XRP Price Soars 400%: What's Next For The Cryptocurrency?

Table of Contents

Factors Contributing to the XRP Price Surge

Several converging factors have contributed to XRP's dramatic price increase. Let's analyze the key elements driving this bullish momentum.

Positive Ripple Legal Developments

The most significant catalyst for XRP's resurgence is the positive momentum in the ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC). Recent developments have significantly impacted investor sentiment and market confidence.

- Dismissal of certain SEC claims: The court's dismissal of certain SEC claims against Ripple has significantly boosted investor confidence, alleviating some of the regulatory uncertainty that previously weighed down XRP's price.

- Judge's positive statements regarding programmatic sales: Favorable statements from the presiding judge regarding Ripple's programmatic sales of XRP have further strengthened the positive narrative surrounding the case.

- Reduced legal uncertainty: The lessening of legal uncertainty has unlocked significant pent-up demand, leading to a surge in trading volume and price appreciation. Investors who were hesitant to invest due to the legal risks are now more willing to participate.

Increased Adoption and Partnerships

Beyond the legal victories, increased adoption and strategic partnerships are fueling XRP's growth.

- New payment system integrations: Ripple's technology, using XRP for cross-border payments, is seeing increased integration into various financial institutions and payment systems globally. This expanding network is enhancing XRP's utility and driving demand.

- Growing cross-border transaction volume: The volume of cross-border transactions facilitated by XRP is steadily increasing, demonstrating the real-world applicability of the cryptocurrency and its potential to disrupt the traditional financial system. This practical application is a strong indicator of long-term growth potential.

- Increased trading volume and user activity: The surge in XRP's price is accompanied by a significant increase in trading volume and user activity on various cryptocurrency exchanges, demonstrating robust market interest.

Overall Market Sentiment and Crypto Market Trends

The broader cryptocurrency market's positive sentiment has also contributed to XRP's price surge.

- Bitcoin's positive price action: Bitcoin's price movements often influence the performance of altcoins like XRP. A rising Bitcoin market typically creates a more favorable environment for altcoins to flourish.

- General bullish market sentiment: A prevailing bullish sentiment within the crypto market generally encourages investment in various cryptocurrencies, including XRP. This positive market psychology amplifies price increases.

- Reduced risk aversion: Decreased risk aversion among investors contributes to a willingness to invest in higher-risk assets, including cryptocurrencies, thereby driving up demand.

Analyzing Future Price Predictions for XRP

Predicting the future price of any cryptocurrency, including XRP, is inherently speculative. However, we can analyze potential future price movements using both technical and fundamental analysis.

Technical Analysis

Technical analysis involves studying price charts and indicators to identify potential price trends.

- Chart patterns: Observing chart patterns such as bullish flags or golden crosses can provide insights into potential price movements. However, these are not foolproof predictors.

- Support and resistance levels: Identifying support and resistance levels can help estimate potential price ranges. Breakouts above resistance levels often signal further price increases.

- Moving averages: Analyzing moving averages can help gauge the overall trend and identify potential buy or sell signals. However, it's crucial to consider other indicators alongside moving averages.

Disclaimer: Technical analysis should not be the sole basis for investment decisions.

Fundamental Analysis

Fundamental analysis focuses on evaluating the underlying value and potential of XRP.

- Ripple's technological advancements: Ripple's ongoing development and improvements to its technology will significantly influence XRP's long-term value. Innovation and adaptation are key to success in the crypto space.

- Market share in cross-border payments: Ripple's market share in the rapidly growing cross-border payment market will directly affect XRP's demand and price. Greater market penetration translates to higher value.

- Regulatory clarity: Increased regulatory clarity, whether positive or negative, will have a major impact on XRP's price. Clearer rules reduce uncertainty and can either boost or hinder investment.

Risk Assessment

Investing in cryptocurrencies involves significant risk.

- Market volatility: The cryptocurrency market is notoriously volatile, and XRP's price can fluctuate dramatically in short periods. Be prepared for significant price swings.

- Regulatory uncertainty: Regulatory uncertainty remains a key risk factor for XRP, and future regulatory actions could significantly impact its price.

- Market manipulation: The possibility of market manipulation remains a concern in the cryptocurrency market.

Always conduct thorough research and only invest what you can afford to lose.

Investing in XRP: Strategies and Considerations

Investing in XRP requires a well-defined strategy and careful risk management.

Diversification and Risk Management

Diversification is crucial for mitigating risk.

- Diversified portfolio: Don't put all your eggs in one basket. Diversify your investments across different asset classes, including other cryptocurrencies and traditional assets.

- Risk tolerance: Assess your risk tolerance before investing in XRP or any other cryptocurrency. Only invest what you can afford to lose.

- Dollar-cost averaging: Consider dollar-cost averaging, investing a fixed amount at regular intervals, to reduce the impact of market volatility.

Choosing a Reliable Exchange

Selecting a secure and reputable cryptocurrency exchange is paramount.

- Security measures: Choose an exchange with robust security measures to protect your investments from hacking and theft. Look for exchanges with two-factor authentication and other security protocols.

- Reputation and track record: Research the exchange's reputation and track record before depositing funds. Read reviews and assess its security protocols.

- Due diligence: Always conduct thorough due diligence before selecting any cryptocurrency exchange.

Staying Informed

Staying updated on news and developments related to XRP is vital.

- Reliable news sources: Follow reputable news sources and analytical platforms for up-to-date information on XRP and the broader cryptocurrency market.

- Analytical tools: Utilize analytical tools to monitor price trends, trading volume, and other relevant market indicators.

- Continuous learning: Continuously learn about cryptocurrency investing and market trends to improve your decision-making.

Conclusion: The Future of XRP After its 400% Price Jump

XRP's recent 400% price surge is a result of positive legal developments, increased adoption, and a generally bullish market sentiment. While the future price of XRP remains uncertain, both technical and fundamental analysis offer potential insights into future price movements. However, it's crucial to acknowledge the inherent risks associated with cryptocurrency investments. Thorough research, diversification, and responsible risk management are essential for navigating this volatile market. Stay informed about the evolving landscape of XRP and other cryptocurrencies. Conduct your own thorough research before investing and make informed decisions about your portfolio. Learn more about the potential of XRP and its future in the exciting world of digital assets.

Featured Posts

-

Los Angeles Angels Baseball 2025 Streaming Options No Cable

May 08, 2025

Los Angeles Angels Baseball 2025 Streaming Options No Cable

May 08, 2025 -

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025 -

Deandre Dzordan I Jokicev Ritual Istina Iza Tri Poljupca

May 08, 2025

Deandre Dzordan I Jokicev Ritual Istina Iza Tri Poljupca

May 08, 2025 -

Can Xrp Continue Its 400 Ascent A Price Prediction Analysis

May 08, 2025

Can Xrp Continue Its 400 Ascent A Price Prediction Analysis

May 08, 2025 -

Exploring The Themes In Krypto The Last Dog Of Krypton

May 08, 2025

Exploring The Themes In Krypto The Last Dog Of Krypton

May 08, 2025

Latest Posts

-

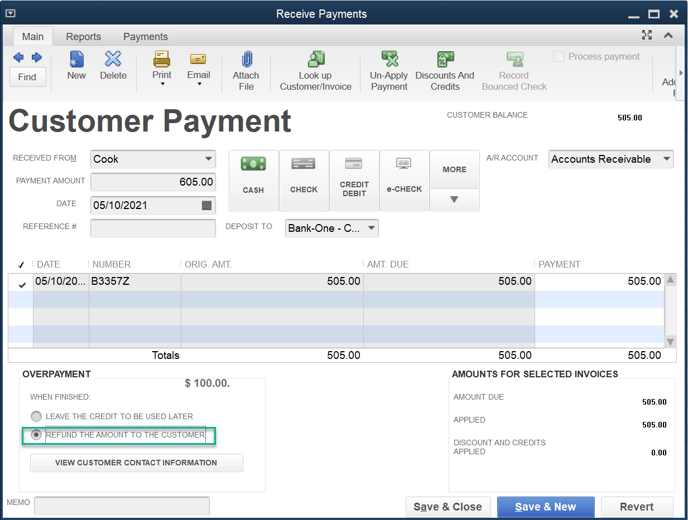

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025 -

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025 -

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025 -

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025 -

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025