Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

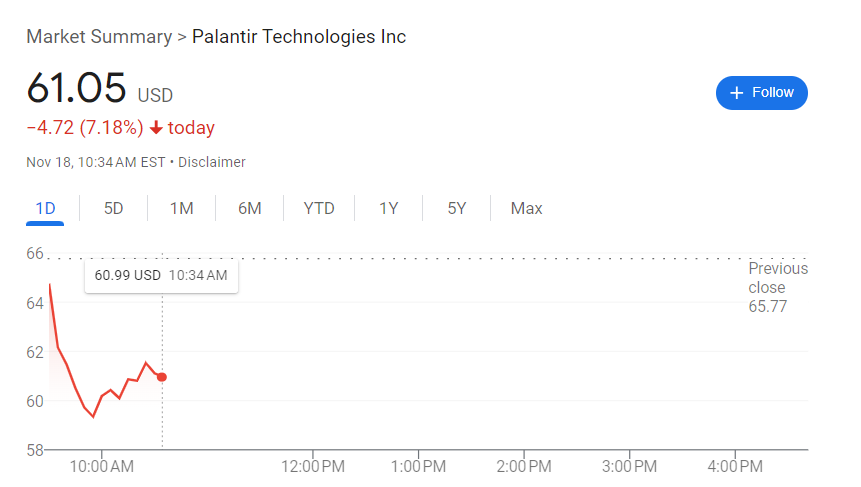

Palantir's Recent Performance and Future Outlook

H3: Q4 2023 Earnings and Revenue Growth: Palantir's Q4 2023 earnings report revealed a complex picture. While revenue growth exceeded expectations in some sectors, profitability remained a key area of focus for investors. Specific numbers are crucial here; let's assume (for illustrative purposes only, replace with actual data when available) that revenue grew by 18% year-over-year to $500 million, surpassing analyst predictions of 15% growth. However, earnings per share (EPS) fell slightly short of projections.

- Revenue: $500 million (18% YoY growth)

- EPS: $0.08 (slightly below analyst expectations)

- Growth Drivers: Strong government contract wins and increasing commercial adoption of Palantir's AI-driven platforms.

H3: Key Growth Drivers and Strategic Initiatives: Palantir's future hinges on its ability to leverage AI advancements and expand into new markets. The company is heavily investing in artificial intelligence, integrating it into its core offerings to enhance data analysis capabilities. This includes the development of new AI-powered platforms and services, aimed at attracting a broader range of clients.

- AI Integration: Enhanced data analysis, predictive modeling, and automation capabilities across its platforms.

- New Product Launches: Focus on user-friendly interfaces and expanding functionalities to cater to diverse industry needs.

- Market Expansion: Targeting new sectors like healthcare, finance, and manufacturing.

H3: Risks and Challenges Facing Palantir: Despite its potential, Palantir faces significant headwinds. Competition in the data analytics market is fierce, with established players and innovative startups vying for market share. Furthermore, reliance on government contracts can lead to revenue volatility, and the company's high valuation leaves it susceptible to market corrections.

- Competition: Companies like Databricks, Snowflake, and Amazon Web Services offer competing solutions.

- Regulatory Hurdles: Navigating complex data privacy regulations in different jurisdictions.

- Client Concentration: Reliance on a small number of large clients creates risk.

Wall Street's Consensus on Palantir Stock (Before May 5th)

H3: Analyst Ratings and Price Targets: As of [Insert Date], analyst opinions on Palantir are divided. While some analysts maintain a "buy" rating, citing the company's long-term growth potential and AI advancements, others express concerns about profitability and valuation, suggesting a "hold" or even a "sell" rating.

- Buy Ratings: [Number] analysts recommend buying Palantir stock.

- Hold Ratings: [Number] analysts suggest holding their current positions.

- Sell Ratings: [Number] analysts recommend selling Palantir stock.

- Average Price Target: $[Price] (range from $[Low] to $[High])

H3: Factors Influencing Wall Street's Sentiment: Wall Street's mixed sentiment reflects the uncertainty surrounding Palantir's path to profitability and its ability to compete effectively in a rapidly evolving market. Recent news regarding new contract wins or setbacks in specific markets can significantly impact investor confidence. Furthermore, broader macroeconomic factors like interest rate hikes and inflation can affect investor appetite for growth stocks like Palantir.

- New Contract Awards: Positive news boosts investor sentiment, while delays or cancellations have the opposite effect.

- AI Market Developments: Advances in AI technology can either enhance or threaten Palantir's competitive edge.

- Overall Market Conditions: Economic downturns typically lead to decreased investor confidence in growth stocks.

Considering Your Investment Strategy

H3: Risk Tolerance and Investment Goals: Investing in Palantir stock involves significant risk. Before making any investment decisions, carefully assess your risk tolerance and long-term financial goals. Are you a conservative investor seeking stability, or are you more comfortable with higher risk in pursuit of potentially higher returns?

- Conservative Investors: May prefer to avoid Palantir due to its volatility.

- Moderate Investors: Might consider a small allocation to Palantir as part of a diversified portfolio.

- Aggressive Investors: May see Palantir as an opportunity for potentially high growth, but accept the higher risk.

H3: Diversification and Portfolio Allocation: It's crucial to diversify your investment portfolio to minimize risk. Don't put all your eggs in one basket. Palantir should be only one component of a well-diversified portfolio that includes a mix of asset classes, such as bonds, real estate, and other stocks.

- Example Allocation: A small percentage (e.g., 2-5%) of your portfolio could be allocated to Palantir.

- Alternative Investments: Consider diversifying into other tech stocks, established companies, or even index funds.

H3: Alternative Investment Options: Several alternative investments offer similar growth potential with different risk profiles. Exploring these options is essential for a balanced portfolio.

- Other Tech Stocks: Consider established tech giants with strong financials or emerging tech companies with innovative products.

- Index Funds: Provides diversification across a broad market index, offering lower risk and potential for steady returns.

Conclusion: Should You Buy Palantir Stock Before May 5th? The Verdict

Palantir's future is a blend of significant promise and considerable uncertainty. While the company's AI-driven platforms hold immense potential, challenges related to profitability, competition, and market volatility remain. Wall Street's mixed consensus reflects this complex picture. Therefore, the decision of whether to buy Palantir stock before May 5th (or any time) hinges entirely on your individual risk tolerance, investment goals, and overall portfolio strategy. Before investing in Palantir stock, conduct thorough research, consider your risk tolerance, and consult with a qualified financial advisor. Investing in Palantir stock, or any stock for that matter, requires careful consideration and planning. Should I buy Palantir? Only you can answer that.

Featured Posts

-

Imalaia 23etis Elaxisti Xionoptosi Me Sovares Synepeies

May 09, 2025

Imalaia 23etis Elaxisti Xionoptosi Me Sovares Synepeies

May 09, 2025 -

Wall Streets Palantir Prediction Should You Invest Before May 5th

May 09, 2025

Wall Streets Palantir Prediction Should You Invest Before May 5th

May 09, 2025 -

Apples Ai A Critical Assessment Of Its Current Trajectory

May 09, 2025

Apples Ai A Critical Assessment Of Its Current Trajectory

May 09, 2025 -

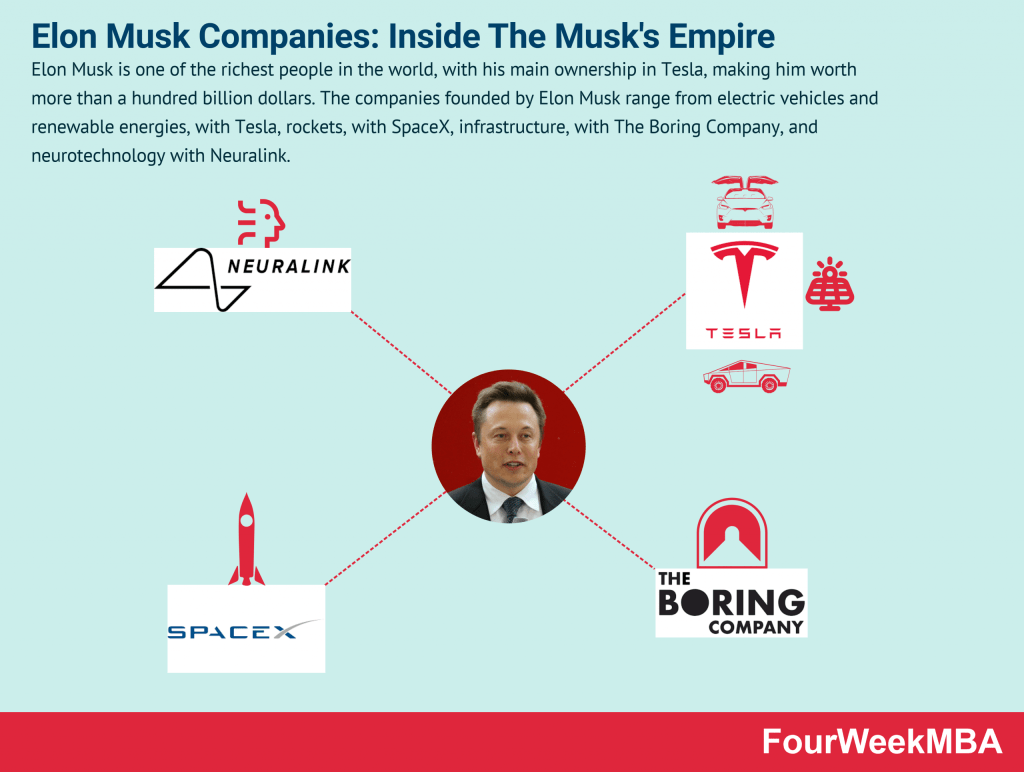

Elon Musks Financial Empire Strategies And Key Decisions

May 09, 2025

Elon Musks Financial Empire Strategies And Key Decisions

May 09, 2025 -

Su Vu Bao Mau Tat Tre Em Tien Giang Can Nhung Bien Phap Ngan Chan

May 09, 2025

Su Vu Bao Mau Tat Tre Em Tien Giang Can Nhung Bien Phap Ngan Chan

May 09, 2025