The Impact Of Trump Tariffs On Apple: A Buffett Perspective

Table of Contents

Trump Tariffs and Apple's Supply Chain Disruptions

The Trump administration's tariffs, primarily targeting goods from China, significantly disrupted Apple's intricate supply chain. This disruption manifested in two primary ways: increased production costs and logistical challenges.

Increased Production Costs

Many components crucial to Apple's products, such as iPhones, iPads, and Macs, are sourced from China. The tariffs imposed on these imported components directly increased Apple's production costs.

- Displays: Tariffs increased the cost of procuring high-resolution displays.

- Processors: The tariffs impacted the cost of procuring advanced processors from Taiwanese foundries, many of which operate in China.

- Other Components: Numerous other components, from memory chips to cameras, experienced price increases due to the tariffs.

These increased costs translated to higher prices for consumers or squeezed Apple's profit margins. In response, Apple initiated efforts to diversify its supply chain, shifting some production to countries like India and Vietnam. This diversification, though costly and time-consuming, aimed to mitigate future risks associated with reliance on a single manufacturing hub.

Logistics and Shipping Challenges

Beyond the direct cost increases, the tariffs exacerbated logistical challenges. Increased customs processing times and paperwork added delays and complexity to the shipping process. This directly impacted Apple's just-in-time inventory management system, a strategy reliant on precise timing and efficiency. The tariffs contributed to increased shipping costs and, in some instances, led to stock shortages, potentially affecting sales figures and customer satisfaction.

The Impact on Apple's Profitability and Stock Valuation

The Trump tariffs undeniably impacted Apple's profitability and influenced investor sentiment, causing stock price fluctuations.

Reduced Profit Margins

The increased production costs directly impacted Apple's profit margins. While Apple is known for its strong pricing power, absorbing all the increased costs wasn't feasible without affecting profitability. Analyzing Apple's quarterly earnings reports from the period reveals a clear correlation between the implementation of tariffs and a reduction in profit margins, compared to previous quarters and competitors less impacted by the trade war.

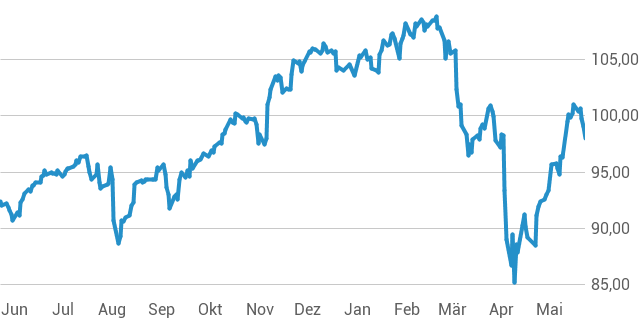

Investor Sentiment and Stock Price Fluctuations

News of the escalating tariffs and their impact on Apple's supply chain caused considerable anxiety among investors. This anxiety, reflected in stock price fluctuations, is a key area where Buffett's value investing philosophy becomes relevant. Buffett emphasizes long-term value, often ignoring short-term market volatility. While Apple's stock price experienced some dips during this period, a long-term perspective might suggest that the market overreacted to short-term challenges. The question remains whether the stock price accurately reflected the long-term fundamental value of the company, considering its overall strength and market dominance.

A Buffett Perspective on Long-Term Value

Warren Buffett's investment strategy offers a valuable framework for assessing the long-term impact of the Trump tariffs on Apple.

Buffett's Focus on Long-Term Growth

Buffett famously prioritizes long-term growth over short-term gains. He focuses on a company's intrinsic value and its competitive advantage, considering factors far beyond quarterly earnings reports. Applied to Apple's situation, this approach suggests that the temporary disruptions caused by the tariffs should be viewed within the context of Apple's overall long-term growth trajectory.

Evaluating Intrinsic Value

Buffett's investment decisions are based on evaluating a company's intrinsic value – its true worth independent of market sentiment. The Trump tariffs undoubtedly presented a challenge to Apple, but did they fundamentally alter its intrinsic value? A thorough analysis considering the company's brand strength, innovation capabilities, and overall market position is necessary to determine whether the tariffs presented a genuine long-term threat to Apple's intrinsic value, or perhaps even a buying opportunity for long-term investors.

Competitive Advantage and Moat

Apple enjoys a significant competitive advantage – a "moat" in Buffett's terminology – built on brand loyalty, innovative products, and a robust ecosystem. The Trump tariffs, while disruptive, didn't eliminate this competitive advantage. While the tariffs might have impacted market share temporarily, the underlying strengths of Apple's business model likely ensured that the impact was limited in the long run.

Conclusion: Assessing the Long-Term Impact of Trump Tariffs on Apple

The Trump tariffs undeniably disrupted Apple's supply chain, impacting production costs and profitability. These disruptions caused fluctuations in investor sentiment and the stock price. However, from a long-term, Buffett-esque perspective, the fundamental value of Apple likely remained largely intact. Its strong brand, innovative capacity, and robust ecosystem acted as a buffer against the negative effects of the trade war. The key takeaway is that focusing on short-term market reactions might have led to misinterpretations. A long-term, value-based approach, considering intrinsic value and competitive advantage, provides a more accurate assessment of Apple's resilience. We encourage readers to conduct further research on Apple's financial performance in relation to trade policies and consider the long-term implications of Trump tariffs and their effect on other multinational corporations. Further reading on Warren Buffett's investment philosophy and its relevance to navigating global trade uncertainties is highly recommended.

Featured Posts

-

Alix Earle From Tik Tok Star To Dwts Pitchwoman A Gen Z Marketing Masterclass

May 24, 2025

Alix Earle From Tik Tok Star To Dwts Pitchwoman A Gen Z Marketing Masterclass

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Deep Dive Into Net Asset Value

May 24, 2025 -

Young Hawaiian Artists Shine Sewn Lei Designs For Memorial Day Poster Contest

May 24, 2025

Young Hawaiian Artists Shine Sewn Lei Designs For Memorial Day Poster Contest

May 24, 2025 -

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025 -

Analyse Snelle Marktdraai Europese Aandelen Een Blijvend Fenomeen

May 24, 2025

Analyse Snelle Marktdraai Europese Aandelen Een Blijvend Fenomeen

May 24, 2025

Latest Posts

-

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

May 24, 2025

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

May 24, 2025 -

Federal Investigation Office365 Data Breach Nets Millions For Hacker

May 24, 2025

Federal Investigation Office365 Data Breach Nets Millions For Hacker

May 24, 2025 -

Ev Mandate Opposition Car Dealers Double Down

May 24, 2025

Ev Mandate Opposition Car Dealers Double Down

May 24, 2025 -

Auto Dealers Push Back Against Mandatory Ev Quotas

May 24, 2025

Auto Dealers Push Back Against Mandatory Ev Quotas

May 24, 2025 -

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025