Analyzing The U.S. Dollar's Performance: A Comparison To The Nixon Presidency

Table of Contents

The U.S. dollar, the world's reserve currency, has experienced periods of both remarkable strength and unsettling volatility throughout its history. One pivotal moment that reshaped the global monetary landscape was the Nixon shock of 1971, a watershed event that continues to cast a long shadow on the dollar's current performance. This article analyzes the U.S. dollar's performance today, comparing and contrasting it with the era following President Nixon's groundbreaking economic decisions, considering key factors such as inflation, global economic conditions, and the dollar's role in the international monetary system.

The Nixon Shock and its Impact on the U.S. Dollar

The Nixon administration's economic policies irrevocably altered the international monetary system established at Bretton Woods.

The Closing of the Gold Window:

On August 15, 1971, President Nixon unilaterally closed the gold window, ending the convertibility of the U.S. dollar to gold. This momentous decision marked the end of the Bretton Woods system, a fixed exchange rate system where other currencies were pegged to the dollar, which itself was backed by gold.

- Impact on international trade: The immediate consequence was increased uncertainty in international markets. The fixed exchange rate system was replaced by a floating exchange rate system, leading to greater volatility in currency values.

- Dollar devaluation: The dollar's value began to decline against other major currencies as it was no longer guaranteed by gold reserves.

- Increased inflation: The removal of the gold standard contributed to inflationary pressures in the United States and globally, as governments were no longer constrained by the need to maintain fixed exchange rates.

Short-Term and Long-Term Effects:

The short-term effects of the Nixon shock included market turmoil and increased inflation. The long-term consequences were far-reaching, fundamentally reshaping the global monetary system.

- Changes in global trade patterns: The floating exchange rate system encouraged greater flexibility in international trade, but also introduced significant risks.

- Rise of other currencies: The relative decline of the dollar's value led to the rise of other currencies, such as the German mark and the Japanese yen, as significant players in international finance.

- The emergence of new economic powers: The shift away from the dollar's dominance paved the way for the emergence of new economic powers like China, eventually challenging the established global order. The dollar's hegemony, while still strong, was undeniably weakened.

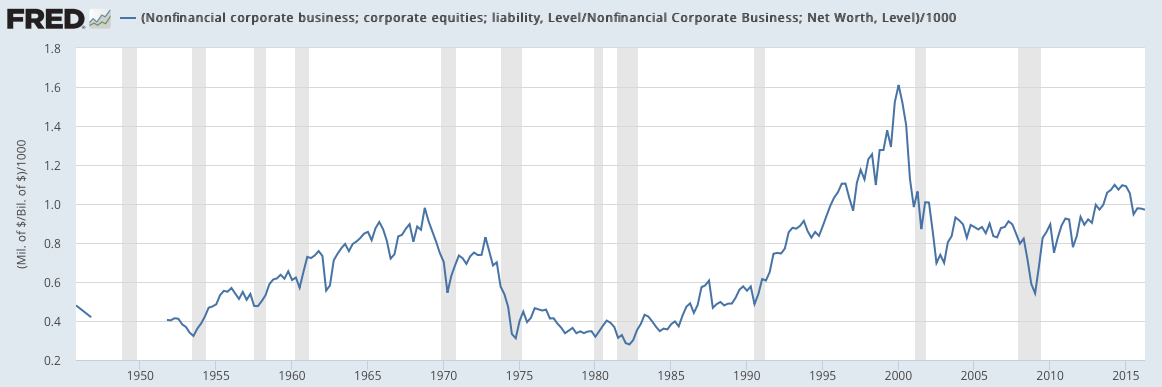

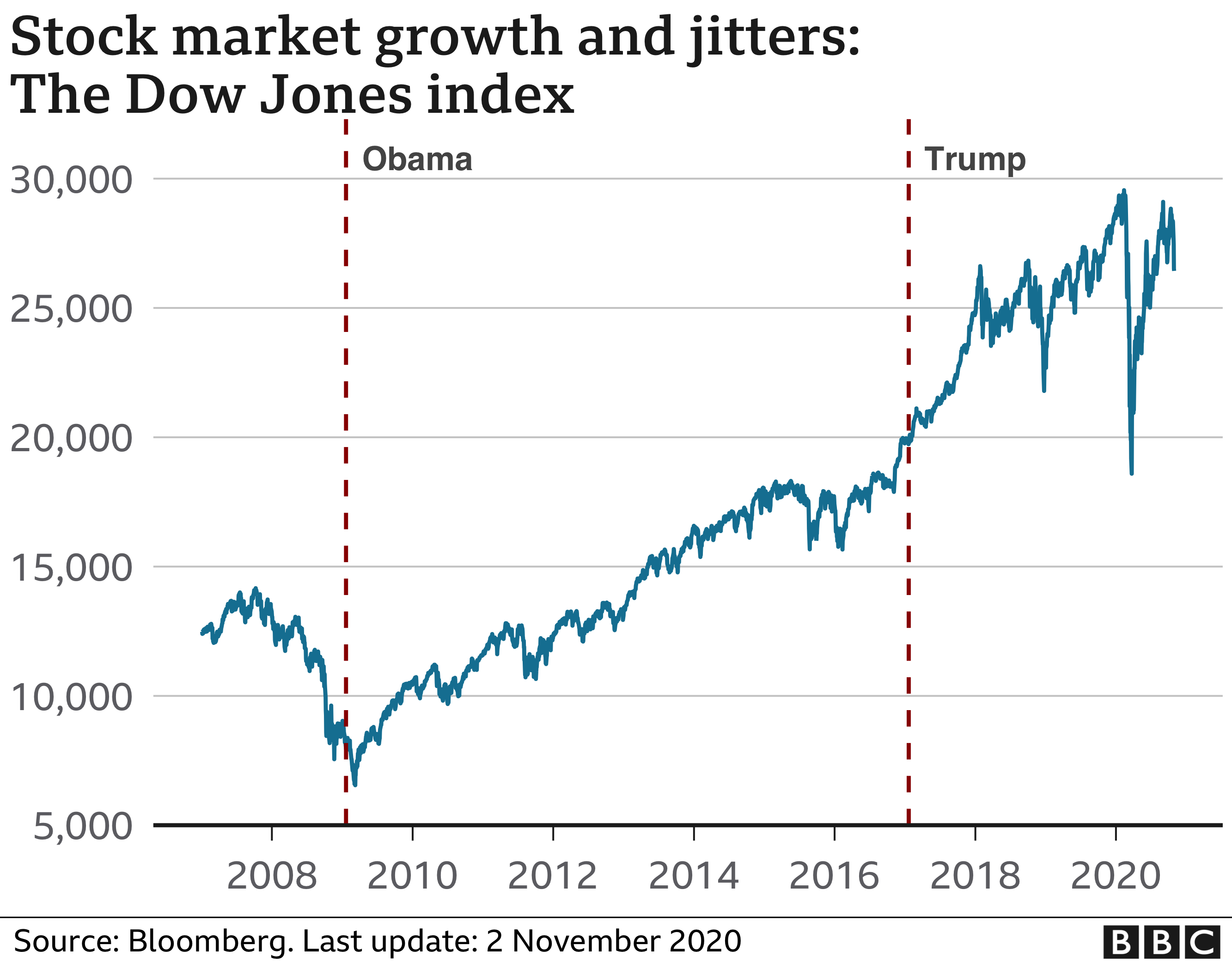

Comparing Current U.S. Dollar Performance to the Post-Nixon Era

Analyzing the current state of the U.S. dollar requires a comparison to the post-Nixon era, focusing on key economic indicators and geopolitical shifts.

Inflation and Interest Rates:

Current inflation rates and interest rate policies differ significantly from the period immediately following Nixon's decision. The Federal Reserve's approach to monetary policy has evolved considerably.

- Quantitative easing: Unlike the post-Nixon era, the Federal Reserve has employed quantitative easing (QE) – a policy of injecting liquidity into the markets – to combat economic downturns.

- Inflation targeting: Modern monetary policy emphasizes inflation targeting, aiming to maintain price stability within a specific range.

- Monetary policy tools: The Fed utilizes a range of tools, including interest rate hikes and reserve requirements, to manage inflation and maintain the dollar's value. This contrasts with the less sophisticated tools available in the early post-Nixon years.

The Dollar's Role in the Global Economy:

The dollar remains the world's dominant reserve currency, but its global dominance is increasingly challenged. Geopolitical factors play a significant role.

- Competition from the Euro, the Yuan, and other currencies: The rise of the Euro and the growing influence of the Chinese Yuan present strong competition to the dollar's status as a global reserve currency.

- Impacts of trade wars and sanctions: Geopolitical events like trade wars and sanctions significantly impact the value of the dollar.

- The role of technology and cryptocurrencies: The emergence of digital currencies and blockchain technology poses a potential long-term challenge to the dollar's supremacy.

Factors Affecting the U.S. Dollar's Value Today

Understanding the current value of the U.S. dollar requires examining both economic indicators and geopolitical factors.

Economic Indicators:

Key economic indicators provide valuable insights into the dollar's strength or weakness.

- GDP growth: A strong GDP growth rate generally supports a stronger dollar. Charts showing correlations between GDP and the dollar's value are readily available online.

- Unemployment rates: Low unemployment rates often indicate a healthy economy, positively impacting the dollar.

- National debt: High levels of national debt can put downward pressure on the dollar's value. Analyzing the fiscal policy of the U.S. government is crucial.

Geopolitical Factors:

Global events significantly influence the dollar's value.

- Geopolitical uncertainty: Periods of political instability or global conflicts tend to increase demand for the dollar as a safe-haven asset.

- International relations: The state of U.S. relations with other countries impacts the dollar's value, particularly trade agreements and sanctions.

- Global conflicts: Major global conflicts can significantly impact the dollar's performance due to increased uncertainty and shifts in capital flows.

Analyzing the U.S. Dollar's Performance: Key Takeaways and Future Outlook

Comparing the U.S. dollar's performance under Nixon with its current performance reveals both similarities and differences. While the Nixon shock fundamentally altered the global monetary system, moving from a fixed to a floating exchange rate, the dollar's role as a reserve currency remains substantial. However, the current global landscape presents challenges, including increased competition from other currencies, rising national debt, and the impacts of geopolitical events. The dollar's value today is influenced by a complex interplay of economic indicators and geopolitical factors. Understanding these elements is crucial for navigating the global economy.

Stay informed about the evolving dynamics of the U.S. dollar by following our future analyses and exploring related resources on [link to relevant resources].

Featured Posts

-

Confronting Google Perplexitys Ceo On The Emerging Ai Browser Landscape

Apr 28, 2025

Confronting Google Perplexitys Ceo On The Emerging Ai Browser Landscape

Apr 28, 2025 -

Addressing Investor Concerns About High Stock Market Valuations Bof As Insight

Apr 28, 2025

Addressing Investor Concerns About High Stock Market Valuations Bof As Insight

Apr 28, 2025 -

Assessing The Damage The Us Economy Under Pressure From A Canadian Travel Boycott

Apr 28, 2025

Assessing The Damage The Us Economy Under Pressure From A Canadian Travel Boycott

Apr 28, 2025 -

Frieds Yankees Debut A Success Offense Explodes In 12 3 Rout Of Pirates

Apr 28, 2025

Frieds Yankees Debut A Success Offense Explodes In 12 3 Rout Of Pirates

Apr 28, 2025 -

Long Term Effects Of Ohio Train Derailment Toxic Chemical Residue In Buildings

Apr 28, 2025

Long Term Effects Of Ohio Train Derailment Toxic Chemical Residue In Buildings

Apr 28, 2025

Latest Posts

-

Boston Red Sox Roster Shuffle Casass Demise And Outfield Change

Apr 28, 2025

Boston Red Sox Roster Shuffle Casass Demise And Outfield Change

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025 -

Orioles Announcers Jinx Finally Snapped After 160 Game Streak

Apr 28, 2025

Orioles Announcers Jinx Finally Snapped After 160 Game Streak

Apr 28, 2025 -

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025