Investing In Palantir Stock: Should You Buy Before May 5th?

Table of Contents

Palantir's Growth Potential and Future Outlook

Palantir's success hinges on its ability to maintain and expand its revenue streams and technological edge. Let's examine the key drivers of its future growth.

Government Contracts and Revenue Growth

Palantir's substantial revenue historically stems from lucrative government contracts, particularly within the defense and intelligence sectors. However, the company is actively diversifying into commercial markets, aiming for a more balanced revenue stream. Future revenue growth will depend heavily on securing new government contracts and achieving significant traction in commercial sectors.

- Recent Contract Wins: Palantir has recently secured several substantial contracts, demonstrating continued demand for its data analytics platforms. Analyzing the specifics of these contracts, including their value and duration, is vital for projecting future revenue.

- International Expansion: Expanding into new international markets offers significant growth opportunities. Success in this area relies on navigating diverse regulatory environments and building strong partnerships.

- Growth in Key Sectors: Palantir's platforms are increasingly deployed in healthcare, finance, and other sectors. Growth in these areas depends on the successful adoption of Palantir's technology by key players within these industries. Analyzing industry trends and Palantir's market penetration is crucial for assessing its growth trajectory.

- Keywords: Palantir government contracts, Palantir commercial growth, PLTR revenue forecast, Palantir international expansion.

Technological Innovation and Competitive Advantage

Palantir's proprietary technologies, including Palantir Gotham (for government clients) and Palantir Foundry (for commercial clients), provide a significant competitive advantage. Its advanced AI capabilities, coupled with its strong data integration and analytics prowess, differentiate it from competitors.

- Palantir AI: The integration of AI and machine learning into Palantir's platforms enhances its analytical capabilities and allows it to offer increasingly sophisticated solutions to its clients. This ongoing development is essential for maintaining a competitive edge.

- Data Analytics Competition: The data analytics market is becoming increasingly competitive. Palantir’s ability to innovate and adapt to this evolving landscape is crucial for sustained success.

- Keywords: Palantir AI, Palantir Foundry, Palantir Gotham, data analytics competition.

Analyzing Palantir's Financial Performance

Understanding Palantir's financial health is paramount for any potential investor. Let's review key financial metrics and their implications.

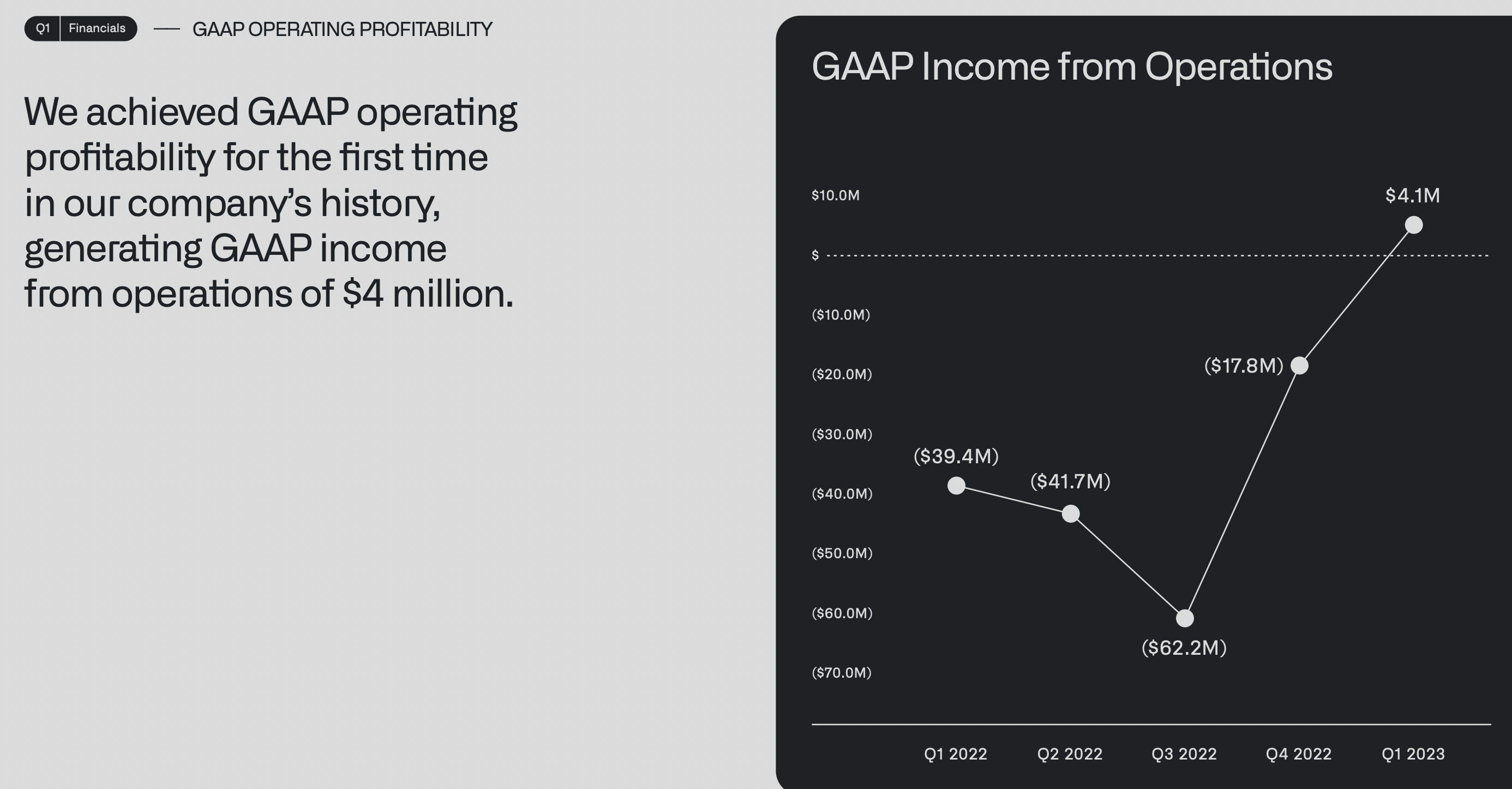

Recent Earnings Reports and Financial Health

Careful examination of Palantir's recent earnings reports provides crucial insights into its financial performance. Key metrics like revenue growth, earnings per share (EPS), and profitability should be closely monitored. Comparing these metrics to industry benchmarks helps assess Palantir's relative performance and financial strength.

- PLTR Earnings: Analyze the recent trends in Palantir's revenue, profitability, and operating expenses to gauge its financial health. Look for consistent growth or signs of improvement.

- Palantir Revenue Growth: Consistent and substantial revenue growth is a positive indicator of the company's ability to secure and retain clients.

- Palantir Debt: The level of Palantir's debt and its ability to manage it effectively are important factors to consider.

- Keywords: PLTR earnings, Palantir EPS, Palantir revenue growth, Palantir debt.

Valuation and Stock Price Analysis

Evaluating Palantir's current stock valuation requires analyzing its price-to-earnings (P/E) ratio and comparing it to its competitors. This helps determine if the stock is currently undervalued or overvalued. Factors like growth prospects, market sentiment, and economic conditions significantly influence stock price fluctuations.

- PLTR Stock Price: Monitor the recent stock price trends to understand market sentiment towards Palantir.

- Palantir P/E Ratio: Compare Palantir's P/E ratio to industry averages to understand its relative valuation.

- Keywords: PLTR stock price, Palantir valuation, Palantir P/E ratio, Palantir stock forecast.

Risks and Considerations Before Investing in Palantir

Investing in Palantir, like any stock, carries inherent risks. Let's consider some critical factors.

Market Volatility and Economic Factors

The technology sector, in general, is subject to market volatility. Economic downturns can significantly impact Palantir's growth, particularly its reliance on government contracts which might be subject to budget cuts.

- PLTR Stock Volatility: Understand the historical volatility of Palantir's stock price before investing.

- Economic Downturn: Assess the potential impact of a recession or economic slowdown on Palantir's business.

- Keywords: PLTR stock volatility, market risk, economic downturn, tech stock investment.

Competition and Market Saturation

Palantir faces competition from established players and emerging startups in the data analytics market. Market saturation could limit future growth opportunities.

- Palantir Competition: Identify and analyze Palantir’s main competitors and their market strategies.

- Data Analytics Market: Understand the size and growth potential of the data analytics market to assess Palantir's long-term prospects.

- Keywords: Palantir competition, data analytics market, market saturation.

Conclusion

Investing in Palantir stock before May 5th requires careful consideration of its growth potential, financial performance, and inherent market risks. While Palantir possesses strong technology and a growing presence in key sectors, market volatility and competition present significant challenges. The decision to invest should align with your individual risk tolerance and investment goals.

Call to Action: Weighing the potential rewards and risks, decide if investing in Palantir stock before May 5th aligns with your investment goals and risk tolerance. Conduct thorough due diligence and consider consulting a financial advisor before making any investment decisions regarding Palantir stock (PLTR). Remember to research and understand the latest financial reports and market analyses before making any investment decisions related to Palantir stock (PLTR) investment. Thorough research is key to a successful Palantir stock investment strategy.

Featured Posts

-

Wildfire Speculation The Ethics And Implications Of Betting On Natural Disasters

May 09, 2025

Wildfire Speculation The Ethics And Implications Of Betting On Natural Disasters

May 09, 2025 -

Is Palantir Stock A Good Investment Pros Cons And Price Prediction

May 09, 2025

Is Palantir Stock A Good Investment Pros Cons And Price Prediction

May 09, 2025 -

West Ham Face 25m Financial Gap How Will They Plug It

May 09, 2025

West Ham Face 25m Financial Gap How Will They Plug It

May 09, 2025 -

Apple At A Crossroads The Future Of Ai And Its Impact

May 09, 2025

Apple At A Crossroads The Future Of Ai And Its Impact

May 09, 2025 -

Rethinking Stephen King 4 Groundbreaking Randall Flagg Theories

May 09, 2025

Rethinking Stephen King 4 Groundbreaking Randall Flagg Theories

May 09, 2025