Investing In BigBear.ai: A Practical Guide For Investors

Table of Contents

Understanding BigBear.ai's Business Model

AI-Powered Solutions for Government and Commercial Clients

BigBear.ai's core offerings revolve around providing cutting-edge AI-driven analytics, data visualization tools, and sophisticated decision support systems. These solutions cater to a diverse clientele, including:

-

Government Agencies: BigBear.ai works with various government agencies, particularly within the defense and intelligence sectors, providing critical analytical capabilities for national security and other crucial missions. They leverage AI to improve situational awareness, enhance predictive modeling, and optimize resource allocation.

-

Defense Contractors: The company partners with leading defense contractors, supporting the development and deployment of advanced technologies. This involves providing AI-powered solutions for mission planning, risk assessment, and supply chain optimization.

-

Commercial Enterprises: BigBear.ai also serves commercial clients across various industries, offering data analytics and AI solutions to optimize operations, improve decision-making, and gain a competitive edge. Examples include solutions for predictive maintenance, fraud detection, and customer relationship management.

Successful case studies showcase BigBear.ai's impact, demonstrating tangible improvements in efficiency, accuracy, and cost savings for its clients. Their revenue streams are diversified across these sectors, mitigating risk and ensuring a more stable financial foundation. This diversification is a key factor to consider when evaluating BBAI stock. Keywords: BigBear.ai stock, BBAI stock, AI analytics, data visualization, government contracts, commercial clients, revenue streams

Competitive Landscape and Market Position

BigBear.ai operates in a competitive landscape, but possesses several key competitive advantages:

-

Deep Expertise: The company boasts a team of highly skilled data scientists, AI engineers, and domain experts, giving them a significant edge in developing innovative and effective solutions.

-

Proprietary Technology: BigBear.ai utilizes its own proprietary AI algorithms and platforms, creating a barrier to entry for competitors.

-

Strong Government Relationships: The company's established relationships with government agencies provide a significant source of recurring revenue and opportunities for future growth.

Key competitors include large technology firms and specialized analytics companies. However, BigBear.ai's focus on specific niche markets and its strong relationships with government clients provide a degree of differentiation. Assessing BigBear.ai's market share and growth potential requires careful analysis of the overall AI market growth and the company's ability to continue to innovate and expand its client base. The barriers to entry in this market are substantial, requiring significant investment in R&D and talent acquisition. Keywords: BigBear.ai competitors, market share, competitive advantage, AI market growth, big data analytics market

Financial Performance and Valuation

Analyzing BigBear.ai's Financial Statements

A thorough assessment of BigBear.ai's financial health involves scrutinizing key financial metrics:

-

Revenue Growth: Examining the trajectory of revenue growth provides insights into the company's ability to attract and retain clients.

-

Profitability: Analyzing profitability metrics, such as gross margin and net income, reveals the company's efficiency in generating profits.

-

Debt Levels: Assessing the company's debt-to-equity ratio helps determine its financial leverage and risk.

-

Cash Flow: Analyzing cash flow statements indicates the company's ability to generate cash from operations and fund its growth initiatives.

By carefully reviewing BigBear.ai's financial statements (10-K filings, quarterly reports), investors can gain a clearer picture of the company's financial performance and identify any trends or potential concerns. Keywords: BBAI financials, revenue growth, profitability, debt-to-equity ratio, cash flow analysis, financial statements

Valuation Metrics and Investment Strategies

Multiple valuation methods can be applied to assess the intrinsic value of BigBear.ai stock:

-

Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value to estimate the company's intrinsic value.

-

Price-to-Earnings (P/E) Ratio: This compares the company's stock price to its earnings per share, offering a relative valuation compared to peers.

Comparing BigBear.ai's valuation to its peers and industry benchmarks is crucial. Investors should consider different investment strategies:

-

Long-Term Buy-and-Hold: This approach involves holding the stock for an extended period, aiming to benefit from long-term growth.

-

Short-Term Trading: This involves actively buying and selling the stock based on short-term price fluctuations.

The choice of investment strategy depends on individual risk tolerance and investment objectives. Keywords: BigBear.ai valuation, DCF analysis, PE ratio, investment strategy, stock valuation

Risks and Opportunities for BigBear.ai Investors

Potential Risks Associated with Investing in BBAI

Investing in BigBear.ai, like any growth-stage technology company, carries inherent risks:

-

Competition: Intense competition from established players and new entrants could impact market share and profitability.

-

Technology Risk: Rapid technological advancements could render BigBear.ai's technology obsolete.

-

Financial Risk: The company's financial performance could fluctuate, impacting its stock price.

-

Geopolitical and Regulatory Risks: Changes in geopolitical events or regulatory environments could significantly affect the company's operations and revenue streams.

A thorough understanding of these risks is essential before making an investment decision. Keywords: BigBear.ai risk factors, investment risk, technology sector risk, geopolitical risk, regulatory risk

Opportunities for Growth and Future Potential

The long-term growth prospects for BigBear.ai are tied to the broader AI and big data analytics market, which is expected to experience substantial growth in the coming years:

-

Market Expansion: BigBear.ai has the opportunity to expand into new markets and geographic regions.

-

New Product Development: Continual innovation and development of new AI-powered solutions will drive future growth.

-

Strategic Acquisitions: Acquiring smaller companies with complementary technologies can accelerate growth.

Several potential catalysts could drive BBAI stock price appreciation, including successful new product launches, strategic partnerships, and expansion into new markets. Keywords: BigBear.ai growth potential, AI market outlook, future growth opportunities, stock price catalysts

Conclusion

Investing in BigBear.ai presents both opportunities and risks. A thorough understanding of the company's business model, financial performance, competitive landscape, and the inherent risks involved is crucial for making informed investment decisions. By carefully considering the factors discussed in this guide, investors can better assess the potential of BigBear.ai and determine if it aligns with their investment goals. Remember to conduct your own thorough due diligence before investing in BigBear.ai or any other stock. Start your research on BigBear.ai (BBAI) today and make informed investment choices.

Featured Posts

-

How To Successfully Do A Screen Free Week With Your Kids

May 21, 2025

How To Successfully Do A Screen Free Week With Your Kids

May 21, 2025 -

The Goldbergs A Complete Guide To The Popular Sitcom

May 21, 2025

The Goldbergs A Complete Guide To The Popular Sitcom

May 21, 2025 -

Warner Bros Developing Film Based On Popular Reddit Post Starring Sydney Sweeney

May 21, 2025

Warner Bros Developing Film Based On Popular Reddit Post Starring Sydney Sweeney

May 21, 2025 -

Bp Ceo Pay Cut A 31 Decrease Explained

May 21, 2025

Bp Ceo Pay Cut A 31 Decrease Explained

May 21, 2025 -

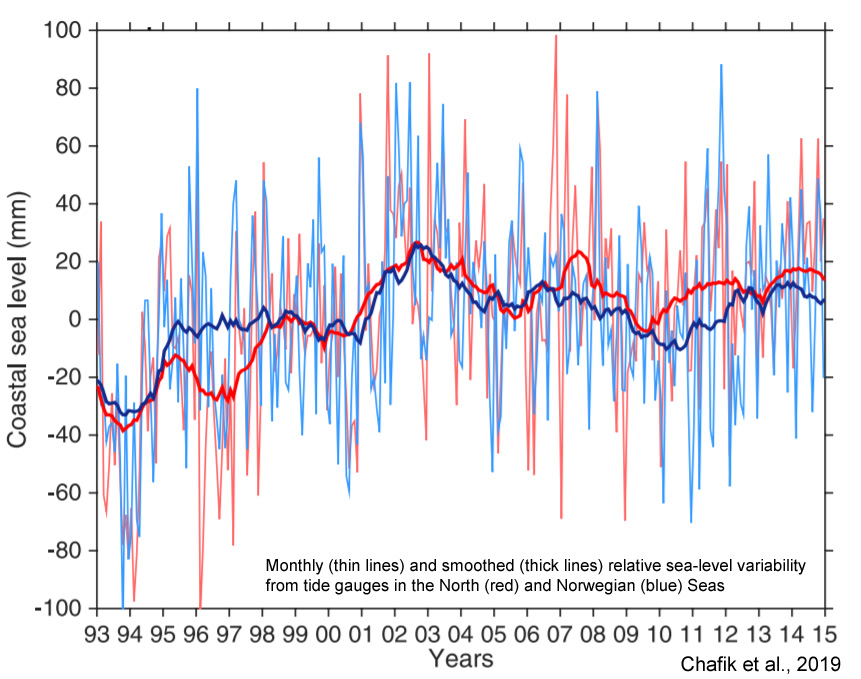

Rising Sea Levels Falling Credit Scores The Link Between Climate And Homeownership

May 21, 2025

Rising Sea Levels Falling Credit Scores The Link Between Climate And Homeownership

May 21, 2025

Latest Posts

-

Ing Groups 2024 Financial Performance Insights From The Form 20 F Report

May 22, 2025

Ing Groups 2024 Financial Performance Insights From The Form 20 F Report

May 22, 2025 -

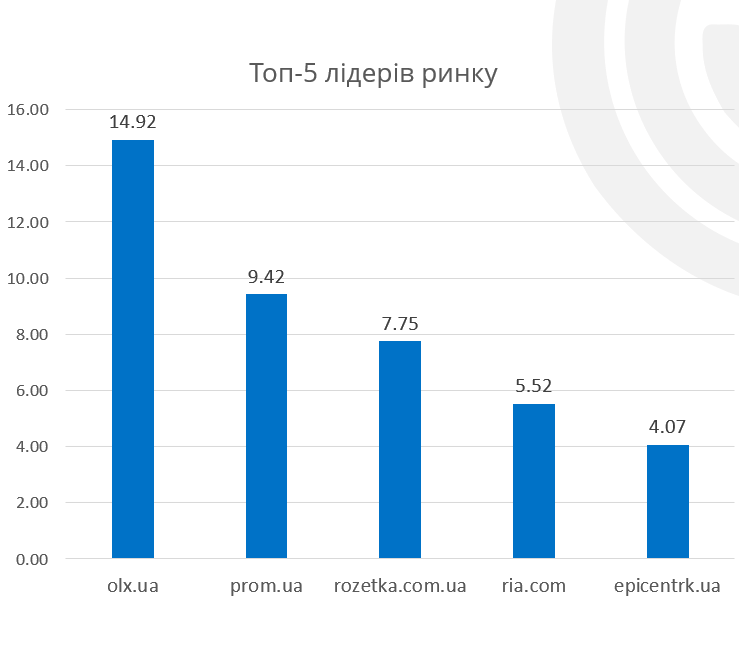

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Dokhodiv U 2024 Rotsi

May 22, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Dokhodiv U 2024 Rotsi

May 22, 2025 -

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025 -

Stephane Du C Ur De La Suisse Romande Aux Scenes Parisiennes

May 22, 2025

Stephane Du C Ur De La Suisse Romande Aux Scenes Parisiennes

May 22, 2025 -

Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lideri Finansovogo Rinku Ukrayini 2024

May 22, 2025

Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lideri Finansovogo Rinku Ukrayini 2024

May 22, 2025