ECB's View On The Disinflationary Impact Of Trump's Tariffs: Holzmann's Analysis

Table of Contents

Holzmann's Role and Expertise

Robert Holzmann, a Governor of the Oesterreichische Nationalbank (Austrian National Bank) and a member of the ECB's Governing Council, holds significant sway in shaping the ECB's monetary policy. His expertise lies in monetary policy, inflation dynamics, and the intricate workings of the global economy. Holzmann's contributions to ECB discussions are highly valued due to his rigorous analytical approach and his profound understanding of macroeconomic factors. While specific publications solely dedicated to this topic may be limited, his participation in ECB press conferences and statements offers valuable insights into his thinking regarding the impact of trade wars on inflation.

The Mechanism of Disinflationary Pressure

Trump's tariffs created a complex web of economic effects, ultimately exerting disinflationary pressure. The mechanism can be understood through several key channels:

- Increased Input Costs: Tariffs raised the cost of imported goods, impacting businesses reliant on imported raw materials and intermediate goods. This increase in input costs squeezed profit margins and hindered investment.

- Reduced Consumer Purchasing Power: Higher prices for imported goods and domestically produced goods incorporating imported inputs reduced consumer purchasing power, leading to decreased aggregate demand.

- Suppressed Aggregate Demand: The combined effects of higher prices and reduced purchasing power dampened overall economic activity, further contributing to lower inflation.

- Supply Chain Disruptions: Tariffs disrupted global supply chains, leading to production delays and shortages, which in turn contributed to reduced output and inflationary pressure.

For example, the increase in steel prices due to tariffs impacted the automotive industry, leading to higher car prices and reduced sales. This exemplifies the intricate linkages between tariffs, input costs, and overall inflationary pressures. Specific data points on these impacts would require referencing ECB publications and reports.

ECB's Overall Assessment (Beyond Holzmann)

While Holzmann's perspective offers a valuable insight, it's crucial to understand the broader ECB stance. The ECB's assessment of Trump's tariffs and their inflationary impact was likely nuanced and multifaceted, reflecting the diverse opinions within the Governing Council. While some members may have echoed Holzmann's concerns regarding disinflationary pressures, others might have emphasized different aspects or potential countervailing inflationary forces. The ECB's overall assessment would likely incorporate a multitude of factors beyond the direct impact of tariffs, such as global economic growth, energy prices, and domestic demand. Analyzing the ECB's official statements and minutes from Governing Council meetings would provide a clearer picture of this broader perspective.

Data and Evidence Used in Holzmann's Analysis

Holzmann's analysis would undoubtedly have drawn upon a range of economic data to support his assessment. This likely included:

- Consumer Price Index (CPI): Tracking changes in the price level of consumer goods and services.

- Producer Price Index (PPI): Monitoring price changes at the wholesale level, reflecting input cost pressures.

- Trade Figures: Analyzing import and export data to assess the direct impact of tariffs on trade flows and prices.

He might have employed econometric models to isolate the effect of tariffs from other factors influencing inflation. The specific methodologies and data sources utilized would be detailed within official ECB publications or transcripts of his presentations. Referencing these sources directly would strengthen the credibility of any analysis.

Limitations and Criticisms of Holzmann's Analysis

It's vital to acknowledge potential limitations and criticisms of Holzmann's analysis. The impact of tariffs on inflation is complex and difficult to isolate from other economic forces. Factors such as exchange rate fluctuations, changes in global commodity prices, and domestic economic policies all play a role. Furthermore, the time lag between the implementation of tariffs and their full economic impact adds complexity to the analysis. Alternative perspectives might highlight other channels through which tariffs could generate inflationary pressures, such as reduced competition and increased market concentration. The uncertainty surrounding the long-term effects of tariffs on inflation requires careful consideration and acknowledges the limitations inherent in any short-term assessment.

Conclusion: Understanding the ECB's and Holzmann's Perspective on Tariffs and Inflation

Holzmann's analysis, while reflecting a specific perspective within the ECB, highlights the potential disinflationary consequences of Trump's tariffs on the Eurozone. His work likely leveraged key economic indicators like CPI and PPI to show the effects on input costs and consumer purchasing power. The ECB's broader assessment, though potentially more nuanced, acknowledges the complexities of this impact. Understanding the ECB's perspective on these matters is crucial for investors, policymakers, and anyone interested in navigating the intricacies of global trade and its influence on the Eurozone economy. To delve deeper into this crucial area, we encourage you to explore the ECB’s publications on inflation analysis, specifically research on Holzmann's views on tariffs and their impact on Eurozone inflation. Staying informed about the ECB's ongoing research is key to comprehending the continuing influence of trade policies on the Eurozone's economic trajectory.

Featured Posts

-

Velikonoce 2024 Jake Ceny Nas Cekaji

Apr 26, 2025

Velikonoce 2024 Jake Ceny Nas Cekaji

Apr 26, 2025 -

Hampden Kendrick Lamar Tickets General Sale Chaos And High Prices

Apr 26, 2025

Hampden Kendrick Lamar Tickets General Sale Chaos And High Prices

Apr 26, 2025 -

Cnn Anchors Top Pick Exploring The Allure Of Florida

Apr 26, 2025

Cnn Anchors Top Pick Exploring The Allure Of Florida

Apr 26, 2025 -

Krogkommissionen Recenserar Aer Stockholm Stadshotell Vaert Besoeket

Apr 26, 2025

Krogkommissionen Recenserar Aer Stockholm Stadshotell Vaert Besoeket

Apr 26, 2025 -

Ftcs Appeal Against Court Approval Of Microsoft Activision Merger

Apr 26, 2025

Ftcs Appeal Against Court Approval Of Microsoft Activision Merger

Apr 26, 2025

Latest Posts

-

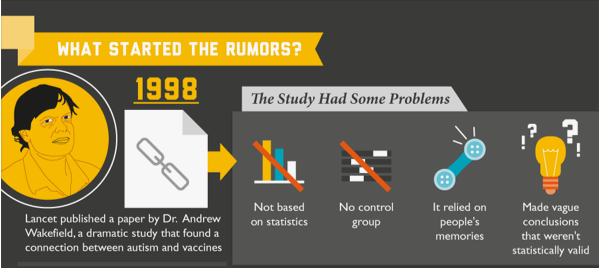

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

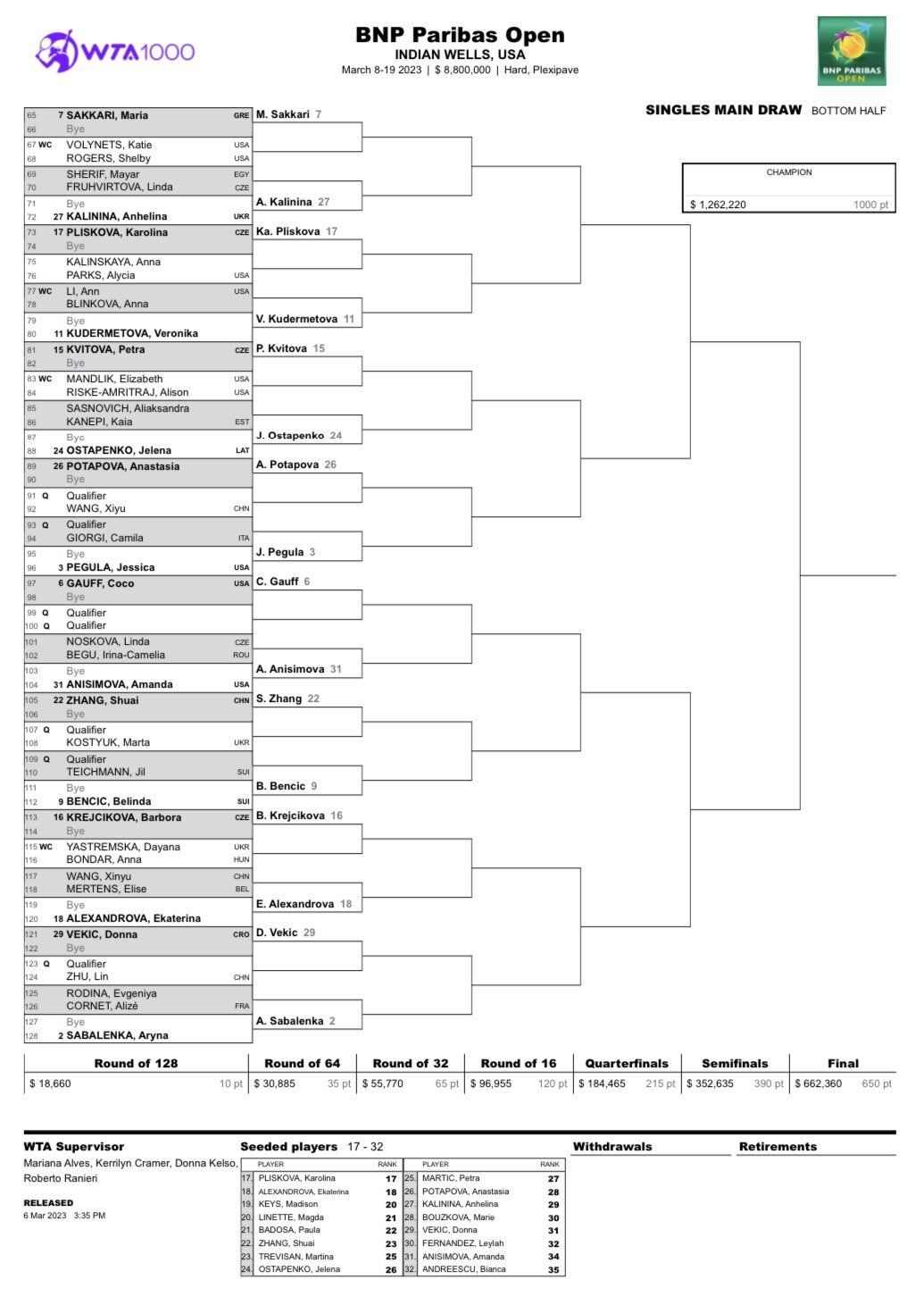

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025