Analysis: Trump's Decision On The Proposed Nippon-U.S. Steel Merger

Table of Contents

Economic Ramifications of Trump's Decision

The economic consequences of blocking the Nippon-U.S. Steel merger were complex and far-reaching, impacting everything from job security to steel prices and investment strategies.

Impact on U.S. Steel Jobs

Did the decision protect American jobs, or were there unforeseen consequences? The immediate impact was uncertain. While the administration framed the decision as protecting American jobs, the long-term effects remained debatable.

- Potential Job Losses: The blocked merger potentially led to job losses within U.S. Steel due to reduced competitiveness and investment.

- Unionized Workers: Unionized steelworkers faced uncertainty concerning their future employment and benefits. The lack of the merger could affect their collective bargaining power.

- Long-Term Employment: The decision's long-term effects on employment in the steel sector hinged on U.S. Steel's ability to remain competitive without the merger's synergistic benefits.

- Government Support: The Trump administration's response to potential job losses included exploring government support programs aimed at retraining displaced workers and boosting domestic steel production. The efficacy of these programs remained a point of discussion.

Effects on Steel Prices and Competition

The decision significantly influenced steel prices and market competition.

- Price Fluctuations: The blocked merger could lead to increased steel prices due to reduced supply and decreased competition. Analyzing price changes before and after the decision is crucial to assessing this impact.

- Market Competition: The lack of a merged entity reduced competition within the U.S. steel market, potentially benefiting other domestic steel producers but harming consumers and businesses.

- Related Industries: Industries reliant on steel as a raw material faced potential cost increases, affecting their profitability and potentially triggering price hikes for finished goods.

- Inflationary Pressures: The potential rise in steel prices contributed to broader inflationary pressures in the U.S. economy.

Investment Implications for the Steel Industry

The decision had a considerable impact on future investments within the American steel industry.

- Investor Confidence: Investor confidence in the U.S. steel sector was likely affected by the decision, potentially reducing investment in expansion and modernization.

- Foreign Direct Investment: The decision might have deterred foreign direct investment in the U.S. steel industry, creating a less attractive climate for international collaborations.

- Mergers and Acquisitions: The decision created uncertainty surrounding future mergers and acquisitions within the industry, making it more challenging to consolidate resources and enhance competitiveness.

Political Considerations Surrounding the Merger

The political landscape surrounding the merger was dominated by the Trump administration's protectionist policies and the ensuing public and Congressional reactions.

Trump Administration's "America First" Policy

The decision aligned perfectly with the Trump administration's "America First" policy, prioritizing domestic interests over global economic integration.

- National Security Concerns: The administration likely invoked national security concerns related to steel production and supply chain resilience as justification for blocking the merger.

- Lobbying Efforts: Intense lobbying efforts from American steelworkers' unions and domestic steel producers significantly influenced the administration's decision.

- Trade Negotiations: The decision set a precedent for future trade negotiations, signaling a protectionist stance that could affect other industries and international partnerships.

Congressional Response and Public Opinion

Congress and the public had mixed reactions to the decision.

- Congressional Statements: Congressional representatives voiced opinions ranging from strong support to harsh criticism, reflecting partisan divides and regional economic interests.

- Public Opinion Polls: Public opinion polls indicated varied perspectives, with some supporting the decision to protect American jobs and others opposing the protectionist measures.

- Political Ramifications: The decision had significant political ramifications for the Trump administration, impacting its reputation both domestically and internationally.

Geopolitical Implications of the Blocked Merger

The blocked merger had significant geopolitical ramifications, particularly impacting U.S.-Japan relations and the global steel market.

U.S.-Japan Trade Relations

The decision strained U.S.-Japan trade relations, raising questions about future economic cooperation and the predictability of U.S. trade policy.

- Damage to Bilateral Relations: The decision potentially damaged bilateral trade relations between the U.S. and Japan, creating mistrust and uncertainty.

- Economic Cooperation: The decision cast doubt on the future of economic cooperation between the two countries, potentially impacting other joint ventures and collaborations.

- Trade Negotiations: The decision had broader implications for ongoing and future trade negotiations between the U.S. and other countries.

Global Steel Market Dynamics

The blocked merger had a ripple effect across the global steel market.

- Global Steel Prices: The decision potentially impacted global steel prices, influencing supply chains and impacting steel-producing countries worldwide.

- Other Steel-Producing Nations: Steel-producing nations outside the U.S. and Japan had to adjust to changing market dynamics and global steel trade patterns.

- Global Trade Organizations: The decision challenged the norms and regulations established by global trade organizations like the WTO, raising questions about the future of multilateral trade agreements.

Conclusion

President Trump's decision on the Nippon-U.S. Steel merger had significant and far-reaching consequences for the American steel industry, U.S.-Japan relations, and the global steel market. This analysis has explored the economic, political, and geopolitical implications of this pivotal decision. Understanding the intricacies of Trump's Nippon-U.S. Steel Merger Decision is crucial for anyone involved in or affected by the steel industry and international trade. Further research and monitoring of the long-term effects are essential to fully grasp the consequences of this landmark decision. To stay informed on the evolving landscape of the steel industry and related policy decisions, continue to follow updates on the impact of Trump's Nippon-U.S. Steel Merger Decision and its ongoing effects on the global steel market.

Featured Posts

-

Dax Index Soars Frankfurt Equities Open Higher Record High Nears

May 25, 2025

Dax Index Soars Frankfurt Equities Open Higher Record High Nears

May 25, 2025 -

Ecb Faiz Indirimi Sonrasi Avrupa Borsalarinda Yasananlar

May 25, 2025

Ecb Faiz Indirimi Sonrasi Avrupa Borsalarinda Yasananlar

May 25, 2025 -

Kyle Vs Teddi A Heated Confrontation Over Their Dog Walker

May 25, 2025

Kyle Vs Teddi A Heated Confrontation Over Their Dog Walker

May 25, 2025 -

How To Buy Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Guide

May 25, 2025

How To Buy Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Guide

May 25, 2025 -

Boe Rate Cut Odds Fall Pound Climbs On Higher Than Expected Uk Inflation

May 25, 2025

Boe Rate Cut Odds Fall Pound Climbs On Higher Than Expected Uk Inflation

May 25, 2025

Latest Posts

-

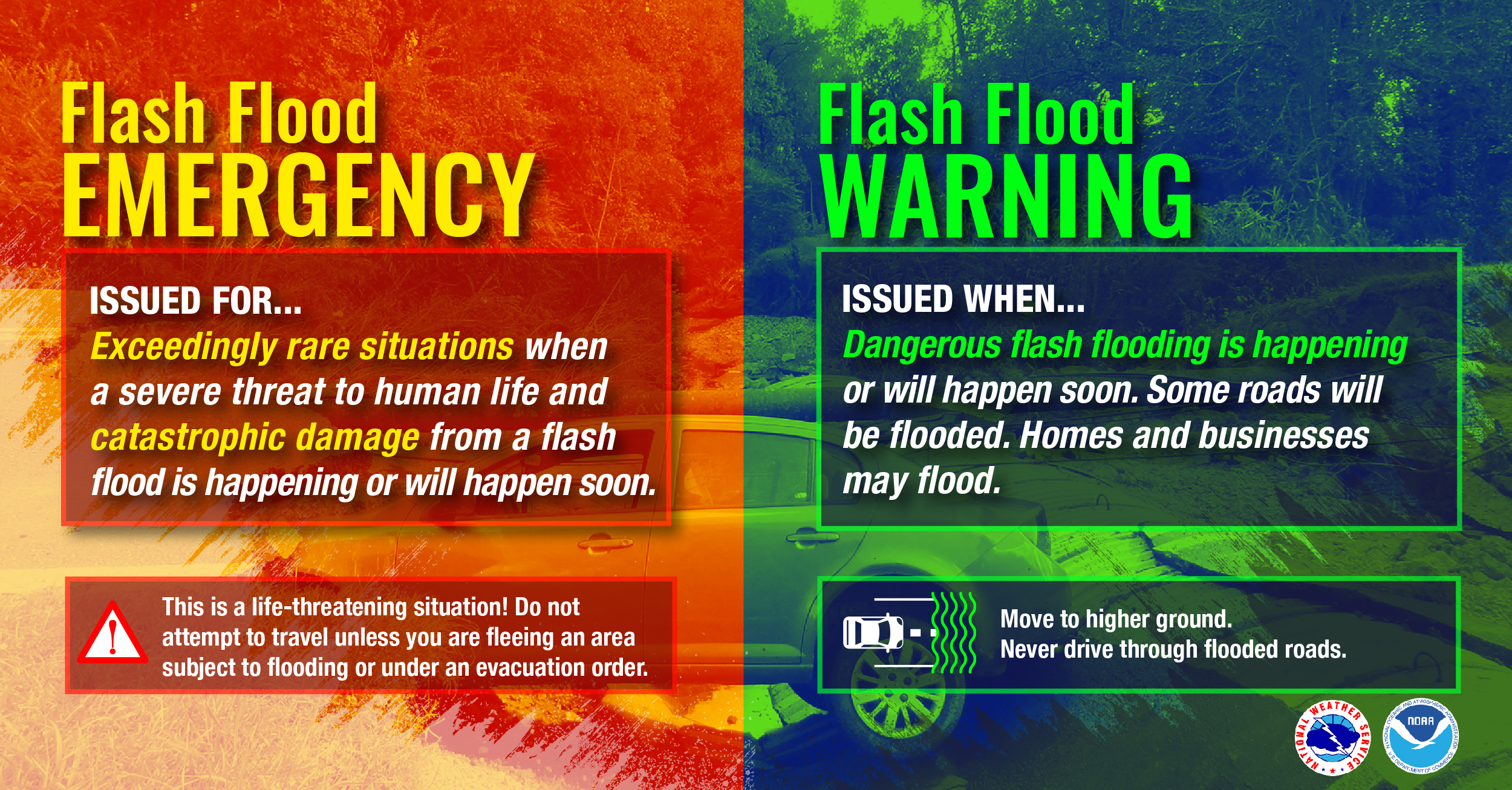

Flash Flood Emergency What You Need To Know To Stay Safe

May 25, 2025

Flash Flood Emergency What You Need To Know To Stay Safe

May 25, 2025 -

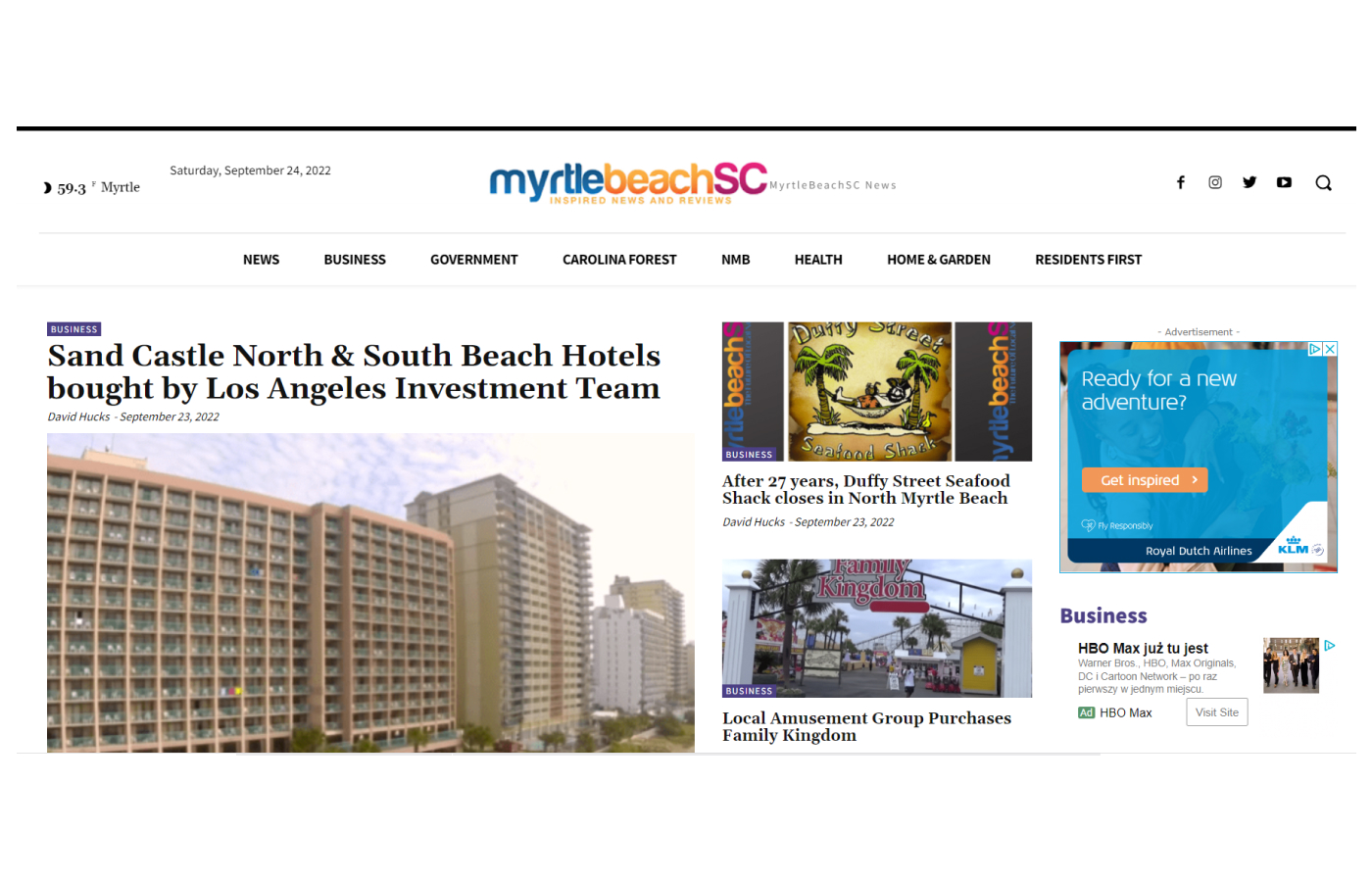

Myrtle Beach Newspaper Honored With 59 Sc Press Association Awards

May 25, 2025

Myrtle Beach Newspaper Honored With 59 Sc Press Association Awards

May 25, 2025 -

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025 -

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025 -

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025