Should You Invest In Uber Technologies (UBER)? A Detailed Look

Table of Contents

Uber's Business Model and Revenue Streams

Uber's success hinges on a diversified business model, encompassing ride-sharing, food delivery, and freight services. Understanding these revenue streams is crucial for assessing the company's overall potential.

Ride-Sharing Services: The Foundation

Uber's ride-sharing services remain its core business. While it faces competition from Lyft and other regional players, Uber maintains a significant global market share.

- Growth Potential in Emerging Markets: Untapped markets in developing countries offer substantial growth opportunities for Uber's ride-hailing services.

- Impact of Regulations: Stringent regulations and licensing requirements in various regions pose a challenge, impacting operational costs and expansion strategies.

- Pricing Strategies: Uber's dynamic pricing model, while effective in managing demand, can also lead to public criticism and regulatory scrutiny. Competition dictates pricing strategies, requiring constant adaptation.

Uber Eats and Food Delivery: A Growing Appetite

Uber Eats has rapidly become a major competitor in the lucrative food delivery market, battling giants like DoorDash and Grubhub.

- Growth in Grocery Delivery: The expansion into grocery delivery has broadened Uber Eats' reach and customer base, capitalizing on the increasing demand for convenient grocery shopping options.

- Expansion into New Markets: Continuous expansion into new geographic areas and partnerships with local restaurants are essential for sustaining growth in this highly competitive market segment.

- Impact of Macroeconomic Factors: Economic downturns can significantly impact consumer spending on food delivery, affecting Uber Eats' profitability.

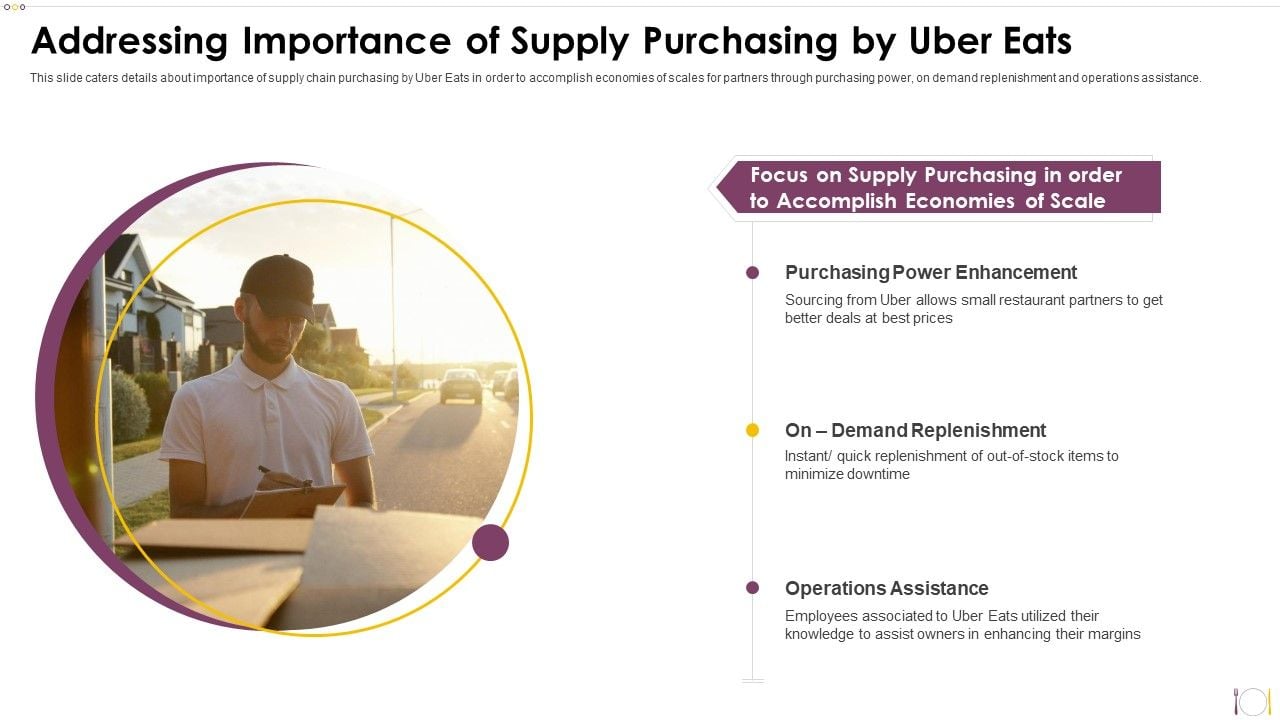

Freight and Logistics: A Long-Haul Play

Uber Freight targets the burgeoning trucking industry, leveraging technology to connect shippers and carriers.

- Supply Chain Challenges: Navigating the complexities of the supply chain, including driver shortages and fluctuating fuel prices, presents significant operational hurdles.

- Technological Innovation: Uber's investment in technological solutions, such as route optimization and efficient dispatch systems, is crucial for maintaining a competitive edge.

- Competitive Advantages: The scale and reach of Uber's network provide a significant competitive advantage in the freight and logistics market.

Financial Performance and Growth Prospects

Analyzing Uber's financial performance is vital for understanding its investment potential.

Revenue Growth and Profitability

Uber has demonstrated significant revenue growth, though profitability remains a key challenge.

- Key Financial Ratios: Investors should carefully examine key financial ratios like the Price-to-Earnings (P/E) ratio, debt-to-equity ratio, and free cash flow to assess the company's financial health.

- Debt Levels: High debt levels can impact the company's financial flexibility and ability to withstand economic downturns.

- Profitability Trends: Tracking Uber's progress in achieving sustainable profitability across its various business segments is essential for long-term investment decisions.

Future Growth Drivers

Several factors contribute to Uber's future growth potential.

- Technological Advancements: Investments in autonomous vehicle technology and artificial intelligence could significantly improve efficiency and reduce operational costs.

- Strategic Partnerships: Collaborations with other businesses can expand Uber's reach and access new markets.

- Expansion into New Markets: Exploring and penetrating new geographic areas presents significant opportunities for revenue growth.

Risks and Challenges Facing Uber

Investing in UBER requires acknowledging substantial risks.

Regulatory Hurdles and Legal Battles

Uber faces ongoing regulatory challenges concerning driver classification, data privacy, and antitrust concerns.

- Driver Classification: The debate over classifying drivers as employees versus independent contractors continues to impact operational costs and legal liabilities.

- Data Privacy: Protecting user data and complying with stringent data privacy regulations is crucial for maintaining customer trust and avoiding legal issues.

- Antitrust Concerns: Competition authorities around the world scrutinize Uber's market dominance, posing potential legal and regulatory risks.

Competition and Market Saturation

Intense competition and potential market saturation pose significant threats to Uber's long-term growth.

- Competitive Pricing: The need to maintain competitive pricing can squeeze profit margins.

- Market Share Dynamics: The ongoing battle for market share with competitors requires continuous innovation and adaptation.

- Innovation by Competitors: Competitors are constantly innovating, introducing new services and technologies that could erode Uber's market position.

Economic Factors and Macroeconomic Risks

Economic downturns and inflation can negatively impact Uber's business.

- Fuel Prices: Fluctuations in fuel prices directly affect the cost of providing ride-sharing and freight services.

- Consumer Spending: Reduced consumer spending during economic downturns can lead to lower demand for Uber's services.

- Economic Recession Risks: A recession can significantly impact Uber's revenue and profitability.

Valuation and Investment Considerations

Before investing in UBER, a thorough valuation is essential.

Stock Valuation

Various valuation methods can be employed to assess Uber's intrinsic value.

- Price-to-Earnings Ratio (P/E): Comparing Uber's P/E ratio to industry peers and historical trends helps assess its relative valuation.

- Price-to-Sales Ratio (P/S): This ratio provides insights into Uber's revenue generation capacity.

- Market Capitalization: Understanding Uber's market capitalization gives context to its overall valuation in the market.

Investment Strategy

Your investment approach should align with your risk tolerance and financial goals.

- Risk Tolerance: Uber's stock is considered relatively high-risk due to its volatile nature and the inherent uncertainties within the ride-sharing market.

- Investment Goals: Define your investment goals – are you looking for short-term gains or long-term growth?

- Portfolio Diversification: Diversifying your investment portfolio is crucial to mitigate risks associated with individual stocks like UBER.

Conclusion: Should You Invest in Uber Technologies (UBER)?

Investing in Uber Technologies (UBER) presents both exciting opportunities and significant challenges. The company's diversified business model, strong brand recognition, and potential for technological innovation offer substantial long-term growth potential. However, intense competition, regulatory hurdles, and macroeconomic risks must be carefully considered. Before investing in UBER, conduct thorough due diligence, analyze financial statements, understand the competitive landscape, and assess your risk tolerance. Consult with a qualified financial advisor to create an investment strategy that aligns with your individual goals. Regularly monitor UBER stock performance and the ride-sharing market to make informed decisions. The long-term potential for growth in the UBER stock and the wider ride-sharing market remains considerable, but careful consideration and ongoing monitoring are paramount.

Featured Posts

-

Transferred Files Best Practices For Secure File Transfer And Storage

May 08, 2025

Transferred Files Best Practices For Secure File Transfer And Storage

May 08, 2025 -

Arsenal Ps Zh Barselona Inter Rozklad Ta Prognozi Pivfinaliv Ligi Chempioniv 2024 2025

May 08, 2025

Arsenal Ps Zh Barselona Inter Rozklad Ta Prognozi Pivfinaliv Ligi Chempioniv 2024 2025

May 08, 2025 -

Ukrainian Cemetery Scandal Financial Abuse Of War Victims

May 08, 2025

Ukrainian Cemetery Scandal Financial Abuse Of War Victims

May 08, 2025 -

Bayern Munich Stunned By Inter Milan In Champions League Quarterfinal

May 08, 2025

Bayern Munich Stunned By Inter Milan In Champions League Quarterfinal

May 08, 2025 -

Greenlands Geopolitical Importance A Look At Us China Tensions

May 08, 2025

Greenlands Geopolitical Importance A Look At Us China Tensions

May 08, 2025

Latest Posts

-

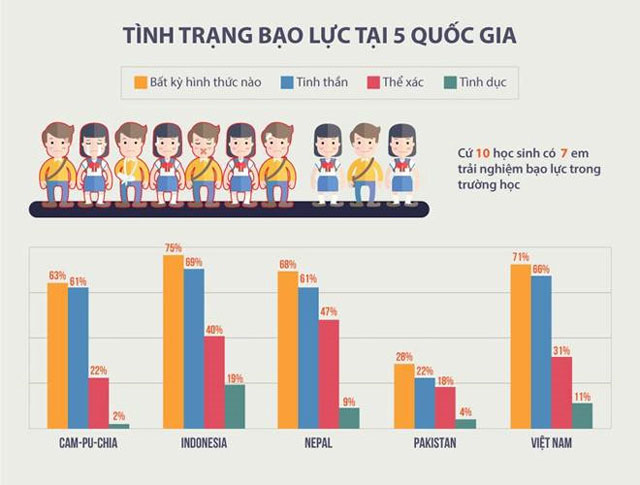

Su Viec Bao Mau Bao Hanh Tre Em O Tien Giang Hau Qua Va Bai Hoc Kinh Nghiem

May 09, 2025

Su Viec Bao Mau Bao Hanh Tre Em O Tien Giang Hau Qua Va Bai Hoc Kinh Nghiem

May 09, 2025 -

Bao Hanh Tre Em Tai Tien Giang Phai Xu Ly Nghiem Va Ngan Chan Tuong Tu

May 09, 2025

Bao Hanh Tre Em Tai Tien Giang Phai Xu Ly Nghiem Va Ngan Chan Tuong Tu

May 09, 2025 -

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025 -

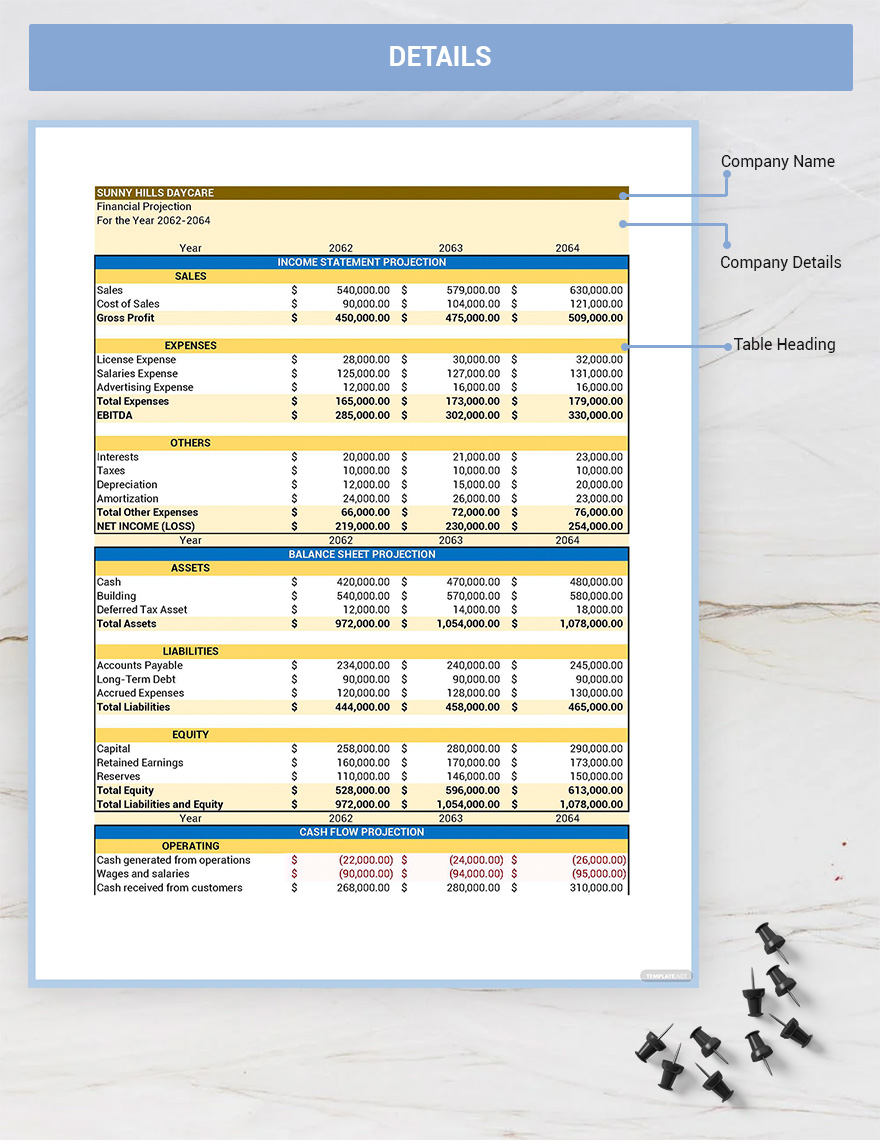

From 3 000 Babysitter To 3 600 Daycare A Financial Nightmare

May 09, 2025

From 3 000 Babysitter To 3 600 Daycare A Financial Nightmare

May 09, 2025 -

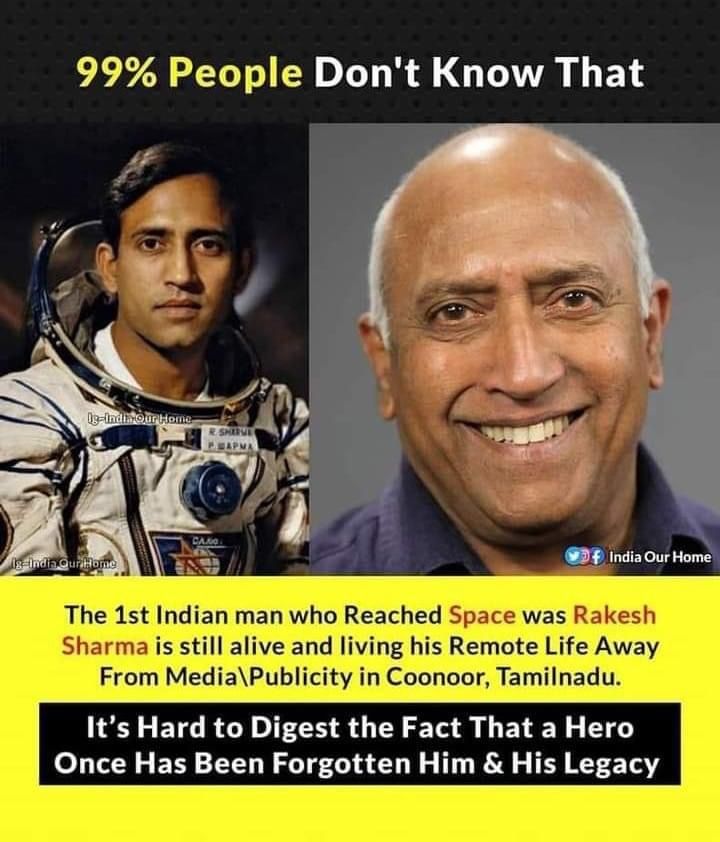

The Current Endeavors Of Rakesh Sharma Indias Pioneer Astronaut

May 09, 2025

The Current Endeavors Of Rakesh Sharma Indias Pioneer Astronaut

May 09, 2025