The Trump Tariffs: A Major Setback For Renault's American Automotive Ambitions

Table of Contents

Increased Import Costs and Reduced Competitiveness

The Trump tariffs levied substantial duties on imported vehicles and automotive parts. For Renault, this translated to a significant increase in the cost of importing cars and components into the US. This directly impacted the price of Renault vehicles sold in the American market, making them less competitive against domestically produced cars and vehicles from other countries with more favorable trade relationships.

- Higher import duties on parts and finished vehicles: Tariffs added thousands of dollars to the cost of each imported Renault vehicle, drastically increasing the final price for consumers.

- Reduced price competitiveness compared to domestic and other foreign manufacturers: The price hikes rendered Renault cars less attractive to US consumers compared to similarly equipped vehicles from Ford, GM, Honda, Toyota, and other manufacturers unaffected or less affected by the tariffs.

- Loss of market share due to higher prices: As a result of the increased prices, Renault experienced a noticeable decline in sales and market share in the US, failing to gain the foothold it had hoped for. While precise sales figures impacted solely by tariffs are difficult to isolate, industry analysts noted a general decline in import sales during this period.

The combination of these factors created a challenging environment for Renault's operations in the US. The company faced an uphill battle against established players with lower costs and stronger brand recognition in the American market.

Disrupted Supply Chains and Production Challenges

The Trump tariffs didn't just impact the final price of Renault vehicles; they also severely disrupted the company's supply chains. The sourcing of parts and components became significantly more complex and costly. Renault relied on a global network of suppliers, and the tariffs forced the company to explore alternative sources outside of the US.

- Increased lead times for parts procurement: Finding new suppliers and establishing reliable supply lines took considerable time and resources, leading to production delays.

- Higher transportation costs due to sourcing from more distant locations: Shifting to suppliers further away from the US increased shipping costs, adding further to the overall expenses.

- Potential for supply shortages impacting production: The disruption to established supply chains created the risk of parts shortages, further hindering production and delivery schedules.

For example, the tariffs on specific electronic components or specialized materials may have forced Renault to source these from Asia, increasing shipping time and expense significantly. This ripple effect highlighted the vulnerability of global supply chains in the face of protectionist trade policies.

Impact on Investment and Future Expansion Plans

The negative impact of the Trump tariffs on Renault's profitability in the US market directly influenced its investment decisions. The reduced profitability and increased uncertainty led to a reevaluation of investment plans in the region.

- Reduced profitability in the US market: The higher costs and lower sales translated into lower profit margins, making the US market less attractive for further investment.

- Delayed or canceled investments in new manufacturing facilities or dealerships: Renault likely postponed or abandoned plans for new manufacturing plants or dealership expansions in the US due to the unfavorable economic climate created by the tariffs.

- Potential job losses or reduced hiring: The diminished prospects for growth in the US market may have led to reduced hiring or even job losses within Renault's American operations.

While Renault didn't publicly announce specific canceled projects directly attributable to the tariffs, the overall slowdown in its US operations during this period strongly suggests a negative impact on its investment strategies.

The Broader Context: Global Trade Wars and Automotive Industry Impacts

Renault's experience with the Trump tariffs wasn't unique. The broader context of the Trump administration's trade policies created significant uncertainty and challenges for the entire global automotive industry. Other automakers faced similar difficulties, experiencing increased costs, supply chain disruptions, and reduced market share.

- Increased uncertainty in the global automotive market: The trade wars fostered a climate of uncertainty, making long-term planning and investment more challenging.

- Negative impacts on international trade relations: The tariffs strained relationships between the US and its trading partners, creating friction and distrust in the global automotive market.

- Long-term consequences for global automotive production and distribution: The disruption to global supply chains and trade relationships could have long-lasting consequences for the efficiency and cost-effectiveness of global automotive production and distribution.

The experience of other European and Asian automakers during this period serves as a testament to the widespread impact of the Trump tariffs on the global automotive landscape.

Conclusion: Lessons Learned from the Trump Tariffs and Future Outlook for Renault in the US

The Trump tariffs presented a significant obstacle to Renault's ambitions in the US market. The increased import costs, disrupted supply chains, and reduced competitiveness led to decreased profitability and a scaling back of investment plans. Understanding the impact of these tariffs is crucial for Renault and other global automakers to effectively navigate future trade uncertainties. This experience highlights the importance of diversifying supply chains, carefully assessing trade risks, and developing flexible strategies to adapt to changing geopolitical landscapes. Understanding the impact of the Trump tariffs on Renault provides valuable insight into the challenges facing multinational corporations in today's globalized yet volatile market. Learn more about mitigating risks associated with trade policy uncertainty.

Featured Posts

-

Harry Kanes Brace Secures Bayern Munich Victory Over Werder Bremen

Apr 25, 2025

Harry Kanes Brace Secures Bayern Munich Victory Over Werder Bremen

Apr 25, 2025 -

Vizit Marka Bernsa Dukhovniy Sovetnik Trampa V Ukraine

Apr 25, 2025

Vizit Marka Bernsa Dukhovniy Sovetnik Trampa V Ukraine

Apr 25, 2025 -

Tim The Yowie Man And The Unique Anzac Day Heater Tradition In Canberra

Apr 25, 2025

Tim The Yowie Man And The Unique Anzac Day Heater Tradition In Canberra

Apr 25, 2025 -

Sky Sports Reporter Confirms Arsenal Talks For Premier League Champion

Apr 25, 2025

Sky Sports Reporter Confirms Arsenal Talks For Premier League Champion

Apr 25, 2025 -

Jack O Connell Cast In Godzilla X Kong Sequel

Apr 25, 2025

Jack O Connell Cast In Godzilla X Kong Sequel

Apr 25, 2025

Latest Posts

-

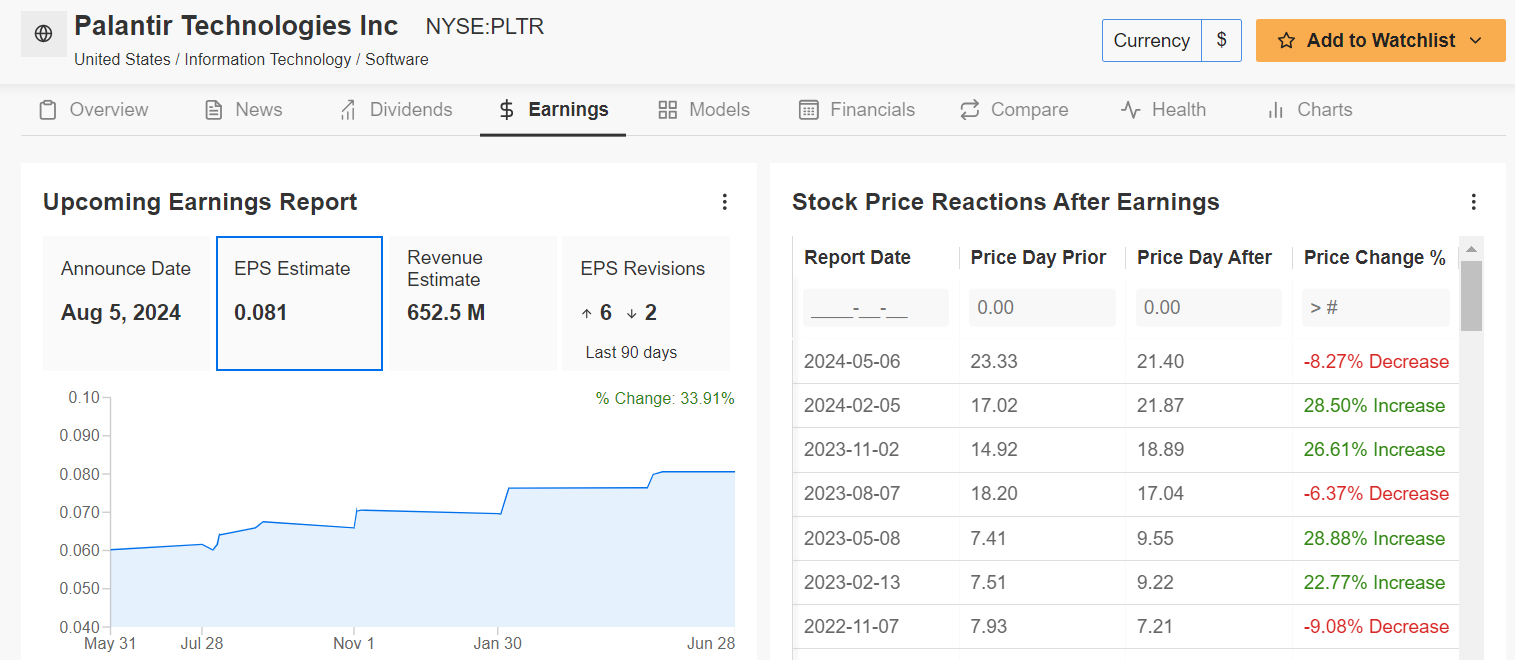

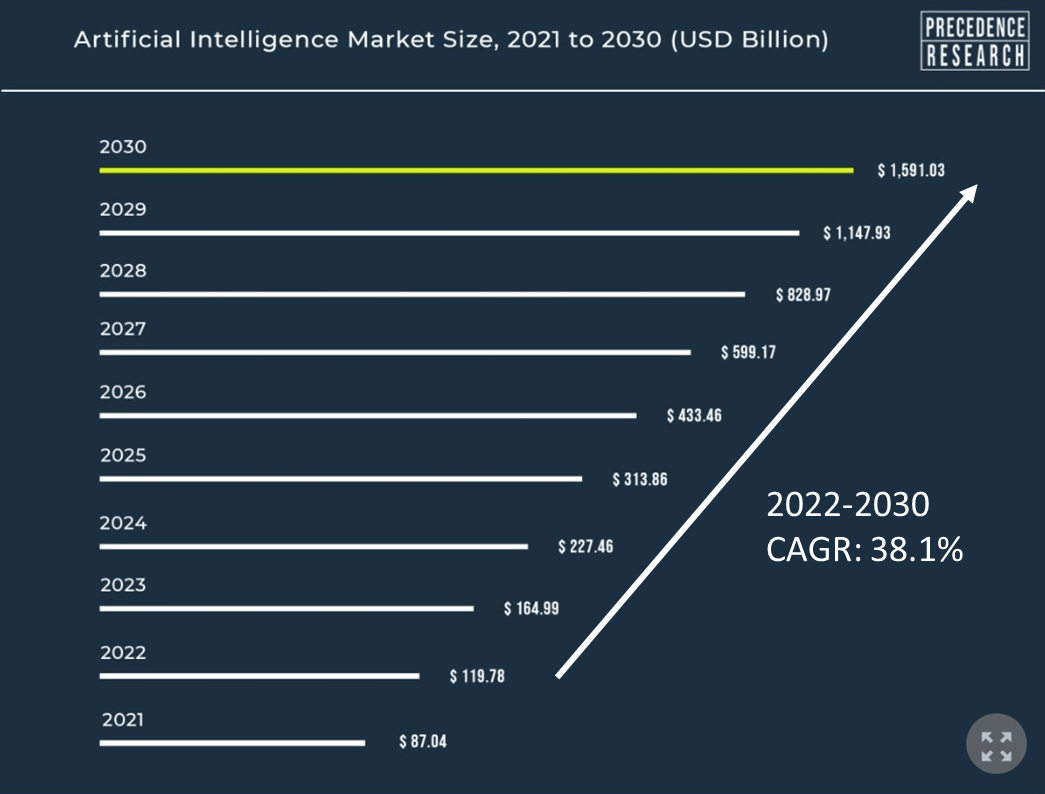

Palantir Stock Before May 5th Is It A Buy Sell Or Hold

May 10, 2025

Palantir Stock Before May 5th Is It A Buy Sell Or Hold

May 10, 2025 -

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 10, 2025

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 10, 2025 -

Should You Buy Palantir Before May 5th A Data Driven Approach

May 10, 2025

Should You Buy Palantir Before May 5th A Data Driven Approach

May 10, 2025 -

Investing In Palantir Stock A Look Ahead To May 5th

May 10, 2025

Investing In Palantir Stock A Look Ahead To May 5th

May 10, 2025 -

Pre May 5th Palantir Stock Evaluation Is It A Good Buy

May 10, 2025

Pre May 5th Palantir Stock Evaluation Is It A Good Buy

May 10, 2025