The $5 XRP Question: A 2025 Market Outlook

Table of Contents

Factors Influencing XRP's Price in 2025

Several key factors will significantly influence XRP's price trajectory in 2025. Understanding these elements is crucial for any investor considering XRP investment.

Ripple's Legal Battle and its Impact

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's price. A favorable ruling could unleash a wave of positive sentiment, potentially driving up the price significantly. Conversely, an unfavorable outcome could severely dampen investor confidence and lead to a prolonged period of price stagnation or decline. The uncertainty surrounding regulatory clarity for cryptocurrencies, especially in the US, adds another layer of complexity to predicting XRP's future.

- Potential Scenarios:

- Positive: A clear court victory for Ripple could lead to a surge in XRP's price, potentially exceeding $5.

- Negative: An unfavorable ruling could result in a significant price drop and decreased investor interest.

- Neutral: A drawn-out legal process could create price volatility but ultimately lead to a gradual increase or decrease, depending on other market factors.

- Impact on Investor Sentiment: The legal battle heavily influences investor sentiment. A positive resolution could attract substantial institutional investment, while a negative one might cause widespread selling.

- Short-term vs. Long-term Effects: The short-term impact of the legal outcome will be significant, but the long-term effects depend on XRP's adoption and utility.

Adoption and Utility of XRP

XRP's price is intrinsically linked to its adoption and utility. Its use in cross-border payments, facilitated by Ripple's On-Demand Liquidity (ODL) solution, is a key driver of demand. Wider integration into financial institutions and increased transaction volume are crucial for boosting XRP's value. Strategic partnerships and collaborations will also play a vital role.

- Key Partnerships: Strategic alliances with major financial institutions could dramatically increase XRP's adoption and legitimacy.

- ODL Expansion: The expansion of ODL into new markets and its integration with more payment providers are crucial for increasing XRP's usage.

- Market Penetration: The extent to which XRP penetrates the global payment market will significantly influence its price.

- Impact on Transaction Volume: Higher transaction volume directly translates to increased demand and potential price appreciation.

The Broader Cryptocurrency Market and Economic Conditions

XRP's price is not isolated; it's influenced by the broader cryptocurrency market and global economic conditions. Bitcoin's price movements often correlate with altcoins like XRP. Macroeconomic factors, such as inflation and recessionary pressures, can also impact investor sentiment towards risky assets like cryptocurrencies.

- Correlation with Bitcoin: Bitcoin's price trends often influence the overall cryptocurrency market, including XRP.

- Macroeconomic Factors: Global economic instability can negatively impact cryptocurrency investments, potentially leading to price declines.

- Technological Disruptions: Innovation within the crypto space, such as advancements in blockchain technology, can influence XRP's value.

- Regulatory Changes: Changes in cryptocurrency regulations globally can significantly impact XRP's price and adoption.

Analyzing Potential Price Scenarios for XRP in 2025

Predicting the future is inherently uncertain, but analyzing potential scenarios helps gauge XRP's potential.

Bullish Scenario ($5+)

For XRP to reach $5 or more by 2025, several positive factors must align. This would require a positive resolution to the SEC lawsuit, widespread adoption of XRP in cross-border payments, and continued growth in the broader cryptocurrency market.

- Key Indicators for a Bullish Market: Widespread adoption by financial institutions, significant increase in ODL usage, positive regulatory developments.

- Potential Price Targets: Reaching $5 or even exceeding it is possible under an extremely bullish scenario.

- Supportive Market Conditions: A strong bull market in cryptocurrencies, coupled with positive regulatory clarity, would be highly supportive.

Bearish Scenario (Below $5)

A bearish scenario could see XRP remaining below $5 in 2025. This could result from an unfavorable outcome in the SEC lawsuit, decreased adoption rates, or a prolonged bear market in cryptocurrencies.

- Key Indicators for a Bearish Market: Negative regulatory developments, decreased adoption, a prolonged bear market in the overall crypto space.

- Potential Price Targets: The price could remain significantly below its current level under a pessimistic scenario.

- Negative Market Conditions: A prolonged crypto winter, coupled with negative regulatory action, could severely impact XRP's price.

Neutral Scenario

A more realistic, neutral scenario suggests a moderate price increase, keeping XRP below $5 in 2025. This scenario balances both positive and negative factors, resulting in steady, yet not spectacular, growth.

- Most Likely Price Range: A moderate increase from current levels, but not reaching the $5 target.

- Factors Affecting Price Stability: Sustained adoption, but perhaps at a slower pace than in a bullish scenario, and no major legal shocks.

Conclusion: Is $5 XRP a Realistic Goal by 2025? Your Next Steps

Whether XRP reaches $5 by 2025 hinges on several interwoven factors: the outcome of the Ripple-SEC lawsuit, the rate of XRP adoption, the broader cryptocurrency market's performance, and global economic conditions. While a bullish scenario reaching $5 is possible, a neutral or bearish outcome is equally plausible. Remember that cryptocurrency investments are inherently risky. Thorough research and understanding your risk tolerance are paramount.

Learn more about XRP's potential, assess your risk tolerance before investing in XRP, and dive deeper into the $5 XRP question. Explore the future of XRP and make informed decisions based on this analysis. Don't hesitate to continue your research before making any investment choices related to XRP price prediction 2025.

Featured Posts

-

Laram Wimbratwr Shrakt Ltnshyt Alsyaht Albrazylyt

May 07, 2025

Laram Wimbratwr Shrakt Ltnshyt Alsyaht Albrazylyt

May 07, 2025 -

Pei Legislature Reviews 500 000 Bill For Nhl Face Off Event

May 07, 2025

Pei Legislature Reviews 500 000 Bill For Nhl Face Off Event

May 07, 2025 -

Broadcoms Proposed V Mware Price Hike An Extreme 1 050 Increase

May 07, 2025

Broadcoms Proposed V Mware Price Hike An Extreme 1 050 Increase

May 07, 2025 -

Albwlysaryw Tetql Tyara Ajnbya

May 07, 2025

Albwlysaryw Tetql Tyara Ajnbya

May 07, 2025 -

Ke Huy Quans The White Lotus Season 3 Cameo Explained

May 07, 2025

Ke Huy Quans The White Lotus Season 3 Cameo Explained

May 07, 2025

Latest Posts

-

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025 -

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025 -

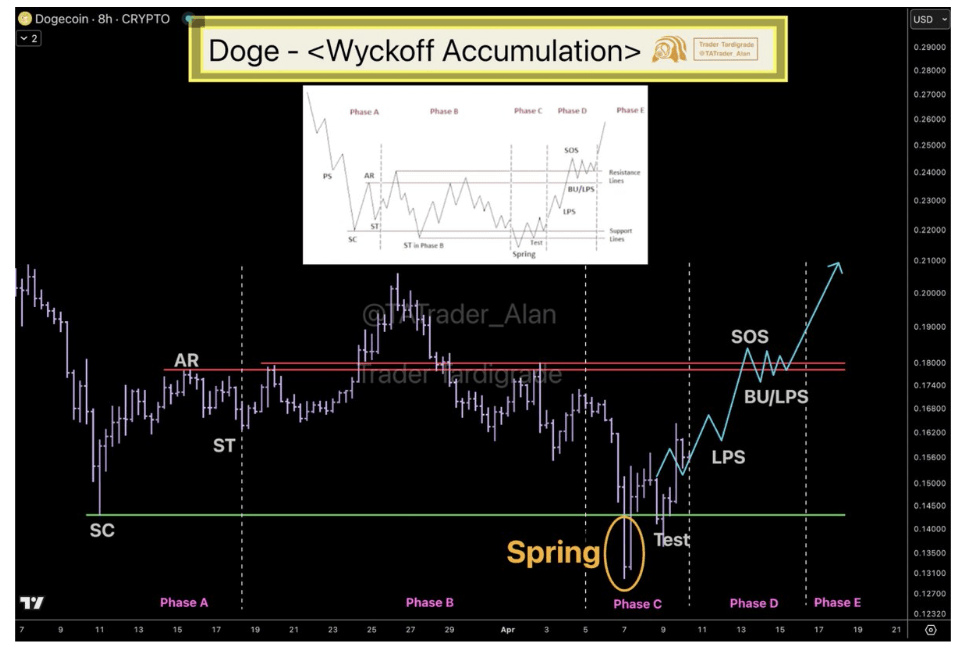

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025

Ethereums Price Action Suggests 2 700 Is Achievable Wyckoff Accumulation Explained

May 08, 2025 -

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025

Technical Analysis Ethereums Potential 2 700 Surge Based On Wyckoff

May 08, 2025 -

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025

Ethereum Price Analysis 2 700 On The Horizon Wyckoff Accumulation Hints At Rally

May 08, 2025