Software Stocks And Tariffs: Microsoft's Relative Strength

Table of Contents

Microsoft's Diversified Revenue Streams Mitigate Tariff Risks

Microsoft's success isn't solely reliant on any single product or geographic region, a key factor in mitigating tariff risks. This diversification across various revenue streams provides a significant buffer against the negative impacts of trade wars.

Cloud Computing Dominance

Azure, Microsoft's cloud computing platform, is a major driver of this resilience. Its global reach significantly reduces reliance on any specific market vulnerable to tariffs.

- Massive Market Share: Azure holds a substantial share of the cloud computing market, competing head-to-head with AWS and Google Cloud. This broad market penetration lessens the impact of localized tariff issues.

- International Expansion: Azure's infrastructure spans numerous countries, allowing Microsoft to seamlessly shift operations and resources if needed, avoiding over-reliance on tariff-affected regions.

- Indirect Tariff Exposure: Unlike hardware manufacturers directly impacted by import tariffs on components, Azure's exposure is significantly less direct, benefiting from the nature of its service delivery.

Strong Enterprise Software Portfolio

Microsoft's enterprise software suite, including Office 365 and Dynamics 365, generates consistent and predictable revenue. The demand for these products remains relatively stable even during economic downturns.

- Long-Term Contracts: Many enterprise clients are bound by long-term contracts, providing revenue visibility and reducing vulnerability to short-term market fluctuations caused by tariffs.

- Subscription Models: The subscription-based nature of these products creates a recurring revenue stream, further mitigating risk.

- Sticky Nature of Enterprise Software: Once a company integrates Microsoft's enterprise software, switching costs are substantial, creating a "sticky" customer base less likely to change providers due to tariff-related price adjustments.

Global Presence and Supply Chain Management

Microsoft's globally diversified manufacturing and supply chain further reduces its vulnerability to localized tariff impacts.

- Strategic Partnerships: Collaborations with manufacturers across various regions ensure a resilient supply chain, reducing dependency on single-source suppliers in tariff-affected areas.

- Manufacturing Diversification: Microsoft strategically locates its manufacturing operations across multiple countries, mitigating the impact of tariffs on specific regions.

Comparing Microsoft to Other Software Stocks Affected by Tariffs

While many software companies are affected by tariffs, Microsoft's position differs significantly from its competitors.

Competitor Analysis

Comparing Microsoft to other major players such as Oracle, Salesforce, and Adobe reveals varying degrees of tariff vulnerability.

- Revenue Model Differences: Companies heavily reliant on hardware sales or with geographically concentrated revenue streams are more susceptible to tariff impacts than those with diversified models like Microsoft.

- Geographic Dependence: Software companies with a higher concentration of revenue from specific tariff-affected regions face greater risk.

- Supply Chain Vulnerabilities: Companies with less diversified supply chains are more vulnerable to disruptions caused by tariffs on specific components.

Impact of Tariffs on Software Pricing

Tariffs can increase operational costs, potentially forcing software companies to adjust pricing strategies.

- Increased Operational Costs: Tariffs on imported components or services can directly impact a company's operational expenses.

- Price Adjustments: Software companies might attempt to pass increased costs onto consumers, but this could affect demand, especially in competitive markets.

- Microsoft's Response: Microsoft’s diversified model and robust financial position give it greater flexibility to manage cost increases without drastically impacting pricing, maintaining a competitive edge.

Investment Implications: Assessing Microsoft's Long-Term Outlook

Considering Microsoft's current position, several factors influence its long-term investment potential.

Risk Assessment

While Microsoft demonstrates relative strength, certain risks remain.

- Geopolitical Uncertainty: Global political instability and trade tensions continue to present challenges.

- Currency Fluctuations: Changes in exchange rates can affect profitability, especially with international operations.

- Regulatory Changes: Evolving regulations could impact Microsoft's operations and growth.

Growth Potential

Microsoft's long-term growth prospects remain strong, driven by several key factors.

- Cloud Computing Expansion: Continued growth in the cloud computing market offers significant opportunities for Azure.

- Artificial Intelligence (AI) Advancements: Microsoft's investments in AI position it to capitalize on this rapidly growing sector.

- Market Share Gains: Microsoft’s continued innovation and strong brand recognition are likely to drive further market share gains.

Valuation and Investment Strategy

Microsoft's current valuation should be considered within the context of its growth potential and risk profile.

- Potential Entry Points: Investors should monitor market conditions and look for favorable entry points.

- Risk Tolerance: Investors should assess their risk tolerance before investing in any stock, including Microsoft.

- Long-Term Investment Horizon: Investing in Microsoft is generally considered a long-term strategy, allowing time to weather short-term market volatility.

Conclusion: Microsoft's Resilience in the Face of Tariff Uncertainty – A Strong Software Stock Choice

In conclusion, Microsoft's diversified business model, strong competitive position, and substantial long-term growth prospects make it a relatively resilient software stock in the face of tariff uncertainty. Its performance compared to other software stocks highlights its superior ability to navigate the complexities of global trade. This resilience, coupled with its expansion into high-growth sectors, makes it a compelling investment option for those seeking exposure to the software stocks market while carefully considering the tariff landscape. Further research into Microsoft's financial statements and future projections is recommended before making any investment decisions. Consider adding Microsoft stock to a diversified portfolio as part of a robust investment strategy for navigating the challenges of global trade.

Featured Posts

-

Cody Poteets Successful Abs Challenge A Chicago Cubs Spring Training Win

May 15, 2025

Cody Poteets Successful Abs Challenge A Chicago Cubs Spring Training Win

May 15, 2025 -

Giants Vs Padres Prediction Outright Padres Win Or 1 Run Loss

May 15, 2025

Giants Vs Padres Prediction Outright Padres Win Or 1 Run Loss

May 15, 2025 -

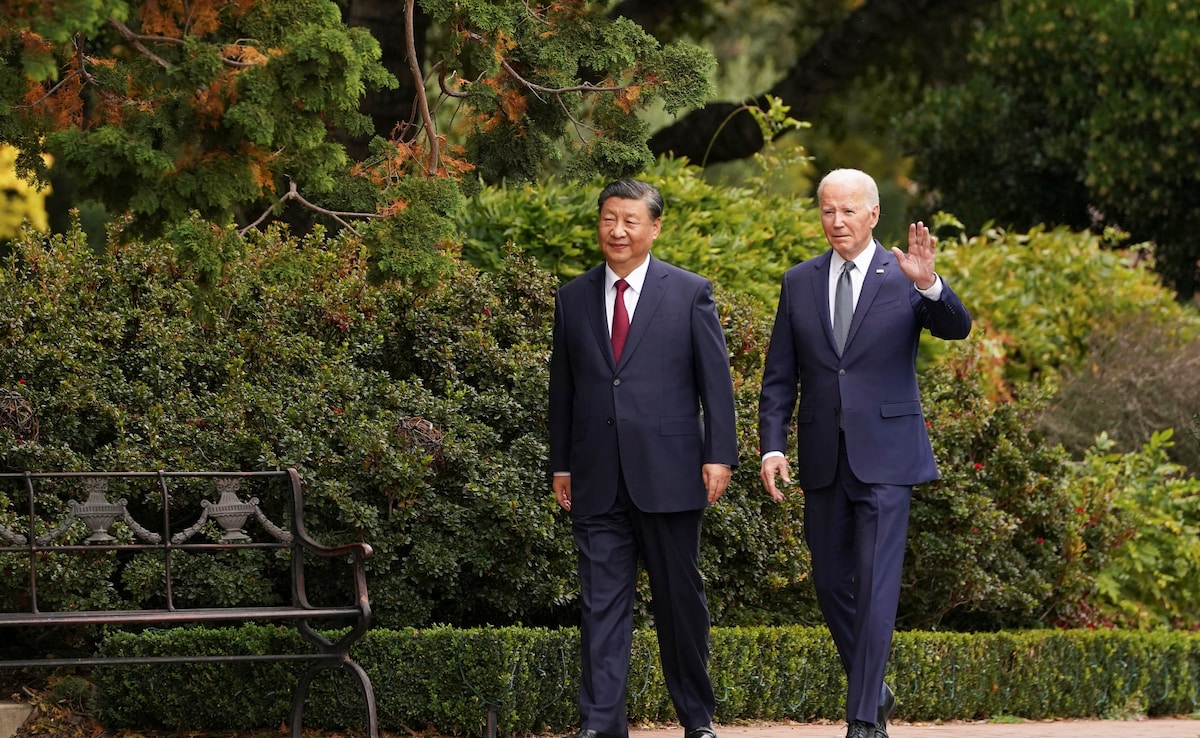

Negotiating Success How Xi Jinpings Experts Secured A Us Deal For China

May 15, 2025

Negotiating Success How Xi Jinpings Experts Secured A Us Deal For China

May 15, 2025 -

Tampa Bay Rays Sweep San Diego Padres A Dominant Performance

May 15, 2025

Tampa Bay Rays Sweep San Diego Padres A Dominant Performance

May 15, 2025 -

Top Dodgers Minor League Performers A Look At Phillips Linan And Quintero

May 15, 2025

Top Dodgers Minor League Performers A Look At Phillips Linan And Quintero

May 15, 2025

Latest Posts

-

Dodgers Offense Struggles In Loss To Cubs

May 15, 2025

Dodgers Offense Struggles In Loss To Cubs

May 15, 2025 -

Albanese Vs Dutton A Critical Analysis Of Their Campaign Pitches

May 15, 2025

Albanese Vs Dutton A Critical Analysis Of Their Campaign Pitches

May 15, 2025 -

Cubs Shut Down Dodgers Offense In Victory

May 15, 2025

Cubs Shut Down Dodgers Offense In Victory

May 15, 2025 -

Election 2024 Dissecting The Platforms Of Albanese And Dutton

May 15, 2025

Election 2024 Dissecting The Platforms Of Albanese And Dutton

May 15, 2025 -

Albanese And Dutton Face Off Comparing Their Key Policy Proposals

May 15, 2025

Albanese And Dutton Face Off Comparing Their Key Policy Proposals

May 15, 2025