.

-

Bullet Points:

- Increased efficiency

- Higher profit margins

- Enhanced competitive advantage

- Potential for new revenue streams (delivery, subscriptions)

The Significant Financial Risks and Stock Price Volatility

While the potential rewards are substantial, investing in self-driving technology is incredibly risky, and this risk significantly impacts Uber's self-driving stock. The financial investment required for research and development (R&D), infrastructure, and legal compliance is enormous. Furthermore, the technology is still under development, and significant hurdles remain.

-

Substantial Financial Investment: The cost of developing, testing, and deploying autonomous vehicle technology is astronomical. This substantial investment puts considerable pressure on Uber's finances and can lead to stock price volatility.

-

Safety Concerns and Legal Liabilities: Accidents involving autonomous vehicles could result in massive legal liabilities, negatively impacting Uber's self-driving stock and overall financial health. Regulatory hurdles and changing safety standards also pose significant risks.

-

Technological Challenges and Delays: Perfecting self-driving technology is a complex engineering challenge. Delays or setbacks in development could significantly impact investor confidence and negatively affect Uber's self-driving stock performance.

-

Stock Price Fluctuations: News related to Uber's autonomous vehicle program directly impacts its stock price. Positive news (successful tests, partnerships) typically leads to price increases, while negative news (accidents, delays) often results in significant drops.

-

Bullet Points:

- High development costs

- Regulatory uncertainty

- Competition from other tech giants (e.g., Waymo, Tesla)

- Potential for significant losses

Analyzing Investor Sentiment and Market Reaction to Uber's Self-Driving Initiatives

Investor sentiment towards Uber's self-driving ambitions is highly dynamic. It fluctuates based on news about the program's progress, technological breakthroughs, accidents, and partnerships. Understanding this sentiment is crucial for assessing the future of Uber's self-driving stock.

-

Changing Investor Sentiment: Initially, investors were largely optimistic about Uber's self-driving plans. However, setbacks and accidents have tempered enthusiasm, leading to increased volatility in Uber's self-driving stock.

-

Impact of News and Events: Positive news, such as successful test runs or strategic partnerships, tends to boost investor confidence and the stock price. Conversely, negative news, such as accidents or regulatory setbacks, often leads to sharp declines.

-

Investor Reports and Financial News: Closely following investor reports, financial news articles, and analyst commentary specifically focused on Uber's autonomous vehicle program provides vital insight into market sentiment and its impact on the stock.

-

Bullet Points:

- Positive news (successful tests, partnerships) vs. negative news (accidents, delays)

- Impact of competitor actions

- Overall market conditions

The Role of Public Perception and Media Coverage

Public perception of autonomous vehicle safety plays a significant role in influencing investor confidence and Uber's self-driving stock. Negative media coverage, particularly following accidents, can severely damage investor sentiment and lead to stock price declines. Conversely, positive media portraying technological advancements can boost confidence.

Conclusion

Uber's investment in self-driving technology is a high-risk, high-reward endeavor with significant implications for its stock price. While the potential for disruption and increased profitability is immense, considerable financial and technological challenges remain. Investor sentiment is highly sensitive to news and developments within the program.

Call to Action: Understanding the complexities of "Uber's self-driving stock" is crucial for investors looking to navigate this volatile yet potentially lucrative market. Stay informed on the latest developments and carefully assess the risks before making investment decisions. Continue to monitor news and analysis regarding Uber's autonomous vehicle program to make informed choices about Uber's self-driving stock.

Featured Posts

-

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025

Xrp News 3 Reasons For A Potential Xrp Price Surge

May 08, 2025 -

Lahwr Myn Gwsht Ky Qymtwn Ka Bhran Chkn Mtn Awr Byf Mhnge Ewam Pryshan

May 08, 2025

Lahwr Myn Gwsht Ky Qymtwn Ka Bhran Chkn Mtn Awr Byf Mhnge Ewam Pryshan

May 08, 2025 -

Micro Strategy Stock Vs Bitcoin Predicting The Best Investment For 2025

May 08, 2025

Micro Strategy Stock Vs Bitcoin Predicting The Best Investment For 2025

May 08, 2025 -

Flamengo Campeon De La Taca Guanabara El Golazo De Arrascaeta Que Definio El Partido

May 08, 2025

Flamengo Campeon De La Taca Guanabara El Golazo De Arrascaeta Que Definio El Partido

May 08, 2025 -

Pnjab Pwlys Myn Ays Pyz Awr Dy Ays Pyz Ke Tbadlwn Ka Aelan

May 08, 2025

Pnjab Pwlys Myn Ays Pyz Awr Dy Ays Pyz Ke Tbadlwn Ka Aelan

May 08, 2025

Latest Posts

-

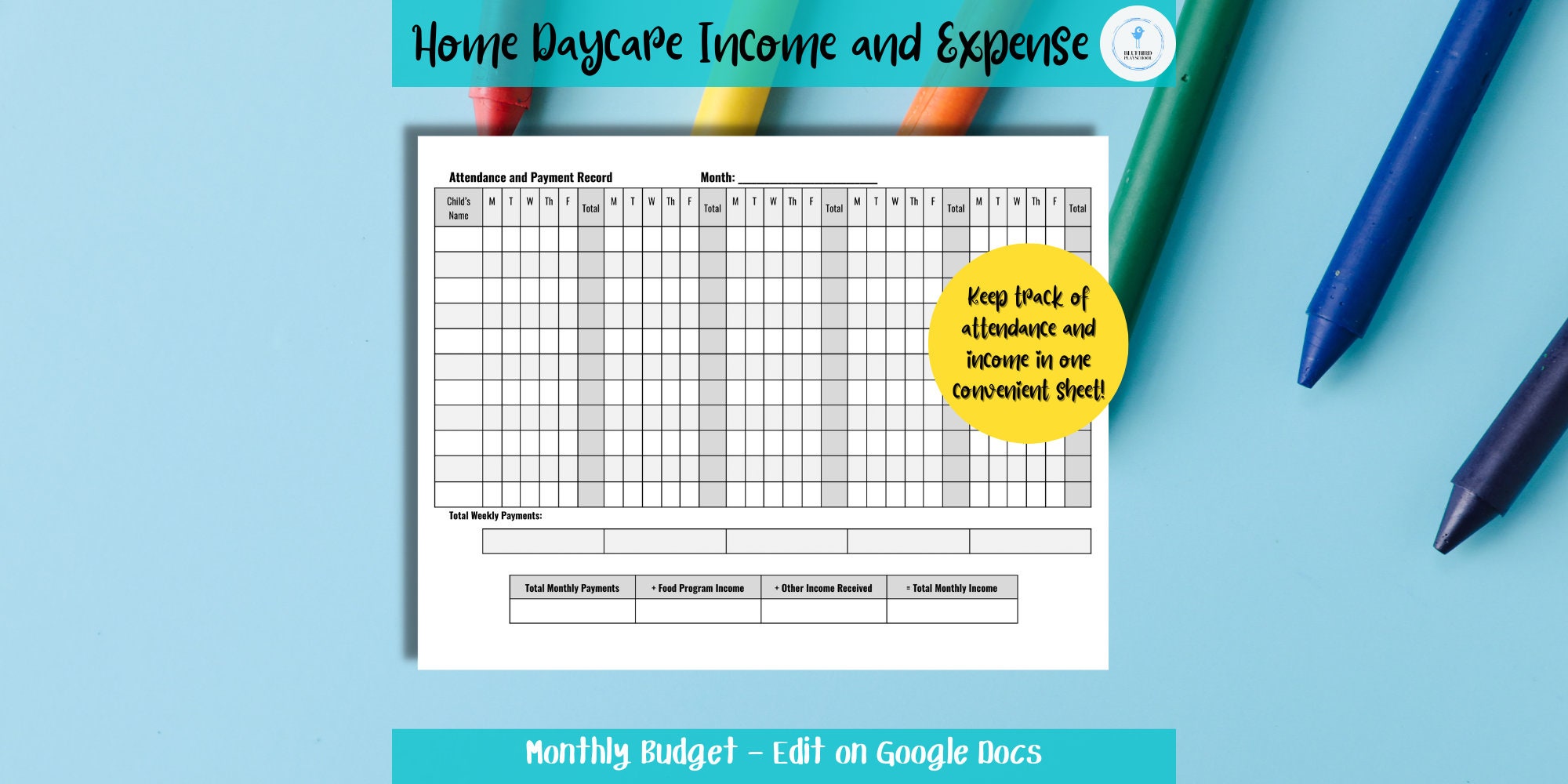

Daycare Decisions Navigating The Complexities Of Modern Parenting

May 09, 2025

Daycare Decisions Navigating The Complexities Of Modern Parenting

May 09, 2025 -

Cong Dong Phan No Truoc Loi Khai Bao Mau Tat Tre Tien Giang

May 09, 2025

Cong Dong Phan No Truoc Loi Khai Bao Mau Tat Tre Tien Giang

May 09, 2025 -

Air India Responds To Lisa Rays Complaint Actors Claims Unfounded

May 09, 2025

Air India Responds To Lisa Rays Complaint Actors Claims Unfounded

May 09, 2025 -

Mans 3 000 Babysitting Bill Snowballs Into 3 600 Daycare Expense

May 09, 2025

Mans 3 000 Babysitting Bill Snowballs Into 3 600 Daycare Expense

May 09, 2025 -

The High Cost Of Daycare And Alternatives For Working Families

May 09, 2025

The High Cost Of Daycare And Alternatives For Working Families

May 09, 2025