The Case For News Corp: An Undervalued Investment Opportunity

Table of Contents

News Corp's Diversified Portfolio: A Hedge Against Market Volatility

News Corp's diverse holdings act as a significant hedge against market volatility. Unlike companies heavily reliant on a single revenue stream, News Corp operates across multiple segments, mitigating risk and providing stability. This diversification is a key factor contributing to its attractiveness as an undervalued investment.

-

Strong presence in both print and digital media: News Corp owns leading newspapers and digital properties, reducing its dependence on any single platform. This dual approach ensures consistent revenue streams even as the media consumption habits evolve. This robust foundation in traditional media, combined with a growing digital presence, provides a solid base for future growth.

-

Ownership of leading news brands providing consistent revenue streams: Its portfolio includes renowned news brands with established audiences and strong brand recognition. These brands generate consistent revenue through subscriptions, advertising, and other revenue streams, providing a reliable income base. The brand loyalty associated with these established names acts as a significant asset.

-

Growth potential in digital real estate and other emerging media segments: News Corp is actively investing in and expanding its digital real estate holdings, positioning itself for growth in this rapidly evolving sector. This forward-looking strategy diversifies its revenue streams beyond traditional media and taps into high-growth areas. Furthermore, its exploration of other emerging media segments offers significant upside potential.

-

Successful book publishing division providing consistent profits and brand loyalty: The book publishing division consistently delivers profits and benefits from strong brand loyalty. This division represents a stable and reliable source of revenue, further diversifying News Corp's income stream and bolstering its overall financial strength.

Strategic Initiatives Driving Future Growth and News Corp Stock Value

News Corp is proactively implementing strategic initiatives to drive future growth and enhance its stock value. These moves demonstrate a commitment to adapting to the changing media landscape and capitalizing on new opportunities.

-

Investments in digital platforms and technology to enhance user experience and revenue generation: News Corp is significantly investing in upgrading its digital platforms and employing cutting-edge technology to improve the user experience and boost revenue generation. This focus on digital transformation is vital for long-term success in the competitive media market.

-

Focus on data-driven decision-making to optimize content creation and distribution: By leveraging data analytics, News Corp optimizes its content creation and distribution strategies, ensuring that its offerings resonate with its target audiences. This data-driven approach enhances efficiency and maximizes the return on investment.

-

Strategic acquisitions to expand market share and diversify revenue streams: News Corp has a history of strategic acquisitions, expanding its market reach and diversifying its income sources. This approach enables them to tap into new markets and capitalize on emerging opportunities. These acquisitions fuel growth and solidify its market position.

-

Cost-cutting measures to improve profitability and shareholder value: News Corp has implemented cost-cutting measures to enhance profitability and maximize shareholder value. This focus on efficiency complements its growth initiatives and contributes to improved financial performance.

Strong Leadership and Experienced Management Team

News Corp's success is also underpinned by its strong leadership and experienced management team. This experienced team inspires investor confidence and provides stability in a volatile industry.

-

Proven track record of successful management in the media industry: The leadership team has a proven track record of successfully navigating the challenges and opportunities of the media industry. Their experience and expertise are invaluable assets.

-

Deep understanding of the evolving media landscape: The management team possesses a profound understanding of the ever-changing media environment, enabling them to make informed decisions and adapt to emerging trends. This insight is crucial for long-term growth and sustainability.

-

Commitment to long-term growth and shareholder value: The leadership team demonstrates a clear commitment to long-term growth and maximizing shareholder value, fostering trust and confidence among investors. This commitment is reflected in their strategic initiatives and operational decisions.

-

Effective implementation of strategic initiatives: The team effectively implements its strategic initiatives, demonstrating a capacity for execution and driving tangible results. This effectiveness contributes significantly to the company’s overall success and growth.

Undervalued Valuation: Why News Corp Stock is a Buy

A compelling argument can be made that News Corp's current market capitalization undervalues its assets and future potential. Several factors suggest that the stock is currently priced below its intrinsic worth, making it an attractive investment opportunity.

-

Market may be overlooking the company's strong fundamentals and growth prospects: The market may be overlooking News Corp's strong fundamentals and its significant growth potential, leading to an undervaluation.

-

Potential for significant share price appreciation based on realistic growth projections: Based on realistic growth projections, there's considerable potential for significant share price appreciation. This upside potential makes it a particularly attractive investment.

-

Attractive dividend yield compared to market competitors: News Corp offers an attractive dividend yield compared to its competitors, providing an additional source of returns for investors.

-

Comparison to similar companies with higher valuations despite lower growth potential: Compared to similar companies with lower growth potential, News Corp’s valuation appears significantly lower, highlighting a potential market inefficiency.

Conclusion

News Corp presents a compelling investment opportunity for those seeking exposure to a diversified media portfolio with strong growth potential. Its strategic initiatives, experienced management, and undervalued valuation make it a compelling case for investors looking for a potentially high-reward investment. The company's diversified holdings across news, books, and digital real estate offer resilience against market fluctuations, while its strategic focus on digital transformation positions it for future growth in the evolving media landscape. The current market price may not fully reflect the company's inherent value, creating a potentially lucrative opportunity.

Call to Action: Consider adding News Corp to your portfolio. Investigate the News Corp investment opportunity further and learn more about its potential to deliver strong returns. Don't miss out on this potentially undervalued investment opportunity; research News Corp and explore its future potential. Consider News Corp stock as part of your diversified investment strategy.

Featured Posts

-

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025 -

Growth And Partnership Bangladeshs Renewed Presence In Europe

May 25, 2025

Growth And Partnership Bangladeshs Renewed Presence In Europe

May 25, 2025 -

Demna Gvasalias Gucci Debut What To Expect

May 25, 2025

Demna Gvasalias Gucci Debut What To Expect

May 25, 2025 -

Country Living Your Escape To The Country Awaits

May 25, 2025

Country Living Your Escape To The Country Awaits

May 25, 2025 -

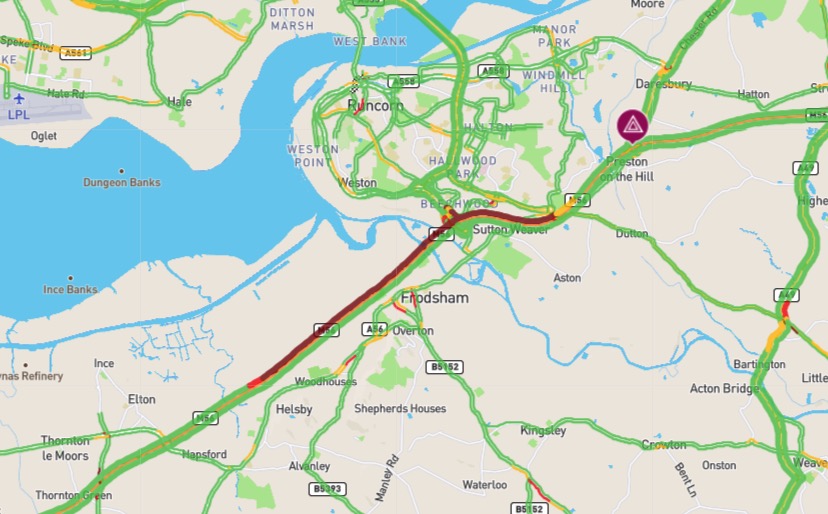

Delays On M56 Near Cheshire Deeside Border Due To Collision

May 25, 2025

Delays On M56 Near Cheshire Deeside Border Due To Collision

May 25, 2025

Latest Posts

-

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025 -

The George Russell Contract Why Mercedes Must Act

May 25, 2025

The George Russell Contract Why Mercedes Must Act

May 25, 2025 -

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025 -

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025 -

1 5 Million Debt Paid George Russells Financial Update And Its Impact On His F1 Career

May 25, 2025

1 5 Million Debt Paid George Russells Financial Update And Its Impact On His F1 Career

May 25, 2025