The Impact Of Tariffs: China's Lowered Rates And Stimulative Lending Policies

Table of Contents

Lowered Tariffs: A Catalyst for Economic Growth?

China's reduction in import tariffs represents a significant shift in its trade policy. While the motivations behind this move are complex, the impact on both domestic and international trade is undeniable.

Impact on Imports and Exports

Lowered tariffs directly affect the cost of imported goods, impacting both Chinese consumers and businesses.

- Increased imports of raw materials and intermediate goods: Reduced tariffs make it cheaper for Chinese manufacturers to source raw materials and components, boosting domestic production and potentially lowering production costs. This is particularly noticeable in sectors like manufacturing and technology. For example, the reduction in tariffs on certain types of steel has led to a significant increase in steel imports, benefiting manufacturers in sectors like construction and automotive.

- Enhanced competitiveness of Chinese exports in international markets: By lowering the cost of production, China’s businesses become more competitive globally. This could lead to increased market share and higher export volumes. The impact is evident in sectors like textiles and electronics, where Chinese products are already highly competitive.

- Potential for increased trade surpluses, but also increased competition for other nations: While China might benefit from increased exports, other countries may face fiercer competition. This could lead to trade tensions and calls for reciprocal tariff reductions or other trade protection measures. The effects are particularly felt by countries that heavily export similar goods to China.

- Specific sectors affected: The impact varies across sectors. Manufacturing, particularly electronics and textiles, has seen a significant boost. The agriculture sector is also experiencing changes, with some products seeing increased import volumes, while others face stiffer competition. For example, the reduction of tariffs on soybeans has led to increased imports from other countries like Brazil and the US.

Reshaping Global Supply Chains

The changes in China's tariff structure are prompting multinational corporations to reassess their global supply chains.

- Shift in sourcing patterns for multinational corporations: Companies are evaluating the cost-effectiveness of sourcing materials and components from China versus other locations. This can lead to a relocation of production facilities or a shift in sourcing strategies, potentially creating both opportunities and challenges for businesses globally.

- Opportunities for foreign businesses to increase their presence in the Chinese market: Lowered tariffs create more attractive conditions for foreign businesses to expand their operations within China or to export their products more easily. This increased competition could lead to innovation and greater choice for consumers.

- Potential challenges for businesses relying on previously established supply chains: Businesses that heavily relied on pre-existing supply chains might need to adapt quickly to remain competitive. This could involve significant investment in adjusting logistics, sourcing strategies, and production processes.

- Pre- and post-tariff reduction supply chain dynamics: A comparison shows a clear shift towards China as a more attractive sourcing destination for many companies. Companies in the apparel industry, for instance, have reported a noticeable increase in sourcing from China following tariff reductions.

Stimulative Lending Policies: Fueling Growth or Inflation?

China's expansionary monetary policy, characterized by stimulative lending, aims to boost economic growth and investment. However, this approach also presents risks.

Increased Investment and Infrastructure Spending

The increased availability of credit is fueling significant investment in infrastructure projects.

- Government-led projects driving economic activity: Large-scale infrastructure projects, including high-speed rail, renewable energy initiatives, and urban development programs, are driving significant economic activity and job creation. These projects contribute directly to GDP growth.

- Potential for job creation and improved infrastructure: Increased investment is creating numerous jobs across various sectors, from construction to manufacturing, supporting broader economic growth. Improved infrastructure will further benefit long-term economic prospects.

- Risks of over-investment and asset bubbles: The rapid increase in investment carries the risk of overcapacity in certain sectors and the formation of asset bubbles. This could lead to financial instability if these bubbles burst.

- Specific infrastructure projects and their economic impact: Data on projects like the ongoing expansion of China's high-speed rail network illustrates the scale of investment and its potential effect on employment and economic output. Investment figures are showing significant growth, but also raise concerns about potential overcapacity.

Risks of Debt Accumulation and Inflation

The surge in lending increases the risk of debt accumulation and inflation.

- Increased borrowing by businesses and consumers: Easy access to credit encourages businesses and consumers to take on more debt, potentially leading to unsustainable levels of borrowing.

- Potential for increased inflation if money supply growth outpaces economic growth: If the increased money supply isn't matched by corresponding increases in production, inflation can result, eroding purchasing power.

- The role of shadow banking and the potential for financial instability: The rapid expansion of shadow banking activities increases the risk of financial instability, as these less-regulated financial institutions could amplify systemic risks.

- Growth of debt levels and potential inflationary pressures: Analysis of recent economic data shows a rising trend in both corporate and household debt, raising concerns about potential inflationary pressures and financial vulnerabilities. The role of shadow banking needs further scrutiny as it remains opaque and difficult to regulate effectively.

Geopolitical Implications of China's Economic Policies

China's economic policies have significant geopolitical ramifications, impacting international trade relations and power dynamics.

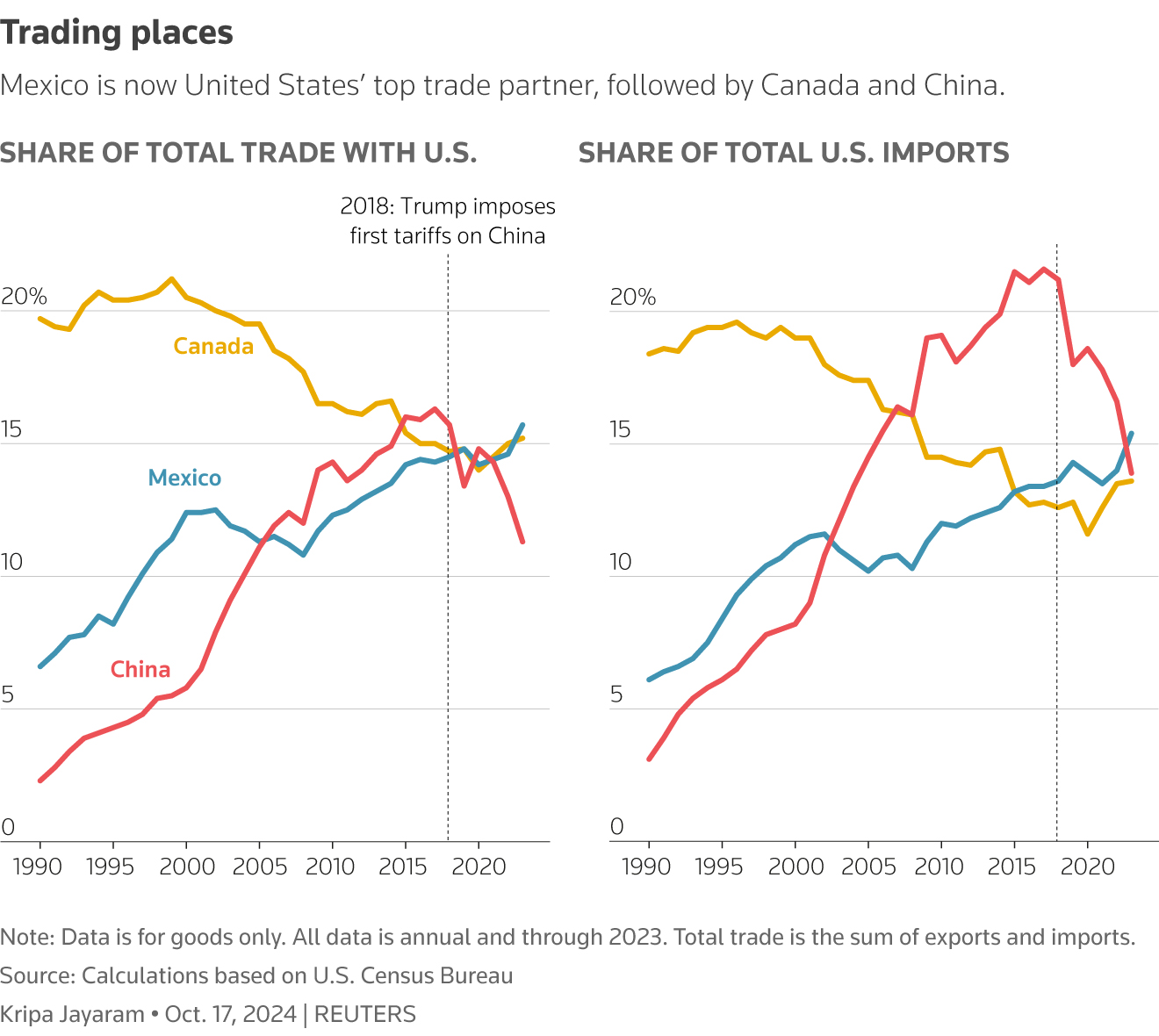

Impact on US-China Trade Relations

The interplay between China's policies and the ongoing trade tensions with the US is complex.

- How lowered tariffs affect the ongoing trade tensions between the US and China: While tariff reductions could potentially ease tensions, the underlying issues of intellectual property rights, trade imbalances, and technological competition remain. This will require more than just tariff reductions to solve.

- Potential for increased cooperation or further escalation: The success of economic cooperation will largely depend on other factors, like political trust and willingness to negotiate on significant underlying differences. The chance of further escalation remains.

- Impact on global trade agreements: China's actions influence the multilateral trading system and could lead to a restructuring of global trade agreements. Other countries may seek to form alternative trade blocs or revise existing agreements in response.

- Specific examples of trade negotiations and agreements: The ongoing discussions within the WTO regarding China's trade practices serve as a crucial example of the geopolitical impact of China's economic policies.

Implications for Other Countries

China's economic policies create both opportunities and challenges for other countries.

- Increased competition for other exporting nations: Other nations exporting similar goods to China now face stiffer competition. This forces these nations to either become more competitive or to focus on producing niche products.

- Opportunities for countries aligning with China's economic initiatives: Countries participating in China's Belt and Road Initiative or other economic partnerships can benefit from increased trade and investment.

- Potential for geopolitical realignment: China's expanding economic influence has the potential to reshape geopolitical alliances and power dynamics.

- Impact on specific countries or regions: Countries heavily reliant on exporting to China, such as those in Southeast Asia, might experience both opportunities and challenges as a result of these policies. The effects vary greatly depending on a country's specific economic structure.

Conclusion

China's recent decisions on tariffs and stimulative lending are significant events with far-reaching implications for the global economy. While lowered tariffs offer potential benefits for growth and trade, the risks associated with aggressive monetary policies, debt accumulation, and escalating geopolitical tensions cannot be ignored. Understanding these complex dynamics is crucial for businesses and policymakers alike.

Call to Action: Stay informed about the evolving impact of China's tariff reductions and stimulative lending policies. Monitor economic indicators and policy changes to effectively navigate this dynamic environment and adapt your business strategies accordingly. Understanding the nuances of China tariffs and their global impact is vital for success in today's interconnected marketplace.

Featured Posts

-

Bobi Marjanovic I Neobican Obicaj Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025

Bobi Marjanovic I Neobican Obicaj Zasto Se Dzordan I Jokic Ljube Tri Puta

May 08, 2025 -

Ev Mandate Faces Renewed Opposition From Car Dealers

May 08, 2025

Ev Mandate Faces Renewed Opposition From Car Dealers

May 08, 2025 -

Why Is My Ps 5 Game Stuttering A Comprehensive Guide

May 08, 2025

Why Is My Ps 5 Game Stuttering A Comprehensive Guide

May 08, 2025 -

Understanding Bitcoins Golden Cross A Comprehensive Guide

May 08, 2025

Understanding Bitcoins Golden Cross A Comprehensive Guide

May 08, 2025 -

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025

5 Military Movies Blending Heart And Action Like Warfare

May 08, 2025

Latest Posts

-

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025 -

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025 -

Understanding The Dwps New Universal Credit Verification System

May 08, 2025

Understanding The Dwps New Universal Credit Verification System

May 08, 2025 -

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025 -

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025