Is This Hot New SPAC Stock The Next MicroStrategy? Investor Analysis

Table of Contents

Understanding the SPAC and its Target Company

The SPAC's Track Record and Management Team

Analyzing a SPAC's history is crucial before considering investment. We need to look beyond the hype and examine the SPAC's past performance, the experience of its sponsors, and the overall competence of its management team. These factors are key indicators of trustworthiness and potential future success. A strong track record suggests a higher likelihood of successful acquisitions and subsequent returns for investors.

- Key Achievements: Identify any previous successful SPAC mergers and the resulting returns for investors. A history of successful exits demonstrates competence in identifying and integrating promising target companies.

- Prior Successful Investments: Examine the investment history of the SPAC's sponsors. Successful investments in other ventures indicate experience and an ability to identify growth opportunities.

- Relevant Industry Expertise: Assess the experience of the management team within the target company's industry. Deep industry knowledge is essential for navigating the complexities of the market and successfully integrating the acquired business.

Keyword integration: SPAC performance, SPAC management team, SPAC track record, SPAC mergers.

The Target Company's Business Model and Potential

Understanding the target company's business model, revenue streams, and competitive landscape is paramount. This requires a deep dive into its operations and future growth projections. A strong business model with clear competitive advantages is crucial for long-term success and potential returns mirroring MicroStrategy's Bitcoin strategy.

- Industry Description: Clearly define the industry the target company operates in, including its size, growth potential, and overall market trends.

- Unique Selling Points (USPs): Identify what makes the target company different and better than its competitors. Strong USPs are essential for market differentiation and sustained growth.

- Competitive Advantages: Analyze the target company's strengths relative to its competitors. This includes factors such as technological innovation, brand recognition, pricing strategies, and access to resources.

- Market Share: Determine the target company's current market share and its potential for future market share growth. This provides insight into its market position and potential for future expansion.

Keyword integration: Target company, business model, revenue streams, competitive landscape, market share.

Comparing to MicroStrategy's Bitcoin Strategy

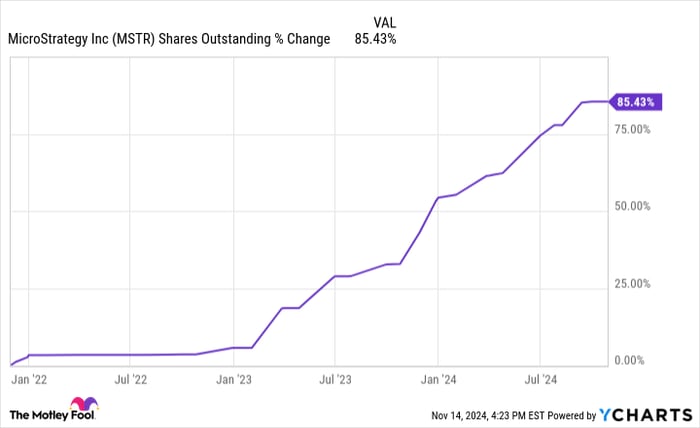

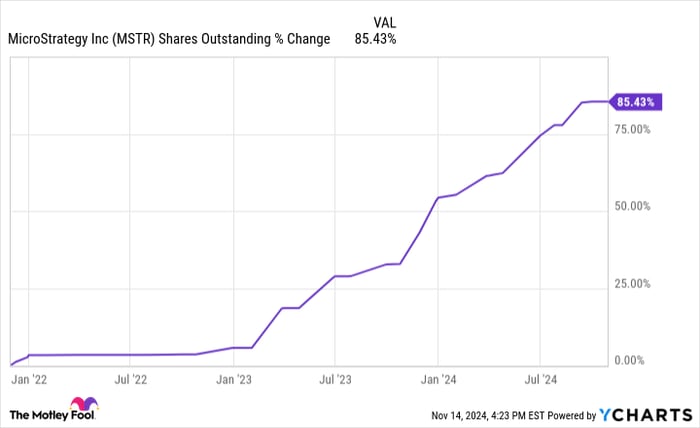

MicroStrategy's Success and Risks

MicroStrategy's significant investment in Bitcoin has been both a success and a risk. Analyzing this strategy allows us to understand the potential rewards and pitfalls of similar approaches. This section will focus on the key factors that contributed to MicroStrategy's success and the inherent risks associated with cryptocurrency investments.

- Returns on Bitcoin: Quantify MicroStrategy's returns on its Bitcoin investment, outlining the periods of significant gains and losses. This provides a tangible example of the potential rewards and volatility of cryptocurrency investments.

- Losses or Setbacks: Acknowledge any losses or setbacks encountered by MicroStrategy during its Bitcoin investment strategy. This demonstrates that even successful investments are subject to market fluctuations and unforeseen risks.

- Strengths and Weaknesses: Discuss the strengths and weaknesses of MicroStrategy's Bitcoin strategy. Identifying these aspects provides valuable insights into potential replication and areas to avoid.

Keyword integration: MicroStrategy Bitcoin, Bitcoin investment, cryptocurrency investment, Bitcoin volatility.

Similarities and Differences between the SPAC and MicroStrategy

To assess the SPAC's potential, we must compare it to MicroStrategy, focusing on their similarities and differences in business models, market positioning, and investment strategies. A key comparison will be the degree of risk tolerance and the strategies used to mitigate potential losses.

| Feature | MicroStrategy | SPAC (Target Company) |

|---|---|---|

| Primary Asset | Bitcoin | [Insert Target Company's Primary Asset/Focus] |

| Investment Strategy | Long-term cryptocurrency holding | [Describe the SPAC's Investment Strategy] |

| Market Position | Dominant player in Bitcoin corporate adoption | [Describe the SPAC Target's Market Position] |

| Risk Tolerance | High | [Assess the SPAC Target's Risk Tolerance] |

Keyword integration: SPAC comparison, MicroStrategy comparison, investment strategy comparison, risk tolerance.

Financial Projections and Risk Assessment

Analyzing the SPAC's Financial Statements

A thorough analysis of the SPAC's financial statements is crucial for evaluating its financial health and potential. This involves examining its balance sheet, income statement, and cash flow statement to identify key financial ratios and indicators.

- Crucial Financial Ratios: Calculate and interpret key financial ratios such as the debt-to-equity ratio, return on assets (ROA), and current ratio. These ratios provide insight into the SPAC's financial stability and profitability.

- Interpretation of Figures: Clearly explain the implications of the calculated financial ratios, highlighting areas of strength and weakness in the SPAC's financial position.

Keyword integration: SPAC financial statements, financial analysis, financial ratios, debt-to-equity ratio, return on assets.

Evaluating the Investment Risks

Investing in a SPAC, particularly one focused on potentially volatile assets, carries inherent risks. A comprehensive risk assessment is necessary to make an informed investment decision.

- Market Volatility: Discuss the impact of market volatility on the SPAC's investment, highlighting the potential for significant price swings.

- Regulatory Uncertainty: Address any regulatory uncertainties or potential changes in regulations that could impact the SPAC's business and investment value.

- Target Company Risks: Assess the specific risks associated with the target company's business, including competitive pressures, operational challenges, and potential legal issues.

- Overall Risk Profile: Summarize the overall risk profile of investing in the SPAC, considering the factors mentioned above.

Keyword integration: SPAC risk, investment risk, market volatility, regulatory uncertainty.

Conclusion

This analysis has compared a promising new SPAC to the success of MicroStrategy's Bitcoin investment. We examined the SPAC's financial health, the target company's potential, and the similarities and differences to MicroStrategy's strategy. While the SPAC shows promise, investing in it carries inherent risks that require careful consideration. The potential for high rewards is balanced by the significant volatility associated with both SPACs and cryptocurrency investments.

Call to Action: Before making any investment decisions regarding this hot new SPAC stock and whether it could become the next MicroStrategy, conduct thorough due diligence and consult with a financial advisor. Remember that investing in any SPAC, particularly those with a focus on cryptocurrencies or other high-growth, high-risk ventures, carries a high degree of risk. Further research into both the SPAC and MicroStrategy's Bitcoin strategy is crucial for informed decision-making. Understanding the nuances of SPAC Stock MicroStrategy Bitcoin investment strategies is paramount for successful investing.

Featured Posts

-

Travis Kalanick Regretting The Decision To Drop Project Name At Uber

May 08, 2025

Travis Kalanick Regretting The Decision To Drop Project Name At Uber

May 08, 2025 -

Xrp Etf Outlook High Supply And Low Institutional Interest Pose Challenges

May 08, 2025

Xrp Etf Outlook High Supply And Low Institutional Interest Pose Challenges

May 08, 2025 -

Aston Villa Ps Zh Analiz Poyedinkiv U Yevrokubkakh

May 08, 2025

Aston Villa Ps Zh Analiz Poyedinkiv U Yevrokubkakh

May 08, 2025 -

Tatums Respectful Comments On Curry Following The Nba All Star Game

May 08, 2025

Tatums Respectful Comments On Curry Following The Nba All Star Game

May 08, 2025 -

Psl 10 Ticket Sales Open Today

May 08, 2025

Psl 10 Ticket Sales Open Today

May 08, 2025

Latest Posts

-

Jayson Tatums Bone Bruise Latest Updates And Game 2 Outlook

May 09, 2025

Jayson Tatums Bone Bruise Latest Updates And Game 2 Outlook

May 09, 2025 -

Boston Celtics Nba Finals Merchandise Shop Now At Fanatics

May 09, 2025

Boston Celtics Nba Finals Merchandise Shop Now At Fanatics

May 09, 2025 -

Jayson Tatums Bone Bruise Game 2 Status Uncertain

May 09, 2025

Jayson Tatums Bone Bruise Game 2 Status Uncertain

May 09, 2025 -

Support The Celtics Find Official Gear At Fanatics

May 09, 2025

Support The Celtics Find Official Gear At Fanatics

May 09, 2025 -

Fanatics Offers The Best Selection Of Boston Celtics Apparel And Merchandise

May 09, 2025

Fanatics Offers The Best Selection Of Boston Celtics Apparel And Merchandise

May 09, 2025