Top 10% Gainers On BSE: Sensex Rally Highlights

Table of Contents

Identifying the Top 10% Gainers on BSE

Identifying the top performers requires a robust methodology. Our analysis considers the percentage gain of each stock over a defined period (e.g., the last quarter or six months), adjusted for stock splits and dividends to provide a true reflection of performance. Data is sourced from the official BSE website and verified against reputable financial news sources like the Economic Times and the Business Standard.

Methodology: Pinpointing BSE Top Performers

Our criteria for identifying the top 10% gainers on the BSE includes:

- Percentage Gain: We calculate the percentage increase in stock price over a specific period, ensuring an accurate representation of performance.

- Adjusted for Splits/Dividends: To avoid skewed results, we account for any stock splits or dividend payouts during the period under review.

- Data Verification: We cross-reference data from multiple reliable sources to ensure accuracy and consistency.

Specific Examples: During the recent Sensex rally, certain sectors significantly outperformed the market average. For instance:

- The IT sector witnessed several stocks achieving gains exceeding 25%, driven by increased global demand and rupee depreciation.

- The Pharmaceutical sector also saw impressive performance, with some companies reporting gains exceeding 20%, fueled by new drug approvals and strong export demand.

- Within the FMCG sector, select companies showed remarkable resilience, with some reporting gains over 15%, despite inflationary pressures. These were buoyed by increased rural consumption and strategic pricing policies.

Sector-Specific Analysis: Driving Forces Behind the Sensex Rally

The recent Sensex rally wasn't uniform; specific sectors outperformed others due to unique factors. Let's analyze some key contributors:

IT Sector Performance: A Technological Tailwind

The IT sector's stellar performance is attributed to a confluence of factors:

- Strong Global Demand: Increased demand for IT services from global clients, particularly in North America and Europe.

- Rupee Depreciation: A weaker Indian Rupee boosted the revenue earned by IT companies in foreign currencies.

- Favorable Government Policies: Supportive government initiatives aimed at promoting the IT sector further fueled growth.

Examples: Several leading IT companies featured prominently amongst the top 10% BSE gainers, demonstrating significant revenue growth and improved profit margins.

Pharmaceutical Sector Analysis: Growth in Healthcare

The pharmaceutical sector’s success can be attributed to:

- New Drug Approvals: Successful launches of new drugs and expansion into new therapeutic areas.

- Growing Domestic Demand: Increased healthcare spending within India contributed to higher sales.

- Global Expansion: Strategic acquisitions and market entry into new global markets.

Examples: Pharmaceutical companies specializing in specific therapeutic areas, like oncology and immunology, experienced exceptional growth during the Sensex rally.

FMCG Sector Performance: Sustained Consumer Demand

Despite inflationary pressures, the FMCG sector showed remarkable resilience:

- Rural Consumption: Increased spending power in rural areas contributed to higher sales volumes.

- Inflation-Adjusted Pricing: Companies strategically adjusted their pricing to mitigate the impact of inflation.

- Product Diversification: Offering a wider range of products catered to diverse consumer needs.

Examples: FMCG companies focusing on essential goods and value-for-money products showed sustained performance.

Investment Implications and Future Outlook

While the Sensex rally presents significant opportunities, investors must approach it with caution.

Risk Assessment: Navigating Market Volatility

Investing in high-growth stocks inherently involves risk:

- Volatility: High-growth stocks can be significantly more volatile than established, blue-chip companies.

- Market Corrections: Market downturns can lead to substantial losses, especially in rapidly growing sectors.

Recommendations: Diversification is key to mitigating risk. Investors should spread their investments across different sectors and asset classes. Fundamental analysis and due diligence are crucial before investing in any stock. Consider a long-term investment strategy to weather short-term market fluctuations.

Future Predictions and Potential Opportunities

While predicting the future is impossible, several factors could influence the continuation of the Sensex rally:

- Global Interest Rates: Rising global interest rates could dampen investor sentiment.

- Geopolitical Events: Uncertain geopolitical events can negatively impact market performance.

- Inflationary Pressures: Continued high inflation could slow down economic growth and affect corporate profits.

Potential Opportunities: While the IT and pharmaceutical sectors show promise, keep an eye on sectors like renewable energy and infrastructure, which could benefit from government policy and growing consumer demand in the coming months. Identifying future BSE top performers requires continuous monitoring of market trends and company fundamentals.

Conclusion

The recent Sensex rally propelled several BSE stocks into the top 10% gainers, particularly within the IT, Pharmaceutical, and FMCG sectors. Understanding the driving forces behind these gains is crucial for investors. While the potential for significant returns exists, risk management and diversification are essential. Thorough due diligence and a long-term perspective are key to successfully navigating the dynamic world of BSE top 10% gainers. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to the BSE top 10% gainers and the Sensex rally.

Featured Posts

-

Latest Caloocan Election Results Malapitan Holds Commanding Advantage

May 15, 2025

Latest Caloocan Election Results Malapitan Holds Commanding Advantage

May 15, 2025 -

Calvin Klein Euphoria Perfume On Sale At Nordstrom Rack

May 15, 2025

Calvin Klein Euphoria Perfume On Sale At Nordstrom Rack

May 15, 2025 -

Effectieve Strategieen Tegen Grensoverschrijdend Gedrag Binnen De Npo

May 15, 2025

Effectieve Strategieen Tegen Grensoverschrijdend Gedrag Binnen De Npo

May 15, 2025 -

Strategic Locations For Business Growth Mapping The Countrys Hot Spots

May 15, 2025

Strategic Locations For Business Growth Mapping The Countrys Hot Spots

May 15, 2025 -

Trump And Oil Prices Goldman Sachs Analysis Of Public Statements

May 15, 2025

Trump And Oil Prices Goldman Sachs Analysis Of Public Statements

May 15, 2025

Latest Posts

-

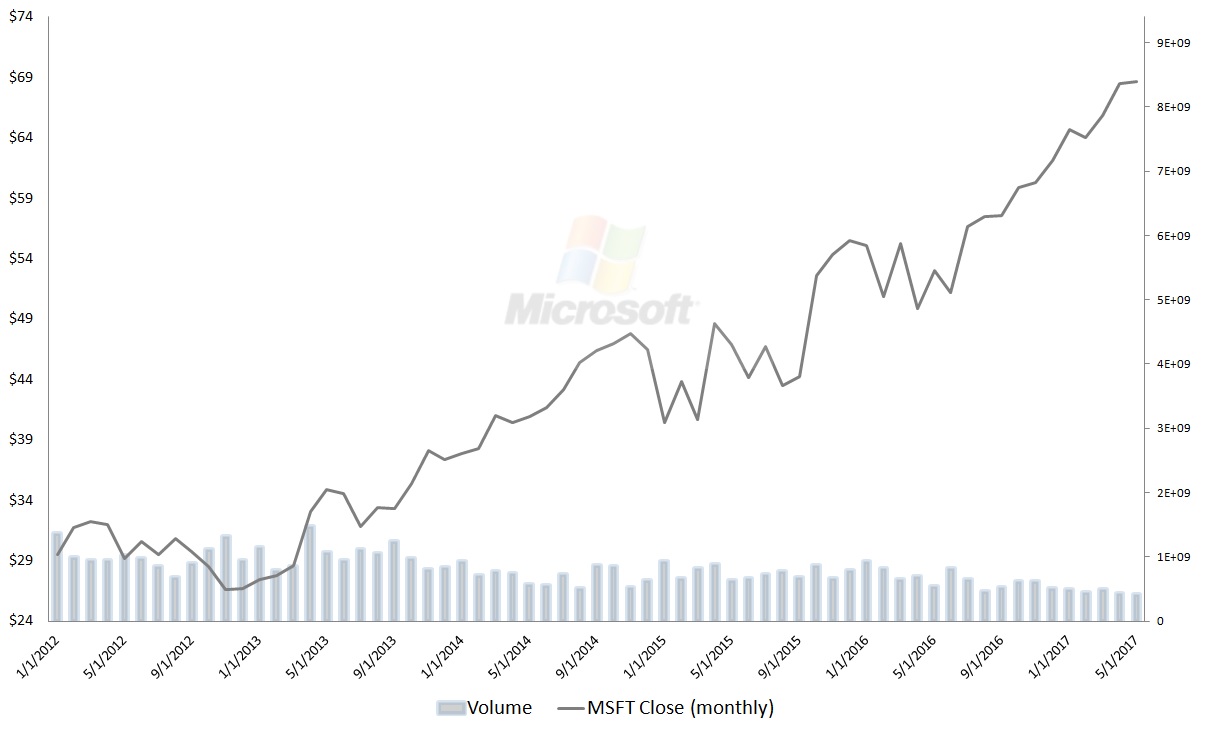

The Safe Harbor Of Microsoft Stock In A Volatile Market

May 15, 2025

The Safe Harbor Of Microsoft Stock In A Volatile Market

May 15, 2025 -

Hondas Ontario Ev Plant 15 Billion Investment Delayed

May 15, 2025

Hondas Ontario Ev Plant 15 Billion Investment Delayed

May 15, 2025 -

Software Stocks And Tariffs Microsofts Relative Strength

May 15, 2025

Software Stocks And Tariffs Microsofts Relative Strength

May 15, 2025 -

Investing In Stability Microsofts Strength In Uncertain Times

May 15, 2025

Investing In Stability Microsofts Strength In Uncertain Times

May 15, 2025 -

Honda Halts 15 Billion Electric Vehicle Plant In Ontario

May 15, 2025

Honda Halts 15 Billion Electric Vehicle Plant In Ontario

May 15, 2025