MicroStrategy Stock Vs. Bitcoin: Predicting The Best Investment For 2025

Table of Contents

H2: Understanding MicroStrategy's Business Model and Stock Performance

H3: MicroStrategy's Core Business: MicroStrategy is a publicly traded company primarily known for its business intelligence (BI) software and services. They provide tools for data analysis, visualization, and reporting, helping organizations make data-driven decisions. However, a significant factor influencing its stock price is its massive Bitcoin holdings.

- Revenue Streams: Software licenses, subscription services, cloud offerings, and consulting.

- Market Share: MicroStrategy holds a notable share within the enterprise BI market, competing with giants like Tableau and SAP.

- Profitability: MicroStrategy's profitability has fluctuated, influenced by the performance of its core business and the volatility of its Bitcoin investment.

- Debt Levels: The company has undertaken debt financing to acquire its Bitcoin holdings, a factor to consider when assessing its financial health.

- Recent Financial Reports: Regularly review MicroStrategy's quarterly and annual reports for the most up-to-date financial information, including revenue, earnings, and debt.

Keyword Focus: MicroStrategy stock price, MicroStrategy financials, business intelligence software, competitive advantage.

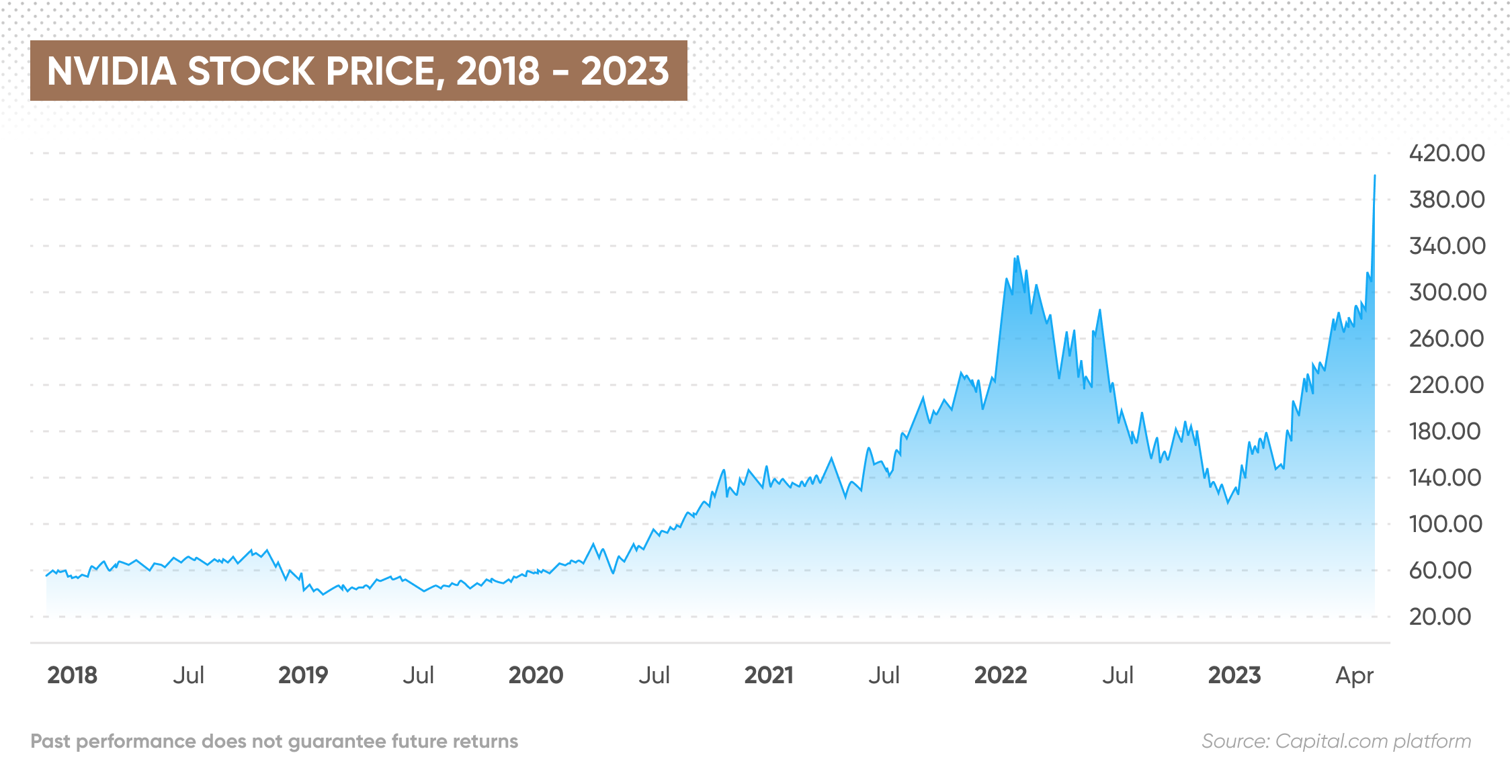

H3: Historical Stock Performance and Future Projections: MicroStrategy's stock price has shown significant volatility, influenced both by its business performance and the price fluctuations of Bitcoin. Analyzing historical stock charts reveals periods of strong growth alongside considerable declines.

- Historical Stock Chart Analysis: Examining past performance provides insights into the stock's volatility and potential for future growth or decline.

- Key Growth Drivers: Continued growth in the business intelligence market, successful software innovation, and the potential appreciation of Bitcoin holdings are key growth drivers.

- Potential Risks: Competition from other BI providers, economic downturns impacting enterprise spending, and the inherent volatility of Bitcoin holdings pose significant risks.

- Expert Opinions and Predictions: While predictions are not guarantees, analyzing analyst forecasts and expert opinions can provide valuable context for future stock price movements. Many sources provide MicroStrategy stock forecasts for 2025.

Keyword Focus: MicroStrategy stock forecast, MicroStrategy stock chart, stock market analysis, investment risk, growth potential.

H2: Bitcoin's Potential as a Long-Term Investment

H3: Bitcoin's Technological Foundation and Market Adoption: Bitcoin is a decentralized digital currency secured by cryptography and operates on a blockchain network. Its increasing adoption as a store of value and medium of exchange is driving its price.

- Blockchain Technology: The underlying technology provides transparency and security, although scalability remains a challenge.

- Institutional Adoption: Major corporations and institutional investors are increasingly including Bitcoin in their portfolios, driving demand.

- Regulatory Landscape: The evolving regulatory landscape around cryptocurrencies globally presents both opportunities and challenges.

- DeFi Applications: Decentralized finance (DeFi) applications are broadening the use cases for Bitcoin and other cryptocurrencies.

Keyword Focus: Bitcoin price prediction, Bitcoin future, cryptocurrency market, blockchain technology, digital currency.

H3: Bitcoin's Volatility and Risk Assessment: Bitcoin's price is notoriously volatile, experiencing significant swings in short periods. Therefore, a carefully considered risk management strategy is crucial.

- Historical Price Fluctuations: Examining historical price data reveals its volatility and the potential for both substantial gains and losses.

- Risk Mitigation Strategies: Diversification within a cryptocurrency portfolio and dollar-cost averaging can help mitigate risk.

- Potential for Significant Gains and Losses: Bitcoin's potential for high returns comes with a high degree of risk.

Keyword Focus: Bitcoin volatility, cryptocurrency risk, investment diversification, risk management, long-term Bitcoin strategy.

H2: Direct Comparison: MicroStrategy Stock vs. Bitcoin for 2025

H3: Comparing Potential Returns and Risks: Directly comparing MicroStrategy stock and Bitcoin requires considering their different risk profiles and potential return scenarios. While Bitcoin offers higher potential upside, it also carries significantly higher volatility.

| Feature | MicroStrategy Stock | Bitcoin |

|---|---|---|

| Potential Return | Moderate, dependent on business growth & Bitcoin holdings | High, but highly volatile |

| Volatility | Moderate to High | Very High |

| Risk Profile | Moderate to High | Very High |

| Liquidity | Relatively High | Relatively High (depending on exchange) |

Keyword Focus: Bitcoin vs MicroStrategy, investment comparison, ROI comparison, risk profile comparison, long-term investment options.

H3: Considering Investment Goals and Risk Tolerance: The optimal choice depends entirely on your individual financial goals and risk tolerance.

- Conservative vs. Aggressive Investment Strategies: Conservative investors might prefer MicroStrategy stock due to its relatively lower volatility, while aggressive investors might be drawn to Bitcoin’s higher potential returns.

- Diversification within a Portfolio: Diversifying your investment across different asset classes is a cornerstone of sound financial planning.

- Seeking Professional Financial Advice: Consulting a qualified financial advisor is always recommended before making significant investment decisions.

Keyword Focus: Investment strategy, risk tolerance, financial planning, portfolio diversification, investment advice.

3. Conclusion:

MicroStrategy stock and Bitcoin represent distinct investment opportunities with different risk-return profiles. MicroStrategy's performance hinges on its core business alongside the value of its Bitcoin holdings, offering moderate potential but with moderate to high risk. Bitcoin, while possessing exceptionally high growth potential, comes with substantially higher volatility and risk. The best choice depends entirely on your individual investment goals, time horizon, and risk tolerance.

Call to Action: Before making any investment decisions regarding MicroStrategy stock or Bitcoin, conduct thorough research and potentially consult a financial advisor. Making informed choices about your MicroStrategy stock and Bitcoin investments is crucial for achieving your long-term financial goals. Consider your risk tolerance and investment timeframe when making your decision regarding MicroStrategy stock vs Bitcoin. Remember that past performance is not indicative of future results.

Featured Posts

-

9 4000 360

May 08, 2025

9 4000 360

May 08, 2025 -

Cadillac Celestiq First Drive Luxury Technology And A 360 000 Price Tag

May 08, 2025

Cadillac Celestiq First Drive Luxury Technology And A 360 000 Price Tag

May 08, 2025 -

Counting Crows Snl Appearance A Turning Point

May 08, 2025

Counting Crows Snl Appearance A Turning Point

May 08, 2025 -

Review Microsofts 12 Inch Surface Pro At 799

May 08, 2025

Review Microsofts 12 Inch Surface Pro At 799

May 08, 2025 -

Play Station Podcast 512 True Blue Discussion

May 08, 2025

Play Station Podcast 512 True Blue Discussion

May 08, 2025

Latest Posts

-

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025 -

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025 -

Understanding The Dwps New Universal Credit Verification System

May 08, 2025

Understanding The Dwps New Universal Credit Verification System

May 08, 2025 -

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025 -

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025