The Upcoming Appointment Of Thailand's New BOT Governor And Tariff Implications

Table of Contents

The Significance of the BOT Governor's Role in Tariff Policy

The Bank of Thailand (BOT) governor holds immense power, influencing the Thai economy's trajectory. Their role extends beyond managing interest rates; it significantly impacts tariff policy's effectiveness. The BOT governor's influence on the exchange rate directly affects the competitiveness of Thai exports and imports, influencing the effectiveness of tariffs.

-

A strong Baht (THB): A strong Baht makes imports cheaper, potentially diminishing the protective effect of tariffs designed to shield domestic industries. This can lead to increased competition from foreign goods and potentially impact domestic producers. Businesses need to understand this dynamic to adjust their pricing and strategies accordingly.

-

A weak Baht (THB): Conversely, a weaker Baht makes Thai exports more competitive globally, even with existing tariffs. This can boost export volumes and benefit export-oriented industries. However, it also increases the price of imports, potentially leading to inflation.

-

Monetary Policy and Inflation: The governor's monetary policy decisions—such as interest rate adjustments—directly impact inflation. High inflation can prompt the government to adjust tariffs to control import prices and stabilize the cost of living. This necessitates a careful balance between monetary policy and tariff management. Understanding the interplay between these factors is crucial for effective economic planning.

Potential Candidates and Their Stated Economic Platforms

Several individuals are potential candidates for the Thailand BOT Governor Appointment. Analyzing their publicly available statements on economic policy, focusing on trade and tariffs, is crucial to predicting the future direction of the Thai economy.

-

Candidate A: (Insert hypothetical candidate A's name and affiliation). Candidate A has expressed a strong commitment to free trade agreements and tariff reductions, aiming to integrate the Thai economy further into the global market. This approach could lead to increased competition but also potential gains from access to larger markets.

-

Candidate B: (Insert hypothetical candidate B's name and affiliation). Candidate B seems more inclined towards protecting domestic industries through tariffs, emphasizing the importance of supporting local producers. This strategy could safeguard certain industries but may limit consumer choice and economic efficiency.

-

Candidate C: (Insert hypothetical candidate C's name and affiliation). Candidate C appears to advocate for a balanced approach, weighing the benefits of free trade against the need to protect specific sectors. This balanced strategy aims for sustainable economic growth while acknowledging the challenges of global competition. This approach likely involves a more nuanced approach to tariff adjustments based on sector-specific needs.

Analyzing the Impact of Different Monetary Policies on Tariffs

Different monetary policies enacted by the new BOT governor will directly influence the effectiveness of tariffs.

-

Higher Interest Rates: Higher interest rates can strengthen the Baht, making imports cheaper and reducing the effectiveness of protective tariffs. This could also attract foreign investment due to higher returns but may negatively impact export competitiveness.

-

Quantitative Easing: Conversely, quantitative easing (QE) can weaken the Baht, increasing export competitiveness even with tariffs. However, it also risks fueling inflation, potentially requiring adjustments to tariff policies to manage import prices. The effect on investment could also be indirect, depending on the overall market reaction to QE.

The Role of International Trade Agreements and the New Governor

The new governor's approach to international trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), will significantly shape Thailand's tariff structure and future negotiations.

-

Tariff Liberalization: A governor favoring increased trade liberalization under RCEP or similar agreements would likely advocate for further tariff reductions, boosting trade volumes but potentially exposing certain domestic industries to more competition. This could lead to restructuring within certain sectors.

-

Foreign Investment: The governor's stance on trade agreements significantly impacts foreign investment. A favorable approach to trade agreements usually attracts foreign investment, while a protectionist approach could deter foreign investors seeking open markets.

Predicting the Impact on Key Thai Industries

The Thailand BOT Governor Appointment will have differential effects on various sectors of the Thai economy.

-

Agriculture: Exchange rate fluctuations significantly impact agricultural exports. A strong Baht might reduce the competitiveness of agricultural products in international markets, while a weak Baht can boost export revenues.

-

Tourism: Changes in import prices of goods and services influence tourism costs. A strong Baht might make Thailand a more affordable destination, while a weak Baht could make it more expensive for foreign tourists.

-

Manufacturing: Tariff structures heavily impact manufacturing competitiveness. Reduced tariffs may increase competition, necessitating higher efficiency and innovation from domestic manufacturers.

Conclusion

The appointment of Thailand's new BOT governor is a critical juncture for the Thai economy. The governor's influence on monetary policy will significantly impact the effectiveness of tariffs and the overall economic climate. By analyzing potential candidates' platforms and understanding the complex interplay between monetary policy, exchange rates, and international trade agreements, stakeholders can better anticipate the implications for various sectors. Staying informed about the Thailand BOT Governor Appointment is crucial for businesses and investors to strategize effectively in the changing economic landscape. Understanding the potential ramifications of this appointment is vital for navigating future economic challenges. Keep up-to-date on developments surrounding the Thailand BOT Governor Appointment to make informed decisions about your investments and business strategies in Thailand.

Featured Posts

-

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 09, 2025

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 09, 2025 -

Itogi Vstrechi Zelenskogo I Trampa V Vatikane Po Mneniyu Makrona

May 09, 2025

Itogi Vstrechi Zelenskogo I Trampa V Vatikane Po Mneniyu Makrona

May 09, 2025 -

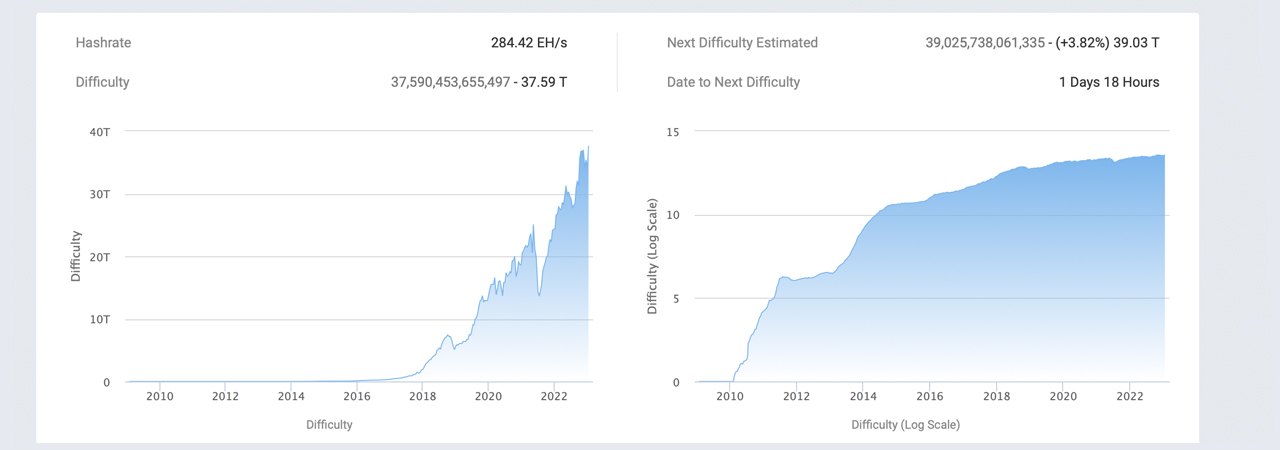

Analysis The Factors Driving The Recent Rise In Bitcoin Mining

May 09, 2025

Analysis The Factors Driving The Recent Rise In Bitcoin Mining

May 09, 2025 -

Is Palantir Stock A Good Investment In 2024 Risks And Rewards

May 09, 2025

Is Palantir Stock A Good Investment In 2024 Risks And Rewards

May 09, 2025 -

Loi Khai Gay Soc Bao Mau Tat Tre Toi Tap O Tien Giang

May 09, 2025

Loi Khai Gay Soc Bao Mau Tat Tre Toi Tap O Tien Giang

May 09, 2025