The Falling Dollar And Its Disruptive Influence On Asian Economies

Table of Contents

Impact on Asian Exports

A falling dollar creates a complex ripple effect on Asian exports. While it presents opportunities for increased competitiveness in some sectors, it also poses serious threats to others heavily reliant on US markets.

Increased Competitiveness for Some

A weaker dollar makes Asian exports cheaper when priced in USD, potentially boosting demand in dollar-denominated markets. This is particularly true for technology and manufacturing sectors, where many Asian nations hold a global competitive advantage. For example, South Korean electronics and Taiwanese semiconductor manufacturers might see a surge in demand as their products become more affordable for US and other dollar-using consumers. However, this advantage is not without its challenges. Many Asian manufacturers rely on imported raw materials priced in USD. Therefore, increased raw material costs can offset the benefits of a weaker dollar, creating a complex pricing equation.

Reduced Demand from US Consumers

The falling dollar, coupled with rising inflation in the US, leads to decreased purchasing power for American consumers. This reduced consumer spending directly impacts Asian economies heavily reliant on US consumption. Industries like textiles from Bangladesh and Vietnam, and consumer electronics from China, are particularly vulnerable to this decreased demand. The resulting drop in orders can lead to production cuts, job losses, and slower economic growth in these export-oriented Asian economies.

- Net Effect on Asian Exports: The impact of a falling dollar on Asian exports is multifaceted. While some sectors benefit from increased price competitiveness, others suffer from reduced US demand. The net effect is a complex interplay of positive and negative factors, requiring careful analysis on a sector-by-sector basis.

Influence on Asian Imports

The falling dollar also significantly impacts Asian imports, creating both challenges and opportunities.

Rising Import Costs

A weaker dollar increases the cost of imports for Asian nations, particularly those priced in USD or whose currencies are pegged to or positively correlated with the USD. This rise in import prices fuels inflationary pressure, impacting essential goods and services. Energy imports (oil, gas) and food staples are particularly sensitive to these fluctuations, potentially straining household budgets and impacting overall economic stability. Increased import costs place a burden on Asian consumers and businesses.

Opportunities for Domestic Industries

The flip side of rising import costs is the creation of opportunities for domestic Asian industries. Higher import prices incentivize import substitution—replacing imported goods with domestically produced alternatives. This could lead to the growth of local food production, renewable energy sources, and other industries capable of filling the gap left by more expensive imports. Governments might also employ protectionist measures, such as tariffs or subsidies, to further support these domestic industries. This could lead to a shift towards greater self-sufficiency and regional economic cooperation.

Financial Market Implications

The falling dollar creates significant uncertainty in Asian financial markets, impacting investment flows and debt servicing costs.

Currency Volatility and Investment Flows

A weakening dollar introduces volatility into Asian currency markets, influencing foreign direct investment (FDI). Investors might hesitate to invest in Asian assets if they anticipate further currency depreciation, seeking higher returns in dollar-denominated assets instead. This capital flight can negatively impact economic growth and stability in Asia. Central banks play a crucial role in managing these fluctuations through intervention strategies aimed at maintaining exchange rate stability.

Debt Servicing Costs

Many Asian countries have significant US dollar-denominated debt. A falling dollar increases the cost of servicing this debt, potentially leading to financial strain and even debt crises. Countries with high levels of external debt denominated in USD are particularly vulnerable. The increased debt burden can lead to reduced government spending on crucial areas like healthcare and education.

Geopolitical Considerations

The falling dollar has significant geopolitical implications for Asia. It could influence relationships between Asian nations and the US, potentially leading to increased regional economic cooperation among Asian nations as they seek alternatives to dollar-dominated trade and finance. This could also lead to a reshaping of global economic power dynamics, with a relative decline in US influence and a rise in the prominence of other economic powers within Asia.

Conclusion: Navigating the Challenges of a Falling Dollar in Asia

The falling dollar presents Asian economies with a complex set of challenges and opportunities. Increased export competitiveness in certain sectors is offset by reduced US demand and rising import costs. Financial market volatility and increased debt servicing costs further complicate the situation. Adaptable strategies are crucial for navigating this volatile period. Asian nations need to diversify their trade partners, strengthen domestic industries, and improve currency management to mitigate the negative impacts of a falling dollar. Further research and discussion on the falling dollar and its disruptive influence on Asian economies are needed to develop effective strategies for long-term economic resilience and sustainable growth. Understanding these intricacies is critical for policymakers, businesses, and investors alike.

Featured Posts

-

Jeff Goldblums New Jazz Album Cynthia Erivo Ariana Grande And More

May 06, 2025

Jeff Goldblums New Jazz Album Cynthia Erivo Ariana Grande And More

May 06, 2025 -

Stock Market Today Dow And S And P 500 Live Updates For May 5th

May 06, 2025

Stock Market Today Dow And S And P 500 Live Updates For May 5th

May 06, 2025 -

Are Bmw And Porsche Losing Ground In China A Deeper Look At The Market

May 06, 2025

Are Bmw And Porsche Losing Ground In China A Deeper Look At The Market

May 06, 2025 -

Kilauea Volcanos Unprecedented Eruption A Rare Pattern After Nearly 40 Years

May 06, 2025

Kilauea Volcanos Unprecedented Eruption A Rare Pattern After Nearly 40 Years

May 06, 2025 -

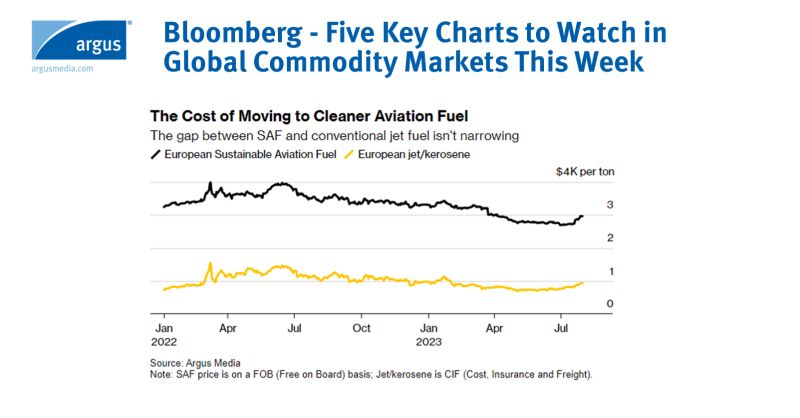

Global Commodity Markets 5 Key Charts To Watch Now

May 06, 2025

Global Commodity Markets 5 Key Charts To Watch Now

May 06, 2025

Latest Posts

-

The Ross Family Ancestry And Influence On Tracee Ellis Ross Life

May 06, 2025

The Ross Family Ancestry And Influence On Tracee Ellis Ross Life

May 06, 2025 -

The Wiz June Release Date Confirmed For Criterion Collection

May 06, 2025

The Wiz June Release Date Confirmed For Criterion Collection

May 06, 2025 -

Getting To Know Tracee Ellis Ross And Her Celebrated Family

May 06, 2025

Getting To Know Tracee Ellis Ross And Her Celebrated Family

May 06, 2025 -

Criterion Collection Adds The Wiz In June Release Date Announced

May 06, 2025

Criterion Collection Adds The Wiz In June Release Date Announced

May 06, 2025 -

Diana Ross 1973 Royal Albert Hall Concert Review And Analysis

May 06, 2025

Diana Ross 1973 Royal Albert Hall Concert Review And Analysis

May 06, 2025