Apple Stock: $200 Buy Point Before Reaching $254? Analyst Insight

Table of Contents

Analyst Predictions and Rationale

The buzz around a potential $200 buy point for Apple stock stems from several key factors highlighted by various analysts. Let's examine the arguments supporting this prediction and the projected $254 price target.

The $200 Buy Point Argument

Several prominent analysts believe Apple stock is currently undervalued, presenting a compelling entry point around $200. This argument rests on several pillars:

-

Undervaluation: Many analysts point to a relatively low Price-to-Earnings (P/E) ratio compared to historical averages and competitors, suggesting the current market price doesn't fully reflect Apple's strong financial performance and future growth potential. For example, [Analyst Name], from [Analyst Firm], suggests that the current P/E ratio undervalues Apple's innovative pipeline and robust ecosystem.

-

Upcoming Product Releases: The anticipated launch of the iPhone 15, alongside potential upgrades to other Apple products like the Apple Watch and AirPods, is expected to boost sales and revenue, driving stock prices higher. New features and improved performance often fuel strong demand and subsequent price appreciation.

-

Strong Financial Performance: Apple consistently demonstrates strong financial results, with steadily increasing revenue and profits. This solid financial foundation provides a strong base for future growth and investor confidence. Recent quarterly reports showcase impressive growth in services revenue and continued market dominance in key segments.

-

Positive Market Sentiment: Overall positive market sentiment towards technology stocks, coupled with investor confidence in Apple's brand and long-term growth prospects, supports the bullish outlook. The recent strength in the tech sector generally adds to the optimism surrounding Apple's stock performance.

Data Point: Apple's trailing twelve-month revenue shows a [insert percentage]% increase year-over-year, demonstrating robust growth and reinforcing the analyst's positive outlook. Its market capitalization currently stands at [insert current market cap], but analysts believe it could expand significantly based on future performance.

The $254 Price Target Justification

The projection of Apple stock reaching $254 is based on several key catalysts:

-

iPhone 15 Sales: The new iPhone is expected to drive significant sales growth, particularly in emerging markets. Analyst projections indicate a [insert projected sales figure] increase compared to the previous generation.

-

Services Revenue Growth: Apple's services segment continues to exhibit remarkable growth, driven by subscription services like Apple Music, iCloud, and Apple TV+. The increasing subscriber base and higher average revenue per user (ARPU) are crucial drivers for the $254 price target.

-

Expansion into New Markets: Apple's continued expansion into emerging markets, coupled with its strong brand recognition and loyal customer base, presents substantial growth opportunities. This expansion is expected to contribute significantly to revenue growth in the coming years.

Data Point: Market research suggests that the global smartphone market is expected to grow by [insert percentage]% in the next few years, providing ample opportunity for Apple to capture market share and drive increased revenue. Further, projections for Apple's services revenue indicate growth of [insert percentage]% annually for the next [number] years.

Potential Risks and Considerations

While the outlook for Apple stock appears positive, potential risks must be considered.

Market Volatility and Economic Uncertainty

Macroeconomic factors can significantly impact stock prices.

-

Inflation: Persistent inflation can erode purchasing power and impact consumer spending, potentially impacting demand for Apple products.

-

Recession Risks: The threat of a recession could reduce consumer confidence and discretionary spending, slowing Apple's growth.

-

Interest Rate Hikes: Increased interest rates can impact borrowing costs for businesses and reduce investment in the stock market.

Data Point: The current inflation rate is [insert current inflation rate], and economists predict [insert prediction about future inflation]. The probability of a recession within the next year is estimated to be around [insert percentage], according to leading economic forecasts.

Competition and Technological Disruptions

Apple faces competition and potential technological disruptions.

-

Samsung Competition: Samsung remains a major competitor in the smartphone market, constantly innovating and challenging Apple's market share.

-

Technological Disruptions: Emerging technologies like advanced AI and VR/AR could reshape the tech landscape, potentially impacting Apple's dominance in existing markets and creating new competitive threats.

Data Point: Samsung currently holds approximately [insert market share percentage]% of the global smartphone market, showcasing its persistent competitiveness. Industry reports indicate a growing investment in AI and VR/AR technologies, which could eventually impact Apple's market position.

Investment Strategies and Considerations

Investing in Apple stock requires careful planning and consideration.

Diversification and Risk Management

-

Diversification: Never put all your eggs in one basket. Diversify your investment portfolio across different asset classes to mitigate risk.

-

Risk Tolerance: Assess your personal risk tolerance and financial goals before investing in any stock, including Apple.

Links: [Link to resource on investment diversification] [Link to resource on risk management]

Long-Term vs. Short-Term Investments

The $200 buy point presents opportunities for both long-term and short-term investors.

-

Long-Term: Long-term investors can benefit from Apple's potential for sustained growth over the long term.

-

Short-Term: Short-term investors might aim to capitalize on the predicted price increase to $254, but this strategy carries higher risk.

Conclusion: Apple Stock: Should You Buy at $200?

Analysts predict a potential $200 buy point for Apple stock, aiming for a $254 price target, driven by strong financial performance, upcoming product launches, and overall market sentiment. However, macroeconomic uncertainties and competitive pressures present risks. Thorough research, understanding your risk tolerance, and a diversified investment strategy are paramount. Is a $200 entry point for Apple stock a sound investment strategy for you? Conduct thorough research and consider your personal investment goals before making a decision. The future of Apple stock remains promising, but careful analysis of the risks and rewards is crucial.

Featured Posts

-

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 25, 2025

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 25, 2025 -

Porsche Cayenne Gts Coupe Szczegolowa Recenzja Po Testach

May 25, 2025

Porsche Cayenne Gts Coupe Szczegolowa Recenzja Po Testach

May 25, 2025 -

Crystal Palace Target Kyle Walker Peters On A Bosman

May 25, 2025

Crystal Palace Target Kyle Walker Peters On A Bosman

May 25, 2025 -

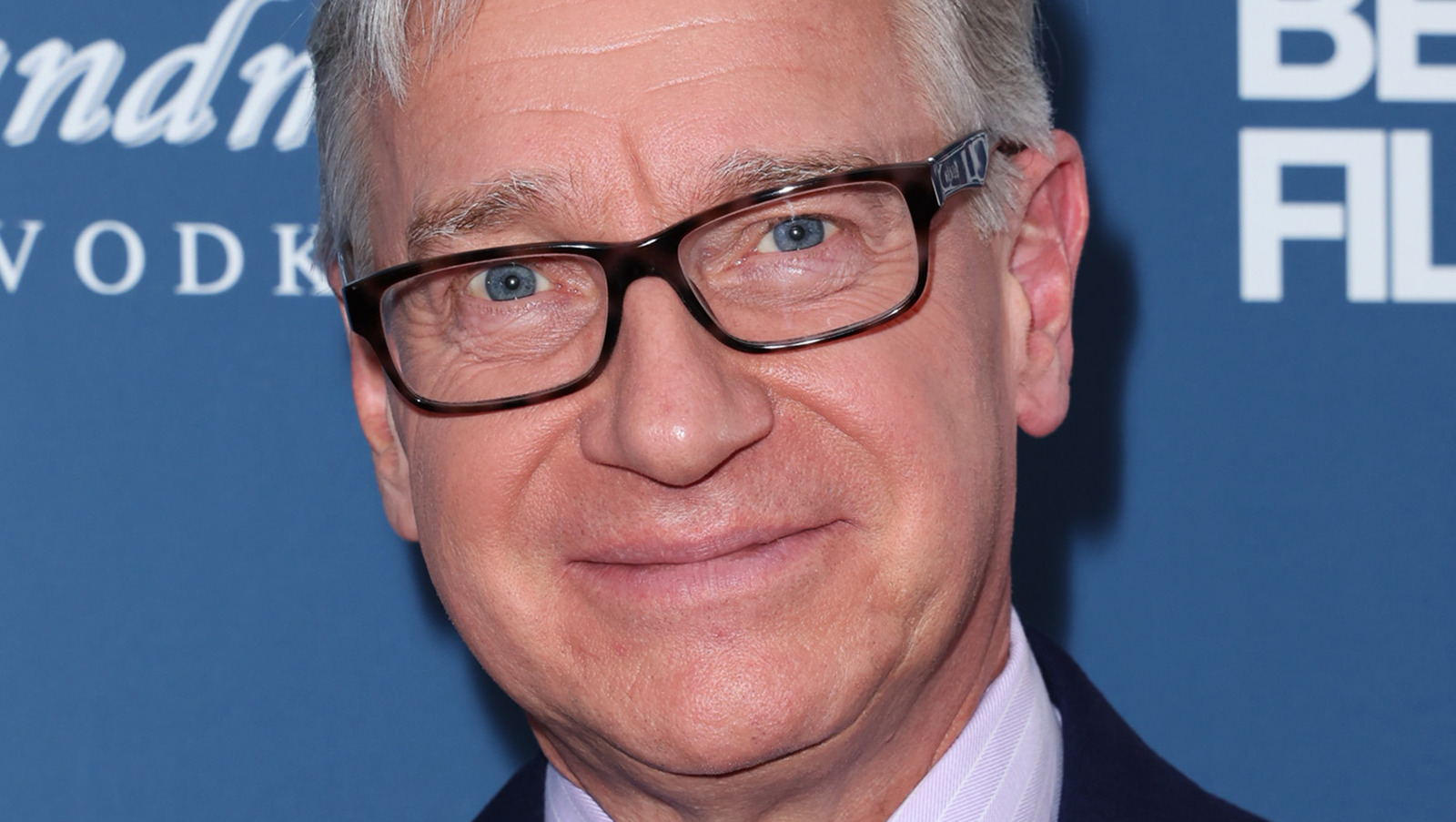

Maryland Softballs Comeback Win 5 4 Victory Over Delaware

May 25, 2025

Maryland Softballs Comeback Win 5 4 Victory Over Delaware

May 25, 2025 -

Chine La Silencieuse Repression Des Voix Critiques En France

May 25, 2025

Chine La Silencieuse Repression Des Voix Critiques En France

May 25, 2025

Latest Posts

-

Covid 19 Pandemic Lab Owners Guilty Plea For Falsified Test Results

May 25, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For Falsified Test Results

May 25, 2025 -

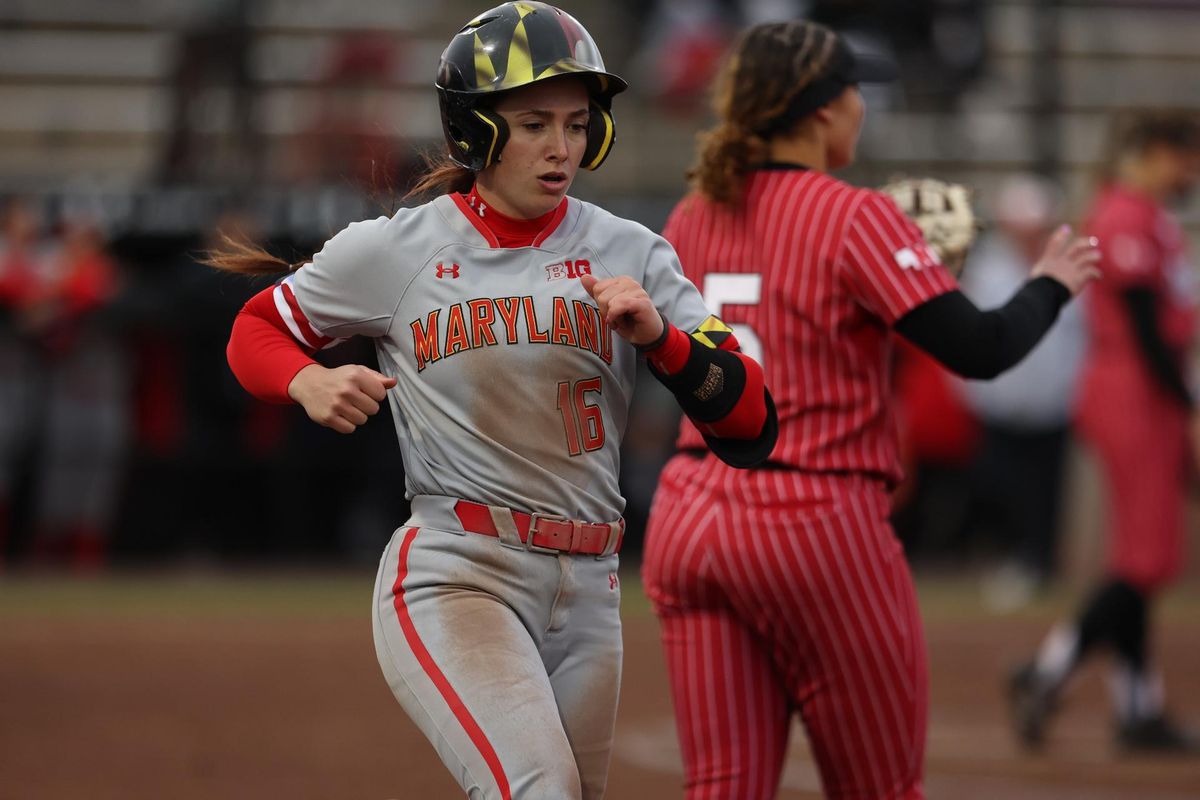

Why Did Trump Target Europe In His Trade Battles A Deep Dive

May 25, 2025

Why Did Trump Target Europe In His Trade Battles A Deep Dive

May 25, 2025 -

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025 -

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025 -

2 2 Million Treatment A Fathers Perseverance And Rowing Feat

May 25, 2025

2 2 Million Treatment A Fathers Perseverance And Rowing Feat

May 25, 2025