Tracking The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

Why Track the NAV of Amundi MSCI All Country World UCITS ETF USD Acc?

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc represents the net value of the ETF's underlying assets per share. Understanding and tracking this value is paramount for several key reasons:

- Informed Investment Decisions: The NAV provides a clear picture of the ETF's intrinsic worth. By monitoring the NAV, you can make more informed decisions about when to buy or sell, taking advantage of potential price discrepancies between the market price and the NAV.

- Performance Assessment: Tracking the NAV allows you to accurately calculate your returns and compare the ETF's performance against its benchmark, the MSCI All Country World Index. This helps you assess whether your investment is meeting your expectations.

- Market Condition Reflection: Fluctuations in the Amundi MSCI All Country World UCITS ETF USD Acc NAV reflect changes in the global market. By monitoring these changes, you gain valuable insights into overall market trends and the performance of the underlying assets.

Key benefits of NAV tracking:

- Understanding daily price changes in relation to the NAV helps identify potential short-term trading opportunities.

- Identifying discrepancies between the market price and the NAV can reveal potential buying opportunities.

- Monitoring the impact of significant global market events (e.g., interest rate hikes, geopolitical instability) on the ETF's NAV allows for proactive portfolio adjustments.

How to Track the NAV of Amundi MSCI All Country World UCITS ETF USD Acc?

Tracking the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. Several reliable sources provide this crucial data:

- Amundi Website: The official Amundi website is the most accurate source for the ETF's NAV. Look for dedicated pages on the specific ETF.

- Financial News Websites: Reputable financial news sources like Bloomberg, Yahoo Finance, and Google Finance typically display real-time or near real-time NAV data for major ETFs.

- Brokerage Platforms: Most brokerage platforms provide detailed information on your investments, including the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc.

Reliable sources for daily updates:

- Accessing the NAV directly through the Amundi website ensures accuracy and timeliness.

- Using financial data providers like Bloomberg Terminal or Refinitiv Eikon offers comprehensive data alongside analytical tools.

- Checking your brokerage account provides a consolidated view of your holdings and their respective NAVs.

- Remember there is usually a short time lag (often a few hours) between market close and the official publication of the NAV.

Factors Affecting the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is influenced by a multitude of factors:

- Currency Fluctuations: Since this is the USD Acc share class, fluctuations in the US dollar against other currencies impact the NAV, particularly for holdings denominated in other currencies.

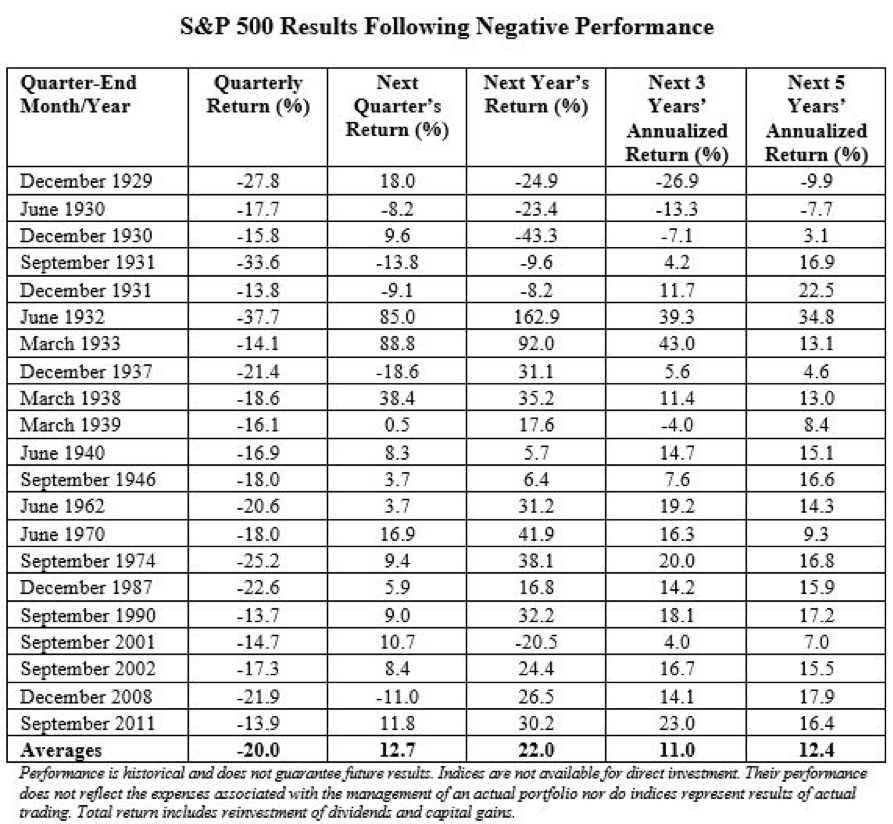

- Underlying Asset Performance: The primary driver of the NAV is the performance of the underlying assets within the ETF. Market movements of major global indices like the S&P 500 and MSCI Emerging Markets directly influence its value.

- Dividend Distributions: When underlying companies pay dividends, the NAV is typically adjusted to reflect these payouts.

- Expense Ratios: The ETF's expense ratio, which covers administrative and management fees, subtly impacts the overall NAV growth.

Understanding key influences:

- The US Dollar's strength or weakness significantly impacts the USD Acc share class NAV.

- Performance of major market indices like the S&P 500 and MSCI Emerging Markets directly correlates with NAV changes.

- Dividend payouts from underlying companies lead to short-term decreases in the NAV followed by price adjustments.

- Expense ratios are a continuous, albeit small, deduction from NAV growth.

Utilizing NAV Data for Informed Investment Decisions with Amundi MSCI All Country World UCITS ETF USD Acc

By consistently tracking the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc, you can significantly enhance your investment strategy.

- Long-Term Growth Assessment: Monitoring the NAV over time provides a clear picture of the ETF's long-term growth potential.

- Buy/Sell Strategies: Comparing the NAV to the market price allows you to identify potential arbitrage opportunities or to time your entries and exits more effectively.

- Portfolio Performance: The NAV data contributes to a more accurate assessment of your overall portfolio performance, particularly when comparing it with other investments.

Strategic application of NAV data:

- Analyzing the historical NAV trend reveals long-term growth patterns and allows investors to adjust their investment horizon accordingly.

- Comparing NAV with market price allows investors to identify periods for potentially profitable buying or selling, minimizing price volatility risks.

- Incorporating NAV data alongside other metrics provides a more robust assessment of portfolio performance, facilitating better risk management.

Conclusion: Mastering NAV Tracking for the Amundi MSCI All Country World UCITS ETF USD Acc

Mastering the art of tracking the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is essential for making well-informed investment decisions. By utilizing the methods and resources outlined above, you gain a clearer understanding of your investment's performance and the broader market landscape. Remember, accurate and consistent NAV tracking, combined with a thorough understanding of market dynamics, will greatly improve your investment success. Start tracking the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc today to optimize your investment strategy!

Featured Posts

-

Faiz Indirimi Kararindan Sonra Avrupa Borsalarinin Performansi

May 25, 2025

Faiz Indirimi Kararindan Sonra Avrupa Borsalarinin Performansi

May 25, 2025 -

Luxus Extrak 80 Millio Forintos Porsche 911 Bemutatasa

May 25, 2025

Luxus Extrak 80 Millio Forintos Porsche 911 Bemutatasa

May 25, 2025 -

Is Kyle Walker Peters Heading To Elland Road Leeds Transfer Update

May 25, 2025

Is Kyle Walker Peters Heading To Elland Road Leeds Transfer Update

May 25, 2025 -

Dax Falls Below 24 000 Frankfurt Stock Market Losses

May 25, 2025

Dax Falls Below 24 000 Frankfurt Stock Market Losses

May 25, 2025 -

A Look Inside Nicki Chapmans Bespoke Chiswick Garden

May 25, 2025

A Look Inside Nicki Chapmans Bespoke Chiswick Garden

May 25, 2025

Latest Posts

-

Is Kyle Walker Peters Heading To Elland Road Leeds Transfer Update

May 25, 2025

Is Kyle Walker Peters Heading To Elland Road Leeds Transfer Update

May 25, 2025 -

Leeds United Transfer News Latest On Kyle Walker Peters

May 25, 2025

Leeds United Transfer News Latest On Kyle Walker Peters

May 25, 2025 -

Southamptons Kyle Walker Peters A Potential Target For Leeds

May 25, 2025

Southamptons Kyle Walker Peters A Potential Target For Leeds

May 25, 2025 -

Negative Close For Frankfurt Stock Market Dax Under 24 000

May 25, 2025

Negative Close For Frankfurt Stock Market Dax Under 24 000

May 25, 2025 -

Leeds Eye Southamptons Kyle Walker Peters Transfer News

May 25, 2025

Leeds Eye Southamptons Kyle Walker Peters Transfer News

May 25, 2025