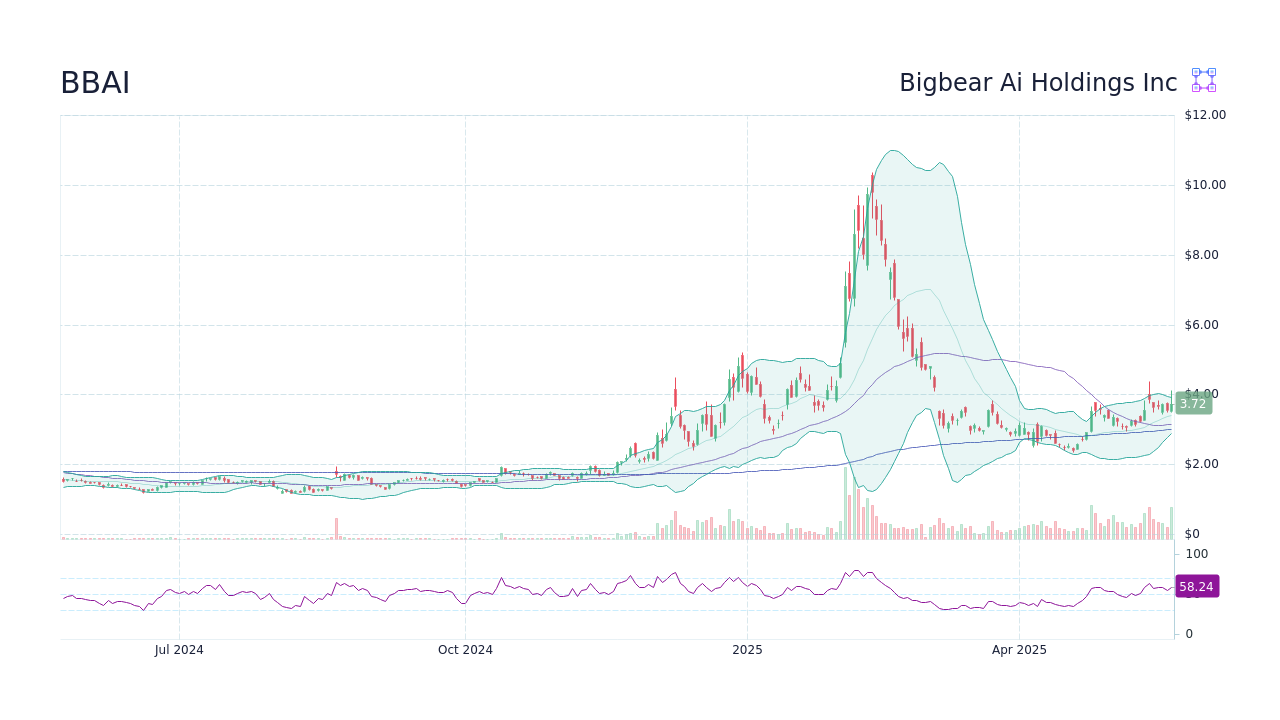

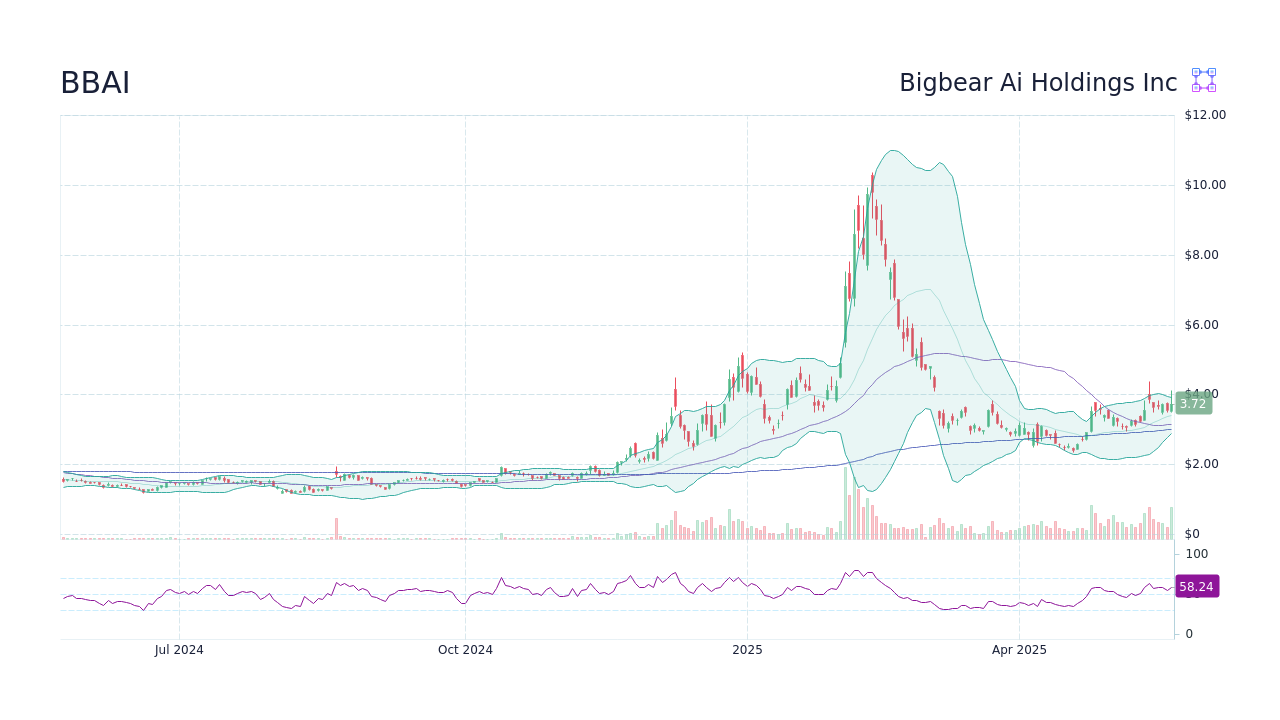

BigBear.ai (BBAI) Stock: Evaluating The 2025 Market Plunge And Future Outlook

Table of Contents

Assessing the Risk of a 2025 Market Plunge for BBAI

Predicting the future of any stock, especially in the volatile AI stock market, is challenging. However, by analyzing potential risks, we can better understand the potential for a downturn in BBAI stock in 2025.

Macroeconomic Factors

Global economic conditions significantly influence technology investments. Several factors could contribute to a market downturn:

- Global economic slowdown: A global recession could drastically reduce investment in technology, impacting BBAI's growth prospects.

- Inflationary pressures and rising interest rates: High inflation and subsequent interest rate hikes can increase borrowing costs for companies like BBAI, hindering expansion and potentially impacting profitability.

- Geopolitical instability: Geopolitical events, such as conflicts or trade wars, create uncertainty in the market, leading to decreased investor confidence and potentially impacting BBAI stock prices.

Specific negative impacts on BBAI could include:

- Reduced government spending on defense and intelligence projects, impacting BBAI's contracts.

- Decreased private sector investment in AI solutions due to economic uncertainty.

- Increased difficulty in securing funding for research and development.

Company-Specific Risks

Beyond macroeconomic factors, inherent company-specific risks exist:

- Intense Competition: The AI and big data analytics sector is fiercely competitive. Established players and new entrants pose a constant threat to BBAI's market share.

- Talent Acquisition and Retention: Securing and retaining top AI talent is crucial for BBAI's success. Competition for skilled professionals can impact its ability to innovate and execute its strategy.

- Execution Risks: BBAI's growth strategy hinges on successful product development, deployment, and market penetration. Delays or failures in these areas could negatively impact its performance.

Financial risks include:

- High debt levels could increase vulnerability during economic downturns.

- Failure to achieve profitability could erode investor confidence and negatively affect the BBAI stock price.

Analyzing BigBear.ai's Strengths and Growth Potential

While risks exist, BBAI also possesses significant strengths and growth potential:

Technological Advantages

BBAI boasts several key technological advantages:

- Proprietary AI Capabilities: BBAI's unique AI algorithms and data analytics platforms provide a competitive edge in several sectors.

- Advanced Analytics Solutions: Their solutions are designed to handle complex data sets, providing valuable insights for clients.

- Strategic Partnerships: Collaborations with industry leaders enhance their technological capabilities and market reach.

Specific technological advancements include:

- Advanced machine learning models for predictive analytics.

- Proprietary data processing techniques for improved efficiency.

- Patented algorithms for specific applications within the defense and intelligence sectors.

Market Opportunities

BBAI has significant market opportunities:

- Government Contracts: The defense and intelligence sectors offer substantial growth potential, given the increasing demand for AI-powered solutions.

- Commercial Markets: Expansion into commercial sectors, such as healthcare and finance, represents significant untapped potential.

- International Expansion: Expanding into new geographical markets can further broaden BBAI's revenue streams.

Target markets and their growth projections indicate considerable upside potential:

- The global AI market is projected to experience significant growth in the coming years.

- Government spending on AI technologies is expected to increase steadily.

- Commercial applications of AI are rapidly expanding across numerous industries.

Financial Performance and Projections

Analyzing BBAI's revenue streams, profitability, and key financial metrics is crucial for assessing its future growth:

- Revenue growth trends demonstrate its market traction and potential.

- Profitability margins indicate the efficiency of its operations and pricing strategies.

- Cash flow analysis reveals its financial health and ability to fund growth initiatives.

Financial forecasts should consider several factors, including market conditions, competitive pressures, and successful execution of its business plans. Investors should consult reputable financial sources for detailed projections and consider the potential return on investment (ROI) carefully.

Investment Strategies for Navigating BBAI's Volatility

Investing in BBAI requires a well-defined strategy to navigate market volatility:

Risk Management Techniques

Mitigating risks is crucial for any BBAI investment:

- Diversification: Spreading investments across different asset classes reduces overall portfolio risk.

- Dollar-Cost Averaging (DCA): Investing a fixed amount at regular intervals reduces the impact of market fluctuations.

- Stop-Loss Orders: Setting stop-loss orders limits potential losses by automatically selling shares when they fall below a predetermined price.

Responsible investment practices include:

- Thorough due diligence and research before making any investment decisions.

- Understanding your own risk tolerance and investment goals.

- Seeking advice from a qualified financial advisor.

Long-Term Investment Outlook

The long-term outlook for BBAI depends on several factors, including its ability to execute its growth strategy, maintain its technological edge, and navigate the competitive landscape.

Comparing BBAI with other AI companies and industry benchmarks helps assess its relative valuation and growth potential. While the potential for significant upside exists, it’s vital to acknowledge the inherent risks involved. The long-term investment outlook should be based on a comprehensive assessment of both the upside and downside potential.

Conclusion

This analysis of BigBear.ai (BBAI) stock highlights the potential for market volatility in 2025, influenced by macroeconomic factors and company-specific risks. However, BBAI's strong technological foundation and significant market opportunities also present a compelling long-term investment case. A well-defined investment strategy, incorporating risk management techniques, is crucial for navigating this volatility.

Call to Action: Understanding the potential for a market dip is essential for making informed decisions regarding your BigBear.ai (BBAI) investment strategy. Conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions. Learn more about effectively managing your BBAI investments and other AI stock market opportunities. Remember, this information is for educational purposes only and not financial advice.

Featured Posts

-

Pete Dunne And Tyler Bate Wwe Raw Reunion

May 21, 2025

Pete Dunne And Tyler Bate Wwe Raw Reunion

May 21, 2025 -

Increased Opposition From Car Dealers To Government Ev Mandates

May 21, 2025

Increased Opposition From Car Dealers To Government Ev Mandates

May 21, 2025 -

Atp Bucharest Cobolli Secures Inaugural Title

May 21, 2025

Atp Bucharest Cobolli Secures Inaugural Title

May 21, 2025 -

American Couple Arrested In Uk After Bbc Antiques Roadshow Appearance

May 21, 2025

American Couple Arrested In Uk After Bbc Antiques Roadshow Appearance

May 21, 2025 -

Half Dome Wins Abn Group Victoria Pitch A New Era In Industry

May 21, 2025

Half Dome Wins Abn Group Victoria Pitch A New Era In Industry

May 21, 2025

Latest Posts

-

Ea Fc 24 Fut Birthday Player Ratings Tier List For Ultimate Team

May 22, 2025

Ea Fc 24 Fut Birthday Player Ratings Tier List For Ultimate Team

May 22, 2025 -

Ea Fc 24 Fut Birthday Best Cards To Use A Complete Tier List Guide

May 22, 2025

Ea Fc 24 Fut Birthday Best Cards To Use A Complete Tier List Guide

May 22, 2025 -

Ea Fc 24 Fut Birthday Ultimate Team Player Tier List And Ratings

May 22, 2025

Ea Fc 24 Fut Birthday Ultimate Team Player Tier List And Ratings

May 22, 2025 -

A Glimpse Into Athena Calderones Extravagant Roman Milestone Party

May 22, 2025

A Glimpse Into Athena Calderones Extravagant Roman Milestone Party

May 22, 2025 -

Athena Calderones Impressive Milestone Celebration Design Details From Rome

May 22, 2025

Athena Calderones Impressive Milestone Celebration Design Details From Rome

May 22, 2025