Sasol (SOL): A Deep Dive Into The Post-2021 Strategic Shift

Table of Contents

Sasol's (SOL) strategic shift post-2021 represents a significant turning point for the energy giant. Facing substantial debt and operating in a rapidly evolving energy landscape, the company embarked on a transformative journey impacting investors, stakeholders, and the broader market. This article analyzes Sasol's post-2021 strategic changes, examining its restructuring initiatives, portfolio optimization, ESG commitments, and future prospects to understand the effectiveness of its transformation. We'll delve into the key drivers behind the Sasol (SOL) strategic shift and assess its potential for long-term success.

Background:

Sasol, a global integrated energy and chemicals company, has a long history rooted in South Africa's coal-to-chemicals industry. However, facing increasing pressure to reduce its carbon footprint and navigate fluctuating energy markets, the company recognized the need for a significant overhaul of its business model. The Sasol (SOL) strategic shift represents a bold attempt to reposition itself for a more sustainable and profitable future.

Restructuring and Debt Reduction Initiatives:

Debt reduction strategies implemented since 2021:

- Asset Sales: Sasol has actively divested non-core assets, generating substantial cash flow to reduce its debt burden. Examples include the sale of specific refineries and chemical plants. This targeted approach allowed for focusing resources on core competencies.

- Cost-Cutting Measures: The company implemented rigorous cost-cutting measures across its operations, including streamlining its workforce, optimizing supply chains, and renegotiating contracts with suppliers.

- Refinancing Efforts: Sasol actively pursued refinancing opportunities, securing new credit lines and extending the maturity of existing debt, thereby improving its liquidity position and reducing immediate financial pressure.

These actions resulted in a significant percentage reduction in debt, bolstering investor confidence and improving Sasol's credit rating. Quantifiable data from Sasol's financial reports should be included here for precise figures.

Operational efficiency improvements and restructuring programs:

- Process Optimization: Sasol has invested in advanced technologies and implemented lean manufacturing principles to enhance operational efficiency across its value chain.

- Digitalization: The adoption of digital tools and data analytics has improved decision-making, reduced operational downtime, and enhanced productivity.

- Supply Chain Optimization: Improvements in logistics and supply chain management have contributed to cost savings and increased efficiency.

These improvements have led to quantifiable cost savings and improved production output, crucial to the success of the Sasol (SOL) strategic shift. Specific examples of improvements and their corresponding metrics need to be added for a complete picture.

Portfolio Optimization and Strategic Focus:

Changes in the product portfolio and market focus:

Sasol's strategic shift involves a deliberate shift away from certain product lines and a focus on higher-margin, more sustainable alternatives. This may include increasing investment in chemicals with a lower carbon footprint, pursuing opportunities in renewable energy, and expanding into new geographic markets. The rationale behind these shifts is to enhance profitability and better align with evolving market demands.

Divestments and acquisitions post-2021:

This section requires a detailed analysis of specific divestments and acquisitions undertaken by Sasol since 2021. Each transaction should be examined in terms of its financial impact, strategic rationale, and contribution to the overall Sasol (SOL) strategic shift. Including the financial details of these transactions is essential to support the claims.

ESG Initiatives and Sustainability Focus:

Sasol's commitment to environmental, social, and governance (ESG) principles:

Sasol has publicly committed to ambitious ESG targets, including greenhouse gas emission reduction goals and improvements in social and governance practices. This section should discuss Sasol's progress towards these goals, highlighting both achievements and challenges. Any controversies related to the company's ESG performance should be addressed. Detailed reporting and data are required here to support the analysis.

Transition to lower-carbon energy sources and sustainability investments:

Sasol is investing in renewable energy projects and exploring ways to reduce its carbon footprint through technological innovations and operational changes. This section needs to include specific details about these investments, analyzing their feasibility and potential impact. This analysis should incorporate considerations of government policies and regulations that influence the transition to lower-carbon energy.

Future Outlook and Growth Prospects for Sasol (SOL):

Analysis of Sasol's future growth strategies:

This section should analyze Sasol's future growth strategies, considering potential new markets and opportunities. It must also evaluate the long-term viability of its business model in a changing energy landscape, considering factors such as the growing adoption of renewable energy technologies and the changing global regulatory environment. Incorporating external forecasts and projections from reliable sources will add credibility to this analysis.

Potential risks and challenges for Sasol in the coming years:

Potential risks and challenges facing Sasol should be identified and analyzed. This includes geopolitical risks, economic fluctuations, and potential disruptions to supply chains. Assessing Sasol's resilience to these external factors is crucial to understanding the long-term sustainability of its strategic shift.

Conclusion:

The Sasol (SOL) strategic shift post-2021 represents a significant undertaking aimed at transforming the company's operations, reducing its debt burden, and achieving greater sustainability. The success of this transformation hinges on the effective execution of debt reduction strategies, portfolio optimization, and ambitious ESG commitments. While significant progress has been made, continuous monitoring and adaptation to the ever-changing energy landscape are crucial for long-term success. While the changes implemented are promising, ongoing scrutiny of financial performance and the effectiveness of implemented strategies is paramount. Stay updated on the evolving Sasol (SOL) strategic shift by reviewing financial reports and participating in investor calls to gain a comprehensive understanding of its progress and long-term potential. Deepen your understanding of the Sasol (SOL) strategic transformation by actively following their announcements and industry news.

Featured Posts

-

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025 -

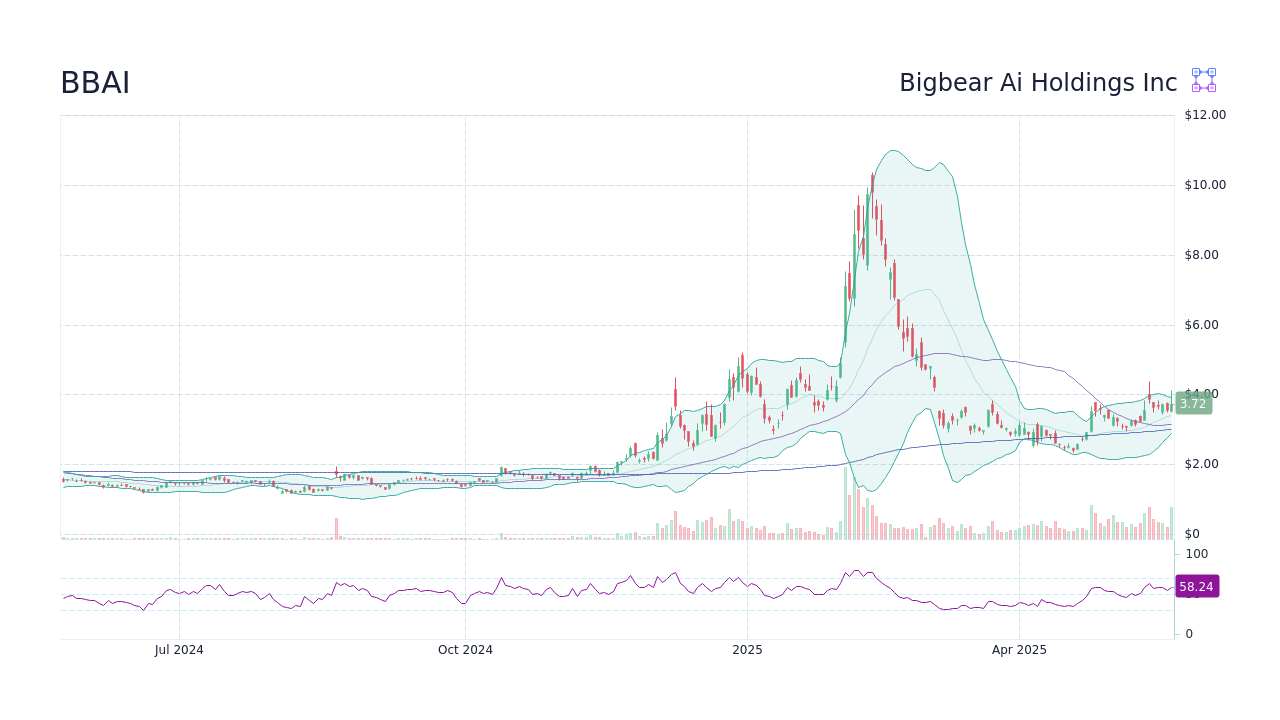

Big Bear Ai Holdings Inc Bbai A Top Ai Penny Stock Pick

May 21, 2025

Big Bear Ai Holdings Inc Bbai A Top Ai Penny Stock Pick

May 21, 2025 -

Jail Term For Tory Councillors Wife Over Racist Social Media Posts

May 21, 2025

Jail Term For Tory Councillors Wife Over Racist Social Media Posts

May 21, 2025 -

Trans Australia Run Record A New World Standard

May 21, 2025

Trans Australia Run Record A New World Standard

May 21, 2025 -

Exploring The Versatility Of Cassis Blackcurrant From Jams To Desserts

May 21, 2025

Exploring The Versatility Of Cassis Blackcurrant From Jams To Desserts

May 21, 2025

Latest Posts

-

D Wave Quantum Qbts Stock Plunge Explained Thursdays Market Activity

May 21, 2025

D Wave Quantum Qbts Stock Plunge Explained Thursdays Market Activity

May 21, 2025 -

Collins Aerospace Layoff Announcement What It Means For Cedar Rapids

May 21, 2025

Collins Aerospace Layoff Announcement What It Means For Cedar Rapids

May 21, 2025 -

Confirmed Layoffs At Collins Aerospace In Cedar Rapids Impact And Details

May 21, 2025

Confirmed Layoffs At Collins Aerospace In Cedar Rapids Impact And Details

May 21, 2025 -

Analyzing The Friday Increase In D Wave Quantum Qbts Share Price

May 21, 2025

Analyzing The Friday Increase In D Wave Quantum Qbts Share Price

May 21, 2025 -

Big Bear Ai Bbai Stock Evaluating The 2025 Market Plunge And Future Outlook

May 21, 2025

Big Bear Ai Bbai Stock Evaluating The 2025 Market Plunge And Future Outlook

May 21, 2025