The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

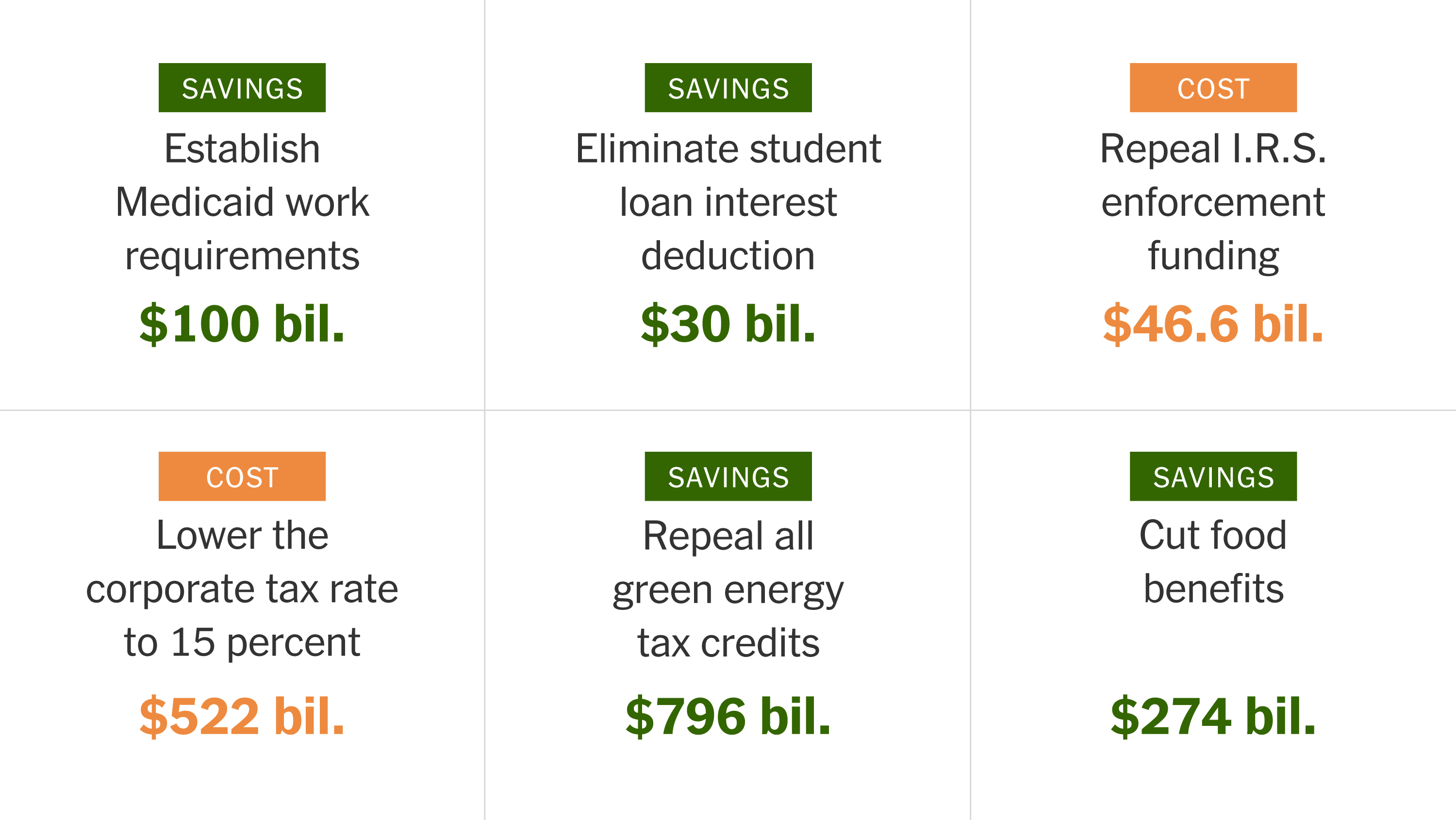

Projected Revenue Losses Under the GOP Tax Plan

The GOP tax plan's core element is significant tax cuts, projected to lead to substantial revenue losses for the federal government. Let's examine the key contributors.

Corporate Tax Rate Cuts

A cornerstone of the plan is the proposed reduction in the corporate tax rate. This reduction, while potentially stimulating economic growth (a claim often debated using dynamic scoring models), is projected to significantly decrease government revenue.

- Revenue Loss Projections: The Tax Policy Center estimates a revenue loss of [Insert TPC Estimate Here] over ten years due to corporate tax cuts. The Congressional Budget Office (CBO) offers a different projection of [Insert CBO Estimate Here], reflecting differing methodological approaches and assumptions.

- Differing Estimates: The discrepancies between these estimates highlight the inherent uncertainties in economic forecasting and the sensitivity of projections to underlying assumptions.

- Potential Counteracting Effects: Proponents argue that the lower corporate tax rate might incentivize increased investment and economic activity, potentially offsetting some revenue loss through increased tax collections from higher corporate profits and individual income. However, the magnitude of this effect is hotly debated.

Lower corporate tax rates directly impact government revenue by reducing the amount of tax collected from corporations. A lower tax rate means corporations pay less in taxes, resulting in a direct reduction in government revenue. This reduction directly contributes to the projected increase in the national deficit.

Individual Tax Rate Changes

The proposed changes to individual income tax rates, brackets, and deductions also contribute significantly to projected revenue losses.

- Tax Bracket Changes: The plan typically involves changes to tax brackets, potentially lowering rates for various income levels. [Insert specific examples of bracket changes and their percentage reductions].

- Impact on Different Income Levels: The distributional effects are crucial. Lower-income households may experience smaller tax cuts or even tax increases due to changes in deductions and credits, while higher-income households are predicted to receive more substantial tax reductions.

- Standard Deduction and Itemized Deductions: Changes to the standard deduction and limitations on itemized deductions influence the overall impact on individuals across different income groups. [Provide specifics on changes and their effects].

Data visualizing income distribution and the resultant tax burden after the implementation of the GOP tax plan would illustrate how the tax burden shifts amongst different income levels, revealing who bears the largest and smallest tax burdens. This analysis can be found in reports from organizations like the Tax Policy Center and the Brookings Institution.

Increased Government Spending and its Impact on the Deficit

Beyond revenue losses, increased government spending further exacerbates the deficit.

Mandatory Spending Increases

Mandatory spending, encompassing programs like Social Security and Medicare, is largely determined by existing laws and the aging population.

- Examples of Mandatory Spending: The increasing costs of healthcare and retirement benefits within these programs are projected to rise significantly over time.

- Projections of Increased Spending: The CBO and other organizations provide projections for these cost increases, highlighting the growing strain on the federal budget.

- Relationship Between Tax Cuts and Increased Demand: Tax cuts, even if stimulating economic growth, can lead to increased demand for government services, potentially creating a feedback loop that further strains the budget.

Discretionary Spending Changes

Discretionary spending, subject to annual appropriations by Congress, includes areas like defense and infrastructure.

- Planned Changes: The GOP tax plan may include proposed adjustments to discretionary spending, with potential increases in some areas (e.g., defense) and cuts in others. [Specify the plan's provisions on discretionary spending].

- Contribution to the Deficit: Changes in discretionary spending, whether increases or decreases, will directly influence the overall impact on the deficit. Increases add to the deficit, while decreases (if substantial) could help mitigate the deficit impact of the tax cuts.

Long-Term Projections and Economic Modeling

Understanding the long-term implications necessitates analyzing different economic models and their inherent biases.

Dynamic Scoring vs. Static Scoring

Estimating the plan's impact involves distinct approaches.

- Definitions: Static scoring assesses revenue changes based solely on the tax code changes without considering potential economic effects, such as growth or behavioral responses. Dynamic scoring incorporates these economic effects, leading to potentially different conclusions.

- Comparison of Results: Dynamic scoring typically projects smaller deficit increases (or even surpluses) compared to static scoring. However, the underlying assumptions in dynamic models are often debated, as are their predictive capabilities.

- Limitations: Each approach has inherent limitations. Static scoring overlooks potential economic effects, while dynamic scoring relies on often contested assumptions regarding economic growth.

Debt Accumulation and Future Implications

The projected revenue losses and spending changes paint a picture of escalating debt.

- Projected Debt Levels: [Insert projected debt levels for 10, 20, and 30 years based on reputable sources].

- Negative Consequences of Rising Debt: High levels of national debt can lead to increased interest rates, crowding out private investment, and reduced government flexibility to address future economic challenges or crises.

- Impact on Economic Growth: Sustained high debt levels can negatively impact economic growth through higher interest rates and reduced investor confidence. This can create a vicious cycle of slower growth, further increasing the debt burden.

Conclusion

The analysis of the GOP tax plan reveals a potentially significant and lasting impact on the national deficit. The projected revenue losses from tax cuts, coupled with potential increases in government spending, paint a concerning picture of long-term debt accumulation. Understanding the "stark math" behind the plan is crucial for informed participation in the ongoing national dialogue. Further research and careful consideration of the long-term implications are necessary before enacting such a transformative policy. Demand transparency and accountability from your elected officials regarding the GOP Tax Plan Deficit Impact and its potential consequences.

Featured Posts

-

Abn Amro Investeert In Transferz Een Innovatief Digitaal Platform

May 21, 2025

Abn Amro Investeert In Transferz Een Innovatief Digitaal Platform

May 21, 2025 -

Big Bear Ai Holdings Bbai Penny Stock Analysis And Investment Potential

May 21, 2025

Big Bear Ai Holdings Bbai Penny Stock Analysis And Investment Potential

May 21, 2025 -

Political Fallout In Saskatchewan Analyzing The Impact Of Recent Remarks By Federal Leader

May 21, 2025

Political Fallout In Saskatchewan Analyzing The Impact Of Recent Remarks By Federal Leader

May 21, 2025 -

12 Ai Stocks Redditors Are Buying Investment Insights

May 21, 2025

12 Ai Stocks Redditors Are Buying Investment Insights

May 21, 2025 -

Abn Amro Opslag Gids Voor Offline Betalingen

May 21, 2025

Abn Amro Opslag Gids Voor Offline Betalingen

May 21, 2025

Latest Posts

-

49 Dogs Seized From Washington County Breeder Details Emerge

May 21, 2025

49 Dogs Seized From Washington County Breeder Details Emerge

May 21, 2025 -

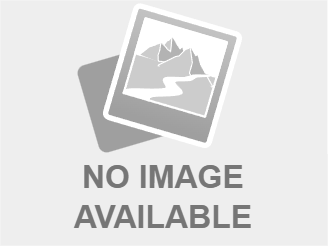

Driving In A Wintry Mix Rain And Snow Safety Tips

May 21, 2025

Driving In A Wintry Mix Rain And Snow Safety Tips

May 21, 2025 -

Investing In Big Bear Ai A Practical Guide For Investors

May 21, 2025

Investing In Big Bear Ai A Practical Guide For Investors

May 21, 2025 -

Big Bear Ai Stock Current Market Conditions And Investment Implications

May 21, 2025

Big Bear Ai Stock Current Market Conditions And Investment Implications

May 21, 2025 -

Preparing For A Wintry Mix Rain And Snow Preparedness Guide

May 21, 2025

Preparing For A Wintry Mix Rain And Snow Preparedness Guide

May 21, 2025