Is Palantir Stock A Good Investment In 2024? Risks And Rewards

Table of Contents

Palantir's Business Model and Competitive Advantages

Palantir's success hinges on its sophisticated data analytics platforms, Gotham and Foundry, which empower organizations to make sense of vast amounts of data. This strong foundation has led to significant growth and positions Palantir for continued success, but success is not guaranteed.

Government Contracts and Data Analytics

Palantir's initial success was largely driven by lucrative government contracts, providing crucial data analytics solutions to intelligence agencies and defense departments worldwide. These contracts offer substantial revenue streams and provide a degree of stability.

- Examples of key government contracts: Contracts with the CIA, Department of Defense, and various international government agencies.

- Palantir's market share: Palantir holds a significant share of the government data analytics market, thanks to its specialized platforms and strong security protocols.

- Competitive advantages in this niche: Palantir’s expertise in handling sensitive data and its strong relationships with government agencies give it a substantial competitive edge.

Commercial Market Expansion and Growth Potential

Beyond its government focus, Palantir is aggressively expanding into the commercial market, offering its data analytics solutions to a wide range of industries, including healthcare, finance, and energy. This expansion is critical for long-term growth and reducing dependence on government contracts.

- Key commercial clients: Major corporations across diverse sectors are adopting Palantir's platforms.

- Growth projections: While not guaranteed, Palantir's projections for commercial market penetration are ambitious and could significantly boost revenue.

- Challenges in this market: Competition from established players and the need for robust customer acquisition strategies present significant challenges.

Technological Innovation and Future Outlook

Palantir's commitment to R&D is evident in its continuous investment in AI, machine learning, and other cutting-edge technologies. These advancements position the company for future growth and maintain a technological advantage.

- Recent technological breakthroughs: Palantir is constantly refining its platforms to integrate new AI and machine learning capabilities.

- Patents: A strong patent portfolio protects Palantir's intellectual property and reinforces its competitive position.

- Future product lines: Palantir continues to develop new products and services to meet evolving market demands, expanding its potential for revenue streams and continued growth.

Assessing the Risks Associated with Palantir Stock

While Palantir offers significant potential, it's crucial to acknowledge the inherent risks associated with investing in its stock.

Dependence on Government Contracts

Palantir's significant reliance on government contracts poses a risk. Fluctuations in government spending, changes in political priorities, and geopolitical uncertainties could all impact revenue streams.

- Examples of potential risks: Budget cuts, contract delays, or changes in government policy could negatively affect revenue.

- Mitigation strategies employed by Palantir: Diversification into the commercial market is a key strategy to mitigate this risk.

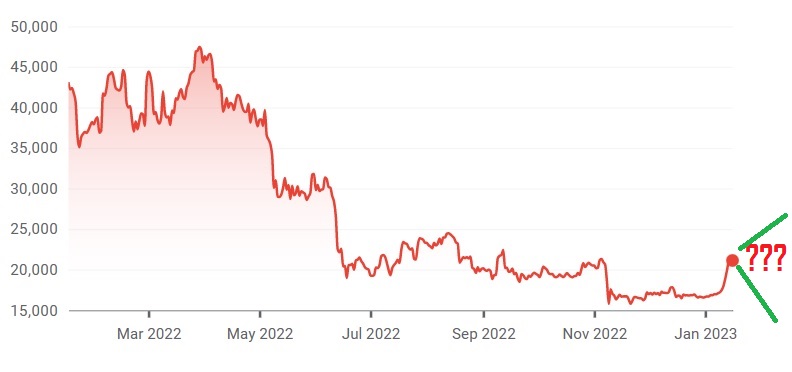

Valuation and Stock Price Volatility

Palantir's valuation, particularly its price-to-earnings ratio (P/E ratio), has fluctuated significantly. This volatility reflects the uncertainty surrounding the company's future growth.

- Historical stock performance: Palantir's stock has experienced periods of both rapid growth and substantial decline.

- Comparison to competitors: Comparing Palantir's valuation to competitors helps gauge whether it is overvalued or undervalued.

- Analyst forecasts: Analyst predictions provide insights into future stock price expectations, though these are not guarantees.

Competition and Market Saturation

The data analytics market is becoming increasingly competitive. The emergence of new players and the potential for market saturation could hinder Palantir's growth.

- Key competitors: Established tech giants and smaller, specialized data analytics firms pose competition.

- Their market share: The competitive landscape is dynamic, with market shares constantly shifting.

- Potential competitive threats: New technologies and innovative business models could disrupt Palantir's market position.

Palantir's Financial Performance and Projections

Analyzing Palantir's financial statements – including revenue growth, profitability, and cash flow – is crucial for assessing its financial health. Reviewing recent financial reports and comparing them to analyst forecasts provides a more complete picture. (Note: Due to the dynamic nature of financial data, specific numbers would need to be added here from current financial reports and reputable analyst sources.) Visualizing this data through tables and charts will help investors grasp the financial trends and potential risks more effectively.

Investment Strategies and Considerations

Potential investors should carefully consider their risk tolerance and investment goals when deciding whether to invest in Palantir stock.

- Long-term investment: A long-term approach might be suitable for investors with a higher risk tolerance and a belief in Palantir's long-term growth potential.

- Short-term trading: Short-term trading is inherently riskier due to the stock's volatility and is not recommended for inexperienced investors.

- Investment strategy: A well-defined investment strategy that includes diversification and asset allocation is critical for managing risk effectively.

- Risk tolerance: Investors should only invest an amount they are comfortable potentially losing.

Conclusion: Is Palantir Stock Right for Your Portfolio in 2024?

Palantir Technologies presents a compelling investment opportunity, given its innovative data analytics platforms and ambitious expansion plans. However, its reliance on government contracts, stock price volatility, and a competitive market landscape introduce considerable risks. The company's future success hinges on its ability to sustain revenue growth in the commercial sector and continue innovating in the face of intense competition. Therefore, before considering investing in Palantir stock, a thorough due diligence process is essential, encompassing a review of its financial performance, a careful assessment of its risks, and a clear understanding of your own investment goals and risk tolerance. Is Palantir stock the right choice for your portfolio in 2024? Only you can answer that after thorough research.

Featured Posts

-

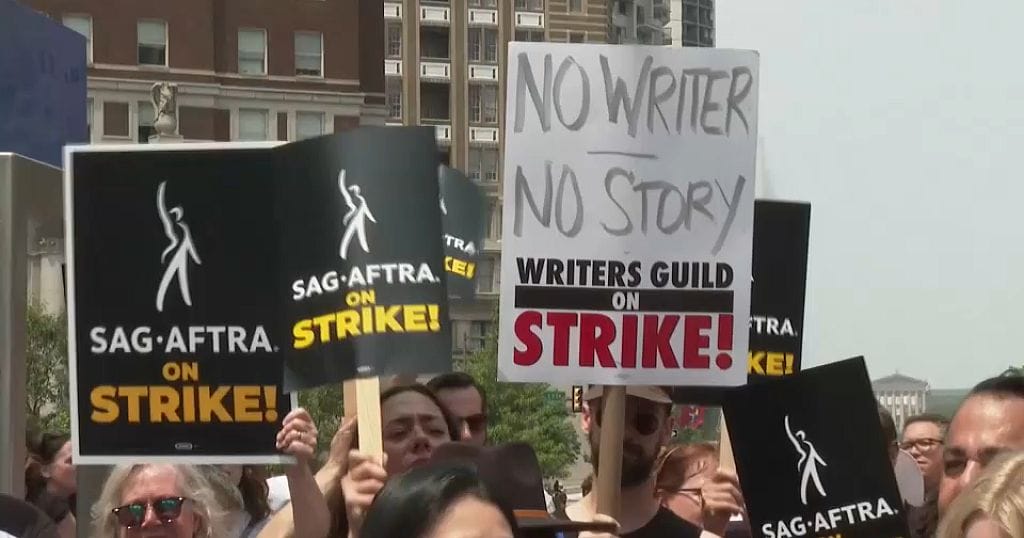

The Impact Of The Dual Hollywood Strike Actors And Writers Unite

May 09, 2025

The Impact Of The Dual Hollywood Strike Actors And Writers Unite

May 09, 2025 -

Government And Commercial Growth Palantir Stock Performance In Q1

May 09, 2025

Government And Commercial Growth Palantir Stock Performance In Q1

May 09, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025 -

Go Compare Drops Wynne Evans After Mail On Sunday Exposes Offensive Remarks

May 09, 2025

Go Compare Drops Wynne Evans After Mail On Sunday Exposes Offensive Remarks

May 09, 2025 -

Bitcoin Rebound Understanding The Factors Driving The Recovery

May 09, 2025

Bitcoin Rebound Understanding The Factors Driving The Recovery

May 09, 2025