Stock Market Reaction To Tax Bill: Bonds Fall, Bitcoin Rises - Live Analysis

Table of Contents

Bond Market Decline: A Tax Bill Fallout

The bond market is experiencing a significant downturn following the implementation of the new tax bill. Several factors contribute to this decline, primarily centered around increased interest rates and shifting investor sentiment. Keywords: Bond market, interest rates, yield curve, treasury bonds, fixed income, inflation expectations.

-

Increased Interest Rates Due to Increased Government Borrowing: Tax cuts often lead to increased government borrowing to offset reduced revenue. This increased demand for funds pushes interest rates higher, making existing bonds less attractive. The government needs to issue more treasury bonds to finance its deficit, increasing supply and potentially lowering bond prices (all else being equal).

-

Shift in Investor Sentiment: Risk-On vs. Risk-Off Strategies: The tax bill's impact on the economy is uncertain. Many investors are adopting a "risk-on" strategy, moving away from the perceived safety of fixed-income assets like bonds toward assets they anticipate will perform better in a potentially stronger (but also potentially riskier) economy. This shift reduces demand for bonds, impacting their prices.

-

Impact on Yield Curve: Steepening or Flattening?: The yield curve, which illustrates the relationship between bond yields and their maturities, is closely watched. A steeper curve (longer-term bond yields significantly higher than short-term yields) might signal growing confidence in future economic growth. Conversely, a flattening curve could indicate concerns about future economic slowdown. The tax bill's impact on the yield curve is a key indicator of investor sentiment and future economic prospects.

-

Specific Examples of Bond Price Drops: We've already seen notable declines in the prices of various treasury bonds, with 10-year Treasury yields notably rising. This is directly linked to the increased borrowing needs discussed above. Corporate bond yields are also increasing, reflecting the higher cost of borrowing for companies. Even municipal bonds, typically considered less risky, are feeling the pressure.

-

Bullet Points:

- Treasury yields are rising significantly.

- Corporate bond yields are increasing, impacting corporate borrowing costs.

- Municipal bond yields are also showing upward pressure.

Bitcoin's Unexpected Surge: A Safe Haven or Speculation?

While the bond market falters, Bitcoin has seen a surprising surge. This rise sparks debate: is it a flight to safety or fueled by speculation? Keywords: Bitcoin, cryptocurrency, digital assets, safe haven, price volatility, market speculation, regulatory uncertainty.

-

Potential Flight to Alternative Assets: Investors seeking refuge from the uncertainty surrounding the tax bill's long-term effects on traditional markets may be turning to alternative assets like Bitcoin. This is partly driven by a perception of Bitcoin as a less correlated asset to traditional markets.

-

Uncertainty Surrounding the Tax Bill's Long-Term Effects: The ambiguity surrounding the tax bill's ultimate economic consequences pushes some investors toward assets perceived as less susceptible to the ripple effects of these changes. Bitcoin, due to its decentralized nature, fits this description for some.

-

Bitcoin's Perceived Inflation Hedge: Concerns about increased government spending and potential inflation, stemming from the tax bill, could drive investors to Bitcoin, viewed by some as a potential hedge against inflation. Its limited supply is a key factor in this perception.

-

Speculative Trading Activity Driving Price Increase: It's crucial to acknowledge the role of speculation in Bitcoin's price movements. The cryptocurrency market is highly volatile, and any news, whether real or perceived, can significantly impact prices. Increased trading volume reflects this heightened speculative activity.

-

Bullet Points:

- Bitcoin price charts show a significant increase following the tax bill's passage.

- Bitcoin trading volume has notably increased, indicating heightened market activity.

- Recent news articles discussing Bitcoin's correlation with macroeconomic uncertainty are noteworthy.

Stock Market's Mixed Response: Sectoral Variations

The stock market's response to the tax bill is less uniform than that of bonds and Bitcoin. Sectoral variations are noteworthy. Keywords: Stock market indices, equity market, sector performance, economic growth, market volatility, investor confidence.

-

Analysis of Major Stock Market Indices: Major indices like the S&P 500 and Dow Jones Industrial Average are showing mixed results. Some sectors benefit from the tax bill's provisions, while others are negatively impacted.

-

Performance of Different Sectors: Technology stocks, for instance, might see increased investor interest, while sectors heavily reliant on government contracts might react differently depending on the bill's specifics. Financial stocks could experience volatility based on shifting interest rates. Consumer goods companies may be affected by changes in consumer spending patterns.

-

Investor Reaction Based on Sector-Specific Impacts: Investors are closely scrutinizing how each sector is affected by the tax changes. Those that benefit from lower corporate tax rates might see their stock prices rise, while others might see a decline.

-

Assessment of Overall Market Sentiment: The overall market sentiment is cautious optimism, with significant volatility expected as the market adjusts to the new tax landscape. Investor confidence remains a crucial element to monitor.

-

Bullet Points:

- Specific examples of stock price changes within different sectors should be included, citing sources.

- Analyst opinions and predictions on future market performance should be mentioned.

- The impact on different market capitalization stocks (large-cap, mid-cap, small-cap) warrants discussion.

Conclusion

The new tax bill has undeniably created a ripple effect across financial markets, resulting in a notable sell-off in the bond market and a surprising surge in Bitcoin's value. The stock market's reaction is more nuanced, with varying performances across different sectors. Understanding these diverse market reactions demands a careful consideration of the bill's implications for interest rates, inflation, and overall investor sentiment.

Call to Action: Stay informed about the ongoing stock market reaction to the tax bill by following our live analysis and updates. Understanding the interplay between bonds, Bitcoin, and traditional equities is critical for navigating this dynamic market environment. Continue to monitor our website for further live analysis on the economic impact of this legislation. Subscribe to our newsletter for timely updates and in-depth analysis.

Featured Posts

-

Aex Stijgt Na Trumps Aankondiging Positief Herstel Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trumps Aankondiging Positief Herstel Voor Alle Fondsen

May 24, 2025 -

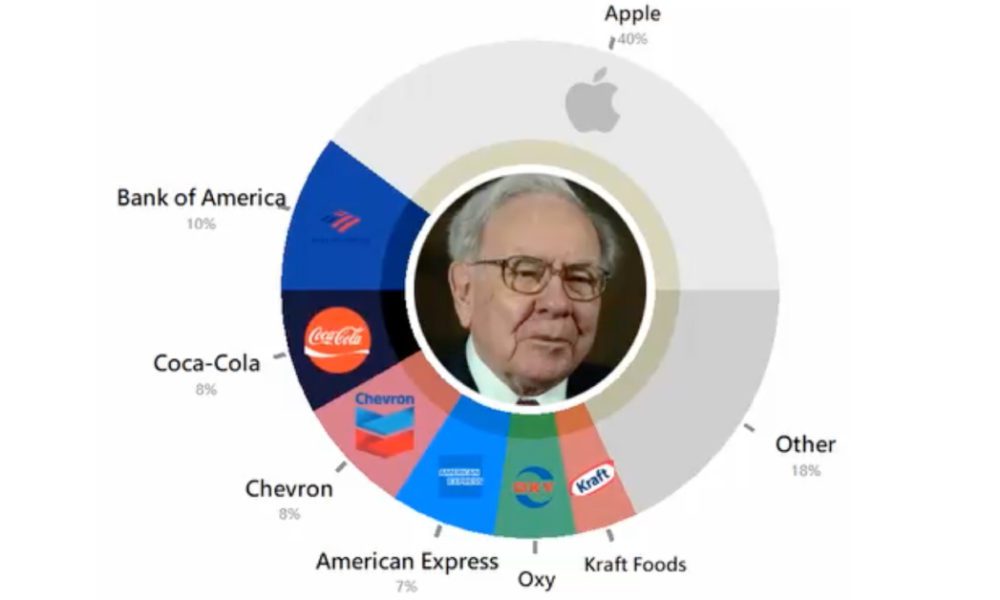

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025

Buffetts Succession At Berkshire Hathaway Impact On Apple Investment

May 24, 2025 -

Mengungkap Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 24, 2025

Mengungkap Sejarah Porsche 356 Warisan Zuffenhausen Jerman

May 24, 2025 -

Cac 40 Weekly Performance Mixed Results For March 7 2025

May 24, 2025

Cac 40 Weekly Performance Mixed Results For March 7 2025

May 24, 2025 -

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia A Photo Gallery

May 24, 2025

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia A Photo Gallery

May 24, 2025

Latest Posts

-

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025

Kermits Commencement Speech University Of Maryland Class Of 2025

May 24, 2025 -

University Of Maryland Selects Kermit The Frog For 2025 Commencement Speech

May 24, 2025

University Of Maryland Selects Kermit The Frog For 2025 Commencement Speech

May 24, 2025 -

Kermit The Frog 2025 University Of Maryland Graduation Speaker

May 24, 2025

Kermit The Frog 2025 University Of Maryland Graduation Speaker

May 24, 2025 -

Kazakhstans Billie Jean King Cup Win A Detailed Look At The Australia Match

May 24, 2025

Kazakhstans Billie Jean King Cup Win A Detailed Look At The Australia Match

May 24, 2025 -

Billie Jean King Cup Qualifier Kazakhstans Stunning Win Against Australia

May 24, 2025

Billie Jean King Cup Qualifier Kazakhstans Stunning Win Against Australia

May 24, 2025