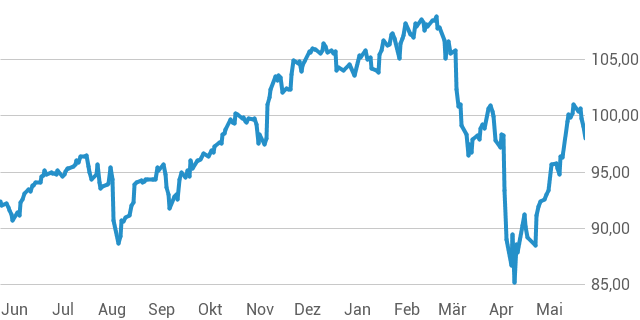

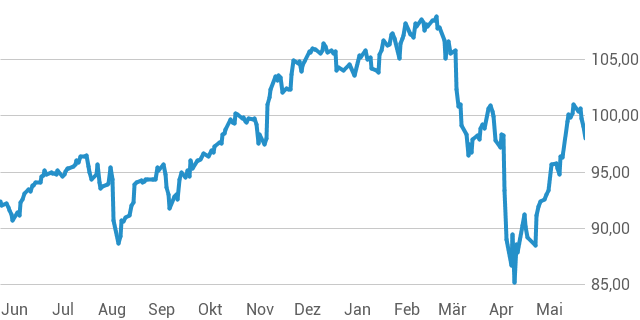

Amundi MSCI All Country World UCITS ETF USD Acc: A Deep Dive Into Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an investment fund's assets minus its liabilities, divided by the number of outstanding shares. For an ETF like the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV reflects the intrinsic value of the underlying assets it holds, offering a snapshot of the ETF's worth. Crucially, the NAV differs from the market price; the market price fluctuates throughout the trading day based on supply and demand, while the NAV is calculated at the end of the trading day.

- NAV reflects the intrinsic value: It's a true representation of what the ETF's holdings are worth.

- Daily calculation: The NAV is typically calculated at the close of the market each day, providing a daily update of the ETF's value.

- Clear picture of holdings: NAV provides a straightforward view of the collective value of all assets within the ETF.

- Performance assessment: Tracking NAV changes over time is essential for assessing the ETF's performance and comparing it against benchmarks like the MSCI All Country World Index.

How is the Amundi MSCI All Country World UCITS ETF USD Acc NAV Calculated?

Calculating the Amundi MSCI All Country World UCITS ETF USD Acc NAV involves a multi-step process:

- Valuation of underlying assets: Each asset held within the ETF (stocks, bonds, etc.) is valued at its market price at the end of the trading day. This involves obtaining accurate price data from reliable sources.

- Summing market values: The market values of all holdings are added together to determine the total asset value.

- Deducting liabilities: Liabilities, such as management fees and other expenses, are subtracted from the total asset value.

- Dividing by outstanding shares: The resulting net asset value is then divided by the total number of outstanding ETF shares.

- Currency conversion: As this is the USD Acc share class, any assets valued in currencies other than USD are converted to USD using the prevailing exchange rates at the end of the trading day.

- Regular audits: Independent audits ensure the accuracy and transparency of the NAV calculation.

This rigorous process ensures the NAV accurately reflects the ETF's true worth.

Factors Affecting Amundi MSCI All Country World UCITS ETF USD Acc NAV

Several factors influence the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

- Global market performance: The performance of the underlying assets, largely tracked by the MSCI All Country World Index, directly impacts the NAV. Positive market movements generally lead to a higher NAV, and vice versa.

- Currency exchange rates: Fluctuations in exchange rates between the USD and other currencies significantly affect the NAV of the USD Acc share class. A strengthening US dollar against other currencies generally increases the NAV, while a weakening dollar decreases it.

- Dividends and capital gains distributions: Dividends received from underlying holdings and capital gains distributions from the sale of assets increase the NAV, but these distributions are usually paid out to shareholders, resulting in a subsequent decrease in the NAV.

- Corporate actions: Events like mergers, acquisitions, and stock splits in the underlying companies also impact the NAV.

Using NAV to Make Informed Investment Decisions

The Amundi MSCI All Country World UCITS ETF USD Acc NAV is a valuable tool for investors:

- Performance tracking: Regularly monitoring NAV changes reveals the ETF's performance over time, showing growth or decline.

- Buy and sell decisions: While not the sole factor, comparing the current NAV to the purchase price helps determine potential profit or loss.

- Comparative analysis: Comparing the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc to other similar global equity ETFs aids in making informed investment choices.

- Growth analysis: Comparing the NAV over various periods (e.g., monthly, yearly) helps investors analyze growth trends.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is vital for effective portfolio management. By monitoring the NAV and understanding the influencing factors, investors can make informed decisions regarding their investment in this globally diversified ETF. Regularly reviewing the Amundi MSCI All Country World UCITS ETF USD Acc NAV, alongside other key performance indicators, empowers you to optimize your investment strategy and achieve your financial goals. Start tracking your Amundi MSCI All Country World UCITS ETF USD Acc NAV today!

Featured Posts

-

Is An Escape To The Country Right For You A Comprehensive Guide

May 24, 2025

Is An Escape To The Country Right For You A Comprehensive Guide

May 24, 2025 -

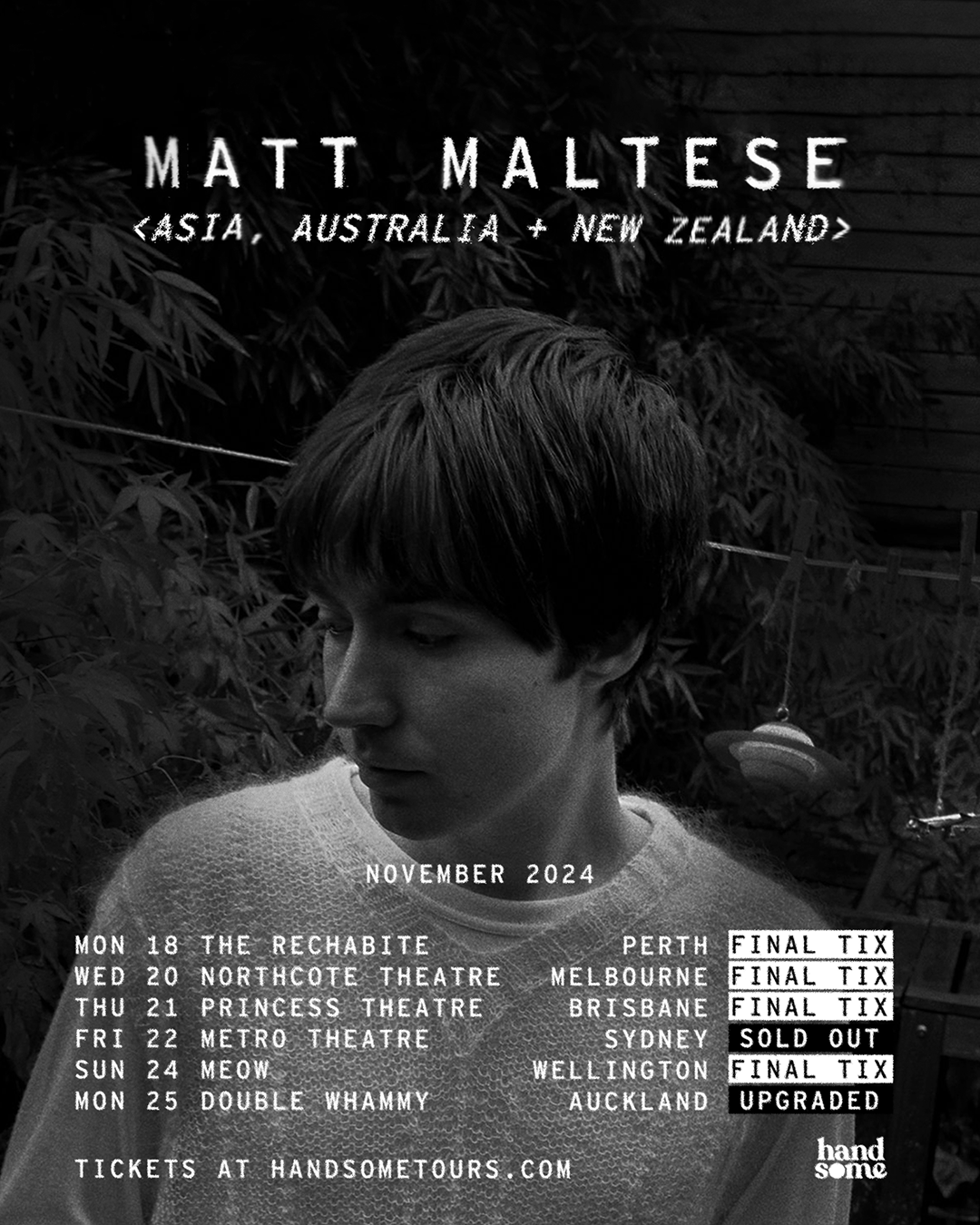

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Porsche 956 Nin Tavan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025

Porsche 956 Nin Tavan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025 -

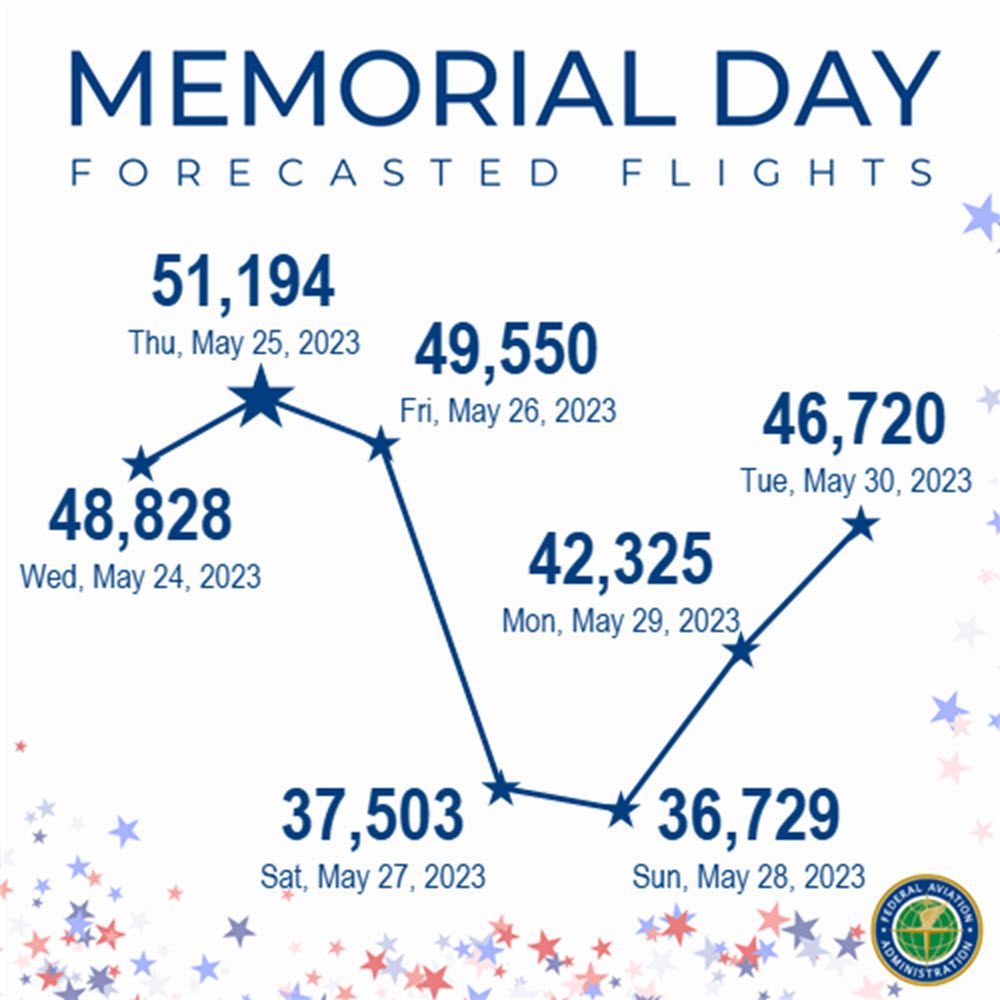

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025 -

Escape To The Country Affordable Luxury Homes Under 1 Million

May 24, 2025

Escape To The Country Affordable Luxury Homes Under 1 Million

May 24, 2025

Latest Posts

-

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025