D-Wave Quantum (QBTS) Stock Plunge Explained: Thursday's Market Activity

Table of Contents

Thursday saw a significant downturn in D-Wave Quantum (QBTS) stock, leaving many investors reeling. This sharp decline sparked immediate questions about the underlying causes. This article dissects the events of Thursday, exploring potential factors contributing to the QBTS stock plunge and offering insights into the current state of the quantum computing market and its impact on D-Wave's stock performance. We'll analyze the situation and consider what this means for future investment in QBTS and the broader quantum computing sector.

Analyzing the QBTS Stock Plunge: Key Factors

Several factors likely contributed to the dramatic drop in D-Wave Quantum's stock price on Thursday. Let's examine the key elements:

Lack of Recent Positive Catalysts

The absence of positive news often creates investor uncertainty and triggers selling pressure, especially in a volatile sector like quantum computing. For D-Wave Quantum, this lack of positive catalysts played a significant role in Thursday's decline.

- Absence of major contract announcements: No large-scale partnerships or significant contract wins were announced recently, leaving investors without positive news to bolster confidence.

- No significant breakthroughs in quantum technology reported: The absence of groundbreaking advancements in D-Wave's quantum annealing technology or broader industry developments dampened investor enthusiasm.

- Limited positive news flow impacting investor sentiment: A general lack of positive press releases, analyst upgrades, or other positive information contributed to a negative sentiment surrounding the stock. This absence of good news amplified existing concerns.

The combination of these factors created a perfect storm for negative investor sentiment and contributed to the sell-off.

Broader Market Downturn & Sector-Specific Concerns

Thursday's QBTS plunge wasn't isolated; it occurred within the context of a broader market downturn and specific concerns within the quantum computing sector.

- Overall negative market sentiment impacting technology stocks: A general negative trend in the technology sector, possibly due to macroeconomic factors or other news, likely affected QBTS. Technology stocks are often more volatile than others and susceptible to broader market shifts.

- Concerns about the quantum computing industry's timeline for commercial viability: The quantum computing industry is still in its early stages. Uncertainty surrounding the timeline for widespread commercial applications can create investor hesitancy. Investors often seek near-term returns, and the long-term nature of quantum computing presents a challenge.

- Investor hesitancy towards early-stage technology companies: Early-stage companies, like D-Wave Quantum, inherently carry higher risk. Investors might be more inclined to move capital to more established, less risky ventures during periods of market uncertainty.

This combination of macroeconomic factors and sector-specific worries heightened the vulnerability of QBTS to a sharp price drop.

Technical Analysis and Trading Activity

Technical indicators and trading patterns also played a role in the intensity of Thursday's QBTS decline.

- High trading volume during the drop: A significantly higher-than-average trading volume suggested a large number of investors actively selling their QBTS shares, amplifying the price decline.

- Potential short-selling activity exacerbating the decline: Short-selling, where investors bet against a stock's price, can accelerate downward pressure. Short-selling activity might have contributed to the speed and depth of the QBTS plunge.

- Chart patterns indicating potential downward pressure: Technical analysts might have identified chart patterns suggesting a potential downward trend before the drop, leading some investors to sell proactively.

Understanding these technical aspects provides further insight into the mechanics of the price movement.

Impact of Earnings Reports (if applicable)

(This section would include details about any recent earnings reports, their impact on investor sentiment, revenue projections, and overall financial performance. This section needs to be updated with relevant information if available). For example, if the earnings report showed disappointing revenue or missed projections, this would likely contribute significantly to the stock price decline.

The Future Outlook for D-Wave Quantum (QBTS)

Despite Thursday's dramatic drop, the future of D-Wave Quantum and the broader quantum computing field remains uncertain but promising.

Potential for Recovery

Several factors could trigger a rebound in QBTS stock price:

- New partnerships and collaborations: Announcing strategic partnerships with major corporations or research institutions could significantly boost investor confidence and drive up the stock price.

- Technological advancements: Any significant breakthroughs in D-Wave's quantum annealing technology or the demonstration of superior performance in specific applications could be a strong catalyst for recovery.

- Positive industry news: Positive developments in the broader quantum computing industry could indirectly benefit D-Wave Quantum and restore investor confidence.

These positive events could reignite investor interest and lead to a stock price recovery.

Long-Term Prospects of Quantum Computing

The long-term potential of quantum computing remains immense. While the commercial applications are still emerging, the technology's potential to revolutionize fields like medicine, materials science, and artificial intelligence is significant. This inherent potential supports the long-term outlook for D-Wave Quantum, despite short-term volatility. Several industry experts predict strong growth in the quantum computing market over the next decade, which should positively impact D-Wave's future.

Conclusion

This analysis explored potential reasons behind the significant drop in D-Wave Quantum (QBTS) stock on Thursday. Factors like the lack of recent positive news, broader market conditions, and technical trading activity likely contributed to the plunge. While the QBTS stock plunge presents challenges, the long-term potential of quantum computing remains promising. Stay informed about D-Wave Quantum's progress and future developments to make informed decisions regarding your investment in D-Wave Quantum (QBTS) and the evolving quantum computing market. Continue researching the QBTS stock and the quantum computing industry for a more comprehensive understanding. Understanding the dynamics of the QBTS stock and the broader quantum computing sector is key to navigating this exciting and volatile market.

Featured Posts

-

Can Apple Revitalize Its Llm Siri

May 21, 2025

Can Apple Revitalize Its Llm Siri

May 21, 2025 -

Sydney Sweeney Post Echo Valley And The Housemaid New Film Project

May 21, 2025

Sydney Sweeney Post Echo Valley And The Housemaid New Film Project

May 21, 2025 -

Big Bear Ai Holdings Bbai Penny Stock Analysis And Investment Potential

May 21, 2025

Big Bear Ai Holdings Bbai Penny Stock Analysis And Investment Potential

May 21, 2025 -

Behind The Scenes Hinchcliffes Unpopular Wwe Segment

May 21, 2025

Behind The Scenes Hinchcliffes Unpopular Wwe Segment

May 21, 2025 -

The Controversy Surrounding An Australian Transgender Influencers Record Breaking Feat

May 21, 2025

The Controversy Surrounding An Australian Transgender Influencers Record Breaking Feat

May 21, 2025

Latest Posts

-

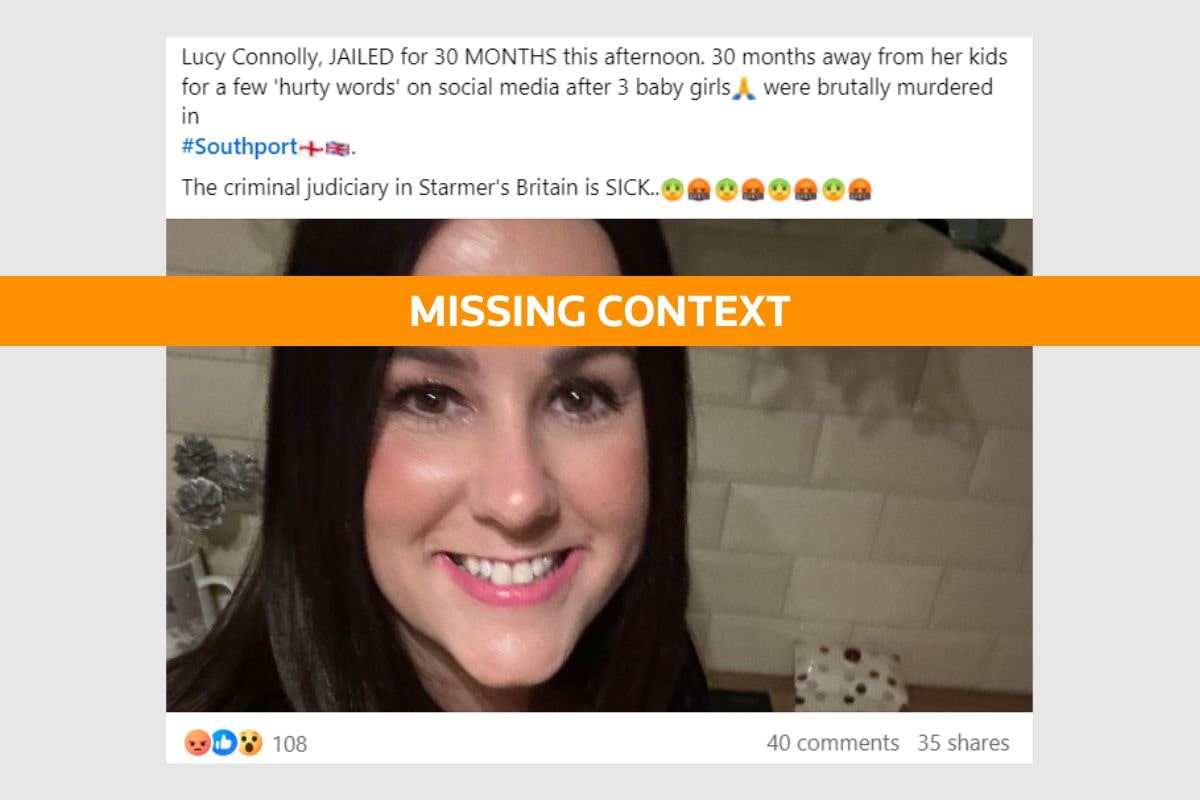

Lucy Connolly Loses Appeal In Racial Hatred Case

May 22, 2025

Lucy Connolly Loses Appeal In Racial Hatred Case

May 22, 2025 -

Jail Time And Homelessness For Mother After Southport Stabbing Tweet

May 22, 2025

Jail Time And Homelessness For Mother After Southport Stabbing Tweet

May 22, 2025 -

Detroit Tigers Impressive 8 6 Win Against The Rockies

May 22, 2025

Detroit Tigers Impressive 8 6 Win Against The Rockies

May 22, 2025 -

Update Ex Tory Councillors Wifes Appeal In Racial Hatred Tweet Case

May 22, 2025

Update Ex Tory Councillors Wifes Appeal In Racial Hatred Tweet Case

May 22, 2025 -

Tigers 8 Rockies 6 Analyzing The Upset

May 22, 2025

Tigers 8 Rockies 6 Analyzing The Upset

May 22, 2025