SEC Review Of Grayscale ETF: Implications For XRP's Price And Future

Table of Contents

Grayscale's Bitcoin ETF Approval and Market Sentiment

The approval of Grayscale's Bitcoin ETF by the SEC would be monumental. It would represent a significant step toward mainstream adoption of Bitcoin, potentially unlocking unprecedented levels of institutional investment. This influx of capital could trigger a surge in positive market sentiment, impacting not only Bitcoin but also altcoins like XRP.

- Increased Liquidity for Bitcoin: A Bitcoin ETF would drastically increase liquidity, making it easier for institutional investors to buy and sell Bitcoin.

- Positive Media Coverage Boosting Investor Confidence: A positive SEC decision would generate widespread positive media coverage, bolstering investor confidence and attracting new capital to the crypto market.

- Potential for Increased Regulatory Clarity: While not a guarantee, approval could signify a move towards greater regulatory clarity within the US crypto market.

- Ripple Effect on Other Cryptocurrencies, Including XRP: The overall positive sentiment and increased liquidity could spill over into the altcoin market, potentially leading to increased demand and price appreciation for XRP.

SEC's Stance on Crypto and its Impact on XRP

The SEC's current stance on cryptocurrencies is cautious, to say the least. Their arguments against previous Bitcoin ETF applications have centered on concerns about market manipulation, investor protection, and the overall regulatory framework. The Grayscale decision could set a powerful precedent, potentially influencing how the SEC approaches other cryptocurrencies, including XRP. The ongoing Ripple lawsuit adds another layer of complexity, as the SEC's decision on Grayscale could be informed by, or influence, their approach in the Ripple case.

- Current Regulatory Uncertainty in the Crypto Market: The lack of clear regulatory guidelines creates uncertainty and hinders widespread institutional adoption.

- The Importance of Regulatory Clarity for Crypto Adoption: Clear regulations are crucial for boosting investor confidence and encouraging broader crypto adoption.

- Potential Scenarios: The SEC could approve, deny, or delay Grayscale's application. Each scenario will have vastly different implications for XRP.

- Impact of Each Scenario on XRP's Price and Trading Volume: Approval could boost XRP's price, while denial might trigger a sell-off. A delay would likely lead to continued market uncertainty.

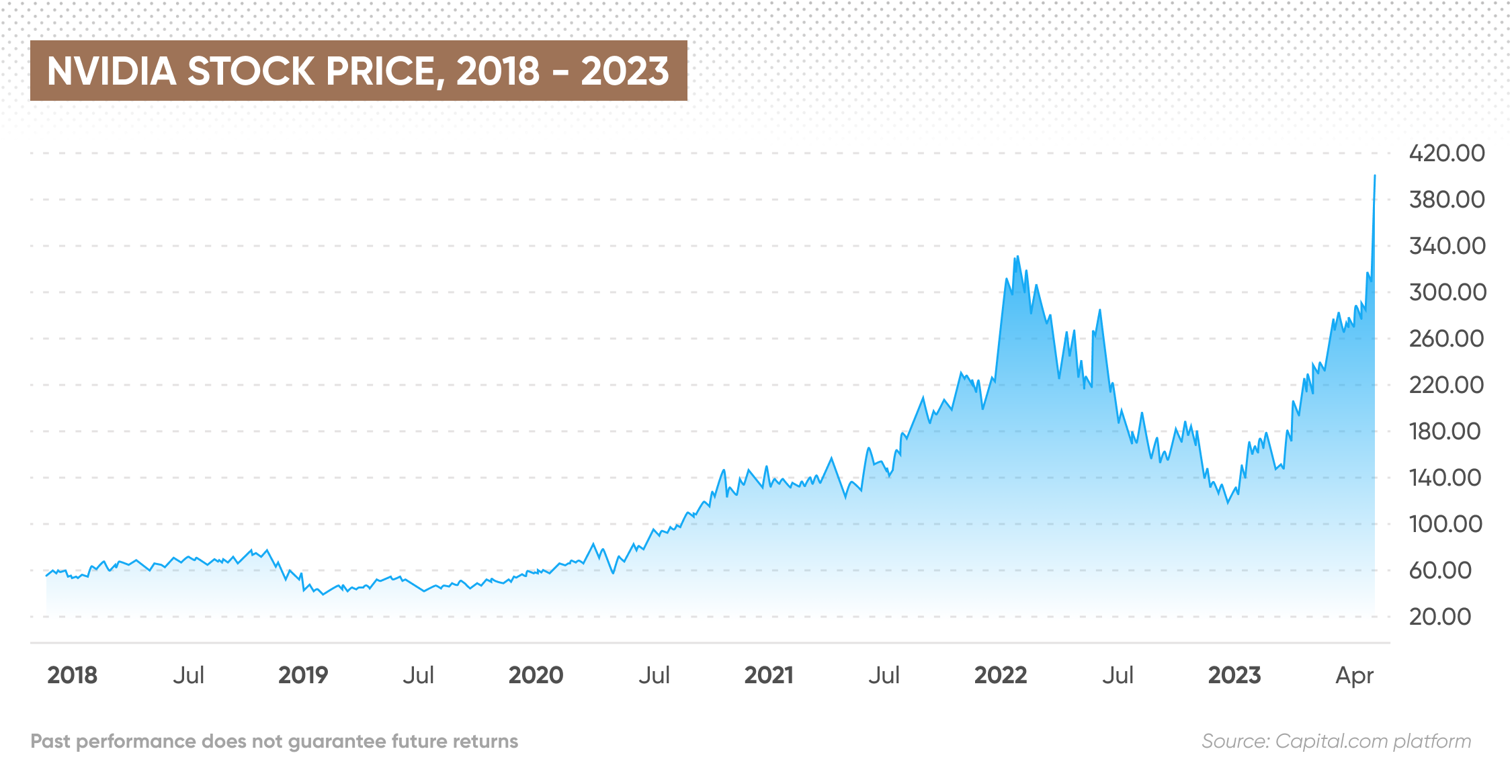

XRP Price Prediction and Market Analysis

Predicting XRP's price is inherently speculative, but analyzing historical price movements and considering the potential outcomes of the SEC's decision provides a framework for informed speculation. XRP's price is often correlated with Bitcoin's price, meaning a positive outcome for Bitcoin could positively affect XRP.

- Technical Analysis Indicators for XRP: Examining indicators like moving averages, RSI, and MACD can offer insights into potential price trends.

- On-Chain Metrics Reflecting XRP Adoption and Utility: Analyzing on-chain data such as transaction volume and network activity can provide valuable information about XRP's real-world usage.

- Market Capitalization and Trading Volume Analysis: Evaluating XRP's market capitalization and trading volume helps to gauge its overall market strength and liquidity.

- Potential Price Targets Based on Different Scenarios: Based on historical data and market sentiment analysis, different price targets can be estimated for various SEC decision outcomes.

Future Implications for XRP and Ripple

The SEC's decision on the Grayscale ETF will have profound and long-lasting implications for XRP and Ripple. A positive outcome could pave the way for increased regulatory clarity, boosting XRP's adoption and potentially influencing Ripple's business strategies.

- Increased Regulatory Clarity for XRP: A positive decision could lead to clearer regulatory guidelines for XRP, facilitating its wider acceptance.

- Potential for Broader Adoption and Integration: Increased regulatory clarity and positive market sentiment could lead to broader adoption by institutions and businesses.

- Long-Term Value Proposition of XRP: The success of XRP hinges on its utility and its ability to solve real-world problems in cross-border payments.

- Impact on Ripple's Ongoing Legal Battle: The SEC's decision could indirectly influence the outcome of the Ripple lawsuit, either positively or negatively.

Conclusion: The SEC Grayscale Decision and XRP's Future: A Call to Action

The SEC's review of Grayscale's Bitcoin ETF application is a critical juncture for the crypto market. The outcome will significantly influence the price and future trajectory of XRP. While predicting the future is impossible, understanding the potential scenarios and their implications is vital for navigating the market effectively. Stay informed about the SEC's decision and its impact on the SEC Review of Grayscale ETF and XRP's future. Follow reputable news sources and engage in informed discussions to stay ahead of the curve. The future of XRP, and perhaps the entire crypto market, may well depend on this crucial regulatory decision.

Featured Posts

-

First Trailer For The Long Walk Simple But Effective Horror

May 08, 2025

First Trailer For The Long Walk Simple But Effective Horror

May 08, 2025 -

Broadcoms Proposed V Mware Price Hike A 1050 Cost Surge For At And T

May 08, 2025

Broadcoms Proposed V Mware Price Hike A 1050 Cost Surge For At And T

May 08, 2025 -

The Role Of Saturday Night Live In Counting Crows Success Story

May 08, 2025

The Role Of Saturday Night Live In Counting Crows Success Story

May 08, 2025 -

Lahore School Timetable Adjustments Psl Impact

May 08, 2025

Lahore School Timetable Adjustments Psl Impact

May 08, 2025 -

Saglik Bakanligi Personel Alimi 37 000 Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025

Saglik Bakanligi Personel Alimi 37 000 Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025

Latest Posts

-

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025 -

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025 -

Understanding The Dwps New Universal Credit Verification System

May 08, 2025

Understanding The Dwps New Universal Credit Verification System

May 08, 2025 -

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025

Scholar Rock Stock Price Plunge A Monday Market Analysis

May 08, 2025 -

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025