The Safe Harbor Of Microsoft Stock In A Volatile Market

Table of Contents

Microsoft's Strong Fundamentals: A Foundation for Stability

Microsoft's enduring success is built upon a foundation of robust financials and consistent growth. This stability makes Microsoft stock an attractive option for investors seeking a safe harbor.

Consistent Revenue and Profit Growth

Microsoft has a proven track record of consistent revenue and profit growth. This is driven by its diverse business segments, each contributing significantly to the company's overall performance.

- Year-over-year revenue growth consistently exceeds expectations, as evidenced in their quarterly financial reports (available on the Microsoft Investor Relations website).

- Strong performance in cloud computing (Azure), which is experiencing rapid growth and expansion, significantly contributes to overall revenue.

- Office 365's subscription model provides a steady stream of recurring revenue, providing predictability and reducing reliance on one-time sales.

- This consistent growth fosters investor confidence and contributes to the long-term value of Microsoft stock.

Diversified Revenue Streams: Reducing Investment Risk

Unlike companies reliant on a single product or service, Microsoft boasts a diversified portfolio of revenue streams, significantly mitigating investment risk.

- Cloud Computing (Azure): A major driver of growth, competing with AWS and Google Cloud.

- Productivity and Business Processes (Microsoft 365): The dominant player in productivity software, generating recurring revenue.

- Intelligent Cloud: Encompassing server products and cloud services, providing enterprise solutions.

- More Personal Computing: Including Windows, gaming (Xbox), and devices, contributing a diverse revenue base.

- This diversification cushions against potential downturns in any specific sector, making Microsoft stock a more resilient investment.

Strong Balance Sheet and Cash Reserves

Microsoft's financial health is exceptional, characterized by a robust balance sheet and substantial cash reserves.

- Billions of dollars in cash reserves provide a significant buffer against economic headwinds.

- Low debt levels ensure financial flexibility and the ability to invest in future growth opportunities.

- This financial strength allows Microsoft to weather economic storms and continue investing in research and development, further solidifying its competitive advantage.

Microsoft's Position in the Growing Tech Sector

Microsoft's leading position in key technology sectors further enhances its appeal as a safe haven investment.

Leading Cloud Computing Provider

Microsoft Azure is a key player in the rapidly expanding cloud computing market, experiencing significant growth and market share gains.

- Azure competes head-to-head with Amazon Web Services (AWS) and Google Cloud, holding a substantial market share.

- The cloud computing market is expected to experience continued exponential growth, providing significant long-term growth potential for Microsoft.

- This leadership position translates to substantial and ongoing revenue generation for the company.

Dominance in Productivity Software

Microsoft's dominance in productivity software, particularly with Microsoft 365, is undeniable. Its subscription model provides a stable and predictable revenue stream.

- Microsoft 365 boasts a massive user base across businesses and individuals worldwide.

- The subscription model ensures recurring revenue, providing financial stability and predictability.

- This recurring revenue significantly contributes to Microsoft's consistent financial performance.

Strategic Acquisitions and Innovation

Microsoft's commitment to strategic acquisitions and innovation strengthens its long-term competitive advantage.

- Acquisitions like LinkedIn and GitHub have broadened Microsoft's reach and capabilities.

- Continuous investment in research and development fuels innovation across various sectors, including artificial intelligence (AI).

- These strategic moves position Microsoft for continued growth and success in a dynamic technological landscape.

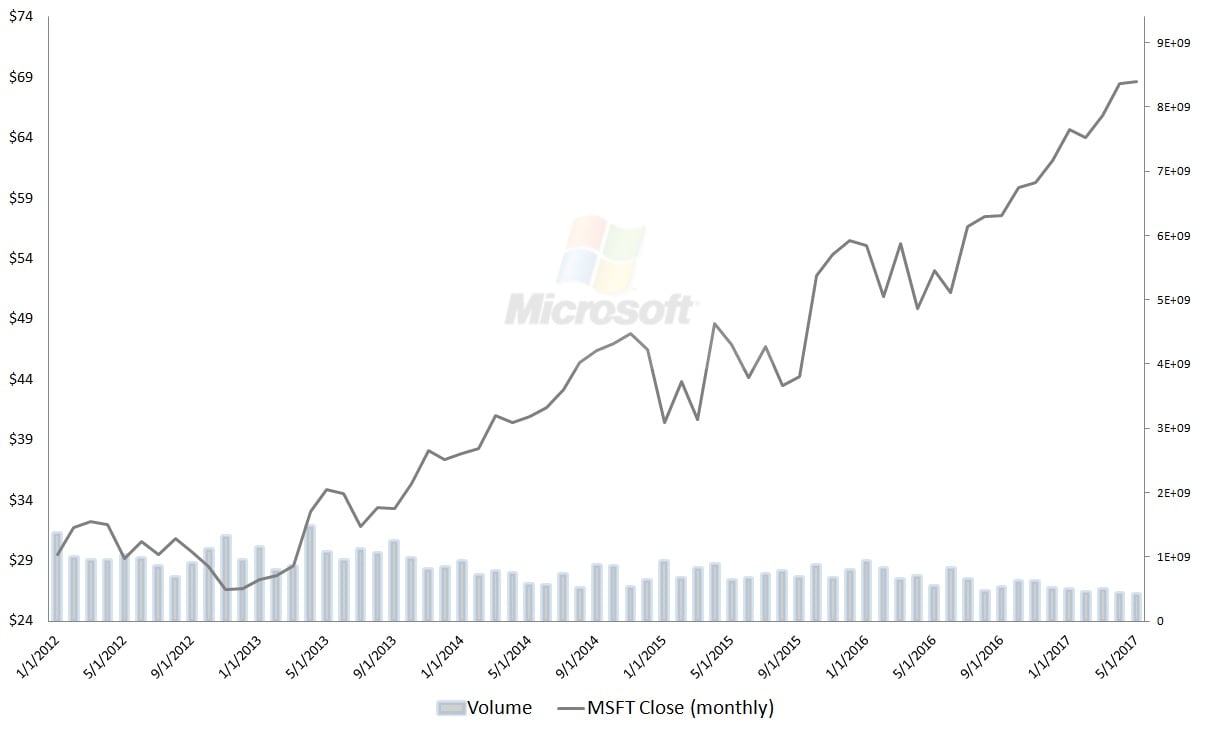

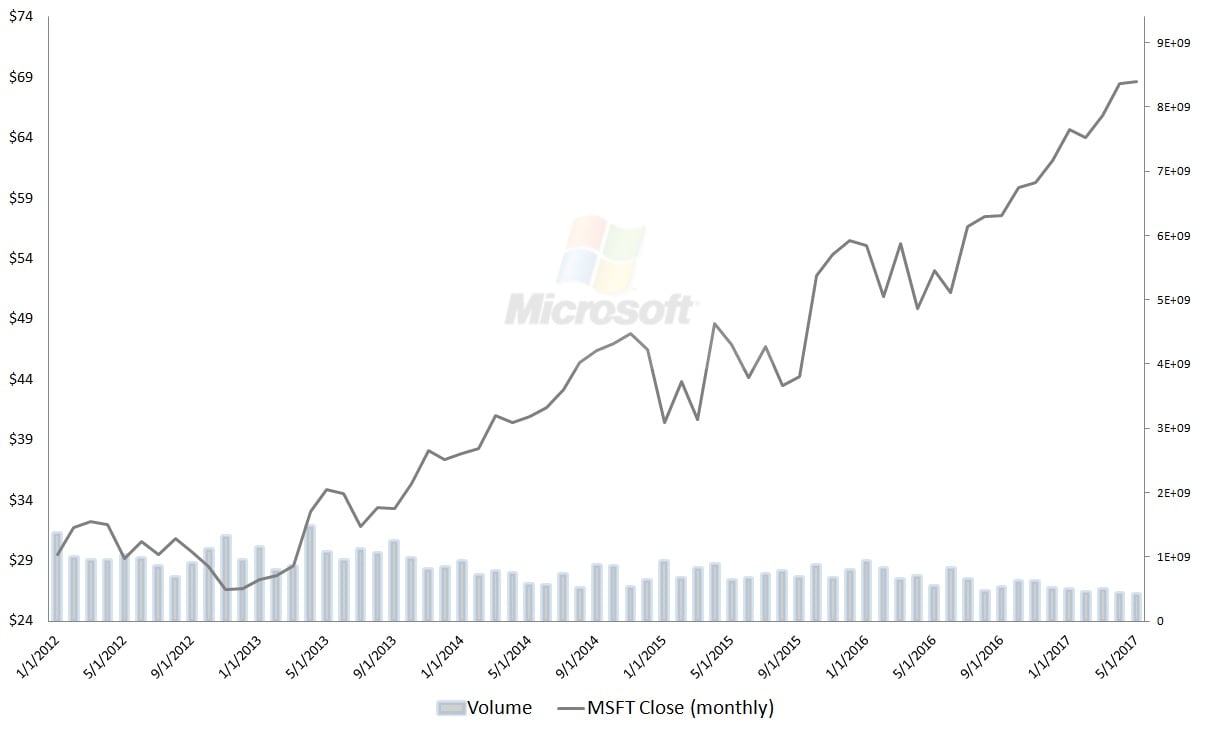

Analyzing Microsoft Stock: A Prudent Investment Approach

Investing in Microsoft stock requires a thoughtful approach, considering various valuation metrics and long-term prospects.

Understanding Valuation Metrics

Key valuation metrics, such as the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio, help assess Microsoft's stock valuation relative to its earnings and growth rate. Analyzing these metrics against industry benchmarks provides valuable insights.

Considering Dividend Yield

Microsoft offers a dividend payout, providing investors with passive income. Analyzing the historical dividend data and its consistency can inform investment decisions.

Long-Term Investment Strategy

A long-term investment strategy is crucial when considering Microsoft stock. Its consistent growth and strong fundamentals make it a compelling long-term holding, offering potential for significant returns over time.

Conclusion: Navigating Volatility with Microsoft Stock – A Safe Harbor for Your Portfolio

Microsoft's strong fundamentals, its leading position in key growth sectors, and its commitment to innovation make its stock a compelling investment choice, particularly during market uncertainty. The consistent revenue growth, diversified business model, and robust financial health solidify Microsoft stock as a potential safe harbor within a volatile market. Consider adding Microsoft stock to your portfolio for a more stable and secure investment future. Learn more about the benefits of investing in Microsoft stock and build a resilient portfolio today.

Featured Posts

-

Ufc Legend Changes Tune Pimbletts Path To Championship Gold

May 15, 2025

Ufc Legend Changes Tune Pimbletts Path To Championship Gold

May 15, 2025 -

Zapozna Te Go Unikatniot Detski Festival Potochinja

May 15, 2025

Zapozna Te Go Unikatniot Detski Festival Potochinja

May 15, 2025 -

Paddy Pimbletts Shocking 35 Second Loss Choked Unconscious By Ex Soldier

May 15, 2025

Paddy Pimbletts Shocking 35 Second Loss Choked Unconscious By Ex Soldier

May 15, 2025 -

San Diego Padres 2025 Season Streaming Guide For Cable Free Viewers

May 15, 2025

San Diego Padres 2025 Season Streaming Guide For Cable Free Viewers

May 15, 2025 -

Analyzing Player Performance New York City Vs Toronto

May 15, 2025

Analyzing Player Performance New York City Vs Toronto

May 15, 2025

Latest Posts

-

Penurie De Gardiens Quelles Solutions Pour Les Employeurs Et Les Candidats

May 15, 2025

Penurie De Gardiens Quelles Solutions Pour Les Employeurs Et Les Candidats

May 15, 2025 -

Mls Injury Roundup Latest On Martinez And Whites Availability

May 15, 2025

Mls Injury Roundup Latest On Martinez And Whites Availability

May 15, 2025 -

Le Metier De Gardien Un Marche Porteur Malgre La Penurie D Offres

May 15, 2025

Le Metier De Gardien Un Marche Porteur Malgre La Penurie D Offres

May 15, 2025 -

High Profile Nhl 4 Nations Face Off In Pei Cost Analysis And Legislative Review

May 15, 2025

High Profile Nhl 4 Nations Face Off In Pei Cost Analysis And Legislative Review

May 15, 2025 -

Earthquakes Loss To Rapids Underscores Goalkeeping Concerns

May 15, 2025

Earthquakes Loss To Rapids Underscores Goalkeeping Concerns

May 15, 2025