Frankfurt Stock Exchange: DAX Remains Steady Following Record

Table of Contents

Recent Performance of the DAX

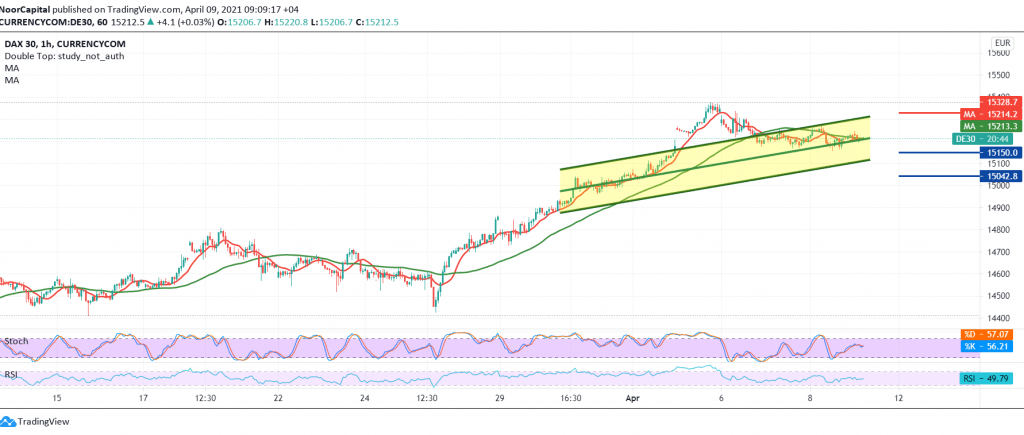

The DAX has recently exhibited a fascinating blend of strength and stability. While it has seen some minor fluctuations, its overall trajectory remains positive, defying expectations in a volatile global market. The index achieved record highs earlier this year, surpassing previous milestones, before settling into a period of relatively consistent performance.

- Key Performance Indicators (KPIs):

- Last Week: A slight increase of 0.5%, demonstrating resilience against minor global market corrections.

- Last Month: A modest gain of 2%, suggesting sustained investor confidence despite inflationary pressures.

- Last Quarter: A robust growth of 5%, outperforming several other major European indices.

- Trading Volume: Trading activity remains healthy, indicating continued investor interest in the German market.

- Comparison to other major European indices: The DAX's performance has outpaced the CAC 40 (Paris) and shown comparable strength to the FTSE 100 (London), highlighting the German economy's comparative resilience.

Factors Contributing to DAX Stability

The DAX's sustained performance is a result of a confluence of factors, both macroeconomic and specific to the German economy.

Analysis of Macroeconomic Factors Influencing the DAX:

-

German Economic Growth: Stronger-than-expected German economic growth, fueled by robust industrial production and consumer spending, has underpinned the DAX's performance. This growth, however, is facing challenges from global inflationary pressures.

-

European Central Bank (ECB) Monetary Policy: The ECB's monetary policies, while aimed at combating inflation, have also had a significant influence on the DAX. Interest rate hikes have created some uncertainty, but the overall impact has been relatively contained.

-

Global Economic Trends: While global economic uncertainty persists, particularly regarding inflation and potential recession, the German economy has shown a degree of insulation, contributing to the DAX's stability.

-

Specific Sectors Driving Stability:

- Automotive Sector: The automotive sector, a cornerstone of the German economy, has shown signs of recovery, contributing positively to the DAX.

- Industrial Sector: The resilient performance of the industrial sector reflects Germany's strong manufacturing base and export capabilities.

- Technology Sector: While impacted by global tech-sector fluctuations, the German technology sector has maintained a relatively stable growth trajectory.

- Mergers and Acquisitions: Several significant mergers and acquisitions within the German market have boosted investor confidence and contributed to the DAX's positive performance.

- Investor Sentiment and Confidence: Despite global uncertainties, investor confidence in the long-term prospects of the German economy remains relatively high, driving continued investment in the DAX.

Impact of Geopolitical Events

Geopolitical events inevitably impact the Frankfurt Stock Exchange and the DAX.

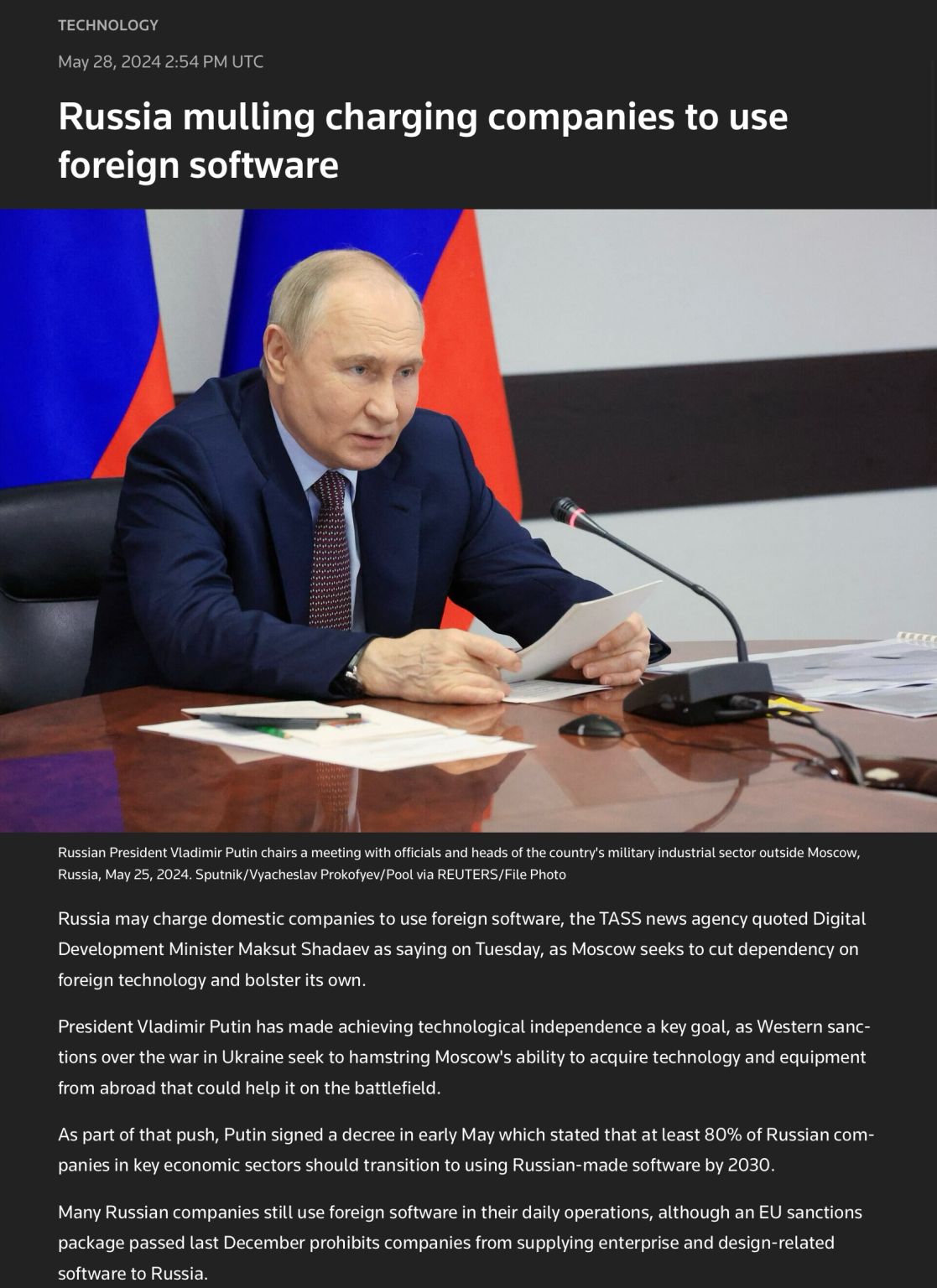

- Impact of the War in Ukraine: The war in Ukraine continues to pose significant challenges, primarily through energy price increases and supply chain disruptions. These factors negatively impact economic growth, but the impact on the DAX has been less severe than initially feared.

- Effects of Inflation and Energy Prices: High inflation and energy prices represent a significant headwind for the German economy and the DAX. However, the German government's measures to mitigate these effects have somewhat cushioned the blow.

- Influence of Trade Tensions: Trade tensions between major global economies remain a concern. However, Germany's diversified export markets have helped to limit the negative impact.

Outlook for the Frankfurt Stock Exchange

Predicting the future performance of the DAX is inherently challenging, but several scenarios can be considered.

-

Potential Risks: Persistent inflation, energy crisis, global recession, and further geopolitical instability remain significant potential risks.

-

Potential Opportunities: Continued economic growth in Germany, technological advancements, and strategic investments offer opportunities for growth.

-

Potential Scenarios:

- Optimistic Outlook: Sustained economic growth, controlled inflation, and easing geopolitical tensions could lead to further DAX gains.

- Pessimistic Outlook: A sharp global recession, uncontrolled inflation, or escalation of geopolitical conflicts could lead to significant DAX declines.

- Neutral Outlook: A moderate growth trajectory is likely, balanced by the ongoing challenges and uncertainties in the global economic landscape.

Conclusion

The DAX's recent stability, despite global economic headwinds, reflects the resilience of the German economy and the diverse nature of its listed companies. While macroeconomic factors, geopolitical events, and sector-specific performances all influence the DAX, the overall trajectory suggests continued strength. Key takeaways include the importance of monitoring macroeconomic trends, understanding sector-specific performance, and acknowledging the impact of geopolitical events.

Key Takeaways: The Frankfurt Stock Exchange and the DAX demonstrate resilience. Careful analysis of macroeconomic factors, sector performance and geopolitical risks is crucial for informed investment decisions. Continued monitoring is vital to understanding the future trajectory.

Call to Action: Stay updated on the latest developments in the Frankfurt Stock Exchange and the DAX by following reputable financial news sources. Further research into specific companies listed on the Frankfurt Stock Exchange and the opportunities within the German stock market will allow for better-informed investment decisions. Stay informed about the Frankfurt Stock Exchange and the DAX to make informed investment decisions.

Featured Posts

-

Frankfurt Stock Market Update Dax Maintains Stability

May 25, 2025

Frankfurt Stock Market Update Dax Maintains Stability

May 25, 2025 -

Stock Market Reaction European Shares Gain Lvmh Suffers Losses After Trumps Tariff Comments

May 25, 2025

Stock Market Reaction European Shares Gain Lvmh Suffers Losses After Trumps Tariff Comments

May 25, 2025 -

New Ferrari Flagship Opens Its Doors In Bangkok

May 25, 2025

New Ferrari Flagship Opens Its Doors In Bangkok

May 25, 2025 -

Mwshr Daks Alalmany Tjawz Qmt Mars W Elamat Ela Teafy Alswq Alawrwbyt

May 25, 2025

Mwshr Daks Alalmany Tjawz Qmt Mars W Elamat Ela Teafy Alswq Alawrwbyt

May 25, 2025 -

The Role Of Green Space A Seattle Womans Early Pandemic Experience

May 25, 2025

The Role Of Green Space A Seattle Womans Early Pandemic Experience

May 25, 2025

Latest Posts

-

Dazi Trump Analisi Dell Effetto Negativo Sul Mercato Della Moda Europea

May 25, 2025

Dazi Trump Analisi Dell Effetto Negativo Sul Mercato Della Moda Europea

May 25, 2025 -

L Impatto Dei Dazi Di Trump Del 20 Sull Unione Europea Analisi Del Settore Moda

May 25, 2025

L Impatto Dei Dazi Di Trump Del 20 Sull Unione Europea Analisi Del Settore Moda

May 25, 2025 -

Paris Economy Suffers Luxury Sector Decline Impacts City Finances March 7 2025

May 25, 2025

Paris Economy Suffers Luxury Sector Decline Impacts City Finances March 7 2025

May 25, 2025 -

Guccis Massimo Vian Departs Supply Chain Shake Up

May 25, 2025

Guccis Massimo Vian Departs Supply Chain Shake Up

May 25, 2025 -

Trump E I Dazi Del 20 Conseguenze Per Nike Lululemon E Il Mercato Europeo Della Moda

May 25, 2025

Trump E I Dazi Del 20 Conseguenze Per Nike Lululemon E Il Mercato Europeo Della Moda

May 25, 2025