Bitcoin At A Critical Juncture: Key Price Levels To Watch

Table of Contents

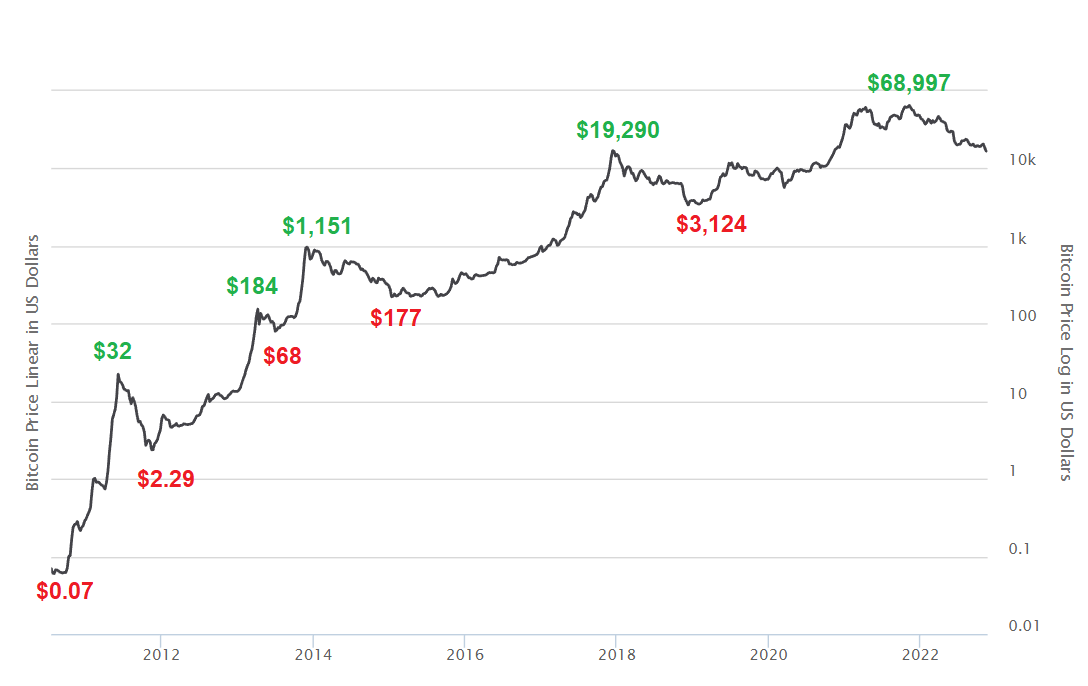

Identifying Key Support Levels for Bitcoin

Support levels in Bitcoin trading represent price points where buying pressure is strong enough to prevent further price declines. These levels act as a "floor," potentially causing a price bounce or reversal. Identifying these crucial support zones is essential for risk management and strategic investment.

The $20,000 Support: A Psychological Barrier

The $20,000 price point holds significant psychological importance for Bitcoin. It represents a major psychological barrier for both buyers and sellers.

- Past Performance: Historically, Bitcoin has shown notable price bounces from around the $20,000 level, indicating strong buyer interest at this point.

- Implications of a Break Below: A decisive break below $20,000 could trigger further selling pressure, potentially leading to a more substantial price correction. Technical indicators like the Relative Strength Index (RSI) and Moving Averages would need to be carefully analyzed for confirmation.

- Technical Indicators: Monitoring indicators like the RSI and MACD around the $20,000 level can provide insights into the strength of buyer support and the potential for a rebound or further decline. (Include a relevant chart here if possible showing historical price action around $20,000)

The $18,000 Support: A More Vulnerable Level

$18,000 represents a lower support level for Bitcoin. A break below this level would signal a more significant weakening of the market.

- Importance: This level could act as a last line of defense before a more substantial price drop.

- Potential Consequences: Breaking through $18,000 could lead to increased panic selling and accelerate a bearish trend.

- Indicators to Watch: Observe volume alongside price action to gauge the conviction behind any break below this level. (Include a relevant chart here if possible showing the $18,000 support area).

Recognizing Dynamic Support: The Ever-Shifting Landscape

It's crucial to remember that support levels aren't static. They shift based on market dynamics.

- Regulatory News: Positive regulatory developments can bolster support levels, while negative news can weaken them.

- Market Adoption: Increased institutional and retail adoption generally strengthens support, while decreased adoption can lower it.

- Macroeconomic Conditions: Global economic events (inflation, recession fears) significantly impact Bitcoin's price and, consequently, its support levels.

Analyzing Crucial Resistance Levels for Bitcoin

Resistance levels mark price points where selling pressure outweighs buying pressure, hindering further price increases. These levels act as a "ceiling," potentially causing price reversals or consolidations.

The $25,000 Resistance: A Significant Hurdle

The $25,000 level has historically acted as a strong resistance zone for Bitcoin. Breaking above it would signal a significant shift in market sentiment.

- Breakout Triggers: High trading volume accompanied by positive news or a breakout from a consolidation pattern could trigger a move above $25,000.

- Historical Context: Review past price charts to observe how Bitcoin reacted to this level in the past.

- Investor Sentiment: A successful break above $25,000 would likely boost investor confidence and attract further investment. (Include a relevant chart here showing the $25,000 resistance).

The $30,000 Resistance: A Major Psychological Barrier

$30,000 represents another significant psychological resistance level. Overcoming it would suggest a strong bullish trend.

- Potential Price Surge: A break above $30,000 could potentially trigger a substantial price increase.

- Sustained Volume: This breakout needs to be supported by consistent high trading volume to confirm its validity.

- Potential Corrections: Even after breaking $30,000, expect some price corrections or consolidations before further upward movement. (Include a relevant chart showing the $30,000 resistance area).

Understanding Dynamic Resistance: Adapting to Market Shifts

Just like support levels, resistance levels are not fixed. They're influenced by market forces.

- Regulatory Changes: Positive regulations can push resistance levels higher, while negative ones can lower them.

- Market Adoption Rates: Widespread adoption tends to shift resistance levels upwards.

- Macroeconomic Factors: Global economic conditions significantly influence Bitcoin's price and resistance levels.

Factors Influencing Bitcoin's Price

Several macroeconomic, regulatory, and market-specific factors influence Bitcoin's price significantly.

Macroeconomic Conditions: The Global Impact

Global economic factors significantly influence Bitcoin's price.

- Inflation: High inflation often drives investors towards Bitcoin as a hedge against inflation.

- Interest Rates: Rising interest rates can negatively impact Bitcoin's price, as investors may move to higher-yield assets.

- Recession Fears: During economic uncertainty, Bitcoin's price can be volatile, sometimes acting as a safe haven, other times experiencing sell-offs.

Regulatory Landscape: Government Intervention

Government regulations and policies heavily influence Bitcoin's price.

- Positive Regulations: Clear and favorable regulations can boost investor confidence and increase Bitcoin's price.

- Negative Regulations: Restrictive regulations or bans can lead to price drops.

- Regulatory Uncertainty: Uncertainty regarding future regulations can create volatility.

Market Sentiment and Adoption: The Power of Belief

Investor sentiment and the rate of Bitcoin adoption play a crucial role in price fluctuations.

- Positive News: Positive news about Bitcoin (e.g., institutional adoption, technological advancements) usually boosts prices.

- Negative News: Negative news (e.g., security breaches, regulatory crackdowns) typically results in price drops.

- Social Media Sentiment: Monitoring social media sentiment can provide insights into prevailing market sentiment and potential price movements.

Conclusion

Bitcoin is currently at a crucial juncture, with several key price levels to watch closely. Understanding both support and resistance levels, alongside the broader macroeconomic and regulatory influences, is vital for informed decision-making in this volatile market. By carefully monitoring these levels and the factors affecting them, investors can better position themselves for both potential gains and mitigate risks. Stay informed and continue to track these Bitcoin price levels for a more comprehensive investment strategy. Remember to always conduct thorough research and consider your risk tolerance before making any investment decisions.

Featured Posts

-

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025 -

5 War Films Where Action Meets Emotional Depth

May 08, 2025

5 War Films Where Action Meets Emotional Depth

May 08, 2025 -

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025 -

Ceku I Transferimit Te Neymar 222 Milione Euro Deshmi Fotografike Dhe Zbulimet E Agjentit

May 08, 2025

Ceku I Transferimit Te Neymar 222 Milione Euro Deshmi Fotografike Dhe Zbulimet E Agjentit

May 08, 2025 -

Lidls Plus App Faces Legal Challenge From Consumer Group

May 08, 2025

Lidls Plus App Faces Legal Challenge From Consumer Group

May 08, 2025

Latest Posts

-

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025 -

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025 -

Thousands To Lose Dwp Benefits April 5th Changes Explained

May 08, 2025

Thousands To Lose Dwp Benefits April 5th Changes Explained

May 08, 2025 -

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025 -

Dwp Notification 12 Benefits Update Your Bank Account Information

May 08, 2025

Dwp Notification 12 Benefits Update Your Bank Account Information

May 08, 2025