Analysis: The Factors Driving The Recent Rise In Bitcoin Mining

Table of Contents

The Impact of Bitcoin's Price on Mining Profitability

The profitability of Bitcoin mining is intrinsically linked to the Bitcoin price. A higher Bitcoin price directly translates to increased revenue for miners, creating a powerful incentive for new participants to enter the market and existing miners to expand their operations.

Increased Bitcoin Value

- Direct Correlation: A higher Bitcoin price means each successfully mined Bitcoin is worth more, significantly boosting miner profits. A 10% increase in Bitcoin price often leads to a proportionally higher increase in mining revenue.

- Transaction Fees: Beyond the block reward, transaction fees contribute to miner profitability. Periods of high network activity and congestion can lead to substantial increases in transaction fees, further enhancing miners' earnings.

- Price Volatility: While price increases are positive, volatility presents a risk. Sharp price drops can quickly erode profitability, forcing some miners to shut down operations. The following chart (if available) would illustrate the correlation between Bitcoin price and mining revenue.

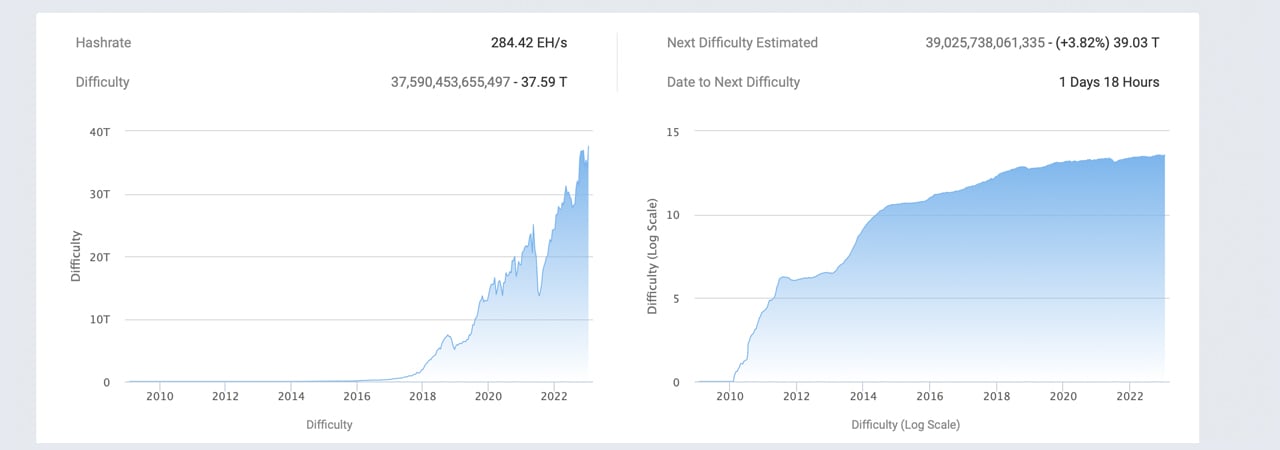

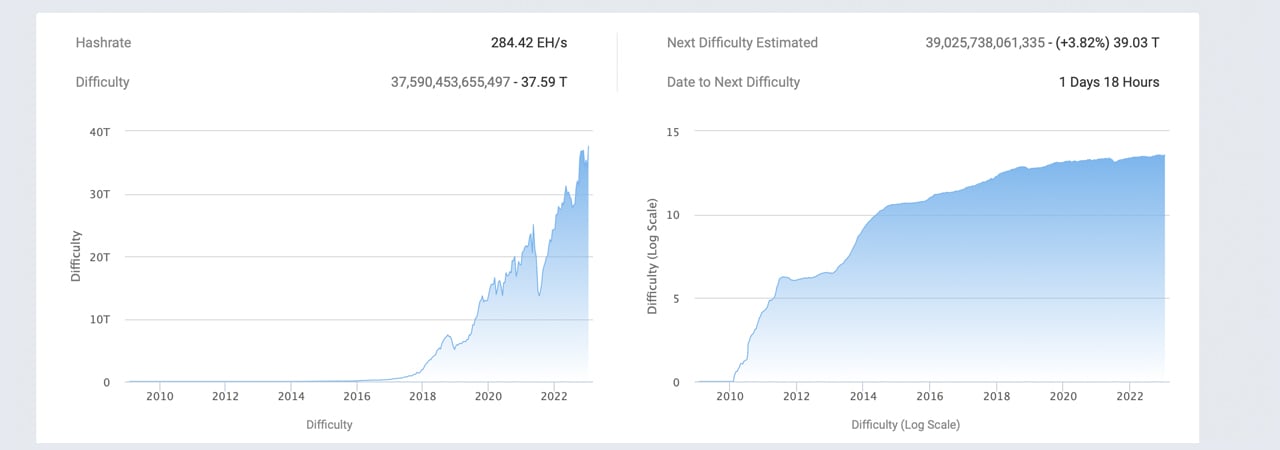

The Influence of Mining Difficulty

Mining difficulty is a crucial factor that influences individual miner profitability. The Bitcoin network automatically adjusts the mining difficulty approximately every two weeks to maintain a consistent block generation time of around 10 minutes.

- Hashing Power: Increased mining activity leads to a higher overall network hash rate. The network adjusts the difficulty upwards to compensate, making it harder to find and mine new blocks.

- Miner Returns: A higher difficulty means that individual miners need more computational power to successfully mine a block. This affects the returns on investment for miners, especially those with less efficient hardware.

- ASICs and Efficiency: The use of specialized Application-Specific Integrated Circuits (ASICs) is crucial in Bitcoin mining. Advancements in ASIC technology lead to increased hashing power and energy efficiency, allowing miners to compete even with increasing difficulty.

Technological Advancements and Energy Efficiency

Technological advancements in mining hardware and a growing adoption of renewable energy sources have significantly contributed to the recent rise in Bitcoin mining activity.

Improved Mining Hardware

The development of more efficient and powerful ASICs is a key driver. These advancements enable miners to process more hashes per second, increasing their chances of successfully mining a block.

- Increased Hashing Power: New generations of ASICs consistently offer substantial increases in hashing power, allowing miners to maintain profitability even with increasing mining difficulty.

- Energy Efficiency: Modern ASICs are designed with increased energy efficiency in mind. This reduces the electricity costs associated with mining, a major operational expense. This allows miners to operate profitably even in areas with higher electricity prices.

- Examples: Specific examples of new ASICs and their performance improvements compared to their predecessors could be included here (e.g., Antminer S19 vs. previous models).

Renewable Energy Adoption

The environmental concerns surrounding Bitcoin mining are increasingly being addressed by the adoption of renewable energy sources. This not only reduces the carbon footprint but also lowers operational costs for miners.

- Cost Reduction: Utilizing hydropower, solar, or wind power significantly reduces electricity bills, enhancing the profitability of mining operations.

- Environmental Benefits: The shift towards sustainable energy sources improves the public image of Bitcoin mining and addresses environmental concerns.

- Investment Attraction: The commitment to sustainability attracts environmentally conscious investors, further fueling the growth of the industry.

Regulatory Landscape and Geographic Shifts

The regulatory environment and the geographic distribution of mining operations play a significant role in shaping the overall mining landscape.

Favorable Regulations in Certain Regions

Some countries have implemented policies that are more favorable to Bitcoin mining, attracting miners seeking stable and supportive regulatory frameworks.

- Supportive Policies: Examples of countries with favorable regulations for Bitcoin mining (if any) can be mentioned here.

- Regulatory Uncertainty: Conversely, regulatory uncertainty or outright bans in other regions force miners to relocate their operations.

- Tax Implications: Tax policies also significantly influence the location choices of Bitcoin mining operations.

Geographic Dispersion of Mining Operations

Miners are increasingly diversifying their operations geographically to mitigate risks associated with specific regions.

- Access to Resources: The availability of cheap electricity and robust infrastructure is a key factor influencing location choices.

- Geopolitical Factors: Political stability and the risk of government intervention or policy changes are major considerations.

- Climate Considerations: Access to cool climates for efficient cooling of mining hardware is also becoming increasingly important.

Conclusion

The recent rise in Bitcoin mining activity is a result of several interconnected factors. The increased Bitcoin price directly boosts profitability, incentivizing participation. Technological advancements in mining hardware and the growing adoption of renewable energy sources enhance efficiency and reduce costs. Finally, favorable regulatory environments and the geographic dispersion of mining operations provide stability and mitigate risk. Understanding the factors driving the recent rise in Bitcoin mining is crucial for anyone invested in the cryptocurrency market. Stay tuned for further analysis and insights into the future of Bitcoin mining. [Link to further resources]

Featured Posts

-

Tien Giang Phan Ung Manh Me Truoc Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025

Tien Giang Phan Ung Manh Me Truoc Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025 -

Putins Victory Day Ceasefire A Temporary Truce

May 09, 2025

Putins Victory Day Ceasefire A Temporary Truce

May 09, 2025 -

The Great Decoupling A New Era Of Global Economic Restructuring

May 09, 2025

The Great Decoupling A New Era Of Global Economic Restructuring

May 09, 2025 -

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025 -

The High Cost Of Daycare And Alternatives For Working Families

May 09, 2025

The High Cost Of Daycare And Alternatives For Working Families

May 09, 2025

Latest Posts

-

Young Thugs Uy Scuti When Can We Expect The New Album

May 09, 2025

Young Thugs Uy Scuti When Can We Expect The New Album

May 09, 2025 -

Council Approves Rezoning Edmonton Nordic Spa Development Progresses

May 09, 2025

Council Approves Rezoning Edmonton Nordic Spa Development Progresses

May 09, 2025 -

Uy Scuti Album Young Thug Offers Release Date Clues

May 09, 2025

Uy Scuti Album Young Thug Offers Release Date Clues

May 09, 2025 -

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025 -

Young Thugs Uy Scuti Album Speculation And Anticipated Release

May 09, 2025

Young Thugs Uy Scuti Album Speculation And Anticipated Release

May 09, 2025