Global Commodity Markets: 5 Key Charts To Watch Now

Table of Contents

1. Crude Oil Price Chart: A Benchmark for Energy Markets

Crude oil prices, specifically those of West Texas Intermediate (WTI) and Brent crude oil, serve as a benchmark for the entire energy sector. Monitoring the oil price chart is essential for understanding broader economic trends. Fluctuations in crude oil prices directly impact gasoline prices, inflation, and global economic growth.

Subpoints:

- Analyzing Price Movements: Analyze daily, weekly, and monthly movements of WTI and Brent crude oil prices to identify short-term and long-term trends. Look for patterns and breakouts that might signal future price movements.

- OPEC+ Influence: The Organization of the Petroleum Exporting Countries (OPEC+) significantly influences global oil supply. Monitoring their production decisions and announcements is crucial for predicting price fluctuations. Unexpected changes in OPEC+ production quotas can lead to sharp price swings.

- Global Demand: Global oil demand, particularly from major consumers like China and the US, plays a vital role in price determination. Economic growth in these regions directly impacts oil consumption and therefore prices.

- Inflationary Pressures: Crude oil prices are closely tied to inflation. Significant increases in oil prices can trigger inflationary pressures across various sectors.

- Support and Resistance: Identify key price support and resistance levels on the chart. These levels often indicate potential turning points in the price trend.

Bullet Points:

- Examine the correlation between oil prices and gasoline prices at the pump.

- Analyze the impact of geopolitical instability in oil-producing regions on global supplies.

- Look for emerging trends in renewable energy sources and their potential to reduce long-term oil demand.

2. Natural Gas Price Chart: Tracking Energy Volatility

Natural gas prices, tracked through benchmarks like the Henry Hub (US) and TTF (Europe) indices, exhibit significant volatility. This volatility stems from factors such as weather patterns, geopolitical events, and the ongoing energy transition. The natural gas price chart provides a crucial insight into energy security and market stability.

Subpoints:

- Market Benchmarks: Monitor price fluctuations in key markets, noting differences between regional prices due to varying supply and demand dynamics.

- Weather's Impact: Weather plays a crucial role. High winter demand pushes prices up, while milder winters can lead to price drops. Summer demand, particularly for cooling, also affects prices.

- LNG Trade: Liquefied natural gas (LNG) exports and imports significantly impact global supply and demand. Track LNG shipments to understand the global flow of natural gas.

- Energy Transition: The shift toward renewable energy sources influences long-term natural gas demand. This transition might lead to price stabilization or even decline in the future.

Bullet Points:

- Track natural gas storage levels in major consuming countries to assess supply adequacy.

- Analyze the relationship between natural gas and electricity prices, as natural gas is a major fuel source for power generation.

- Consider the impact of geopolitical tensions and potential disruptions to gas pipelines on supply.

3. Precious Metals Price Chart: A Safe Haven in Times of Uncertainty

Gold and silver, the most prominent precious metals, are considered safe haven assets. Their price charts are closely watched by investors seeking diversification and protection against inflation and market uncertainty.

Subpoints:

- Gold and Silver Correlation: Observe the price movements of gold and silver, noting their correlation. They often move in tandem, but their price ratios can fluctuate.

- Inflation Hedge: Precious metals are often seen as an inflation hedge, meaning their value tends to increase during inflationary periods.

- Interest Rates & USD Strength: Interest rates and the strength of the US dollar significantly impact precious metal prices. Higher interest rates generally put downward pressure on gold prices.

- Investor Sentiment: Investor sentiment and geopolitical risks greatly affect demand for precious metals. Uncertainty often drives investment in safe haven assets like gold.

Bullet Points:

- Compare the performance of gold and silver against other asset classes, such as stocks and bonds.

- Examine the impact of central bank policies on precious metal prices. Central banks' actions can influence both supply and demand.

- Consider the role of industrial demand for precious metals in various applications.

4. Agricultural Commodities Price Chart: Feeding the World

Agricultural commodity prices, encompassing grains like corn, wheat, and soybeans, directly impact food security and global food prices. Monitoring these commodity price charts is essential for understanding the stability of the global food system.

Subpoints:

- Key Commodities: Track the prices of corn, wheat, soybeans, sugar, and other essential agricultural commodities.

- Supply Chain Impacts: Weather patterns, climate change, and geopolitical events significantly impact agricultural supply chains. Droughts, floods, and conflicts can disrupt production and lead to price spikes.

- Global Demand: Population growth and rising global food demand exert significant pressure on agricultural commodity prices.

- Government Policies: Government policies, trade agreements, and export controls influence agricultural markets.

Bullet Points:

- Analyze the impact of fertilizer prices on agricultural production costs. Fertilizer prices can significantly affect yields and food prices.

- Consider the effect of biofuel production on agricultural commodity prices. Biofuel production competes with food production for resources.

- Discuss the implications of food insecurity and global hunger.

5. Base Metals Price Chart: Industrial Growth Indicators

Base metals, including copper, aluminum, and zinc, are essential for construction, manufacturing, and infrastructure development. Their price charts serve as indicators of global industrial activity and economic growth.

Subpoints:

- Key Metals: Monitor the price movements of copper, aluminum, zinc, and other key base metals.

- Manufacturing Activity: The demand for base metals is closely tied to global manufacturing activity and industrial production. Strong manufacturing growth usually boosts base metal prices.

- Supply Chain Disruptions: Supply chain disruptions and geopolitical tensions can significantly impact base metal supplies and prices.

- Technological Advancements: Technological advancements, such as the growth of the electric vehicle market, influence demand for certain base metals like copper.

Bullet Points:

- Consider the influence of mining production on base metal supplies. Mining output can be affected by various factors, including labor disputes and environmental regulations.

- Analyze the impact of government regulations on mining operations. Environmental and safety regulations can impact mining costs and production.

- Examine the relationship between base metal prices and infrastructure investment. Large-scale infrastructure projects typically drive demand for base metals.

Conclusion

Staying informed about the global commodity market is crucial for successful investment strategies and informed business decisions. By carefully monitoring these five key charts—crude oil, natural gas, precious metals, agricultural commodities, and base metals—you can gain valuable insights into market trends and make more strategic choices. Regularly review and analyze these global commodity markets charts to stay ahead of the curve. Understanding the dynamics of these charts will empower you to make more informed decisions in the volatile world of commodity trading and investment. Begin tracking these key global commodity markets today to optimize your strategies.

Featured Posts

-

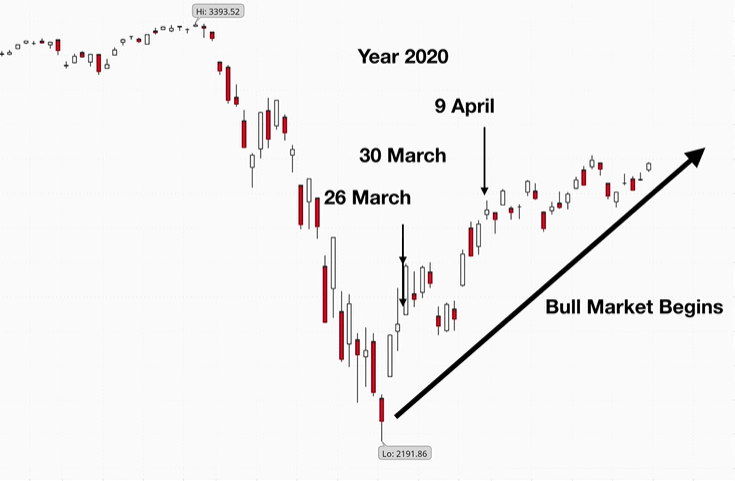

What Recession Stock Investors Remain Bullish

May 06, 2025

What Recession Stock Investors Remain Bullish

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Patrick Schwarzenegger On White Lotus Addressing Nepotism Claims

May 06, 2025

Patrick Schwarzenegger On White Lotus Addressing Nepotism Claims

May 06, 2025 -

U S Government Eyes Google Ad Monopoly Implications For The Tech Giant

May 06, 2025

U S Government Eyes Google Ad Monopoly Implications For The Tech Giant

May 06, 2025 -

Polski Nitro Chem Producent Trotylu Najwyzszej Jakosci

May 06, 2025

Polski Nitro Chem Producent Trotylu Najwyzszej Jakosci

May 06, 2025

Latest Posts

-

Ddg Fires Shots At Halle Bailey With Dont Take My Son Diss Track

May 06, 2025

Ddg Fires Shots At Halle Bailey With Dont Take My Son Diss Track

May 06, 2025 -

Ddgs New Diss Track Targets Halle Bailey Dont Take My Son Explodes Online

May 06, 2025

Ddgs New Diss Track Targets Halle Bailey Dont Take My Son Explodes Online

May 06, 2025 -

The Fly A Case For Jeff Goldblums Underrated Oscar Deserving Role

May 06, 2025

The Fly A Case For Jeff Goldblums Underrated Oscar Deserving Role

May 06, 2025 -

Jeff Goldblums Transformative Role In The Fly An Oscar Worthy Performance

May 06, 2025

Jeff Goldblums Transformative Role In The Fly An Oscar Worthy Performance

May 06, 2025 -

Ddgs New Diss Track Targets Halle Bailey Dont Take My Son

May 06, 2025

Ddgs New Diss Track Targets Halle Bailey Dont Take My Son

May 06, 2025