Suncor Achieves Record Production Despite Sales Volume Slowdown

Table of Contents

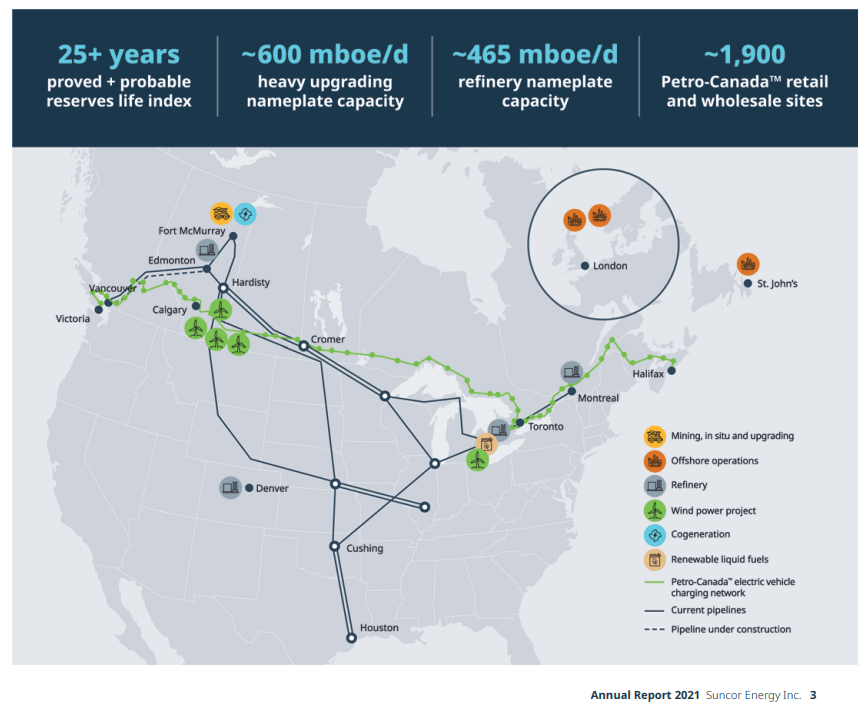

Record-Breaking Production Levels at Suncor

Suncor's achievement of record production is a testament to significant improvements in its operational efficiency and the successful rollout of new projects.

Increased Upstream Efficiency and Output

Suncor's oil sands operations have witnessed remarkable gains in productivity. Technological advancements, including improved extraction methods and optimized in-situ recovery techniques, have led to a substantial increase in oil production from existing assets. This translates to:

- Higher extraction rates: Data shows a significant percentage increase in oil extracted per unit of input, leading to cost savings and higher overall output. Specific figures, if publicly available, should be cited here.

- Reduced operational downtime: Improvements in maintenance and preventative measures have minimized disruptions, contributing to sustained high production levels.

- Enhanced automation: The implementation of advanced automation technologies has streamlined operations and reduced human error, boosting efficiency.

These operational improvements within Suncor's oil sands operations are key drivers of the "Suncor record production" narrative. The company's focus on upstream efficiency has directly impacted its overall production capacity.

New Project Contributions

The contribution of new projects coming online or reaching full capacity has further fueled Suncor's record production. These include:

- [Project Name 1]: This project, located in [Location], has added [quantifiable amount] barrels per day to Suncor's overall production.

- [Project Name 2]: Similarly, [Project Name 2] in [Location] has significantly boosted production capacity.

These new oil sands projects, coupled with the enhanced efficiency of existing operations, explain the impressive production figures. The success of these projects highlights Suncor's ongoing commitment to capacity expansion in its oil sands assets.

Reasons for the Sales Volume Slowdown

While Suncor achieved record production, a simultaneous sales volume slowdown presents a complex picture. Several factors contribute to this:

Global Market Conditions

The global energy market is inherently volatile. Fluctuations in global oil prices and overall demand play a significant role.

- Geopolitical instability: Geopolitical events and uncertainty in various regions significantly impact oil prices and market stability.

- Oil demand fluctuations: Seasonal changes and global economic conditions influence the level of oil demand, affecting sales volume.

- Competition: Increased competition from other oil producers worldwide can also influence Suncor's market share and sales volume.

These external factors are largely outside Suncor's direct control, yet significantly impact their sales figures.

Refining and Downstream Challenges

Challenges within Suncor's downstream operations (refining, marketing, and distribution) have also impacted sales volume.

- Refining capacity constraints: Potential limitations in Suncor's refining capacity might hinder its ability to fully process the increased upstream production.

- Logistical bottlenecks: Issues in transportation and distribution networks can create bottlenecks, reducing the volume of oil that reaches the market.

- Maintenance shutdowns: Planned or unplanned maintenance at refining facilities can temporarily affect processing capacity and sales.

Inventory Management

Strategic inventory management also plays a crucial role.

- Increased inventory levels: Suncor might be strategically increasing its oil inventory in anticipation of future price increases or to manage supply chain fluctuations. This would reduce immediate sales figures, even with high production.

- Supply chain optimization: The company may be adjusting inventory levels to optimize its supply chain, potentially leading to temporary dips in sales volume.

Financial Implications and Future Outlook

The interplay of record production and reduced sales volume has significant financial implications.

Impact on Suncor's Financial Performance

While production reached record highs, lower sales volume could affect overall revenue and profitability. A detailed analysis of Suncor's financial reports is needed to fully assess the impact on earnings per share and overall financial health. [Insert financial data if available].

Suncor's Strategy for Future Growth

Suncor is likely implementing strategies to address the sales volume slowdown and ensure future growth. These might include:

- Increased downstream investments: Investing in refining capacity and improving distribution networks to better handle increased production.

- Market diversification: Exploring new markets and diversifying its product portfolio to reduce reliance on specific regions or product types.

- Strategic partnerships: Collaborating with other companies to improve efficiency, expand market reach, or share risks.

Conclusion: Navigating the Paradox – Suncor's Path Forward

Suncor's achievement of record production amidst a sales volume slowdown highlights the complexity of the global energy market. Increased upstream efficiency and new projects boosted production, while global market conditions, downstream challenges, and inventory management contributed to the sales slowdown. Suncor's future success hinges on its ability to effectively manage these challenges through strategic investments, market diversification, and efficient operational strategies. Learn more about Suncor's record production and its strategies for future growth in the energy sector by visiting the official Suncor website.

Featured Posts

-

Palantir Stock A Comprehensive Investment Guide Before May 5th

May 09, 2025

Palantir Stock A Comprehensive Investment Guide Before May 5th

May 09, 2025 -

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025 -

Franco Colapinto Sponsors Live Tv Slip Up Causes F1 Buzz

May 09, 2025

Franco Colapinto Sponsors Live Tv Slip Up Causes F1 Buzz

May 09, 2025 -

Investing In Palantir Stock Should You Buy Before May 5th

May 09, 2025

Investing In Palantir Stock Should You Buy Before May 5th

May 09, 2025 -

Ai Digest Transforming Mundane Scatological Data Into Compelling Podcast Content

May 09, 2025

Ai Digest Transforming Mundane Scatological Data Into Compelling Podcast Content

May 09, 2025