Should You Invest In This SPAC Targeting MicroStrategy's Market?

Table of Contents

Understanding the MicroStrategy Model and its Market

MicroStrategy's Bitcoin Strategy

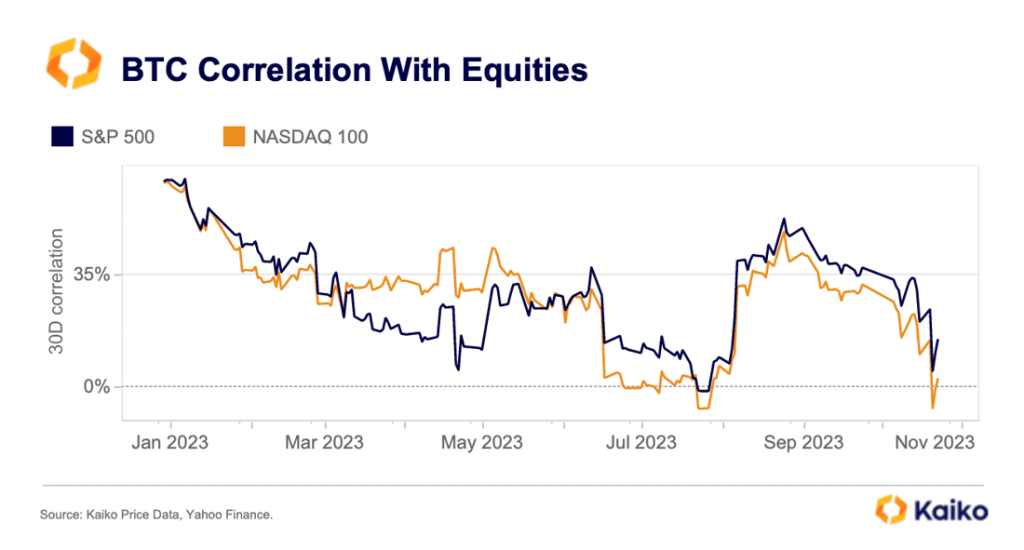

MicroStrategy's significant Bitcoin holdings have dramatically reshaped its image and valuation. This "MicroStrategy Bitcoin Strategy," a bold bet on the future of cryptocurrency, has captivated investors and fueled considerable debate. The company's foray into Bitcoin, a move largely unprecedented for a business intelligence (BI) firm, has redefined its risk profile and market positioning within the broader "Bitcoin Investment Strategy" landscape. However, it’s crucial to remember that this strategy is not without its risks, significantly impacting how we view a SPAC targeting a similar market. The success of this strategy has made the company a benchmark, but also a highly volatile one within the "Business Intelligence Market".

- Analysis of MicroStrategy's financial performance since its Bitcoin adoption: While MicroStrategy's stock price has experienced volatility tied to Bitcoin's price fluctuations, the company has also seen increased investor interest, attracting those seeking exposure to the cryptocurrency market.

- Discussion of the risks and rewards associated with a Bitcoin-centric business model: The primary risk lies in Bitcoin's price volatility, which directly impacts MicroStrategy's balance sheet and overall valuation. However, the potential rewards are equally substantial, offering exposure to a potentially transformative asset class.

- Examination of MicroStrategy's competitive advantages and disadvantages in the BI market: MicroStrategy maintains a strong position in the BI market, but its Bitcoin strategy might divert resources and attention from core business operations.

The Appeal of the MicroStrategy Market

The business intelligence and data analytics sector is experiencing explosive growth. The demand for efficient "Business Intelligence" solutions is driven by the increasing volume of "Big Data" and the need for organizations to extract actionable insights. "Cloud Computing" is further fueling this expansion, providing scalable and cost-effective platforms for data processing and analysis. The market's attractiveness is undeniable, encompassing various sub-sectors such as "Data Analytics," predictive analytics, and data visualization.

- Market size and growth projections: The global business intelligence market is projected to experience significant growth in the coming years, driven by increasing digitization and the need for data-driven decision-making.

- Key industry players and their market share: The market is highly competitive, with established players like Tableau, Power BI, and Qlik competing for market share. New entrants are constantly emerging, adding to the dynamism of the sector.

- Emerging technologies driving market expansion: Advancements in artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are creating new opportunities and driving innovation within the BI sector.

Analyzing the SPAC Opportunity

SPAC Structure and Risks

SPACs, or "Special Purpose Acquisition Companies," are shell corporations that raise capital through an IPO to acquire a private company. Investing in a "SPAC Investment" presents a unique set of advantages and risks. While it offers potential early access to promising companies, the "SPAC Merger" process carries inherent uncertainties. The "SPAC Risks" include dilution of shares for existing investors post-merger, potential management conflicts, and the overall uncertainty associated with the target company's performance after the merger.

- Explanation of the SPAC merger process: SPACs typically have a set timeframe to identify and merge with a target company. If they fail to do so within the allocated time, the investors' money is returned.

- Discussion of common SPAC risks and mitigation strategies: Investors should carefully analyze the SPAC's management team, the target company's financials, and the terms of the merger agreement before investing.

- Analysis of the SPAC's management team and track record: The experience and reputation of the SPAC's management team play a critical role in the success of the merger.

Due Diligence for SPAC Investments in this Sector

Thorough "SPAC Due Diligence" is paramount before investing in any SPAC, particularly in volatile sectors like the one MicroStrategy operates within. Rigorous "Investment Due Diligence," involving detailed "Financial Analysis" and comprehensive "Risk Assessment," is essential. The investment decision should be based on a comprehensive understanding of the target company's business model, financial health, and competitive landscape.

- Key factors to consider when evaluating a SPAC targeting the BI market: Assess the target company's technology, market position, competitive advantages, and management team.

- Methods for assessing the target company's financial health and future prospects: Scrutinize the target company's financial statements, revenue projections, and risk factors.

- Importance of understanding the SPAC's terms and conditions: Carefully review the SPAC's prospectus and merger agreement to understand the terms and conditions of the investment.

Alternative Investment Options

Direct Investments in Established BI Companies

Instead of investing in a SPAC, consider direct investments in established players in the business intelligence market. This approach might offer a less volatile, albeit potentially less lucrative, investment opportunity.

- Comparison of risk profiles between SPAC investments and direct investments: Direct investments in established companies generally carry lower risk than SPAC investments, but may also offer lower potential returns.

- Examples of publicly traded BI companies and their performance: Research publicly traded companies in the BI sector to assess their financial performance and market position.

Diversification Strategies

Diversification is crucial for mitigating risk within any investment portfolio. Consider diversifying your investments across different asset classes and sectors to reduce exposure to any single market.

Conclusion

Investing in a SPAC targeting MicroStrategy's market presents both significant potential rewards and substantial risks. The attractiveness of the business intelligence market is undeniable, but the volatility associated with a Bitcoin-centric business model and the inherent uncertainties of SPAC investments demand careful consideration. Thorough due diligence, including a comprehensive understanding of the SPAC's structure, the target company's financials, and the overall market landscape, is absolutely crucial before making any investment decisions. Remember, understanding the risks and rewards before investing in a SPAC targeting MicroStrategy's market is key to making informed investment choices. Conduct thorough research and due diligence before committing your capital to any such venture.

Featured Posts

-

Colin Cowherds Unwavering Criticism Of Jayson Tatum Is He Underrated

May 08, 2025

Colin Cowherds Unwavering Criticism Of Jayson Tatum Is He Underrated

May 08, 2025 -

Bitcoins Sudden Rise Analysis From Trumps Crypto Advisor

May 08, 2025

Bitcoins Sudden Rise Analysis From Trumps Crypto Advisor

May 08, 2025 -

Bitcoin In Rally Zone Analysts Chart Suggests Potential Upswing May 6th

May 08, 2025

Bitcoin In Rally Zone Analysts Chart Suggests Potential Upswing May 6th

May 08, 2025 -

Ryujinx Emulator Development Halted Nintendos Involvement Explained

May 08, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Explained

May 08, 2025 -

Sonys Ps 5 Pro Everything We Know About The Performance Boost

May 08, 2025

Sonys Ps 5 Pro Everything We Know About The Performance Boost

May 08, 2025

Latest Posts

-

Strong Parks And Streaming Performance Boost Disneys Profit Forecast

May 09, 2025

Strong Parks And Streaming Performance Boost Disneys Profit Forecast

May 09, 2025 -

Record Fentanyl Bust Pam Bondi Details Largest Us Seizure

May 09, 2025

Record Fentanyl Bust Pam Bondi Details Largest Us Seizure

May 09, 2025 -

Disney Parks And Streaming Fuel Increased Profit Projections

May 09, 2025

Disney Parks And Streaming Fuel Increased Profit Projections

May 09, 2025 -

Trumps Unwavering Stance On Tariffs Warners Analysis

May 09, 2025

Trumps Unwavering Stance On Tariffs Warners Analysis

May 09, 2025 -

Pam Bondi And The Upcoming Epstein Files Release

May 09, 2025

Pam Bondi And The Upcoming Epstein Files Release

May 09, 2025