Wall Street's Palantir Prediction: Should You Invest Before May 5th?

Table of Contents

Analyzing Wall Street's Palantir Forecasts

H3: Positive Predictions and Their Rationale:

Several prominent analysts hold a bullish outlook on Palantir stock. Their optimism stems from several key factors contributing to Palantir's growth potential. These factors include the company's strong position in securing lucrative government contracts, a rapidly expanding commercial sector showing increased adoption of Palantir's powerful data analytics platform, and significant technological advancements, particularly in the field of Artificial Intelligence (AI) integration.

- Strong Government Contracts: Palantir's Gotham platform is a critical tool for various government agencies, providing a steady stream of revenue and demonstrating the company's ability to deliver sophisticated solutions.

- Growing Commercial Sector: Palantir Foundry, its commercial platform, is gaining traction in diverse industries, indicating a significant expansion beyond its initial government focus.

- AI Integration: Palantir's ongoing investments in AI and machine learning are expected to enhance its offerings and drive future growth, attracting a wider range of clients and applications.

- Analyst Predictions: For example, Analyst X predicts a Palantir price target of $XX by the end of the year, citing the increasing adoption of Foundry as a key driver. Analyst Y has issued a Palantir buy rating with a target price of $YY, emphasizing the long-term growth potential in the government and commercial sectors.

H3: Bearish Predictions and Potential Risks:

Despite the positive outlook, it's crucial to acknowledge potential downsides. Concerns exist regarding Palantir's high valuation relative to its current earnings, intense competition in the burgeoning big data analytics market, its substantial reliance on government contracts for a significant portion of its revenue, and the possibility of slower-than-expected revenue growth.

- High Valuation: Some analysts argue that Palantir's stock price is currently overvalued compared to its financial performance and future projections.

- Competition: The big data analytics market is fiercely competitive, with established players and new entrants constantly vying for market share.

- Government Contract Dependence: Over-reliance on government contracts exposes Palantir to potential changes in government spending or procurement policies.

- Revenue Growth Concerns: While the company has shown growth, there's a risk that this growth may slow down, potentially impacting investor sentiment. Analyst Z expressed caution, highlighting these risks in their Palantir risk assessment report.

Factors to Consider Before Investing in Palantir Before May 5th

H3: Upcoming Events and Their Impact:

The period around May 5th may hold significant events capable of influencing the Palantir share price. Any earnings reports, product launches, or participation in major industry conferences could dramatically shift investor sentiment. A positive earnings surprise, for instance, could lead to a substantial price increase; conversely, disappointing results could trigger a sell-off.

- Palantir Earnings Date: The release of Palantir's earnings report will be a pivotal moment, as it will reveal the company's financial performance and offer insights into its future guidance.

- Potential Product Launches: Any new product announcements or significant updates to existing platforms could generate excitement and drive investor interest.

- Industry Conferences: Palantir's presence at and any announcements made during major industry conferences can significantly impact investor perception.

H3: Diversification and Risk Tolerance:

Before investing in Palantir, or any individual stock, remember the importance of diversification and assessing your personal risk tolerance. Tech stocks, in general, are known for their volatility; Palantir is no exception. A well-diversified portfolio can help mitigate potential losses from any single investment.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce overall risk.

- Assess Your Risk Tolerance: Consider your comfort level with potential losses before investing in a potentially volatile stock like Palantir.

- Long-Term vs. Short-Term Goals: Align your investment timeframe with your risk tolerance and investment objectives.

H3: Fundamental and Technical Analysis:

While a thorough analysis requires expertise, a brief look at both fundamental analysis (examining Palantir's financial statements, growth prospects, and market position) and technical analysis (analyzing chart patterns, trading volume, and indicators) can inform your decision.

- Key Financial Metrics: Review Palantir's revenue growth, profitability, and debt levels to assess its financial health.

- Chart Patterns: Observe the stock's price movements and identify any potential trends or patterns that might indicate future price direction. (Note: Technical analysis should be approached cautiously and ideally with the guidance of a financial professional.)

Conclusion: Making Your Palantir Investment Decision Before May 5th

Investing in Palantir before May 5th presents both opportunities and risks. Wall Street's predictions are varied, with some analysts expressing strong optimism while others caution against potential downsides. Thorough research is crucial, considering both positive growth potential and inherent risks. Remember to assess your risk tolerance, diversify your portfolio, and carefully weigh the potential impact of upcoming events. Understand the fundamentals and consider the technical indicators, but remember to consult with a financial advisor.

Ultimately, the decision of whether or not to invest in Palantir before May 5th rests with you, but armed with this information, you can make a more informed choice.

Featured Posts

-

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025 -

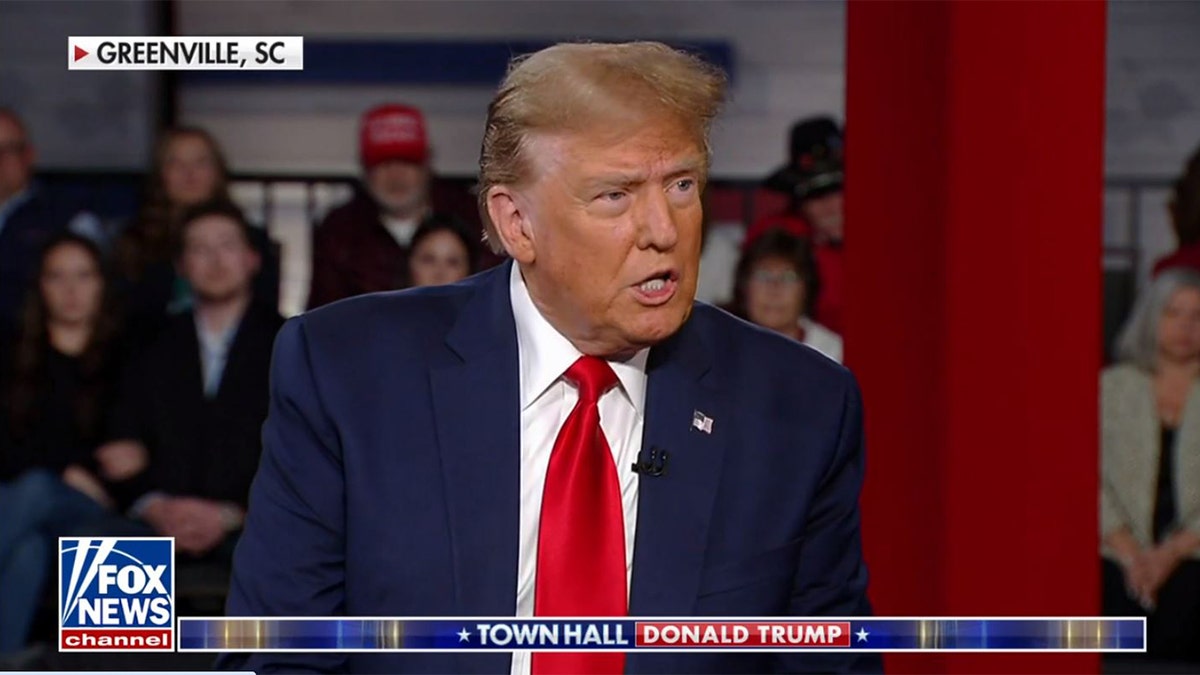

Aoc Condemns Trump On Fox News Sharp Exchange

May 09, 2025

Aoc Condemns Trump On Fox News Sharp Exchange

May 09, 2025 -

The La Wildfires And The Growing Market For Disaster Related Wagers

May 09, 2025

The La Wildfires And The Growing Market For Disaster Related Wagers

May 09, 2025 -

Vstrecha Zelenskogo I Trampa V Vatikane Rezultaty I Kommentariy Makrona

May 09, 2025

Vstrecha Zelenskogo I Trampa V Vatikane Rezultaty I Kommentariy Makrona

May 09, 2025 -

Gambling And The Los Angeles Wildfires A Socioeconomic Analysis

May 09, 2025

Gambling And The Los Angeles Wildfires A Socioeconomic Analysis

May 09, 2025