BigBear.ai Stock: Current Market Conditions And Investment Implications

Table of Contents

BigBear.ai's Business Model and Financial Performance

BigBear.ai provides AI-powered solutions, primarily targeting the national security and critical infrastructure sectors. This focus on high-stakes applications distinguishes it from many other players in the broader AI market. Understanding its financial performance is essential for evaluating BigBear.ai stock.

Revenue Streams and Growth Prospects

BigBear.ai's revenue is largely derived from government contracts and commercial partnerships. The company's growth trajectory hinges on securing new contracts and expanding its commercial presence.

- Government Contracts: BigBear.ai holds several substantial contracts with various government agencies, providing mission-critical AI solutions. The continued growth in government spending on AI and cybersecurity is a significant positive factor for the company. Specific examples of contracts and their values, while often publicly unavailable due to security concerns, are generally detailed in the company’s quarterly and annual reports. Analysis of these reports can provide insights into the revenue contribution of such contracts.

- Commercial Partnerships: BigBear.ai is actively expanding into the commercial sector, partnering with private companies to offer AI solutions across various industries. The success of these partnerships will directly influence BigBear.ai's revenue diversification and overall growth prospects. Projected revenue growth figures are typically provided in company press releases and investor presentations. Careful analysis of these projections is recommended alongside a comparison with actual results.

- Market Share: BigBear.ai's market share within the niche sectors it serves is a key indicator of its competitive strength. Determining this precisely requires in-depth industry analysis and may involve estimations based on available public data and reports from industry research firms.

Profitability and Financial Health

Assessing BigBear.ai's financial health requires scrutinizing its profitability, debt levels, and cash flow.

- Key Financial Ratios: Investors should analyze key financial ratios such as the Price-to-Earnings (P/E) ratio and the debt-to-equity ratio to understand BigBear.ai's financial standing. Comparing these ratios to industry averages and those of its main competitors provides valuable context.

- Comparison to Competitors: Benchmarking BigBear.ai's financial performance against its key competitors in the AI and government contracting sectors is critical for assessing its relative strength and potential. This comparison should consider factors like revenue growth, profitability, and financial leverage.

- Cash Flow: Analyzing BigBear.ai's cash flow statement reveals its ability to generate cash from operations and manage its investments. Strong positive cash flow generally indicates better financial health and sustainable growth potential.

Competitive Landscape and Market Position

BigBear.ai operates in a competitive landscape, vying for contracts and partnerships with other AI solution providers.

- Key Competitors: Identifying BigBear.ai's key competitors, such as other companies specializing in AI for defense and national security or large technology companies with robust AI capabilities, is a first step.

- Unique Selling Propositions (USPs): BigBear.ai’s unique selling propositions are important to identify. These could include its specialized expertise in specific AI applications, its strong government relationships, or its proprietary technologies. Understanding what sets BigBear.ai apart from its competitors is crucial.

- Market Saturation and Disruption: Evaluating the level of market saturation and the potential for disruption within BigBear.ai's target sectors is key. High market saturation may signify increased competition, while potential for disruption could present opportunities for growth.

Current Market Conditions Affecting BigBear.ai Stock

Several market factors influence BigBear.ai stock performance. Understanding these factors is crucial for making informed investment decisions.

Macroeconomic Factors

Broader economic trends, such as inflation, interest rates, and recessionary fears, can significantly impact the stock market, including BigBear.ai.

- Correlation with Macroeconomic Indicators: Analyzing the historical correlation between macroeconomic indicators and BigBear.ai's stock price can reveal patterns and sensitivities. For example, rising interest rates may negatively affect the company's valuation due to higher borrowing costs.

- Economic Outlook: The overall economic outlook and forecasts for future growth play a significant role in investor sentiment and therefore, stock prices. Positive economic forecasts are usually associated with higher stock prices and increased investor confidence.

Sector-Specific Trends

Trends within the AI and government contracting sectors directly affect BigBear.ai's prospects.

- Technological Advancements: Rapid technological advancements within the AI field could either enhance BigBear.ai's capabilities or render some of its existing technologies obsolete.

- Regulatory Changes: Changes in government regulations, especially those related to national security, data privacy, and the use of AI in government operations, can significantly impact BigBear.ai's operations and revenue streams.

- Government Spending Patterns: Government spending patterns on defense, cybersecurity, and other related areas have a direct influence on the demand for BigBear.ai's services.

Investor Sentiment and Analyst Ratings

Investor sentiment and analyst ratings play a significant role in BigBear.ai's stock price volatility.

- Analyst Reports: Regularly reviewing analyst reports from reputable financial institutions provides insights into their projections for BigBear.ai's future performance and potential stock price movements.

- Buy/Sell Recommendations: Analyst recommendations (buy, sell, or hold) influence investor decisions and can create price fluctuations. A high concentration of buy recommendations might push the stock price up, while the opposite could happen with sell recommendations.

- News Impact: News related to BigBear.ai, such as contract wins, new partnerships, or technological breakthroughs, can significantly affect investor confidence and thus, the stock price.

Investment Implications and Strategies for BigBear.ai Stock

Before investing in BigBear.ai stock, a thorough risk assessment and valuation analysis are necessary.

Risk Assessment

Investing in BigBear.ai stock carries inherent risks.

- Dependence on Government Contracts: BigBear.ai's significant reliance on government contracts exposes it to the risk of contract losses or reduced government spending.

- Competition: Intense competition from other AI solution providers and larger technology firms poses a challenge.

- Technological Obsolescence: Rapid technological advancements in the AI field could render BigBear.ai's technologies obsolete, potentially impacting its competitiveness.

Valuation and Potential Returns

Assessing the valuation of BigBear.ai stock is crucial for determining its potential return.

- Valuation Methods: Various valuation methods can be used, including discounted cash flow (DCF) analysis and comparable company analysis. Each method offers different perspectives on the fair value of the stock.

- Potential Return Scenarios: Different investment scenarios (bullish, bearish, neutral) should be considered, each with its corresponding potential returns. These scenarios should reflect the range of possible outcomes based on the company's performance and market conditions.

Investment Recommendations

Based on the analysis, an informed investment recommendation can be made. This should be tailored to an investor's individual risk tolerance and investment goals. Disclaimer: This is not financial advice. Always consult a financial advisor before making any investment decisions.

- Buy, Sell, or Hold: Based on the assessment of risks and potential rewards, a clear recommendation (buy, sell, or hold) can be offered.

- Justification: The rationale behind each recommendation should be clearly articulated, highlighting the supporting factors from the analysis.

- Portfolio Allocation: Investors should consider the appropriate allocation of BigBear.ai stock within their overall investment portfolio, ensuring diversification and alignment with their risk tolerance.

Conclusion: Making Informed Decisions About BigBear.ai Stock

BigBear.ai stock presents both opportunities and risks in the current market. Understanding the company's business model, financial performance, and the prevailing market conditions is vital for making informed investment decisions. Remember to consider the risks associated with investing in BigBear.ai stock, such as its dependence on government contracts and the competitive landscape. Conduct thorough research, consult with a financial advisor, and stay updated on the latest developments in BigBear.ai stock and the broader AI sector before making any investment decisions. Stay informed about the latest developments in BigBear.ai stock and the AI sector to make well-informed investment choices. For further information, consult reputable financial news websites and BigBear.ai's investor relations page.

Featured Posts

-

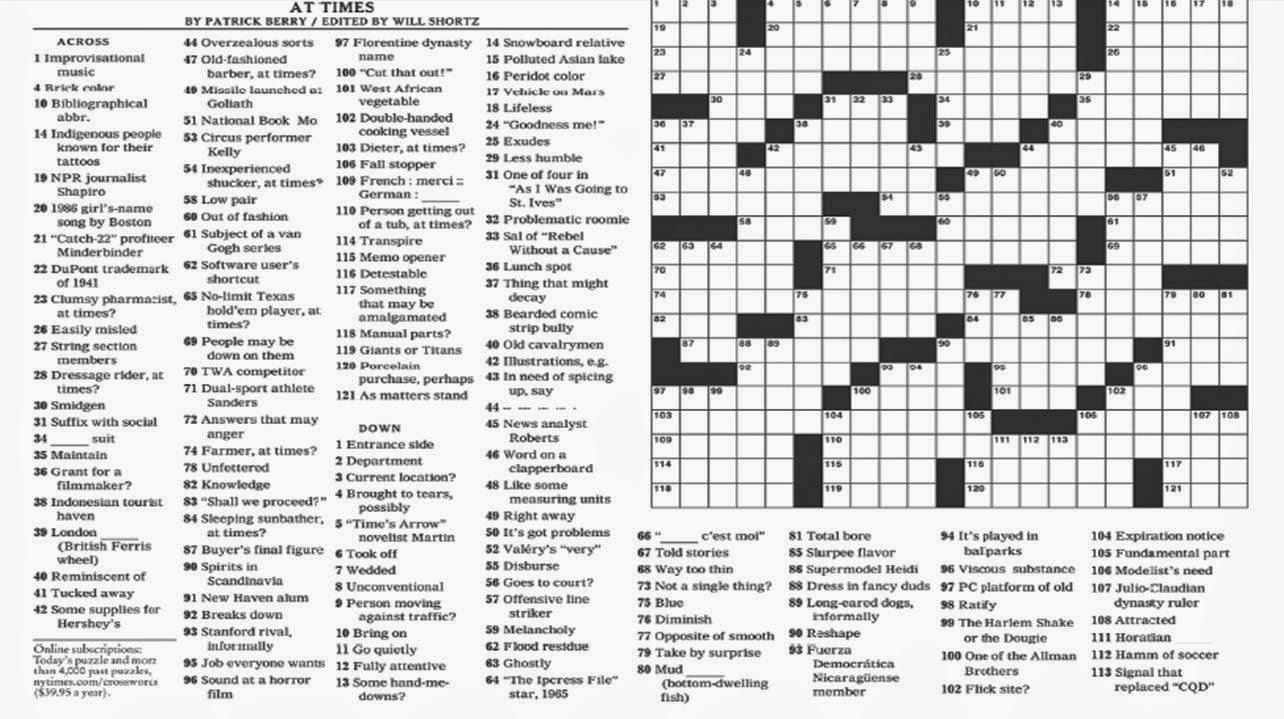

March 16 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025

March 16 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025 -

The Impact Of Recent Performance On Giorgos Giakoumakis Mls Valuation

May 21, 2025

The Impact Of Recent Performance On Giorgos Giakoumakis Mls Valuation

May 21, 2025 -

Thqyq Fy Tqryry Dywan Almhasbt 2022 2023 Alnwab Ythbtwn Wjwd Mkhalfat

May 21, 2025

Thqyq Fy Tqryry Dywan Almhasbt 2022 2023 Alnwab Ythbtwn Wjwd Mkhalfat

May 21, 2025 -

Economic Fallout In College Towns The Impact Of Decreasing Enrollment

May 21, 2025

Economic Fallout In College Towns The Impact Of Decreasing Enrollment

May 21, 2025 -

Paris Prochaine Etape Pour La Chanteuse Suisse Stephane

May 21, 2025

Paris Prochaine Etape Pour La Chanteuse Suisse Stephane

May 21, 2025

Latest Posts

-

Dramatic Win For Oh Jun Sung At Wtt Star Contender Chennai

May 22, 2025

Dramatic Win For Oh Jun Sung At Wtt Star Contender Chennai

May 22, 2025 -

Escaping The Trap Of Insufficient Funds A Step By Step Guide

May 22, 2025

Escaping The Trap Of Insufficient Funds A Step By Step Guide

May 22, 2025 -

Chennai Wtt Star Contender Oh Jun Sungs Hard Fought Victory

May 22, 2025

Chennai Wtt Star Contender Oh Jun Sungs Hard Fought Victory

May 22, 2025 -

No Money Practical Ways To Improve Your Financial Situation

May 22, 2025

No Money Practical Ways To Improve Your Financial Situation

May 22, 2025 -

Early Exit For Aruna At Wtt Chennai

May 22, 2025

Early Exit For Aruna At Wtt Chennai

May 22, 2025