The Trump Administration And The Nippon-U.S. Steel Merger: A Comprehensive Overview

Table of Contents

The Proposed Merger: Key Details and Rationale

The proposed merger between Nippon Steel Corporation (now JFE Steel Corporation after a merger with JFE Holdings) and U.S. Steel Corporation aimed to create a global steel giant. While the merger itself ultimately did not materialize, understanding the proposed deal is crucial to comprehending the dynamics at play during the Trump administration. Both companies sought to enhance their competitive positioning within the global steel market.

The strategic rationale for the merger included:

- Market share implications: Combining the market shares of these two major steel producers would have significantly altered the global steel landscape, potentially leading to increased market dominance.

- Potential synergies and cost savings: Merging operations would have resulted in significant cost savings through economies of scale, streamlined production processes, and reduced administrative overhead. This was a key driver for both corporations.

- Geographic expansion opportunities: The merger would have provided access to new markets and expanded distribution networks, allowing for better penetration in different regions. U.S. Steel's strong North American presence coupled with Nippon Steel's international reach presented compelling expansion prospects.

The Trump Administration's Response and Trade Policy Considerations

The Trump administration's response to the proposed Nippon-U.S. Steel merger was heavily influenced by its broader trade policies, particularly its focus on protecting American industries and jobs. The administration's stance was characterized by intense scrutiny and a cautious approach.

The administration's trade policies, including steel tariffs imposed under Section 232 of the Trade Expansion Act of 1962, played a crucial role in shaping the merger's fate. These tariffs were aimed at combating what the administration deemed unfair trade practices and boosting domestic steel production.

- Specific statements or actions by relevant officials: Then-Secretary of Commerce Wilbur Ross and U.S. Trade Representative Robert Lighthizer closely monitored the situation, expressing concerns about the potential impact on the American steel industry and national security. Public statements emphasized the need for thorough review.

- Impact of tariffs on the merger feasibility: The tariffs added complexity to the merger negotiations, potentially increasing costs and impacting the overall financial viability of the combined entity.

- Arguments for and against the merger from a national security perspective: Concerns were raised regarding potential vulnerabilities in the U.S. steel supply chain if a significant portion of production fell under foreign control. Conversely, proponents argued the merger could improve efficiency and competitiveness, ultimately strengthening the American steel industry.

Impact on the American Steel Industry and Workers

The potential impact of the (hypothetical) merger on the American steel industry and its workforce was a major point of contention.

- Potential benefits: Increased efficiency, modernization of facilities, and investment in new technologies could have resulted from the merger, potentially creating long-term benefits.

- Potential drawbacks: Job displacement through plant closures and consolidation, reduced competition leading to higher prices, and concerns about the relocation of production facilities outside the U.S. were significant concerns.

- Opinions from labor unions and industry experts: Labor unions expressed strong opposition to the merger, citing concerns about job security and the potential erosion of workers' rights. Industry experts were divided, with some arguing for the potential benefits of consolidation and others highlighting the risks to competition and employment.

Long-Term Implications for Global Steel Markets

The proposed Nippon-U.S. Steel merger would have had significant ramifications for the global steel market.

- Changes in market share for key players: The merger would have reshaped the global steel industry's competitive landscape, potentially creating a dominant player capable of influencing steel prices and market conditions.

- Impact on steel prices worldwide: Reduced competition could have led to higher steel prices globally, impacting downstream industries reliant on steel as a raw material.

- Geopolitical implications: The merger could have intensified existing trade tensions and sparked discussions regarding global trade policies and the regulation of mergers and acquisitions in strategic industries.

Conclusion

The proposed Nippon-U.S. Steel merger presented a complex scenario involving intertwined considerations of economic efficiency, national security, and trade policy. The Trump administration’s response, heavily influenced by its protectionist trade policies, highlights the difficulties in balancing the pursuit of global competitiveness with the protection of domestic industries and jobs. While the merger did not materialize, the analysis of the proposed deal reveals the critical issues and potential consequences of such large-scale mergers within the global steel industry. Further research into the long-term effects of similar large-scale consolidations within the global steel industry is crucial for understanding its lasting impact on the global steel landscape and the future of trade policy. Understanding the intricacies of potential future mergers, similar in scale to the proposed Nippon-U.S. Steel Merger, is essential for informed discussion and policymaking.

Featured Posts

-

The Case For News Corp An Undervalued Investment Opportunity

May 25, 2025

The Case For News Corp An Undervalued Investment Opportunity

May 25, 2025 -

Us Band Hints At Glastonbury Gig Unconfirmed Festival Appearance

May 25, 2025

Us Band Hints At Glastonbury Gig Unconfirmed Festival Appearance

May 25, 2025 -

Annie Kilners Social Media Activity Examining The Claims Against Kyle Walker

May 25, 2025

Annie Kilners Social Media Activity Examining The Claims Against Kyle Walker

May 25, 2025 -

Razbor Stati Iz Gazety Trud Gryozy Lyubvi Ili Ilicha

May 25, 2025

Razbor Stati Iz Gazety Trud Gryozy Lyubvi Ili Ilicha

May 25, 2025 -

Frankfurt Stock Exchange Dax Remains Steady Following Record

May 25, 2025

Frankfurt Stock Exchange Dax Remains Steady Following Record

May 25, 2025

Latest Posts

-

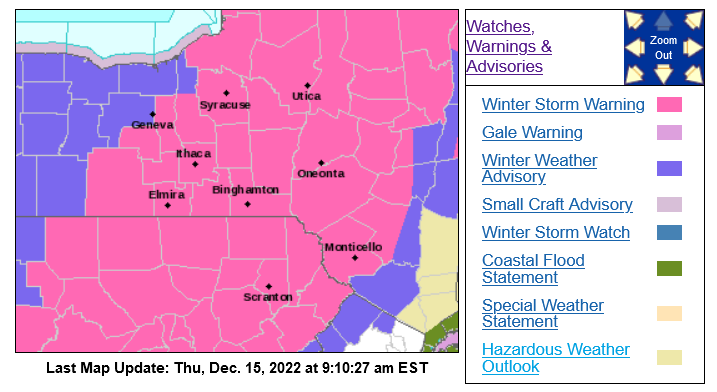

Thunderstorm Activity Prompts Flash Flood Warning In Cayuga County

May 25, 2025

Thunderstorm Activity Prompts Flash Flood Warning In Cayuga County

May 25, 2025 -

Cayuga County Residents Urged To Prepare For Flash Flooding

May 25, 2025

Cayuga County Residents Urged To Prepare For Flash Flooding

May 25, 2025 -

Flash Flood Threat Cayuga County Under Warning Until Tuesday Night

May 25, 2025

Flash Flood Threat Cayuga County Under Warning Until Tuesday Night

May 25, 2025 -

Addressing North Myrtle Beachs Water Usage Crisis For Public Safety

May 25, 2025

Addressing North Myrtle Beachs Water Usage Crisis For Public Safety

May 25, 2025 -

Public Safety Implications Of High Water Consumption In North Myrtle Beach

May 25, 2025

Public Safety Implications Of High Water Consumption In North Myrtle Beach

May 25, 2025