Stock Market Valuations And Investor Concerns: BofA's Reassurance

Table of Contents

BofA's Perspective on Current Stock Market Valuations

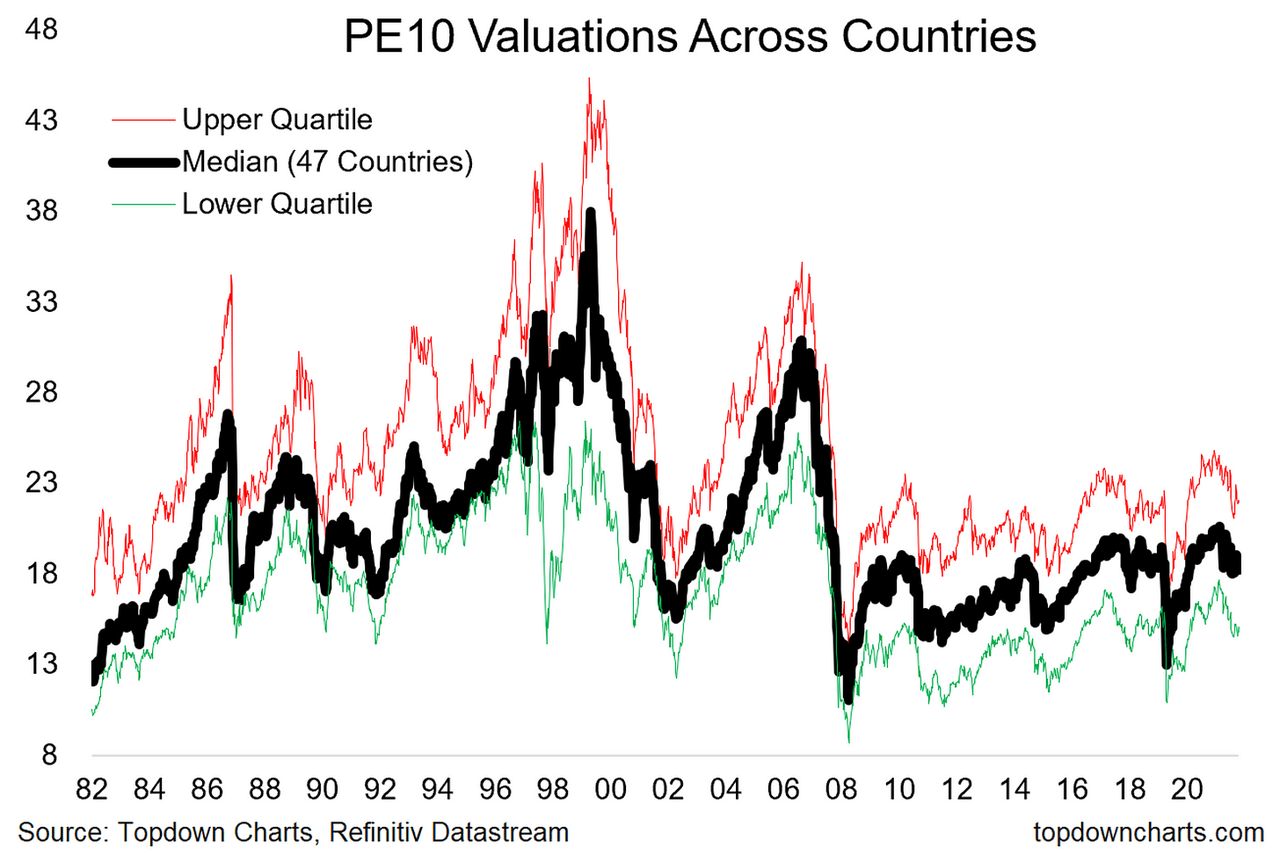

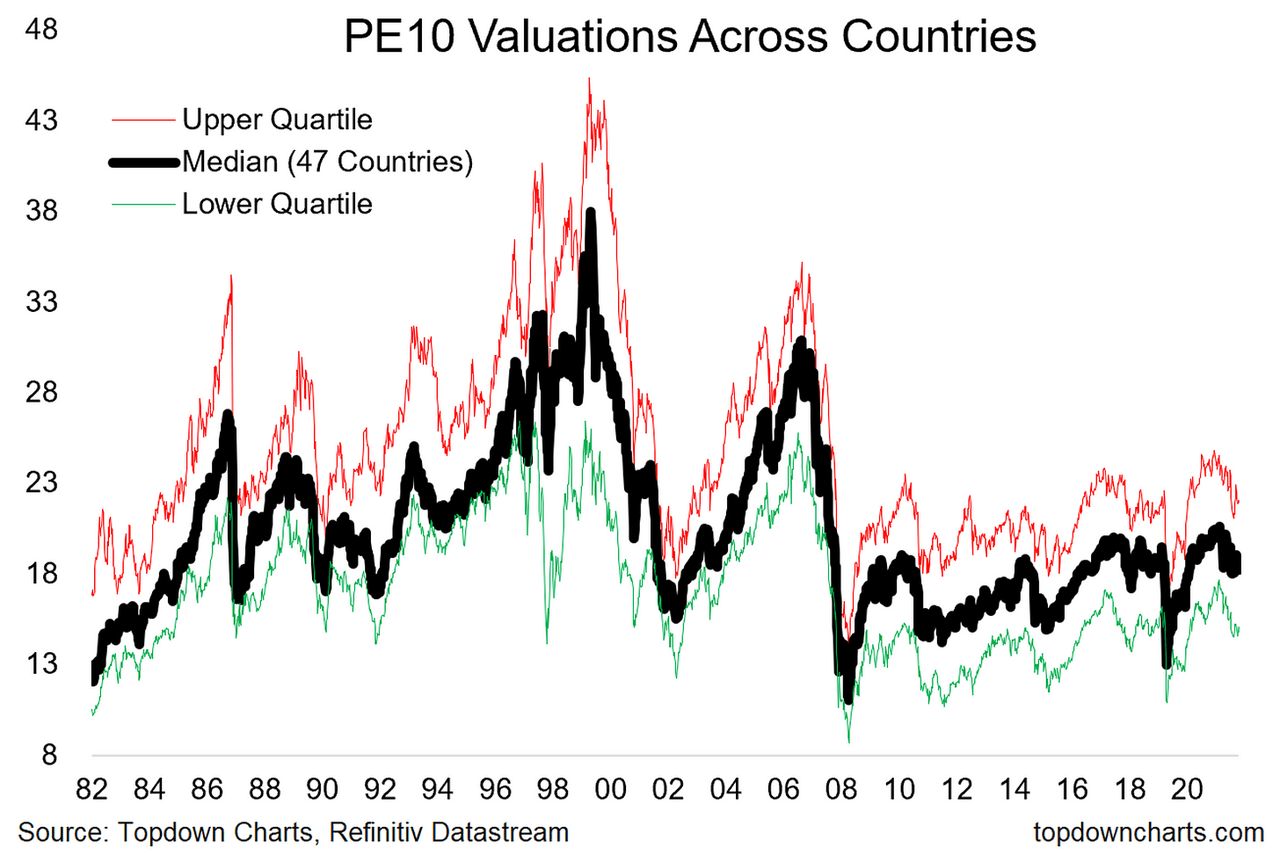

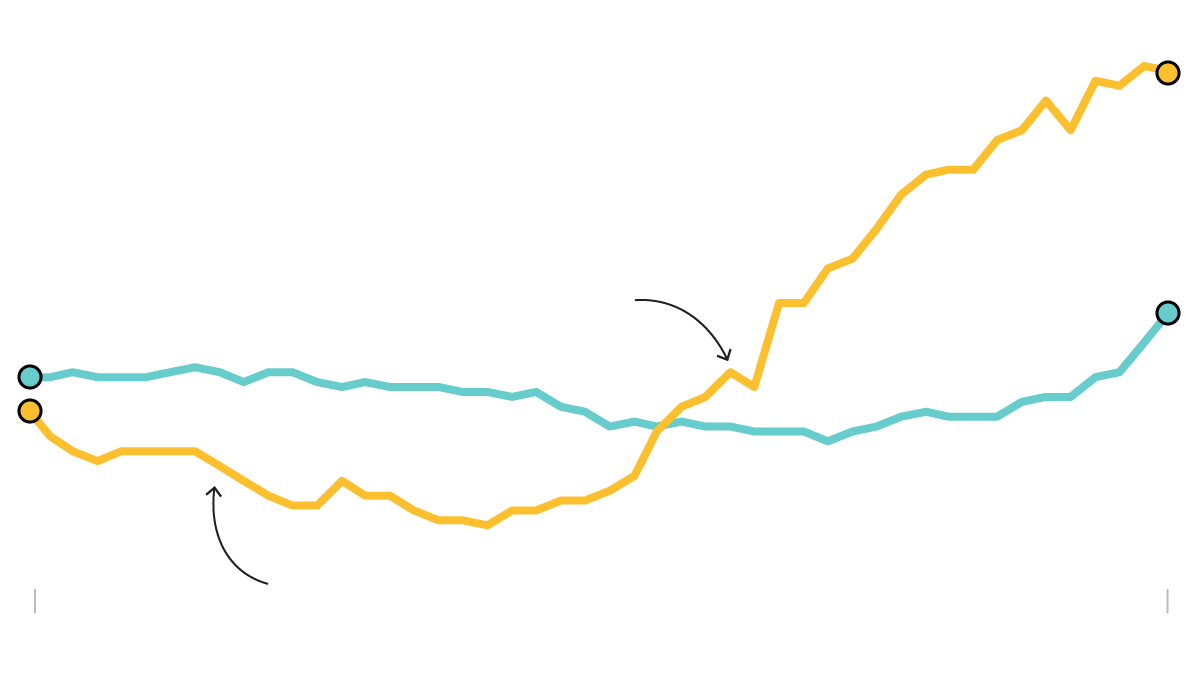

BofA's assessment of current stock market valuations is nuanced, acknowledging the elevated levels but avoiding outright pronouncements of a bubble. Their analysis incorporates various valuation metrics, including price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and cyclically adjusted price-to-earnings (CAPE) ratios, to paint a comprehensive picture.

-

BofA's Arguments: BofA argues that while valuations are higher than historical averages in some sectors, they are not necessarily unsustainable. They point to factors such as low interest rates (at least historically speaking, before recent increases), robust corporate earnings growth in certain sectors, and continued technological innovation as potential justifications for the current levels. They also highlight the ongoing impact of quantitative easing policies from central banks and their effects on asset prices.

-

Sectoral Views: BofA's analysis often highlights specific sectors. For instance, they might identify technology stocks as potentially overvalued based on high P/E ratios relative to historical data, while viewing certain cyclical sectors, like energy or materials, as potentially undervalued depending on commodity prices and economic forecasts. These opinions naturally change as markets fluctuate and new data is released.

-

Methodology: BofA employs sophisticated quantitative models, incorporating macroeconomic forecasts, industry-specific data, and fundamental analysis of individual companies. Their methodology involves a combination of top-down (macroeconomic) and bottom-up (company-specific) analysis, aiming for a balanced perspective.

Addressing Key Investor Concerns

Several key anxieties fuel investor concerns about market valuations. These include: inflation, rising interest rates, and geopolitical instability. BofA directly addresses these concerns in their analysis:

-

Inflation's Impact: BofA's outlook on inflation generally incorporates its potential to erode corporate earnings and impact consumer spending, thus affecting stock valuations. Their analysis considers the Federal Reserve's actions and their influence on inflation and interest rates. Their predictions are dynamic and subject to revision as economic data evolves.

-

Interest Rate Hikes: BofA's analysis incorporates the effect of rising interest rates on corporate borrowing costs and investor risk appetite. Higher rates increase the cost of capital, potentially impacting earnings and leading to lower stock valuations, especially for growth companies. They incorporate interest rate forecasts into their discount rates when determining present value of future cash flows.

-

Geopolitical Risks: BofA's valuation models acknowledge geopolitical risks, considering their potential impact on various sectors and global supply chains. These risks, often difficult to quantify, are incorporated as qualitative factors alongside quantitative data. For example, the war in Ukraine is a major geopolitical variable impacting energy prices and supply chains and is considered when evaluating energy sector valuations.

BofA's Recommendations for Investors

Based on their valuation analysis and economic forecasts, BofA typically offers diversified investment strategies:

-

Long-Term vs. Short-Term: BofA generally advises long-term investors to maintain a strategic asset allocation approach, focusing on their long-term goals and risk tolerance rather than reacting to short-term market fluctuations. Short-term investors, however, might need to be more cautious and potentially more liquid.

-

Asset Class Recommendations: Specific asset class recommendations vary depending on the economic outlook and market conditions. BofA might suggest a mix of equities, bonds, and potentially alternative investments, adjusting the allocation based on their assessment of relative valuations and risk. They frequently mention the importance of diversifying to manage risk.

-

Risk Tolerance: BofA consistently emphasizes the importance of aligning investment decisions with individual risk tolerance. Investors with a higher risk tolerance may be advised to maintain a higher equity allocation, while more risk-averse investors might favor a more conservative approach with a larger bond allocation.

Alternative Perspectives on Stock Market Valuations

It's crucial to acknowledge that BofA's perspective isn't the only one. Other financial institutions and analysts hold differing views on stock market valuations:

-

Contrasting Viewpoints: Some analysts might argue that valuations are significantly overextended and predict a market correction. Others might offer more optimistic views, pointing to potential future earnings growth and technological innovation. It's beneficial to compare diverse opinions and arrive at your own considered judgment.

-

Limitations of Valuation Metrics: It's important to remember that relying solely on valuation metrics to predict future market performance has limitations. Unexpected economic events or shifts in investor sentiment can significantly influence market behavior.

-

Independent Research: Investors should conduct thorough independent research and due diligence before making any investment decisions. Relying on a single source, even a reputable one like BofA, is risky.

Conclusion

BofA's analysis of current stock market valuations offers a valuable perspective, acknowledging the elevated levels but also considering mitigating factors. They address key investor concerns regarding inflation, interest rates, and geopolitical risks, offering diversified investment strategies tailored to different risk tolerances. However, investors must remember to consider alternative viewpoints and conduct thorough research before making any decisions. Understanding stock market valuations is crucial for navigating market volatility and achieving your long-term financial goals. Stay informed about stock market valuations and continue to monitor BofA's analysis and other expert opinions to make well-informed investment decisions. Learn more about BofA's insights and other key factors affecting stock market valuations to build a robust investment strategy.

Featured Posts

-

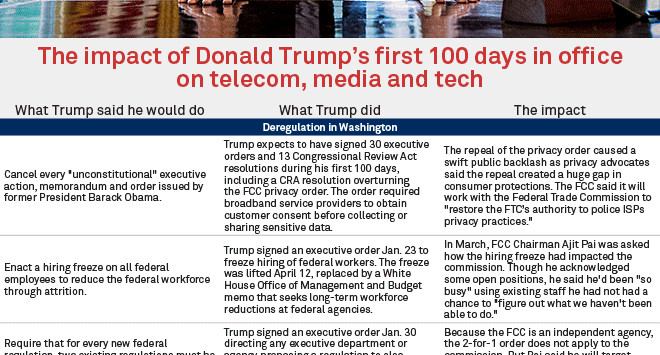

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025 -

Trump On Annexing Canada Xi Jinping And Avoiding Term Limits Highlights From Time Interview

Apr 28, 2025

Trump On Annexing Canada Xi Jinping And Avoiding Term Limits Highlights From Time Interview

Apr 28, 2025 -

U S Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025

U S Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Can We Curb Americas Truck Bloat Exploring Practical Solutions

Apr 28, 2025

Can We Curb Americas Truck Bloat Exploring Practical Solutions

Apr 28, 2025 -

The Great Sell Off How Retail Investors Profited From Market Swings

Apr 28, 2025

The Great Sell Off How Retail Investors Profited From Market Swings

Apr 28, 2025

Latest Posts

-

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025

The U S Dollar And Presidential Economic Policy A Case Study Of The Nixon Administration And Beyond

Apr 28, 2025 -

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025

Could The U S Dollar Experience Its Worst Start Since Nixon An Economic Assessment

Apr 28, 2025 -

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025

U S Dollars First 100 Days A Historical Perspective And Economic Forecast

Apr 28, 2025 -

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025 -

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025

The U S Dollar A Troubled First 100 Days Under The Current Presidency

Apr 28, 2025