Palantir Stock: A Comprehensive Investment Guide Before May 5th

Table of Contents

Palantir's Business Model and Recent Performance

Palantir Technologies operates in the lucrative big data analytics sector, offering its cutting-edge software platforms to both government and commercial clients. Understanding this dual revenue stream is crucial to evaluating Palantir stock.

Understanding Palantir's Government and Commercial Contracts

Palantir's success hinges on its ability to secure and maintain large contracts. Its government business, traditionally a major revenue driver, involves providing data integration and analysis tools to intelligence agencies and defense departments worldwide. The commercial side focuses on providing similar solutions to companies across various industries, from finance and healthcare to manufacturing and energy. The relative importance of these two segments fluctuates, impacting investor sentiment.

- Key government clients: While specific client details are often confidential, Palantir has publicly acknowledged working with various US government agencies and international allies.

- Significant commercial partnerships: Palantir is increasingly focusing on expanding its commercial partnerships, demonstrating its adaptability and growth potential beyond government contracts. Key partnerships should be named and their impact on Palantir's revenue growth highlighted.

- Growth in specific sectors: Highlight sectors where Palantir is experiencing significant growth, such as [mention specific sectors and their relevance to Palantir's future growth].

Analyzing Palantir's Financial Performance

Analyzing Palantir's financial performance requires a thorough examination of several key metrics. Looking beyond headline numbers and digging into the details reveals valuable insights.

- Revenue growth year-over-year: Examine the trend of revenue growth to gauge the company's trajectory and potential for future expansion.

- Profit margins: Assess the profitability of Palantir's operations by examining gross, operating, and net profit margins. Identify any trends and their potential impact.

- Debt levels: Analyze Palantir's debt-to-equity ratio and overall debt burden. High debt levels can pose risks to the company's financial stability.

- Cash flow: Assess the company's ability to generate cash from its operations. Positive and consistent cash flow is a sign of financial health.

Key Risks and Challenges Facing Palantir

Despite its potential, Palantir faces several challenges that investors should consider.

- Competitive landscape: The big data analytics market is increasingly competitive, with established players and new entrants vying for market share. Discuss key competitors and their strengths.

- Regulatory hurdles: Government regulations and data privacy concerns can impact Palantir's operations, particularly in the government sector. Discuss the implications of relevant regulations.

- Macroeconomic factors: Economic downturns can affect both government and commercial spending on data analytics solutions, impacting Palantir's revenue.

Evaluating Palantir Stock Valuation

Determining whether Palantir stock is currently undervalued or overvalued requires a comprehensive valuation analysis.

Assessing Palantir's Current Stock Price

- Current stock price: State the current stock price (as of the date of publication).

- P/E ratio: Compare Palantir's price-to-earnings ratio to those of its competitors to assess its relative valuation. A high P/E ratio might suggest that the market anticipates strong future growth.

- Market capitalization: Analyze Palantir's market capitalization to gauge its overall size and market standing within the data analytics sector.

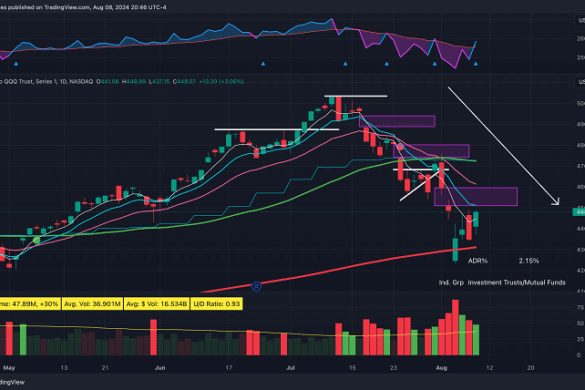

- Historical price chart: Review the historical price chart to identify trends and potential support/resistance levels.

Considering Future Growth Potential

Palantir's future growth hinges on several factors:

- Potential for international expansion: Assess the opportunities for Palantir to expand its operations into new international markets.

- New product development: Analyze the potential for Palantir to develop new products and services to meet evolving market demands.

- Market share growth: Assess Palantir's potential to capture a larger share of the growing data analytics market.

Analyzing Analyst Ratings and Price Targets

Before making any investment decision, carefully review analyst ratings and price targets for Palantir stock. However, remember that these are just opinions, and past performance is not indicative of future results.

- Average analyst rating (Buy, Hold, Sell): Summarize the consensus view among financial analysts.

- Range of price targets: Review the range of price targets provided by analysts and understand the rationale behind them.

- Reasons behind analyst opinions: Look at the reasoning provided by analysts to support their ratings and price targets.

Investment Strategies for Palantir Stock Before May 5th

Investing in Palantir stock requires a well-defined strategy aligned with your personal risk tolerance and investment goals.

Determining Your Risk Tolerance

- Long-term vs. short-term investment goals: Clarify your investment timeline. Are you investing for the long term (5+ years) or short term?

- Risk tolerance questionnaire examples: Consider using online resources or consulting a financial advisor to assess your risk tolerance. Palantir stock is considered a growth stock and therefore carries inherent risk.

Considering Different Investment Approaches

- Buy and hold strategy pros/cons: Buying and holding Palantir stock for the long term can mitigate short-term volatility, but requires patience and confidence in the company's future growth.

- Dollar-cost averaging explanation: Investing a fixed amount regularly, regardless of price fluctuations, can reduce the risk of investing a lump sum at a market peak.

- Day trading risks: Short-term trading carries significant risks and is not recommended for inexperienced investors.

Diversification and Portfolio Management

- Asset allocation strategies: Determine how much of your portfolio you're willing to allocate to Palantir stock. Diversification is crucial to mitigate risk.

- Diversification benefits: Spreading your investments across different asset classes can help reduce your overall portfolio volatility.

- Portfolio rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation.

Conclusion

Investing in Palantir stock before May 5th requires careful consideration of the company's business model, recent financial performance, valuation, and the inherent risks involved. Understanding your own risk tolerance and investment goals is paramount. While the potential for growth is significant, the volatility of Palantir shares demands a thorough understanding of the market dynamics before making any investment decision. Conduct thorough research, perhaps consulting with a financial advisor, before committing your capital. Remember, the May 5th deadline underscores the importance of timely and informed decision-making regarding your Palantir stock investment. Don't delay – carefully analyze the information presented here and make a decision about investing in Palantir that aligns with your individual financial situation and risk tolerance.

Featured Posts

-

Rethinking Daycare Challenges And Alternatives For Working Families

May 09, 2025

Rethinking Daycare Challenges And Alternatives For Working Families

May 09, 2025 -

High Babysitting Costs Result In Higher Daycare Expenses A Real Life Example

May 09, 2025

High Babysitting Costs Result In Higher Daycare Expenses A Real Life Example

May 09, 2025 -

2025 82000

May 09, 2025

2025 82000

May 09, 2025 -

The Snl Impression That Upset Harry Styles

May 09, 2025

The Snl Impression That Upset Harry Styles

May 09, 2025 -

Pakistan Stock Exchange Outage Amidst Market Instability And Rising Tensions

May 09, 2025

Pakistan Stock Exchange Outage Amidst Market Instability And Rising Tensions

May 09, 2025