Elon Musk's Financial Empire: Strategies And Key Decisions

Table of Contents

Early Investments and Foundational Businesses

Elon Musk's financial empire wasn't built overnight. His early entrepreneurial endeavors laid the crucial groundwork for his future successes. These foundational businesses provided the capital and experience necessary to launch his more ambitious projects.

Zip2 and PayPal: Laying the Groundwork

Musk's initial foray into the tech world involved Zip2, a software company providing online city guide services to newspapers. This venture proved highly successful, culminating in its sale to Compaq for $307 million in 1999, providing Musk with a substantial initial capital injection. This success propelled him into his next major venture. He co-founded X.com, an online financial services company, which later merged with Confinity to form PayPal. The subsequent IPO of PayPal in 2002 generated a massive return for Musk, significantly bolstering his financial resources and further solidifying his entrepreneurial acumen.

- Zip2's sale to Compaq: A pivotal moment that provided Musk's first substantial wealth.

- X.com's merger with Confinity: Created PayPal, a dominant force in online payments, significantly increasing Musk's net worth.

- PayPal's IPO: A landmark event that provided Musk with the capital needed for his future ventures.

Strategic Acquisitions and Mergers

Throughout his career, Musk has demonstrated a strategic approach to acquisitions, using them to expand existing businesses and enter new markets. This approach has been particularly evident in his leadership of Tesla.

- Tesla's acquisition strategy: Tesla's acquisitions have often been focused on strengthening its technological capabilities and expanding its product offerings, enhancing its overall market position and value.

- Acquisition of SolarCity: This acquisition integrated solar energy solutions into Tesla's portfolio, diversifying its revenue streams and strengthening its position in the renewable energy sector. It was a strategic move to become a leader in sustainable energy solutions, although it also faced criticism for potential conflicts of interest.

- Rationale behind acquisitions: Musk's acquisitions are frequently driven by a long-term vision to accelerate technological advancements and dominate specific markets. They are not just about acquiring companies, but about accelerating the timeline for achieving his ambitious goals.

Tesla's Role in Musk's Financial Success

Tesla's phenomenal growth has been a primary driver of Elon Musk's immense wealth. Its success story encompasses the production of cutting-edge electric vehicles and the diversification into renewable energy solutions.

From Electric Cars to Energy Solutions

Tesla's impact on Musk's net worth is undeniable. The company's journey from a niche electric vehicle manufacturer to a global leader in sustainable transportation and energy has been remarkable.

- Tesla's IPO: A significant milestone that unlocked substantial value for early investors and Musk himself.

- Success of Model S, Model 3, and Model Y: These models have driven significant sales growth, solidifying Tesla's position as a market leader in electric vehicles.

- Expansion into energy storage solutions with Powerwall and Powerpack: Diversification into renewable energy storage complements Tesla's electric vehicle business, creating a more robust and resilient business model.

Strategic Partnerships and Government Incentives

Tesla's success isn't solely attributable to its innovative products. Strategic partnerships and government incentives have played a vital role in its growth, significantly benefiting Musk's financial position.

- Government incentives for electric vehicles: Government subsidies and tax credits have made electric vehicles more affordable, boosting Tesla's sales and market share.

- Partnerships with energy companies and infrastructure providers: Collaborations have helped Tesla expand its charging infrastructure and integrate its energy solutions into existing grids.

- Impact of these factors on Tesla's growth: These external factors have significantly accelerated Tesla's growth trajectory, contributing substantially to Musk's financial success.

Diversification Beyond Tesla: SpaceX and Other Ventures

Elon Musk's financial empire isn't solely reliant on Tesla. His diversification strategy includes a range of high-risk, high-reward ventures, demonstrating his commitment to long-term growth and innovation.

SpaceX: A High-Risk, High-Reward Venture

SpaceX, Musk's aerospace manufacturer and space transportation services company, represents a significant aspect of his financial portfolio. Its long-term vision and potential for future returns are substantial.

- SpaceX's contracts with NASA and other entities: These contracts provide revenue streams and validate SpaceX's technological capabilities.

- Development of reusable rockets: This innovation significantly reduces the cost of space travel, opening up new opportunities for commercial space exploration.

- Potential for space tourism and colonization: These ambitious goals represent significant future revenue streams, although they involve considerable risk and uncertainty.

The Boring Company, Neuralink, and Other Investments

Musk's investment portfolio extends beyond Tesla and SpaceX. His diverse ventures showcase a commitment to exploring various technological frontiers.

- The Boring Company's tunneling technology and infrastructure projects: This venture aims to revolutionize urban transportation by creating underground tunnel networks.

- Neuralink's brain-computer interface technology: This ambitious project tackles the development of advanced brain-computer interfaces, offering the potential for groundbreaking medical applications.

- Other smaller investments and their potential impact: These investments demonstrate Musk's commitment to exploring various technological avenues and diversifying his risk.

Musk's Risk Management and Investment Strategies

Elon Musk's approach to investment is characterized by a high-risk, high-reward strategy, a willingness to pursue ambitious goals, and a long-term vision.

High-Risk, High-Reward Approach

Musk's willingness to take on significant risks is a defining characteristic of his investment strategy. This approach, while potentially leading to substantial losses, has also yielded immense rewards.

- Examples of risky decisions and their outcomes: Many of Musk's ventures involve significant technological challenges and uncertainties, but successful execution often results in massive returns.

- The importance of innovation and disruption in his approach: Musk consistently seeks to disrupt established industries through innovation, a strategy that is inherently risky but offers the potential for immense gains.

- His long-term vision and its impact on investment decisions: Musk's long-term vision drives his investment decisions, often prioritizing long-term potential over short-term profitability.

Long-Term Vision and Future Planning

Musk's long-term vision plays a central role in shaping his financial decisions. His commitment to sustainable energy and space exploration influences his investment choices.

- The importance of sustainable energy in Musk's vision: This commitment drives his investments in Tesla and related ventures, aiming for a future powered by renewable energy.

- The long-term goals of SpaceX and Neuralink: These ventures represent a commitment to extending human civilization beyond Earth and enhancing human capabilities.

- How these visions shape his financial investments: Musk's financial investments are aligned with his long-term vision, demonstrating a strategic approach to wealth creation beyond immediate financial returns.

Conclusion

Elon Musk's financial empire is a testament to his visionary leadership, bold strategies, and willingness to take calculated risks. From early successes like PayPal to his current ventures in electric vehicles, space exploration, and brain-computer interfaces, his financial journey exemplifies the potential rewards of disruptive innovation and long-term vision. By understanding the key decisions and strategies that have shaped his empire, we can glean valuable insights into building financial success in today's dynamic business landscape. Learn more about the intricacies of Elon Musk's financial empire and discover how his strategies can inspire your own financial goals.

Featured Posts

-

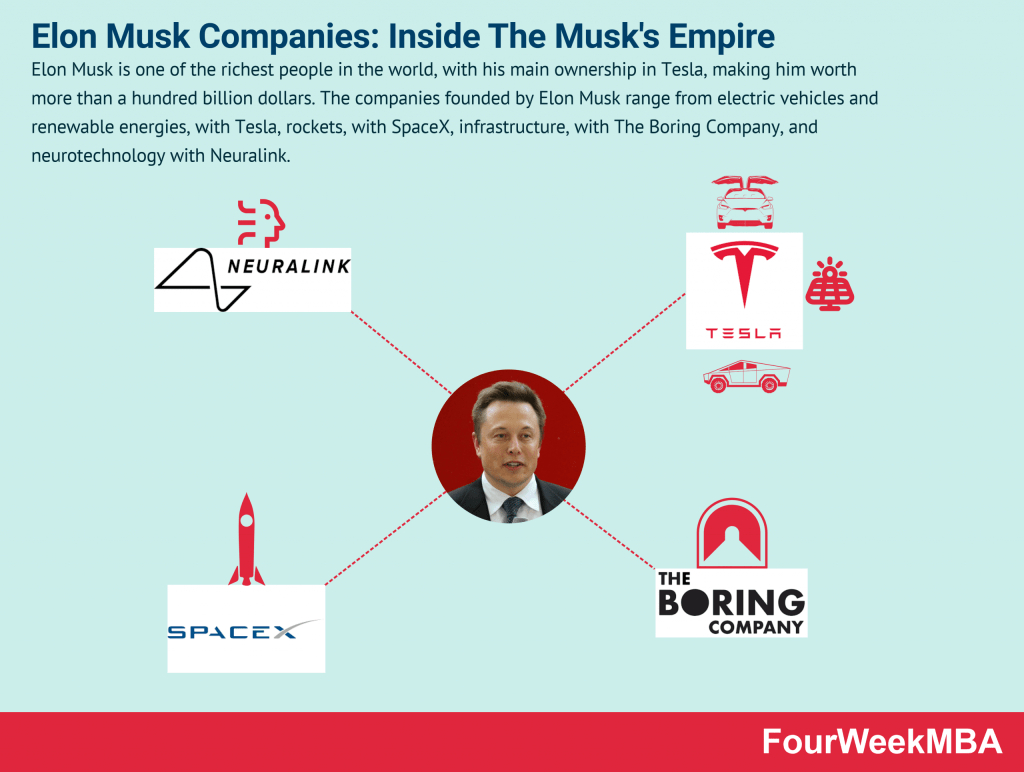

Bundesliga 2 Matchday 27 Colognes Top Spot Takeover

May 09, 2025

Bundesliga 2 Matchday 27 Colognes Top Spot Takeover

May 09, 2025 -

23 20

May 09, 2025

23 20

May 09, 2025 -

Planning Your Summer Trip Understanding Real Id Compliance

May 09, 2025

Planning Your Summer Trip Understanding Real Id Compliance

May 09, 2025 -

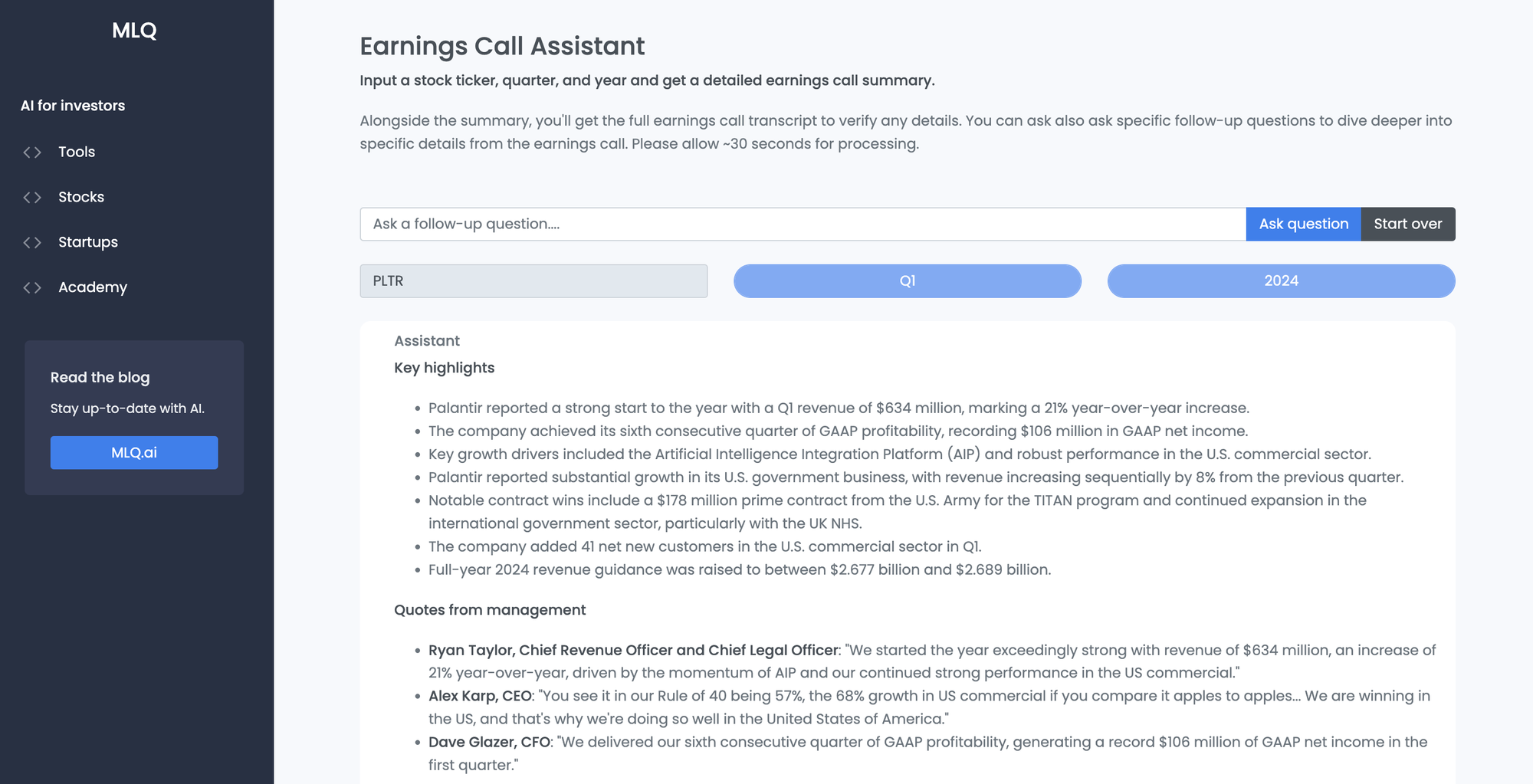

Palantir Stock Analyzing Q1 2024 Government And Commercial Revenue

May 09, 2025

Palantir Stock Analyzing Q1 2024 Government And Commercial Revenue

May 09, 2025 -

Unlock Nyt Strands Game 405 Hints For April 12th

May 09, 2025

Unlock Nyt Strands Game 405 Hints For April 12th

May 09, 2025